What's wrong with a loss?

The mere fact of receiving a loss is neither good nor bad.

If we turn to the legislation, then clause 1 of Art. 2 of the Civil Code of the Russian Federation explains that entrepreneurship is an independent activity that is carried out at one’s own risk. Moreover, this activity must be legal, and its goal is the systematic receipt of profit. Please note that making a profit is precisely the goal, and not a mandatory result of entrepreneurship. This interpretation of the law is also confirmed in court documents, for example, in the resolution of the plenum of the Supreme Arbitration Court of the Russian Federation “On some issues that arise for the courts when applying the Special Part of the Code of the Russian Federation on Administrative Offenses” dated October 24, 2006 No. 18, as well as in the resolutions of the Federal Antimonopoly Service of the Moscow District dated 09.11.10 No. A40-175533/09-35-1333 and dated 04.05.10 No. A40-114683/09-4-826.

Thus, losses in the economic activities of enterprises and entrepreneurs are quite acceptable and often justified (for example, at the very beginning of their work). Another thing is that there are quite serious reasons for unprofitable activities - these are carefully analyzed and studied by controllers.

If you have access to ConsultantPlus, find out in what cases the tax office can call for a loss-making commission . If you don't have access, get a free trial of online legal access.

Commission for losses in the Federal Tax Service - what is it?

The procedure for conducting tax commissions is explained in the open letter of the Federal Tax Service “On the work of the commission on the legalization of the tax base and the base for insurance premiums” dated July 25, 2017 No. ED-4-15 / [email protected]

Its only goal, as follows from this document, is to increase tax revenues to the budget. There is also an opinion that one of the reasons for the emergence of tax commissions is to increase the investment attractiveness of Russian business.

The Tax Base Legalization Commission operates on the basis of an order, and its composition is approved by the head of the tax authority.

Who can be a member of the commission at the tax office? These are managers and authorized employees of departments performing the following functions:

- carrying out inspections (desk and on-site);

- carrying out pre-test analysis;

- debt settlement.

The commission may also include representatives of the executive branch, law enforcement officials, the Pension Fund of the Russian Federation, the State Labor Inspectorate and the prosecutor's office.

Let's look at the tax commission's action plan to legalize the tax base. It consists of several successive stages:

- A selection of “suitable” taxpayers is made, and appropriate lists are formed for summons to the tax commission.

- Analytical activities are being carried out regarding the financial and economic activities of selected taxpayers, and information is being prepared for the upcoming meeting. It should be understood here that such an analysis is carried out comprehensively. Therefore, even if the reason for the inspectors’ attention was a loss on income tax, tax specialists will study declarations and documents not only for this tax, but also for others - VAT, transport, excise taxes, personal income tax, etc.

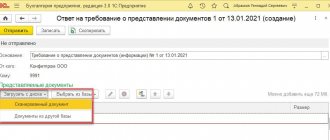

- Selected taxpayers are sent information letters in the prescribed form containing a proposal to independently make appropriate changes to the reporting. This document must be drawn up in accordance with Appendix 11 to the Federal Tax Service letter No. AS-4-2/ [email protected] If the taxpayer does not respond to the inspectors’ message or refuses to make changes to the reporting, he is summoned to a meeting.

- A meeting of the tax commission on legalization takes place directly (we will examine this stage in more detail a little later). The case is considered on an individual basis. At the end of the meeting, a protocol is drawn up, which records recommendations for the taxpayer and the deadline by which the recommended measures must be implemented (10 days are given for this).

- Post-commission monitoring of taxpayer reporting. After the meeting, inspectors quarterly study the dynamics of changes in the financial performance of the company in a variety of areas.

- Continuation of work with taxpayers who have not eliminated the identified problems. At this last stage, there is a possibility that they will be included in the on-site inspection plan.

What facts can be revealed during the tax commission? This:

- incomplete reflection of business transactions in the taxpayer’s records;

- entering false information into tax and accounting reporting;

- use of schemes for unreasonable VAT refunds;

- inclusion of unlawful expenses in income tax returns;

- the use of “envelope” and other illegal salary schemes;

- late payment of personal income tax;

- payment of wages in the amount of the minimum wage or below the subsistence level.

It is interesting that to analyze the activities of taxpayers caught in the “tax pencil”, Federal Tax Service employees are allowed to use a variety of sources:

- accounting and tax reporting of the taxpayer;

- information from the Unified State Register, Unified State Register of Individual Entrepreneurs, Unified State Register of Legal Entities and many other documents;

- data obtained when requesting documents in accordance with Art. 93.1 Tax Code of the Russian Federation;

- information from the media and the Internet;

- information received from various commercial and government institutions and organizations - banks, law enforcement agencies, funds, customs authorities, etc.;

- letters and complaints from legal entities and individuals;

- information received from employees or participants of enterprises;

- other sources.

