What is “VAT deductible”

The total amount of VAT that a taxpayer must pay to the budget can be reduced by tax deductions. In Art. 171 of the Tax Code of the Russian Federation there is a complete and closed list of transactions for which VAT can be deducted. The benefit is valid in the following cases:

- VAT has been paid on goods, works, services, property rights (hereinafter referred to as GRU), which are planned to be resold or used in activities subject to VAT.

- VAT is calculated and paid when importing goods and materials into the Russian Federation or when fulfilling the obligations of a tax agent.

- Construction and installation work was completed for our own needs.

- Contractors submitted VAT when carrying out assembly and disassembly, installation and dismantling, capital construction or liquidation of fixed assets.

- An advance has been received or issued for future payment.

- After the sale, the price or quantity of goods shipped, work performed, services provided, or property rights changed.

- The goods were returned to the seller or a buyback was carried out.

- A contribution to the authorized capital was received in the form of property, property rights or intangible assets.

- VAT is paid on travel expenses.

- VAT is compensated using the tax free system.

- A foreign organization has charged VAT for the purchase of electronic services.

Who is entitled to deduction

The following taxpayers have the right to apply VAT deductions (clause 1 of Article 143 of the Tax Code of the Russian Federation):

- legal entity;

- IP;

- persons recognized as VAT taxpayers in connection with the movement of goods across the customs border of the Customs Union, determined in accordance with the customs legislation of the Customs Union and the legislation of the Russian Federation on customs affairs.

However, a VAT defaulter can also deduct the tax (clause 8 of Article 145, clause 6 of Article 346.25, clause 9 of Article 346.26 of the Tax Code of the Russian Federation). This becomes possible when an organization or individual entrepreneur has lost the right to:

- on the application of the simplified tax system and patent taxation systems, UTII;

- exemption from taxpayer obligations under Art. 145 of the Tax Code of the Russian Federation.

From the quarter in which this right is lost, the organization or individual entrepreneur must charge and pay VAT.

In this quarter, the payer has the right to claim VAT for deduction if three conditions are simultaneously met (availability of an invoice, receipt of goods, use of goods in activities subject to VAT). In this case, the third condition is met only if the goods were not used by the organization or individual entrepreneur at a time when they were not VAT payers. This position was reflected in letters of the Ministry of Finance of the Russian Federation dated December 30, 2015 No. 03-11-06/2/77709, dated March 20, 2014 No. 03-11-11/12249.

Please note that clause 6 of Art. 346.25 of the Tax Code of the Russian Federation contains information on the deduction of VAT on purchases that were not included as expenses. That is, payers on the simplified tax system with the object “income” do not have the right to deduction (definition of the Constitutional Court of the Russian Federation dated January 22, 2014 No. 62-O).

Who can apply VAT deductions

Only VAT payers can take advantage of the deduction - that is, organizations and entrepreneurs on OSNO or Unified Agricultural Tax.

The remaining special regimes are exempt from VAT, so tax cannot be deducted on them. Instead, tax amounts are included in the cost of purchased goods or separately included in expenses.

To accept VAT as a deduction, you must comply with all the conditions from Art. 171 Tax Code of the Russian Federation. If this is not done, during an audit the tax office may deprive the right to deduction and charge additional input tax. In general, VAT can be deducted if four conditions are simultaneously met:

- VAT is presented by the supplier;

- purchased GWS will be resold, used in VAT-taxable transactions or exports;

- purchased GWS are accepted for accounting;

- the supplier presented a correctly executed invoice or UPD.

In fact, it is not necessary to pay VAT to the supplier to qualify for the deduction. But there are exceptions, for example, VAT on the cost of imported goods can be deducted only after paying the tax at customs.

Let's consider the conditions in more detail.

Condition 1. VAT is presented by the supplier

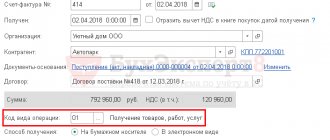

In addition to the price of sold GWS, the supplier must submit VAT for payment. The tax amount is reflected in the contract, invoice and primary sales documents.

When the supplier has not highlighted VAT in the documents, it cannot be calculated and deducted independently. This happens, for example, when working with counterparties on the simplified tax system or foreign sellers.

But if the buyer performs the duties of a tax agent, he must independently calculate and pay VAT to the budget.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Condition 2. Purchased GWS will be resold, used in VAT-taxable transactions or in exports

You cannot claim a deduction for goods and services that are used in non-VAT-taxable transactions. In this case, the input tax is included in the cost of the purchased GWS.

The deduction can be used only if input VAT is paid on an object that is involved in taxable transactions or export works and services (excl. Article 149 of the Tax Code of the Russian Federation).

If you initially bought goods for use in non-taxable transactions, but then decided to resell them or use them in taxable activities, VAT can be deducted. Conversely, when purchasing goods for use in taxable transactions and actual use in non-taxable ones, the VAT accepted for deduction must be restored.

