In September, when discussing the federal budget for 2021, Minister of Labor and Social Protection Maxim Topilin said:

If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call by phone for any region.

“Social assistance for Russians will decrease as the minimum wage increases.”

This meant that wages would increase, and the budget of the Social Insurance Fund would be exempt from payments. The state is trying to prevent double payments: by increasing wages and accruing benefits.

To solve a number of social problems, President Vladimir Putin announced other measures of social assistance to citizens with children. As a result, at the meeting of the council for the implementation of the National Strategy, 6 decisions were formed.

From February 1, 2021 – indexation of some benefits

“Children’s” benefits usually include payments related to the birth of children. The list of such payments is contained in Federal Law No. 81-FZ of May 19, 1995 “On State Benefits for Citizens with Children” (hereinafter referred to as Law No. 81-FZ). Most often, employers have to deal with the calculation and payment of the following types of “children’s” benefits:

- benefits for registration in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly allowance for child care up to 1.5 years;

- maternity benefit.

The listed types of benefits are paid by the employer to its employees. In this case, with the social benefits paid, you can reduce insurance contributions to the Social Insurance Fund or receive the necessary compensation from the fund.

It is worth noting that in some regions there is a pilot project in which benefits are paid not by employers, but directly from the Social Insurance Fund. The territorial bodies of the Social Insurance Fund in the “pilot” regions themselves calculate and pay “children’s” benefits. Here is a list of such regions as of February 1, 2021:

| Region |

| Republic of Adygea (Adygea) |

| Altai Republic |

| The Republic of Buryatia |

| Republic of Kalmykia |

| Altai region |

| Primorsky Krai |

| Amur region |

| Vologda Region |

| Omsk region |

| Oryol Region |

| Magadan Region |

| Tomsk region |

| Jewish Autonomous Region |

| The Republic of Mordovia |

| Bryansk region |

| Kaliningrad region |

| Kaluga region |

| Lipetsk region |

| Ulyanovsk region |

| Republic of Tatarstan |

| Belgorod region |

| Rostov region |

| Samara Region |

| Republic of Crimea |

| Sevastopol |

| Astrakhan region |

| Kurgan region |

| Novgorod region |

| Novosibirsk region |

| Tambov Region |

| Khabarovsk region |

| Karachay-Cherkess Republic |

| Nizhny Novgorod Region |

Will there be indexing? Who gets the benefit?

The indexation percentage a few years earlier depended directly on the level of inflation issues that occurred in Russia. But today officials do not link the indicator, but take into account the correlation of prices for consumer goods. Of course, we are talking mainly about essential products.

Here we will assume that the growth of social benefits will be minimal and not as high as the inflation rate in the country. This policy is generally aimed at ensuring that residents stop leading a dependent lifestyle and radically change their approach to their existence.

Indexation of child benefits in 2018

There has been no indexation of “children’s” benefits since January 1, 2021. In 2018 and subsequent years, child benefits are indexed annually - only from February 1. The indexation coefficient is approved by the Government of the Russian Federation (Federal Law dated December 19, 2016 No. 444-FZ.) Indexation concerns the following benefits paid by the employer:

- a one-time benefit for women who registered in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance.

From January 1 to February 1, 2021, “children’s” benefits should be paid in the same amounts as in 2021. Here are the amounts of “children’s” benefits in the table from January 1, 2021.

| Type of benefit | Size from January 1, 2021 |

| Benefit for registration in early pregnancy | RUB 613.14 |

| One-time benefit for the birth of a child | RUB 16,350.33 |

| Minimum monthly allowance for child care up to 1.5 years | 3795, 60 rub. |

However, from February 1, 2021, the indexation coefficient for child benefits is 1.025 (Resolution of the Government of the Russian Federation dated January 26, 2018 No. 74 “On approval of the amount of indexation of payments, benefits and compensation in 2021”).

1.025 – indexation coefficient for child benefits from February 1, 2018.