As can be seen from the above list, almost any information about a taxpayer that comes to the attention of inspectors can serve as a reason for a closer study of its activities.

Sending an information letter

At the stage of preparation for the meeting of the “salary” commission, an information letter may be sent to the taxpayer (tax agent, insurance premium payer) (its form is given in Appendix 8 to

The purpose of such a letter is to encourage organizations and individual entrepreneurs to independently analyze the results of commercial activities, identify the reasons for the low tax burden, the high share of professional deductions, understating the base for insurance premiums, low wages, repaying debts on personal income tax and insurance premiums, as well as correcting errors (distortions) of tax reporting.

In the information letter, inspectors propose, among other things:

- clarify tax obligations (or obligations to pay insurance premiums) in the manner established by Art. 81 of the Tax Code of the Russian Federation, including clarifying the amount of professional deduction, the amount of payments not subject to insurance premiums, thereby adjusting the basis for their calculation;

- present the results of the SOUT if the payer calculates insurance premiums at additional rates;

- pay off debts on personal income tax and insurance premiums;

- calculate personal income tax and insurance contributions from the income actually received by employees of the organization that is subject to taxation;

- Conduct an independent risk assessment in accordance with Order of the Federal Tax Service of the Russian Federation dated May 30, 2007 No. MM-3-06/ [email protected]

The information letter must be sent in advance - no later than one month before the date of the planned commission meeting.

After the expiration of the established period, the tax authority issues a notice of summons to the taxpayer (its form has been approved

) in the following cases:

- failure to provide updated documents;

- in case of non-payment of debt on personal income tax and insurance premiums;

- in case of failure to provide explanations that provide reasoned reasons explaining the lack of grounds for an invitation to the commission.

The tax office calls you to a meeting on profits - is it worth going?

This question is probably asked by every taxpayer who has received a written notice of a summons to a commission at the tax office. Really, is it worth it? Let's see what the law says about this.

On the one hand, the Tax Code does not provide for such a tax control measure as a commission. The basic tax law distinguishes only 2 forms of control measures - an on-site tax audit and a desk audit. According to subparagraph 11 clause 1 art. 21 of the Tax Code of the Russian Federation, taxpayers are allowed not to comply with unlawful (which do not comply with the code or other laws) demands of tax authorities. So you don't have to go anywhere? However, not all so simple.

According to Art. 82 of the Tax Code of the Russian Federation, tax control is carried out through tax audits, by obtaining explanations from taxpayers, checking accounting and reporting data, inspecting relevant premises, as well as in other forms provided by law. Let's turn to Art. 31 of the Tax Code of the Russian Federation, from sub. 4 clause 2 of which we can conclude: tax workers have the right to call the taxpayer with a special written notice in order to receive clarification regarding the taxes he pays, both in connection with tax audits and in other cases provided for by law. At the same time, the form of this notification is established by order of the Federal Tax Service of Russia dated 05/08/2015 No. ММВ-7-2/ [email protected]

Thus, tax officials still have legal grounds for calling the taxpayer to such commissions, and their demands cannot be ignored. The same is confirmed by judicial practice: judges come to the conclusion that the actions of tax inspectors in this case are within the scope of their powers and do not violate the rights and interests of the taxpayer.

When things are bad

When a payer or tax agent does not come to a commission meeting without a good reason and, in addition, his reporting does not indicate an improvement in his financial condition, the question will be asked:

- about a new call to the interdepartmental commission under local authorities;

- calling to an interdepartmental commission under the regional administration (applies to state unitary enterprises, municipal unitary enterprises, joint-stock companies with state or municipal participation);

- conducting a pre-audit analysis at the Federal Tax Service;

- preparing documents for scheduling an on-site tax audit.

Also see “How through the legalization commissions they get into the on-site inspection plan.”

Read also

01.09.2017

The legality of an invitation to a commission - is there liability for failure to appear?

The notice of the taxpayer's summons to the commission may indicate both a specific date when the inspector would like to see you, as well as information about his office hours and a requirement to contact him at the specified time - to set the exact date for your visit to the inspection.

If you do not appear on the appointed day for the commission meeting, this will be recorded by the inspector in the minutes. Please note that your failure to appear may be regarded by tax authorities as disobedience to the legal requirement of a supervisory authority official, which, according to Part 1 of Art. 19.4 of the Code of Administrative Offenses of the Russian Federation, threatens to collect a fine:

- 500–1,000 rubles from citizens (although individuals can get off with a warning);

- 2,000–4,000 rubles - from entrepreneurs and organizations (officials).

