In Russia there is a transport taxation system called “Platon”. It only applies to large trucks. That's why it was called that. The pressing issue now is the reduction of Plato by the amount of transport tax in 2021.

The main function of this system is to collect funds from drivers of heavy vehicles for the damage they cause to roads.

The development of the described system was a necessity, since there are more and more trucks every year. Roads are losing their quality faster. And the financial resources that tax authorities accumulate from transport taxes are not enough to carry out restoration repairs. That is why the Plato system was created.

So, let's look at Plato and the transport tax itself, what are the nuances.

Accounting for transport tax and “Platonov” fee as expenses

The amount of the advance payment made to the operator of the state toll collection system LLC RT-Invest Transport Systems (hereinafter referred to as LLC RTITS) is not an expense and, accordingly, is not reflected in tax accounting (clause 14 of article 270 of the Tax Code of the Russian Federation ).

“Profitable” expenses recognize the difference between the “Platonovsky” fee and the amount of transport tax calculated for the tax (reporting) period in relation to heavy trucks - vehicles with a permissible maximum weight of over 12 tons (clause 48.21 of Article 270 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated November 21, 2016 No. 03-05-05-04/68317).

PROPERTY “ENERGY EFFICIENT” BENEFITS

Important!

That is, the tax expenses will not include the entire “Platonov” payment in its entirety, but in part of the excess of the amount of transport tax calculated for the heavy cargo for which it was paid (clause 48.21 of article 270 of the Tax Code of the Russian Federation - for companies on the OSN, clause 37 Clause 1 of Article 346.16 of the Tax Code of the Russian Federation - for “simplers”, Clause 45 of Clause 2 of Article 346.5 of the Tax Code of the Russian Federation - for payers of the Unified Agricultural Tax).

FOR EXAMPLE

The advance payment for transport tax was 120 rubles, and the “Platonov” fee was 100 rubles. In this case, the company, based on the results of the first quarter, half of the year and 9 months, will not take into account the difference in terms of the excess of the transport tax over the “Platonov” fee. And only at the end of the year he will include 20 rubles in tax expenses.

As a general rule, one company can reduce transport tax by the amount of the “Platonov” fee. For example, if vehicles were leased, and heavy trucks were registered to the lessor, then the transport tax cannot be reduced by the “Platonic” fee paid by the lessee (Letter of the Ministry of Finance of the Russian Federation dated July 18, 2016 No. 03-05-04-04/41940 ).

That is, in this situation (heavy trucks are registered to the lessor), and not to the lessee, the lessor has no right to reduce the transport tax by the amount of the “Platonic” fee for the heavy truck.

In “profitable” expenses, you can only take into account the amount of transport tax actually paid (clause 1, clause 1, article 264 of the Tax Code of the Russian Federation, clause 48.21, article 270 of the Tax Code of the Russian Federation, clause 2, article 362 of the Tax Code of the Russian Federation). This means that it is impossible to simultaneously take into account in tax expenses both the amount of accrued transport tax and the deduction for the “Platonic” fee.

CHECKING THE CONTRACTOR

Important!

Thus, the “Platonic” fee reduces profits only to the extent of excess transport tax, and not in full.

If the vehicle is leased, the owner of the vehicle will charge and recognize the transport tax in full, and the lessee will charge and pay the “Platonic” fee and take it into account as part of other expenses.

Reflection of transport tax and Platon fee in accounting

The procedure for reflecting in accounting transactions for the calculation and transfer of “Platonovsky” fares with the subsequent deduction of transport tax in relation to heavy trucks is recommended by financiers in the Letter of the Ministry of Finance of the Russian Federation dated December 28, 2016 No. 07-04-09/78875.

The amount of the advance payment made to the operator of the state toll collection system, RTITS LLC, is not an expense and, accordingly, is not reflected in the cost accounts, but is taken into account as part of accounts receivable (clause 3, clause 16 of the Accounting Regulations PBU 10/ 99 “Expenses of the organization”, approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n).

Thus, the transferred advance payment of funds to the Platon operator is reflected in the debit of account 76 “Settlements with various debtors and creditors.”

In accordance with clause 16 of PBU 10/99, expenses are recognized as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the emergence of liabilities, leading to a decrease in the capital of this organization, with the exception of a decrease in contributions by decision of participants (owners of property ). Taking this into account, the amount of the “Platonic” fee payable by an economic entity is recognized as an expense in accounting.

Based on this and the Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved. By Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, the accrued amount of the “Platonovsky” fee is reflected in the debit of cost accounting accounts in correspondence with the account for accounting settlements with the budget.

This means that the full amount of the fare accrued by the operator RTITS LLC is included in expenses for ordinary activities during the period when the operator charges the fare (clause 18 of PBU 10/99).

