To resolve financial issues, many companies attract internal and third-party sources of financing. In the second case, at a certain stage the company may have so-called long-term and short-term obligations. If they exist, one of the main tasks of a company or enterprise is timely repayment of debts, while the funds received are not the property of the company, it simply uses them until the time for their repayment comes.

How are assets and liabilities divided into short-term and long-term according to International Financial Reporting Standards?

Definition

Liabilities _

) are one of the three sections of the balance sheet besides assets and equity. This section reflects the company's debt obligations to its creditors that arose as a result of previous operations. By their economic essence, they, like equity capital, are a source of financing the company’s assets. In the event of default on debt obligations, creditors have the right to claim the company's assets to the extent of the outstanding debt to them.

Liabilities also include advances received that were paid for future goods, work or services. Since this amount has not yet been earned, it may be recorded as deferred income or customer deposits.

Conclusions based on the results of financial analysis

In accordance with the Rules for conducting financial analysis by an arbitration manager, approved by Decree of the Government of the Russian Federation of June 25, 2003 N 367, the current liquidity ratio shows the organization’s ability to meet its short-term obligations with liquid assets. Solvency in the near future is characterized by the absolute liquidity ratio. The table below calculates the liquidity ratios for Zvezda JSC, as well as the indicator of the security of the debtor’s obligations.

Below, on a qualitative basis, the most important indicators of the financial position and performance of Zvezda JSC during the analyzed period are summarized (from December 31, 2013 to December 31, 2015).

The analysis yielded the following exceptionally good financial indicators:

- return on assets for the 4th quarter of 2015 was 24.2% per year;

- net assets exceed the authorized capital, while during the analyzed period there was an increase in net assets;

- for the last quarter, earnings before interest and taxes (EBIT) were received in the amount of 591,749 thousand rubles, and there was a positive trend compared to the data for the previous quarter (-96,966 thousand rubles);

- net profit from financial and economic activities for the last quarter amounted to 362,777 thousand rubles;

- excellent ratio of the most liquid assets (cash and short-term financial investments) and short-term liabilities (absolute liquidity ratio is 0.4);

Among the positive financial indicators are the following:

- the indicator of security of the debtor's obligations as of December 31, 2015 is equal to 1.23 (a sufficient amount of liquid and adjusted non-current assets to cover all the debtor's obligations);

- growth over the entire period under review in the amount of equity, despite the fact that the organization’s total assets have decreased;

- high return on equity (143.3% per annum), which was largely a consequence of the small share of equity capital;

Among the unsatisfactory financial indicators are the following:

- high dependence of the organization on borrowed capital (own funds account for only 20%);

- the current liquidity ratio (0.78) does not correspond to the criterion (1) adopted for this indicator;

During the analysis, only one indicator was obtained that has a critical value - the value of the working capital ratio is critical (-1.76).

historical assessment (defined as a score corresponding to the arithmetic mean value of the indicator for all periods except the last), current assessment (the value of the indicator as of the last date) and forecast assessment (the state of the indicator predicted through a linear trend 1 year after the end of the analyzed period).

| Index | Indicator weight | Grade | Average score (gr.3 x 0.25 gr.4 x 0.6 gr.5 x 0.15) | Rating based on weight (gr.2 x gr.6) | ||

| historical | current | forecast | ||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Autonomy coefficient | 0,15 | -1 | -1 | -1 | -1 | -0,15 |

| Current ratio | 0,12 | -1 | -1 | -2 | -1,15 | -0,138 |

| Absolute liquidity ratio | 0,12 | -1 | 2 | 1 | 1,1 | 0,132 |

| The indicator of the security of the debtor's obligations with its assets | 0,12 | 1 | 1 | 1 | 1 | 0,12 |

| Provision ratio of own working capital | 0,09 | -2 | -2 | -2 | -2 | -0,18 |

| Return on assets | 0,16 | -1 | 2 | 2 | 1,25 | 0,2 |

| Net profit margin | 0,16 | -1 | 2 | 2 | 1,25 | 0,2 |

| Revenue dynamics | 0,08 | -2 | -2 | -2 | -2 | -0,16 |

| Total | 1 | Final grade (total gr.7 : gr.2): | 0,02 | |||

The final assessment of the financial condition of Zvezda JSC as of December 31, 2015 was 0.02. The financial condition of the organization can be described as satisfactory. The financial indicators of Zvezda JSC generally comply with established standards or deviate slightly from them.

The organization has the ability to continue financial and economic activities and conduct settlements with creditors. The dynamics of assessments of key indicators allows us to assume that the likelihood of a change in the financial position of the organization over the next 12 months compared to the current assessment is insignificant.

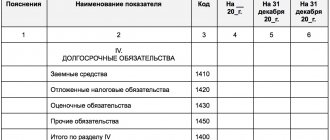

Structure of liabilities in the balance sheet

Liabilities have the same classification structure as assets: current liabilities and non-current liabilities. They are reflected in the balance sheet in order of increasing due date for their payment.

Current responsibility

Current liabilities are those that must be paid within 12 months or the operating cycle if its duration is more than one year. Their occurrence is usually associated with the use of current assets (English Current Assets), the creation of another current liability or the provision of any services.

Typically this section of the balance sheet includes the following items.