Taking into account the new coefficient, from February 1, 2021, “children’s” benefits should be paid in indexed amounts, which are shown in the table below.

| Amounts of child benefits from February 1, 2018 | |

| Benefit for registration in early pregnancy | RUB 628.47 = (RUR 613.14 x 1,025) |

| One-time benefit for the birth of a child | RUR 16,759.09 = (RUB 16,350.33 x 1.025) |

| Minimum monthly allowance for child care up to 1.5 years | 3795, 60 rub. (comment below) |

In districts and localities where regional wage coefficients have been established, “children’s” benefits (both in January 2021 and from February 1, 2021) will be higher, since they need to be additionally increased by the amount of the increasing coefficient (Article 5 of Law No. 81-FZ). Next, we will comment on the conditions and procedure for indexing benefits from February 1, 2021.

Children's housing deduction on mortgage 6 percent

Another demographic measure proposed by the presidents this year was preferential mortgage lending for the birth of a second or third child. The essence of the program, which starts on January 1, 2018, is to provide residential mortgage loans at a rate of 6% per annum. The main condition is the birth of a second or third child in the period from 01/01/2018 to 12/31/2022. The program is subsidized by the state.

However, the duration of the preferential interest is limited to 3 years for families with a second child and 5 years for a third.

Previously received mortgage loans for the birth of children after January 1, 2021 are subject to refinancing at 6% per annum.

Emergency hotline for the population : we provide free consultations to pensioners, parents and beneficiaries of any category from legal experts over the phone.

Benefit for registration in the early stages of pregnancy from February 1, 2021

This benefit is supposed to be paid once (that is, in a lump sum). Women who:

- registered in medical institutions before 12 weeks of pregnancy;

- have the right to maternity benefits (Article 9 of Law No. 81-FZ).

This benefit will be paid in a new amount from February 1, 2021 - 628.47 rubles. rubles However, a controversial situation is possible. Let's give an example.

The employee goes on maternity leave from February 2, 2018. On January 26, 2021, the woman submitted to the accounting department a certificate from the antenatal clinic stating that in 2021 she registered in the early stages of pregnancy (up to 12 weeks). How much benefits should I pay for early registration?

The benefit for registration in the early stages of pregnancy should be paid in addition to the maternity benefit (Article 9 of Law No. 81-FZ). Therefore, the benefit for registration in the early stages of pregnancy must be transferred in the amount that is established on the start date of maternity leave. In our case, the woman went on maternity leave on February 2, 2021. Therefore, the registration allowance should be paid in the amount of 628.47 rubles (including indexation by a factor of 1.025). If the start of maternity leave was in January 2021, then the benefit would be in a smaller amount - 613.14 rubles.

One-time benefit for the birth of a child from February 1, 2021

One of the parents has the right to a lump sum benefit upon the birth of a child. If two or more children were born, then the benefit is paid for each of them (Article 11 of Law No. 81-FZ). The employer must pay the benefit within six months after the birth of the child if the employee has submitted the documents necessary to assign the benefit (Article 17.2 of Law No. 81-FZ). Due to the indexation of benefits from February 1, 2021, an ambiguous situation may arise when assigning.

The child was born in 2021, and the woman came to the accounting department in February 2018 to receive a one-time benefit for the birth of a child. How much benefits should I pay?

The amount of a lump sum benefit for the birth of a child should be calculated on the date of birth, and not on the date of application for benefits (FSS letter dated January 17, 2006 No. 02-18/07-337). In our case, the child was born in 2017, so the benefit amount will be 16,350.33 rubles. (excluding indexation by a factor of 1.025). A one-time benefit for the birth of a child in the indexed amount (RUB 16,759.09) is paid if the child is born from February 1, 2018.

Monthly childcare benefit for children up to 1.5 years old from February 1, 2021

Minimum amount of care allowance

The minimum wage from January 1, 2021 is 9,489 rubles. See “Minimum wage from January 1, 2021.” Therefore, the minimum benefit amount from January 1 is 3795.60 rubles. (RUR 9,489 x 40%). Less than this amount cannot be paid as a childcare benefit for a child under 1.5 years of age.

