Form RSV-1 is a calculation of insurance premiums that all employers must submit to the tax office. You can check the correctness of filling out using the list of critical errors compiled by the Federal Tax Service.

Just a few years ago, all employers (enterprises and individual entrepreneurs) were required to submit a quarterly form RSV-1 (PFR) to the Pension Fund of Russia in relation to all individuals working for them under employment contracts. Since legislation changes periodically and the Federal Tax Service of the Russian Federation is now administering insurance premiums, the name and addressee of the form have changed. The announcement that the DAM form is now submitted to the tax office was made by the regulatory authorities in advance, but contribution payers are still experiencing difficulties in this matter, because part of the reporting is still submitted to the Pension Fund of the Russian Federation, SVZ, for example. Now the form is called the Unified Calculation of Insurance Premiums, and it is still submitted every quarter by all employer-insurers, but this time to the Federal Tax Service of Russia. This report now includes not only pension contributions, but also social and compulsory health insurance contributions. Therefore, the form, as before, can be called RSV, the decoding of the abbreviation allows: “calculation of insurance premiums.”

Let's take a closer look at some of the nuances that the modified, rather large, form of RSV-1 (2020) hides. Detailed instructions for filling it out can be found in the article “Sample of filling out the DAM form for the 3rd quarter of 2021.”

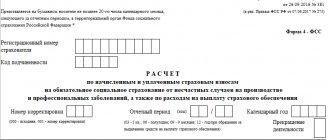

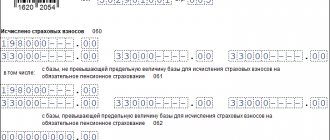

And the form itself looks like this.

Terms and procedure for provision

The deadline for submitting the calculation is the same for all employers - the form must be sent to the territorial body of the Federal Tax Service at the place of registration of the insurance premium payer no later than the 30th day of the month following the reporting period. In this case, the calculation period for contributions is a calendar year, and the reporting periods are:

- I quarter;

- half year;

- 9 months.

The deadlines for submitting the report in 2021 are as follows:

- for the first quarter of 2021 - until 05/03/2019;

- for the first half of 2021 - until July 30, 2019;

- for 9 months of 2021 - until October 30, 2019;

- for the billing period (2020) - until 01/30/2019.

Control ratios when checking calculations

The Tax Service has changed the rules for checking control ratios (CR) of accrued amounts in the calculation of insurance premiums. Now the actions of the inspection bodies are regulated by letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 02/07/2020. In the document, all changes are presented in the form of a detailed table. The new CS make it possible to better compare the amounts of payments accrued under employment contracts to employees not only with the minimum wage established by the region, but also with the average wages in certain industries for the previous period. This technique will make it possible to more effectively identify “black” salaries. In total, the list of control ratios has been reduced, but at the same time it has become more effective.

In Kontur.Externe, checks for new control ratios are already built in: if an error is detected, the system will not allow you to send the calculation.

Most of the report's benchmark ratios are evaluated according to the rate code. If an error is detected, the inspector sends a notice of non-compliance, which must be corrected within a specified time frame.

RSV submission form

If the average number of employees of an organization for the previous reporting (calculation) period exceeds 25 people, then the policyholder can only submit an electronic DAM; paper version is not required. The accounting department knows very well what this is: you need to generate a report in a special program, certify it with an electronic signature and send it to the tax service via the Internet. A similar requirement applies to all newly created organizations with more than 25 employees. All other companies can report on paper.

We must not forget that failure to comply with the procedure for submitting the DAM form threatens the payer with a fine of 200 rubles under Article 119.1 of the Tax Code of the Russian Federation.

Method of submitting the report - on paper or via the Internet

Since 2021, the rules by which the possibility of submitting a declaration in electronic or paper form have been determined have changed. From the 1st quarter of 2021 in accordance with clause 4 of article 80, clause 10 of art. 431 of the Tax Code of the Russian Federation establishes a new limit on the number of employees :

- companies with more than 10 employees are required to provide a report in electronic form, previously this parameter was 25 people

- companies created during the reporting period, including through reorganization, are required to report electronically if the number of employees exceeds 10 people, and not 25, as was previously the case

Legal entities and individual entrepreneurs with fewer than 10 employees can choose the method of submitting the report independently: submit the calculation on paper in person, send it by registered mail with a list of attachments by mail, or submit it via electronic communication channels.

Filling procedure and features

When filling out DAM forms, you still need to follow certain rules. Information about them can be found both in administrative and explanatory acts of the Federal Tax Service. The current form for a single calculation for insurance premiums and the procedure for filling it out are approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/ [email protected] KND code 1151111. Second source: letters and official explanations. The Russian Federal Tax Service constantly publishes various explanations on how to fill out this report. For example, the Letter of the Federal Tax Service of the Russian Federation dated April 12, 2017 No. BS-4-11 / [email protected] states who must fill out which section. These data are shown in the table:

| Category of employer-insurer | What you need to fill out |

| All insurers (legal entities and individual entrepreneurs, except heads of peasant farms) |

|

| Additionally, these employers must fill out if they fall into the following categories: | |

|

|

|

|

|

|

At the same time, policyholders are required to submit a “zero” DAM. In letter No. BS-4-11/4859 dated March 17, 2017, tax officials reminded that if employees were not paid wages in the reporting quarter, then subsection 3.2 of Section 3 does not need to be filled out. There are also opinions that if an organization does not make payments in favor of individuals, and therefore no insurance premiums during the billing (reporting) period, it is still obliged to provide a calculation with zero indicators. This, in particular, is stated in the Letter of the Ministry of Finance of the Russian Federation dated March 24, 2017 No. 03-15-07/17273.

Let's look at a few more important explanations about the features of filling out this form in more detail.

Who submits the DAM for the 1st quarter of 2021

Calculation of insurance premiums has been introduced since 2021. It replaced several forms that were canceled after the transfer of insurance premiums to the tax authorities: RSV-1, RSV-2, RSV-3 and partially 4-FSS.

Employers making payments must submit the DAM for the 1st quarter of 2021:

- employees working under employment contracts (regardless of its validity period);

- persons with whom GPC agreements have been concluded;

- authors of works under copyright contracts;

- “physicists” under agreements on the alienation of the exclusive right to certain results of intellectual activity, publishing license agreements, license agreements on granting the right to use the results of intellectual activity.

The following employers submit RSV:

- organizations;

- separate sections of Russian organizations that independently pay income to their employees and pay contributions to the budget from it;

- separate units of foreign organizations operating in Russia;

- IP;

- heads of peasant farms;

- an individual without individual entrepreneur status.

Zero RSV is given by:

- the only founders who also serve as CEOs;

- organizations or individual entrepreneurs if they had no activities and no payments to employees during the reporting period;

- heads of peasant farms in the absence of employees and activities.

Individual entrepreneurs, lawyers, private notaries who do not have employees do not submit insurance premium calculations.