If you cannot attend a meeting for a good reason, be sure to inform the inspectors about this - in this case, most likely, it will be postponed to another day. If you ignored the invitation to the commission or did not show up for it without a good reason, the following actions by the tax authorities are possible:

- callback direction;

- a call to a loss-making commission at the regional level Federal Tax Service;

- summons to a commission in the administration or local government;

- conducting a pre-check analysis of the violator’s activities;

- preparation of materials for an on-site audit in relation to a given taxpayer.

Separately, it is worth mentioning the issue of providing such a document as a “Questionnaire reflecting the main financial and economic indicators of an organization in the city of Moscow,” which is often requested by tax authorities when calling for a loss-making commission, not only from Moscow taxpayers, but also from those registered in other regions. Should I fill it out or not?

Let's remember when tax authorities may require documents. The answer to this question is given by Art. 93 and 93.1 of the Tax Code of the Russian Federation: requesting documents is possible only within the framework of on-site and desk audits, to which the tax commission, as we have already found out, has no relation. But even as part of the audits, the taxpayer is obliged to provide the tax authorities only with those documents on the basis of which he calculated and paid a particular tax.

Such documents include primary documentation, as well as reporting - accounting and tax. The preparation of any other certificates or reports is not provided for by the tax legislation of the Russian Federation, and therefore any written explanations for the losses you have can be given at your own discretion.

Another significant point is that the form of the questionnaire was approved by Decree No. 701-PP dated August 10, 2010, which has become invalid. Therefore, the requirement to fill it out is, in principle, illegal. However, tax officials, apparently out of habit or because this form is convenient for them, continue to send out questionnaires along with notices of summons to the commission.

Another thing is that the same questionnaire contains information that will not be difficult to enter:

- basic information about the company (TIN, address, date of tax registration);

- information about the manager and chief accountant (full name and contact details);

- information about the founders;

- information about the types of actual activities;

- information about occupied and leased premises and land plots;

- main reporting indicators (revenue, costs, income and expenses, profit, amounts of rental and salary payments, information on the cost of fixed assets, etc.);

- information about investment programs, etc.

Almost all the information that is necessary to fill out the questionnaire is contained in the financial statements and is entered quite quickly. Such a certificate can be useful not only to tax authorities, but also to yourself, since it will help you to reasonably operate with the necessary figures during a meeting of the tax commission. But still, keep in mind that tax officials will not be able to force you to fill out this paper.

No-show

When a company representative does not come to a meeting of the tax commission on the legalization of bases for a valid reason, the event may be postponed. Here we pay attention to 2 nuances:

- The Federal Tax Service has not established a list of valid reasons (i.e. it will be decided on the spot);

- rescheduling the meeting in this case is the right, not the duty of the commission.

In addition, the absence of the payer or tax agent at the meeting must be reflected in the minutes.

Call to the Loss Commission: Who do they pay attention to?

According to tax officials, there are two categories of taxpayers who are most likely to be invited to the commission (by the way, not only taxpayers, but also tax agents may be of interest to tax authorities):

1. Legal entities and individuals whose activities, according to controllers, have tax risks. If this fact is discovered, such taxpayers are given the opportunity to correct the situation on their own.

2. Unscrupulous taxpayers who have an underestimated tax base that is insufficient to warrant an on-site audit. The commission also gives them a chance to improve the situation, but if they do not take advantage of it, an on-site inspection will most likely not be avoided.

What actions of taxpayers may cause increased interest of controllers? This:

- declaration by the organization of losses when conducting financial and economic activities (if a loss is declared in line 100 of sheet 02 of the income tax return, the same as for the previous 2 tax periods, or if this line is not filled in);

- low tax burden for income tax, as well as for other taxes.

The tax burden on profits is determined using a fairly simple formula:

Nnp = Npo / Drv,

Where:

Nnp - the value of the tax burden;

NPO - the amount of income tax for the reporting period (line 180 of sheet 02 of the declaration);

Дрв - the total value of income from sales and non-operating income (sum of lines 010 and 020 of sheet 02 of the declaration).

A profitable tax burden is considered low if it is less than 3% for manufacturing organizations and less than 1% for trading organizations.

Correctly calculating the tax and tax burden can only be done on the basis of well-designed tax registers - for information on how to create them, read the article “How to independently develop tax registers for income tax?”