The “minimum wage” for caring for the second and subsequent children has not changed since January 1, 2018. It was still 6131.37 rubles. rubles and after January 1, 2021.

From February 1, 2021, the indexation coefficient for benefits was approved in the amount of 1.025 (Resolution of the Government of the Russian Federation dated January 26, 2018 No. 74 “On approval of the indexation coefficient for payments, benefits and compensation in 2021”). This means that from February 1, if benefits are indexed, their amounts will be:

- allowance for the first child - 3142.33 rubles. (RUR 3,065.69 x 1,032)

- allowance for the second and subsequent children - 6284.65 rubles. (RUR 6,131.37 x 1.025).

It turns out that after indexation from February 1, 2021, the amount of the benefit for the first child turned out to be less than the amount calculated from the minimum wage as of January 1, 2021: 3,795.60 rubles. >3142, 33 rub.

In this case, the amount of the benefit cannot be less than the amount calculated from the minimum wage. Therefore, even after February 1, 2021, the minimum amount of benefit for caring for the first child remains at 3,795.60 rubles. However, the minimum amount of benefit for the second and subsequent children is increasing from February 1, 2021 - to 6284.65 rubles.

Maximum amount of care allowance

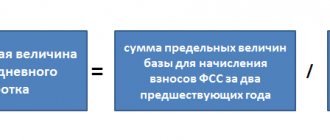

In 2018, the maximum amount of childcare benefits for children up to 1.5 years is not limited. However, the amount of average daily earnings from which the benefit is calculated is limited.

The amount of average daily earnings for calculating benefits cannot exceed the sum of the maximum values of the base for calculating insurance premiums for the two years preceding the year of parental leave, divided by 730 (Part 3.3 of Article 14 of the Federal Law of December 29, 2006 No. 255- Federal Law). Therefore, in order to determine the maximum amount of average daily earnings, the following formula is used:

| Maximum average daily earnings = Sum of the maximum values of the base for calculating insurance contributions to the Social Insurance Fund for the two previous years / 730 |

It turns out that if an employee’s vacation begins in 2021, it is necessary to take into account the values of the maximum values of the base for calculating contributions to the Social Insurance Fund for 2021 and 2021. They are:

- in 2021 – 718,000 rubles;

- in 2021 – 755,000 rubles.

Therefore, in 2021, the maximum average earnings for calculating care leave will be 2021.81 rubles. ((RUB 718,000 + RUB 755,000) ÷ 730 days).

Next, you need to multiply the average daily earnings by the average monthly number of calendar days equal to 30.4 (Part 5.1, Article 14 of Law No. 255-FZ). Total in 2021, the maximum average monthly earnings for calculating benefits will be 61,341.42 rubles. (RUB 2017.81 × 30.4).

The amount of the monthly childcare benefit for a child up to 1.5 years old is generally equal to 40% of the average monthly earnings (Part 1, Article 15 of Law No. 81-FZ). Therefore, in 2021, the maximum amount of monthly benefit per child is RUB 24,536.57. (RUB 61,341.42 × 40%). This is the amount that must be reimbursed from the Social Insurance Fund. From February 1, 2021, due to indexation by 1.025, nothing changes in this amount.

Monthly payments from maternity capital for 2 children

This type of payment is an indirect measure to support families with children under 3 years of age. In theory, paragraph 4 of Art. 1 of the new law No. 418-FZ of December 28, 2017 means that maternity capital funds assigned at the birth of a second and subsequent child can be spent by providing a monthly payment. In this case, a woman can submit an application for this payment along with an application for the issuance of a maternity capital certificate.