When reflecting in the accounting records the transport tax due for payment to the budget at the end of the tax period, the amount of such tax minus the amount of the “Platonov” fee actually paid in a given tax period is credited to the account for accounting settlements with the budget.

INTRODUCTION OF DOWNTIME FOR REASONS NOT DEPENDING ON THE EMPLOYER

Important!

Advance payments for transport tax for heavy loads for which the “Platonov” fee has been paid are not reflected in accounting.

That is, in relation to heavy trucks for which the “Platonov” fee is paid, the transport tax is reflected in the accounting accounts at the end of the year and in terms of the excess of the transport tax accrued at the end of the calendar year over the toll accrued during this period.

How the law of July 3, 2016 No. 249-FZ works

NOTE! From 2021, the preferential payment procedure described below has ended. It was introduced temporarily, until December 31, 2018. Therefore, from 01/01/2019, both TN and advance payments to Platon must be paid for heavy loads. For details, see the material “Deduction for “Platon” oPlaton” - user’s personal account (nuances)" .

It should be noted that to reduce tax, it does not matter whether the payer is an individual or a legal entity. At the same time, there are differences in the procedure for calculating the tax: “lawyers” calculate the tax themselves, while “physicists” are calculated by the Federal Tax Service and then send out notifications.

See also “The application of a deduction for payment in “Plato” does not depend on the status of a “physicist” - the owner of a heavy truck .

FOR EXAMPLE

The company transferred an advance payment of 50,000 rubles to the operator of the Platon system. According to the report of the operator RTITS LLC, the fare for the first quarter of 2021 amounted to 20,000 rubles.

In the accounting accounts, these transactions will be reflected in the following accounting entries:

| Debit 76 “Settlements with the operator RTITS LLC” | Credit 51 “Current account” | — | 50,000 rub. | An advance payment was transferred to the operator RTITS LLC |

| Debit 20,23,25,26,29,44 | Credit 68 “Calculations with the budget using the Platon fee” | — | 20,000 rub. | Tolls for heavy trucks are taken into account as expenses for ordinary activities |

| Debit 68 “Calculations with the budget using the Platon payment” | Credit 76 “Settlements with the operator LLC RTITS” | — | 20,000 rub. | Payment of tolls for heavy trucks to the budget is reflected |

Note.

Accounting entries are provided for heavy cargo vehicles for which the “Platonov” fee is transferred. For other vehicles, advance payments are still made (if the Law of the subject of the Russian Federation provides for such a procedure), which are reflected quarterly in the accounting accounts (in the last month of the reporting quarter).

It should be noted that the company determines the procedure for accounting for fares independently and enshrines it in its accounting policy (clause 4 and clause 7 of the Accounting Regulations PBU 1/2008 “Accounting Policy of the Organization”, approved by Order of the Ministry of Finance of the Russian Federation dated 06.10.2008 No. 106n).

Therefore, the company may use a different accounting record scheme.

What amount will expenses be reflected in tax accounting in the first quarter of 2021?

As already noted, for the purpose of calculating income tax, the “Platonovsky” fee is taken into account as part of other expenses, taking into account the restrictions provided for in clause 48.21 of Article 270 of the Tax Code of the Russian Federation.

Let’s assume that the amount of calculated advance payments for heavy cargo (the amount is determined solely for calculating tax liabilities, but is not reflected in the accounting accounts) amounted to 5,000 rubles.

Then for the first quarter of 2021 the company will take into account 15,000 rubles (20,000 rubles - 5,000 rubles) in tax expenses.

And the company does not include advance payments for transport tax as part of tax expenses, since advance payments are preliminary payments, the payment of which is provided for during the tax period (clause 3 of Article 58 of the Tax Code of the Russian Federation), and therefore take them into account on the basis of clause 1 Article 264 of the Tax Code of the Russian Federation is impossible.

That is, for each last day of the 3rd month of the 1st, 2nd and 3rd quarters, the “Platonic” fee can be taken into account in expenses in a portion exceeding the advance payment for transport tax calculated for the same truck and for the same quarter.

ACCOUNTING SERVICES FOR TRANSPORT AND LOGISTICS COMPANIES

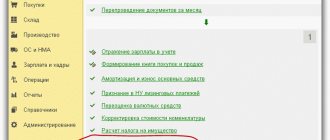

1c:franchisee consultant accountant

As a result of creating this document, the corresponding transactions will be generated. To view the result of conducting the document “Routine operation” with the type of operation “Calculation of income tax” (Fig. 10), click the DtKt button. Fig. 10 Calculation of deferred taxes associated with payment of the amount of the “Platon” fee transferred to the budget by the operator for 2021. Constant tax liabilities are recognized = Amount of the “Platon” fee transferred to the budget by the operator * Income tax rate (1,530.00 RUB = RUB 7,650.00 * 0.20). A breakdown of the amount of deferred taxes can be viewed in the report “Calculation Reference for Tax Assets and Liabilities” (Fig. 11) (menu: Operations – Period Closing – Calculation References – Tax Assets and Liabilities). Fig.11 6.