The concept of inducement to voluntarily pay taxes

Tax authorities interact with taxpayers not only at the formal level. An example of “non-formal” methods is an excerpt from the text of the Letter of the Federal Tax Service of Russia dated July 25, 2021 No. ED-4-15 / [email protected] : “...encouraging taxpayers to independently clarify their tax obligations.” In order to motivate or “encourage” taxpayers to voluntarily pay taxes and fees, it is necessary to establish mutually beneficial, even “partnership” relationships with them. What does this mean? And the essence of such a mutually beneficial partnership is that taxpayers voluntarily provide detailed information about their activities in exchange for explanations from tax inspectors about the correctness of taxation of some large or complex transactions, etc. This measure of influence on taxpayers has been actively used by tax authorities in their work since 2015. In addition, electronic interaction regarding the correct calculation and completeness of VAT payment and reimbursement was recently introduced. And this is another form of control by taxpayers and close cooperation with them. For the same purpose, in 2015, a new obligation for taxpayers to declare expanded declarations for transactions from the book of purchases and sales was introduced, which allowed tax officials to automatically stop all kinds of schemes for illegal VAT refunds. Despite the tightening of tax control by the tax authorities, this innovation has made life easier for taxpayers themselves, who have become much easier to submit additional documents to the tax inspectorate upon its requests. Even earlier, in 2009, a pre-trial procedure for resolving tax disputes through a higher tax authority was introduced. Let us remind you that until this moment, taxpayers’ claims were considered only in court. In other words, all of these changes make it possible for taxpayers and tax authorities to establish increasingly effective relationships that improve the financial condition of legal entity taxpayers and at the same time lead to an increase in the budget.

How does the commission work?

The loud name “commission” refers to the usual conversation between tax officials and the head of the enterprise and the chief accountant - sometimes formal, sometimes not very formal. Moreover, controllers most often want to see precisely these company representatives and no one else. However, they can be completely legally replaced by an authorized representative.

What motivates this position? Let's turn again to the law. As we have already found out, according to sub. 4. clause 2 art. 31 of the Tax Code of the Russian Federation, tax authorities have the right to call the taxpayer to give explanations in cases established by law. However, there is no question here that it is the manager or chief accountant who should come to the inspection, much less them together. According to Art. 29 of the Tax Code of the Russian Federation, authorized representatives can also give explanations to controllers. Therefore, you have the right to choose who will represent your company at a meeting of the loss-making profit commission.

How does the tax commission work in practice? During a conversation with company representatives, inspectors find out the reasons for the taxpayer’s loss (this is where the data from the “Questionnaire” can come in handy) and ask him to announce the measures that he plans to take to get out of the unprofitable state. The purpose of this conversation is one - to exclude “bad” indicators from reporting.

Further, depending on the specific situation, tax officials offer one or another way to solve this alleged problem. Why "allegedly"? Yes, because in many cases the loss is not a problem for the taxpayers themselves.

As a rule, tax specialists see few options. Most often it is proposed to reduce expenses of the current tax period. In other words, inspectors are trying to get taxpayers to increase their income tax accruals for the “problem” tax period or reduce losses by submitting an amendment.

At the same time, questions may be asked about other taxes, in particular, VAT. And if representatives of the funds are present at the meeting, then it is possible to discuss the problems that the taxpayer has regarding the payment of insurance premiums.

The results of the conversation are recorded in the protocol, which also indicates the period for eliminating the violations (in general, this is 10 days). If the taxpayer refuses to adhere to the recommendations given to him, the following measures of influence on him are possible:

- increased attention to the “obstinate” company and increased desk control of the reporting it submits is a very likely option;

- the promise of an early on-site inspection (however, as the inspectors themselves admit, refusal to submit clarification is not always a reason for carrying out “global” control measures - the decision on an on-site inspection is made based on a combination of factors and risks);

- promise of bankruptcy - tax authorities believe that they have the right to this measure on the basis of Art. 20 of the Law “On Limited Liability Companies” and Art. 35 of the Law “On Joint-Stock Companies”, however, this position is based on an incorrect interpretation of these norms and the equation of concepts such as “liquidation” and “bankruptcy”; The judges in this case are on the side of the taxpayer.

In principle, this is an exhaustive list of enforcement measures, however, as practice shows, not every announced measure is implemented.

What questions might the inspector ask?

At the commission meeting itself, the taxpayer’s representative is usually asked the following questions:

- What exactly does the organization do? They are interested in the details of trade, performance of work and provision of services.

- What suppliers and buyers does the company work with and whether the head of the organization meets with representatives of counterparties. Is there a security service and are contractors checked for “reliability” and is “due diligence” exercised when concluding contracts?

- Is the taxpayer’s office located at the legal address, is there a lease agreement, what amounts are the lease payments.

- How many employees work in the company and what do they do? They may ask about the size of the wage fund.

- If a company representative cannot confidently answer some of these questions, the inspector may conclude that the taxpayer does not exercise due diligence when choosing a counterparty and, as a result, the reality of the business transactions carried out by him is questionable.

- The commission is also interested in whether the taxpayer cooperates with fly-by-night companies to create a formal document flow.

In order to confidently and clearly answer all the inspector’s questions, it is worth spending some time preparing for the meeting. Refresh your memory with information about the main contractors and the specifics of the company’s activities (it will be useful to talk about the production cycle and the specifics of carrying out work, providing services, etc.).