The conditions for receiving benefits for the second child at the expense of maternity capital funds are similar to the conditions for receiving benefits for the firstborn:

- family residence in Russia;

- Russian citizenship of children;

- the average per capita income of each family member is no more than 1.5 times the minimum wage;

- payment period - until the second child reaches 1.5 years of age;

- The amount of the benefit corresponds to the minimum subsistence level for children established in the 2nd quarter of 2021 of a specific constituent entity of the Russian Federation.

We remind you that the amount of maternity capital decreases monthly by the amount of the payment received.

You should apply for monthly benefits for the birth of your second child no later than six months after the birth. At later dates, benefits will be assigned only from the date of application, and not from the moment of birth.

Maternity benefit from February 1, 2021

Minimum allowance for BiR

Maternity benefits paid by employers are not indexed annually. That is, from February 1, 2018, the maternity benefit has not increased. However, please note that the maximum benefit amount has increased since 1 January 2018, as the new maximum average daily earnings must be taken into account when calculating benefits from the beginning of 2021. Let me explain.

Maternity benefits are paid in a lump sum and in total for the entire period of maternity leave, which is (Part 1, Article 10 of Law No. 255-FZ):

- 140 days (in general);

- 194 days (with multiple pregnancies);

- 156 days (for complicated births).

Maternity benefits, in general, should be calculated from the average earnings for the billing period, that is, for the two years preceding the onset of illness, maternity leave or vacation (from January 1 to December 31). Accordingly, if an employee goes on maternity leave in 2018, then the billing period will be 2021 and 2021 (Part 1, Article 14 of the Federal Law of December 29, 2006 No. 255-FZ).

However, earnings for the billing period should not be less than a certain amount. The state guarantees the calculation of benefits based on the minimum allowable earnings. It is defined like this:

| Minimum wage at the beginning of vacation x 24 |

In total, the minimum earnings for the billing period in 2021 are 227,736 rubles. (RUR 9,489 x 24)

Another value that will be required to calculate maternity benefits is the minimum average daily earnings. To find out the minimum average daily earnings for calculating benefits, the accountant needs to divide the resulting value by 730. The following formula is used:

| Minimum average daily earnings = minimum wage at the beginning of vacation x 24 / 730 |

Accordingly, from January 1, 2021, the minimum average daily earnings is 311.967123 rubles per day (227,736 rubles / 730 days). From January 1, 2021, the average daily earnings for calculating benefits cannot be less than this value.

If maternity leave began in 2021, then the minimum average daily earnings for calculating maternity benefits should be taken equal to 311.97 rubles. If actual earnings are below the minimum, then benefits had to be calculated from this value. Here are the minimum amounts of maternity benefits from January 1, 2021:

- RUR 43,675.80 (311.967123 × 140 days) – in the general case;

- RUB 60,521.62 (311.967123 x 194 days) – in case of multiple pregnancy;

- RUR 48,666.87 (311.967123 x 156 days) – for complicated childbirth.

Maximum allowance for BiR

The maximum maternity benefit that a worker can receive is limited to the maximum average daily earnings. In 2021 it is 2021.808219 rubles. (718,000 rub. + 755,000 rub.) / 730.

Thus, the maximum amount of maternity benefits in 2021 will be:

- RUB 282,493.15 – during normal childbirth (2017.808219 x 140);

- RUB 314,778.08 – for complicated childbirth (2017.808219 x 156);

- RUB 391,454.79 – for complicated multiple births (2017.808219 x 194).

From February 1, 2021, the maximum allowable amount of maternity benefits does not change, since it does not depend in any way on indexation. The coefficient 1.025 does not affect the size.