Documentary evidence of transport tax deduction

The operator, in relation to each registered heavy load in the register of the toll collection system, maintains a personalized record of the owner (possessor) of the vehicle, containing the following information, updated at least once a day, for each vehicle of the owner (possessor):

- the route traveled by the vehicle;

- planned route;

- time and date of movement of the vehicle on public roads of federal significance in accordance with the route map;

- operations for the vehicle owner to pay a fee to the operator, indicating its amount, as well as the date and time of receipt;

- other operations.

Documentary evidence of the toll fee is the operator's report, which indicates the route of the heavy truck with reference to the time (date) of the start and end of the movement of heavy trucks, and primary accounting documents drawn up by the taxpayer himself, confirming the use of this heavy truck on the corresponding route (Letters of the Ministry of Finance of the Russian Federation dated 11.01. 2016 No. 03-03-RZ/64, dated December 28, 2015 No. 03-03-06/1/76740).

In order to recognize expenses for the purpose of calculating income tax, it is necessary to have documentary evidence of expenses (clause 1 of Article 252 of the Tax Code of the Russian Federation).

TAX BENEFITS FOR SMALL BUSINESSES USING THE EXAMPLE OF MOSCOW

Important!

The deduction when calculating transport tax in relation to heavy goods must be applied based on the amount indicated in the route map or register (for the corresponding calendar year) in relation to this heavy goods. And the use of a deduction when calculating transport tax in the amount of the advance payment paid to the toll collection system on account of planned routes is unlawful (Letter of the Ministry of Finance of the Russian Federation dated January 26, 2017 No. 03-05-05-04/3747).

Thus, the deduction of transport tax on the “Platonov” fee is applied based on the amount of the fee only for the route actually traveled by the heavy load.

Procedure for granting benefits

Vehicle owners can receive a benefit in the situation if:

- The car was entered into the register;

- System employees gave the motorist a receipt indicating that the payments had been made.

Once a year, prepares a report on the basis of which benefits are offered. You can order it on the website or at the Platon office.

Transport tax and tax according to the Platon system must be paid by individuals and legal entities equally. Those who want to reduce tax must show the following documents:

- Statement;

- Information about the owner of the vehicle;

- Vehicle passport;

- Data on payment for the use of highways.

You can send documents either independently or through a representative.

The application for the benefit must be submitted before the tax office begins generating notifications for the past period. The application must be written in 2 copies. The first remains with the tax office, the second with the owner of the vehicle. If the vehicle owner submits an application later than the deadline, he will still have the right to receive benefits. The amount of overpaid tax will be recalculated.

FOR EXAMPLE

RUB 3.73/km, coefficient 0.41

— the distance traveled by vehicles registered in the Toll System Register (km).

For example, 4,975.311 km.

| Balance at the beginning of period (rub.) | Accrued for the period (RUB) | Accrual adjustment (RUB) | Funds credited (RUB) | Refund/transfer of enrollment (RUB) | Balance at the end of the period (RUB) |

| 0 | 7 608,51 | 0 | 50 000,00 | 0 | 42 391,49 |

The amount of the fee to be paid when moving a heavy load along the planned route is indicated in the route map or calculated through a toll collection system based on data received from the on-board unit or a third-party on-board unit in automatic mode.

Fines

Fine up to 5,000 rubles. the following persons will have to pay:

- Drivers of a vehicle owned by a foreign carrier;

- Car owners

If a fine of 5,000 has not been paid, it is doubled.

If the program detects the same driver for several similar violations on the same day, then only the first fine will be subject to payment. Other violations will not be subject to penalties, because the fine is charged once.

Penalties will also have to be paid for the following actions:

- A trip without Plato and a route map;

- Carrying out a trip at a time that is not specified in the route map;

- Insufficient number of advance payments on Platon’s balance sheet.

The Plato program operates at the state level. So violators will receive notifications. Violators on the roads are detected by video cameras.

Information from these cameras is received by traffic police officers, who issue fines to motorists.

The calculation looks like this:

3.73 rub./km x 0.41 x 4,975.311 km = 7,608.51 rub.

In this case, the calculation takes into account the amounts for canceled route cards and adjustments made to charges for on-board devices.

Such a report is generated automatically from the state toll collection system “Platon”. A similar document is prepared by the operator of the state toll collection system, RTITS LLC, acting on the basis of the Order of the Government of the Russian Federation of August 29, 2014 No. 1662, the Decree of the Government of the Russian Federation of June 14, 2013 No. 504, of May 18, 2015 No. 474, dated 03.11.2015 No. 1191.