If during the reporting quarter you had both taxable and non-taxable VAT transactions, start keeping separate records. Take part of the tax on taxable transactions as a deduction, and include the rest of the input VAT in the cost of purchases.

Condition 3. Purchased goods and materials are accepted for accounting

Purchased goods and materials must be capitalized according to accounting rules, only then can input VAT be deducted. Capitalization must be confirmed by documentation - a correctly executed primary document.

GWS can be considered capitalized, the cost of which is reflected in the accounting accounts. For example, goods for resale should be reflected on account 41, work and services - on accounts 20, 44, etc.

Also fill out the primary registration form for the goods and services accepted for registration. These can be standard documents or independently developed forms: invoices, receipt orders, acts, invoices, etc.

Condition 4. The supplier presented a correctly executed invoice or UPD

You must receive an invoice or a universal transfer document (UDD) from the supplier. If there are no invoices, they are issued with violations or are not reflected in the VAT return, do not accept input tax as a deduction (Article 172 of the Tax Code of the Russian Federation, letter of the Federal Tax Service dated October 21, 2013 No. ММВ-20/3/96).

An invoice or UPD is not always required (clauses 2.1, 3, 6–8 of Article 171 of the Tax Code, letter of the Ministry of Finance dated September 16, 2019 No. 03-07-14/71091). This is not necessary when importing goods, receiving a contribution to the management company, VAT compensation for a foreigner, or purchasing electronic services from foreign companies. In such cases, invoices can be replaced with other documents. For example, for property on account of a contribution to the authorized capital, these could be acts OS-1, OS-1a, etc. To do this, the documents also need to indicate the amount of VAT recovered by the participant.

Additional terms

In order to deduct VAT on some transactions, additional conditions must be met. For example, to deduct VAT, which you must pay yourself, the tax must be transferred to the budget. To deduct VAT on property against a contribution to the management company, the participant must restore the tax to the budget.

Also, for some transactions, special conditions for accepting tax for deduction are established, and all four listed above do not apply. For example, to deduct VAT on an advance payment, the buyer needs an invoice from the seller, an agreement with the condition of the advance and a payment document for its payment. In order for the seller to be able to deduct VAT on the advance received, he must ship the goods or return the advance to the buyer.

Conditions of deduction

In general, input VAT is deductible if the following four conditions are simultaneously met:

- the tax is presented by the supplier;

- goods, works or services were purchased for VAT-taxable transactions, including for resale;

- purchased goods, works or services are registered;

- a correctly executed invoice (universal transfer document) has been received.

This is stated in articles 169, 171, 172 of the Tax Code of the Russian Federation.

When can you claim a VAT deduction?

The deduction can be submitted in the quarter in which all mandatory conditions are met. Example. Algorithm LLC purchased goods for resale and capitalized them on July 1 (3rd quarter). At the same time, the supplier issued an invoice with the allocated amount of VAT on June 30 (2nd quarter). Algorithm LLC fulfilled the last condition (accepted goods for accounting) only in the 3rd quarter, so the organization can declare a deduction no earlier than in the declaration for the 3rd quarter.

If an organization had received goods on June 30 and received an invoice on July 24, it could have taken advantage of the deduction in the 2nd quarter. There is an important condition here: the invoice must be received before the 25th of the month following the quarter, that is, before the deadline for filing the declaration.

VAT deductions for past periods can be claimed within three years from the date of capitalization. When returning an advance payment or goods, the deduction can be claimed within a year; the three-year period does not apply in this case.

Condition 2: acceptance for accounting

The next condition for applying the VAT tax deduction, which we will consider, is the need to accept goods, services, and accounting rights. The subtlety is that the Tax Code of the Russian Federation does not specify what kind of accounting we are talking about, and this sometimes creates problems due to differences in the interpretation of this concept by taxpayers and tax authorities.

Indeed, there are several types of accounting, for example accounting, warehouse, management, tax. Which of them should be preferred for the purpose of applying VAT deductions? The most reasonable thing that can be done in such a situation is to follow the procedure for registration, which is established in accounting legislation, namely in the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

According to this document, the basis for recording any business transaction in accounting appears when there is a primary document for it. Thus, confirmation of the fact of registration of goods or services will be the presence of all the necessary primary information on them. Moreover, it then has legal force when all the necessary details are filled out and signatures are present. Tax authorities often use existing “defects” in primary documents to declare a VAT deduction illegal.

We also note that the Tax Code of the Russian Federation does not define any specific accounts on which “purchases” should be reflected. This also often causes disagreements with inspectors. For example, is it legal to take advantage of the deduction if the object is listed on accounts 07 or 08, or can it be applied only when the fixed asset moves to account 01?

You will find the answer to this question in our material How to claim VAT on fixed assets or equipment for deduction.”