Benefit amounts from February 1, 2021: table

Below in the table we show the amounts of benefits from January 1, 2021 and February 1, 2021. Using this table, it will be more convenient for an accountant to understand what exactly has changed in connection with the February indexation.

| Benefit | From January 1, 2021 | From February 1, 2021 |

| One-time benefit for women upon birth of a child | RUB 16,350.33 | RUB 16,759.08 (16,350.33 × 1.025) |

| *Minimum monthly allowance for child care up to 1.5 years (for the first child) | RUB 3,795.60 (minimum wage × 40%) | RUB 3,795.60 (minimum wage × 40%) |

| Minimum monthly allowance for child care up to 1.5 years (for the second and subsequent child) | 6131.37 rub. | 6284.65 rub. (6131,37 × 1,025) |

| Maximum monthly child care benefit | RUB 24,536.57 | RUB 24,536.57 |

| Allowance for a child placed in a family for upbringing (adoption, guardianship and trusteeship) | RUB 16,350.33 | RUB 16,759.08 (16 350,33 × 1,025) |

| Allowance for a disabled child or a child over 7 years of age or several children who are brothers or sisters of each other placed in a family for upbringing (adoption, guardianship and trusteeship) | RUB 124,929.83 | RUB 128,053.07 (124 929,83 × 1,025) |

| For pregnancy and childbirth Maximum size To calculate the maximum benefit amount, you need to take into account the maximum size of the log house. daily earnings, which for 2021 amounted to 2021.80 rubles. ((RUB 718,000 + RUB 755,000) / 730) Minimum size To calculate the minimum benefit amount, it is necessary to take into account the minimum wage, which for 2021 amounted to 9,489 rubles. | Minimum salary Pregnancy without complications - RUB 43,675.39. Complicated childbirth during same-sex pregnancy - RUB 48,667.32. Complicated childbirth during multiple pregnancy - RUB 60,522.18 (minimum wage x 24 / 730 x number of vacation days: 140, 156 or 194) Maximum speed Pregnancy without complications - RUB 282,493.40. Complicated childbirth during a singleton pregnancy - RUB 314,778.08. Complicated childbirth during multiple pregnancy - RUB 91,454.80. ((718,000 + 755,000) / 730 x number of vacation days: 140, 156 or 194) | Minimum salary Pregnancy without complications - RUB 43,675.39. Complicated childbirth during same-sex pregnancy - RUB 48,667.32. Complicated childbirth during multiple pregnancy - RUB 60,522.18 Maximum speed Pregnancy without complications - RUB 282,493.40. Complicated childbirth during a singleton pregnancy - RUB 314,778.08. Complicated childbirth during multiple pregnancy - RUB 91,454.80. |

| One-time benefit for women registered in the early stages of pregnancy | RUB 613.14 | RUB 628.46 (613,14 × 1,025) |

| Benefit for a pregnant woman of a conscript | RUB 25,892.45 | RUB 26,539.76 (25892,45 × 1,025) |

| Allowance for the child of a conscript serving | RUB 11,096.76 | RUB 11,374.17 (11096,76 × 1,025) |

| Survivor's benefit for a child of a military personnel | 2231.85 rub. | RUB 2,287.64 (2231,85 × 1,025) |

| Monthly payment for a child living in the Chernobyl zone from birth to 1.5 years | 3162.00 rub. | 3241.05 rub. (3162,00 × 1,025) |

*This benefit depends directly on the established minimum wage. Therefore, first the amount is calculated taking into account the indexation coefficient (3065.69 rubles * 1.025 = 3142.33 rubles). And then it is compared with the minimum wage * 40% (9489 rubles * 40% = 3795.60 rubles). Since the total amount is less than the minimum wage allowance, RUB 3,795.60 is taken. Due to the increase in the minimum wage from May 1, 2021, the allowance for caring for the first child will be 4465.2 rubles.

Payments to large families for a child under three years of age and child benefits for children under 18 years of age to low-income families are established by regional law.

Read also

30.01.2018

conclusions

Working and unemployed people can receive a minimum allowance for a child, but the amount will be different for the first child and the same for the second.

For the first born, workers receive a minimum payment of 40% of the minimum wage, and the unemployed receive 3,142.33 rubles.

For the second - officially employed and unemployed people receive the same amount - 6284.65 rubles.

The minimum care payment is assigned if a person is unemployed or employed with less than six months of experience or with low income.