The extract is necessary to track the status of settlements on the “Platonic” fee.

It does not contain information about the dates of movement, numbers of heavy trucks.

To do this, you need to order details of transactions by travel date through the company’s personal account.

Detailed operations by travel date.

What innovations can we expect in the near future?

Legislators’ current plans include the introduction of an analogue of the Platon toll collection system for regional roads.

In addition, in Plato itself they are improving and expanding the control system for heavy-duty “hares” - increasing the number of control frames on the highways and the number of specialized patrol cars.

A separate way is to consider the possibility of combining on-board control devices of various types into one, multifunctional one. But so far such proposals have raised a sufficient number of justified objections.

For example, the Ministry of Transport is against combining ERA-GLONASS with any other devices, especially with fiscal functions. According to officials, ERA (emergency response in case of accidents) was created and intended to minimize damage, first of all, to the life and health of people on the roads. Teaming up with the same Plato can reduce the effectiveness of the ERA.

More information about Plato can be found in the article “Latest news about the Plato system.”

More on the topic Obtaining a vehicle registration certificate

This report provides the following data:

Account number, balance, number of heavy loads and then details of transactions by date and heavy load.

| Movement date | GRZ | Type of transaction | Path along the federation routes, km | Enrollment | Write-off |

| 30.12.2016 | E285VA174 | Charging (BC) | 75.129 km | RUB 114.88 | |

| 30.12.2016 | E275MA174 | Charging (BC) | 74.03 km | 115.22 rub. |

At the end of the year, you can confirm your right to deduct transport tax using the report “Information on motor vehicles with a permissible maximum weight of over 12 tons, as well as information on payment of payment for compensation for damage caused to federal highways,” which is generated for each heavy load (Letter of the Federal Tax Service of the Russian Federation dated August 26, 2016 No. BS-4-11/15777).

Advance payment

You can only accept as expenses the amount accrued by the operator. And it doesn’t matter what method you use to recognize expenses – cash or accrual. Because the payment is charged and debited to the account

Since November 15, 2015, in order to compensate for the damage caused, trucks with a maximum permissible weight over 12 tons will be charged a toll on free federal roads. To do this, each truck is registered in the Platon system.

The operator of the Platon system is a commercial organization. Therefore, accountants have a question about how to keep accounting records for collecting Plato fees.

Where can the owner(s) of the vehicle obtain such information?

Information interaction between the owner and operator is carried out through the use of the following service channels:

- user information support centers;

- information resource of the toll collection system, located on the Internet information and telecommunications network (www.platon.ru), and the personal account of the owner (owner) of the vehicle, which ensures that the owner (owner) of the vehicle is provided with information contained in the personalized record of the owner (owner) of the vehicle funds that include a settlement entry(s);

- a user information support center, which is a complex of technical means without personnel, providing, among other things, the possibility of registration in the toll collection system and payment of fees by the owner (possessor) of the vehicle.

Important!

All of the above reports can be generated by the owner of heavy trucks through his personal account on the official Platon website (https://platon.ru) or in a similar mobile application.

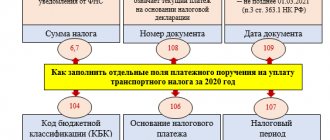

Reflection of the “Platonov” fee in the transport tax return

The transport tax declaration, in which the taxpayer can indicate a tax benefit and (or) deduction for a vehicle with a permissible maximum weight of over 12 tons, was approved by Order of the Federal Tax Service of the Russian Federation dated December 5, 2016 No. ММВ-7-21/ [email protected]

Despite the fact that the Order of the Federal Tax Service is in effect starting with the submission of a tax return for 2021, those taxpayers who need to apply the heavy-duty exemption could already report using the new form for 2021 (clause 3 of the Letter of the Federal Tax Service of the Russian Federation dated December 29, 2016. No. PA-4-21/ [email protected] ).

How does the Plato system work?

It performs several main tasks:

- Information processing;

- Collection of necessary information;

- Saving data on the movement of trucks on highways.

Motorists can use this system for free. However, they must register on the system website. You will have to pay 600 rubles every month for the service.

The Platonic program block is installed in the car. Through a mobile connection, he reports the coordinates of the vehicle to a special center. The received data is processed. After this, the driver is issued an invoice for trips on federal highways.

The functioning of the Plato system occurs automatically. If the car turns off the federal highway, the system turns off automatically. All vehicles weighing more than 12 tons are required to join the system. Only those cars that transport people, as well as various company cars, are exempt from taxes.

The tax payment scheme under this system is advance. Those. First, money is deposited, and after that the operator gradually writes off the required amount. Payment is made for each kilometer of travel.