- Debt to banks

. Represents the amount of short-term debt owed to banks, for example, under a bank line of credit. - Accounts payable

. This is the amount of debt owed to suppliers of products and services that were provided on credit, but the payment period for which has not yet arrived. - Salaries, rent, taxes and utilities payable

. This reflects the amounts that the company must pay to its employees, landlords, government, etc. - Accrued liabilities (accrued expenses)

. These liabilities arise because expenses are incurred in a period prior to the period in which they are paid. This item covers a wide variety of expenses, for example, advances received from clients, dividends payable, arrears of accrued wages, etc. - Bills payable (short-term loans)

. These are the amounts that the company is obliged to pay to the creditor, which usually also includes the payment of interest. - Deferred income (customer prepayments)

. These are payments received from customers for goods and services that the company has not yet provided or has not yet begun to incur any costs associated with providing them. - Dividends payable

. It arises in a situation where a company has already announced dividends, but has not yet paid them to its owners. - The current portion of long-term debt

. This item reflects the portion of long-term debt that falls due in the next 12 months. In theory, any associated premiums or discounts should also be classified as current liabilities. - Current portion of finance lease obligations

. This is part of the long-term finance lease payments that are due over the next year.

long term duties

Long-term liabilities are those that must be repaid later than 12 months or after the operating cycle, if it is longer than one year. They should be reflected as the present value of future payments.

The most common examples of long-term liabilities are.

- Bills payable (long-term loans).

This is the amount that the company is required to pay the lender, which usually includes interest. - Long-term debt (bonds payable).

This is long-term debt minus the current portion. - Deferred tax liabilities.

They arise as a result of discrepancies between accounting and tax accounting standards in the case when the amount of tax payable in accounting exceeds the amount of tax payable in tax accounting. In other words, it is the amount of tax that the company will have to pay in the future. - Employee pension plan.

This is the company's obligation to pay pension benefits to its retired and active employees. Payments from this fund begin upon the employee's retirement. This item reflects the additional amount the company must contribute to its current pension fund to meet its future pension obligations. - Long-term finance lease obligations.

Basic Concepts

Every legal entity, regardless of the type of activity, has obligations. They are usually divided into long-term and short-term (or current). From the name it is already clear that division is carried out on a temporary basis.

Current liabilities are those debts that the company needs to pay off within the next year. Their elimination is carried out using current resources, which include:

- Dividends intended for payment.

- Tax payments.

- Bills that are classified as short-term.

- Income received as an advance payment, but not worked out, etc.

Current resources have the main difference from long-term ones in that, theoretically, an enterprise could use them to carry out daily activities. Another distinctive feature of them is that they are converted into cash equivalent and spent in a short time. Most often this is a calendar year. If their repayment is postponed, then they become long-term. In this case, a penalty will be charged on the total amount.

An assessment of current liabilities is necessary when analyzing the liquidity of an enterprise, which can be important for both internal and external users. For example, to estimate the liability coverage ratio, the following formula is used:

This is a general formula, and the calculation of assets and liabilities is as follows:

According to the new balance it will look like this:

Contingent liabilities

Contingent Liabilities

) are potentially possible obligations, the transformation of which into real ones depends on the development of certain events in the future. The most common examples of such liabilities are warranties and amounts of legal claims against the company.

It is necessary to reflect contingent liabilities on the balance sheet when there is a significant probability of their transformation into real liabilities and their amount can be accurately estimated. If the probability is remote, they should not be reflected in either the balance sheet or the notes to the financial statements. Interim positions should be disclosed in the notes to the financial statements.

- ← Balance sheet asset structure

- Balance sheet equity structure →

Classification of obligations according to various criteria

All obligations of an organization can be classified according to various criteria, namely:

- On a subjective basis.

Depending on who exactly the organization owes, obligations can be divided into three types:

- to the owners for initial contributions to the authorized (share) capital, as well as those generated in the process of economic activity (reserve or additional capital, retained earnings);

- to the personnel of the organization regarding wages;

- to third parties (counterparties, government agencies, credit institutions and other economic entities).

- By affiliation.

Depending on who exactly owns the obligations, they are divided:

- on equity capital (authorized, reserve, additional), which is not repaid in the course of the enterprise’s activities;

- for borrowed funds (wages or debts to banks), which are repaid within a certain period of time in the course of carrying out activities.

- By urgency:

- short-term (with a deadline of no more than 12 months);

- long-term (with a deadline of more than 12 months).

- By size specification:

- obligations for which the amounts of payments are known in advance (payments under bank loan agreements, payments under agreements with suppliers and contractors);

- estimated liabilities for which the amounts of payments are unknown in advance and depend on certain conditions (for pending legal proceedings, for warranty service, for events related to the restructuring of the enterprise).

Each of the obligations of the organization has characteristics according to all of the listed characteristics, and therefore they can be grouped, deducing the final value for any specific classification point.

Regulatory and legislative acts on the topic

| Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n | Approval of the balance sheet form |

| clause 7.3 of the Concept approved by the Methodological Council for Accounting under the Ministry of Finance | On the grounds for the emergence of obligations |

| clause 19 PBU 4/99 | Definition of long-term liabilities |

| Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n | Algorithm for calculating indicators of items of long-term liabilities |