Calculation of VAT for deduction

To calculate VAT deductible, add up all VAT on your transactions listed in Art. 171 Tax Code of the Russian Federation. However, remember that all conditions must be met to claim a deduction; check this before including the tax on the transaction in the calculation.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

The tax office checks all VAT claimed for deduction for compliance with the conditions, and another criterion is its amount. Inspectors have their own standards for deductions. If yours turns out to be larger, tax officials may require clarification or come with an audit.

There is no exact data on how the Federal Tax Service considers the “Safe Deduction”. Typically one of two methods is used:

- Method 1. The Federal Tax Service calculates the share according to declarations for the year and compares it with the threshold value of 89 percent.

- Method 2. The Federal Tax Service calculates the share according to the declarations for the quarter and compares it with the average share of deductions by region.

Calculate your share of deductions using the formula:

Share of deductions = All deductions (p. 190 section 3) / Accrued VAT (p. 118 section 3) × 100%

If the percentage of deductions is greater than the safe amount, you can carry them forward to later quarters or claim them in installments over three years. Both transfer and division into parts are valid only for deductions from clause 2 of Art. 171 Tax Code of the Russian Federation.

VAT refund

The procedure for VAT refund is provided for in Art. 176 of the Tax Code of the Russian Federation. In the event that the VAT calculated for deduction is greater than the VAT payable, the resulting tax difference is subject to refund or offset.

Upon receipt of a VAT return for the reporting period, tax officials conduct a desk audit of the validity of the VAT refund. If no violations are found, then at the end of the audit the tax inspectorate is obliged to make a decision on a tax refund (Clause 2 of Article 176 of the Tax Code of the Russian Federation). The Federal Tax Service Inspectorate shall notify the taxpayer in writing of the decision made within 5 days from the date of the relevant decision. The next day after making a decision on a refund, the tax authority sends an order to the treasury for a tax refund. The tax is transferred within 5 days from the date of receipt of this order (clause 8 of Article 176 of the Tax Code of the Russian Federation).

The amount of VAT claimed for refund can be offset against the arrears of taxes, fines and penalties. Moreover, tax authorities can do such an offset independently without taking into account the taxpayer’s opinion.

If violations were revealed during the cameral, then a corresponding act is drawn up, and the Federal Tax Service makes a decision on the existence of an offense and holding the taxpayer accountable.

How to reflect the VAT deduction in the declaration

The amounts of VAT to be deducted are reflected in lines 120-190 of section 3 of the VAT return. In lines 120-185, the deduction is distributed by type. And in line 190 the total amount of deduction for the quarter is calculated; for this, the values from lines 120-185 are added together.

Next, from line 118, which indicates the amount of tax including recovery, subtract line 190. This way you will receive the amount of VAT payable or refundable. If the difference between lines 118 and 190 is greater than 0, reflect the VAT payable in line 200, if less, reflect the VAT payable in line 210.

The subsidiary received property from the parent organization

An organization that transfers any property free of charge to its “daughter” does not have to pay VAT. And the invoice, which is issued during such a transfer, is not subject to registration in the purchase book of the subsidiary company. This follows from paragraph 19 of the rules for maintaining a purchase book, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. Accordingly, the subsidiary has no grounds for deducting tax on valuables received from the parent company. The Ministry of Finance of Russia regularly reminds of this (see, for example, letter dated December 13, 2016 No. 03-03-05/74496; “A subsidiary should not pay income tax when receiving property free of charge from the “parent” company, whose share is more than 50 %").

Postings for registering VAT deductions

| Wiring | Operation |

| Dt 19 Kt 60 | Input VAT on goods, works, services, property rights is reflected |

| Dt 68 Kt 19 | Input VAT is accepted for deduction |

| Dt 76 Kt 68 | VAT has been charged on advance payments towards future deliveries |

| Dt 68 Kt 76 | Accepted for deduction of VAT on an advance received previously from a buyer or an advance paid to a supplier |

| Dt 19 Kt 68 | VAT accepted for deduction has been restored |

| Dt 91-2 Kt | Recovered VAT is written off as expenses |

Keep VAT records in the Kontur.Accounting web service. The service will indicate which documents need to be completed and which transactions need to be monitored in order to avoid fines and reduce VAT payable. The system makes it easy to keep records, payroll and report via the Internet. The first two weeks in Accounting are free for all new students.

What are the tax rates?

Tax rates are differentiated depending on the type of product or the circumstances of the sale. The following rates exist:

- The basic rate is 20%. This rate has been set since 2021. Anyone who does not use preferential rates pays VAT at the basic rate. The rate applies to everyone who does not fall under parts 1 and 2 of Article 164 of the Tax Code of the Russian Federation

- 10% for some product groups. This rate applies to some food and children's products, printed publications, medical products, and also applies to air transportation within the country.

- 0% or actual exemption from VAT. The possibility of applying such a rate is prescribed by law. Part 1 of Article 164 of the Tax Code of the Russian Federation contains a list of transactions that are not subject to VAT