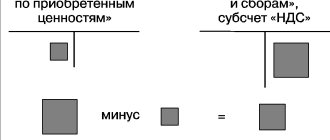

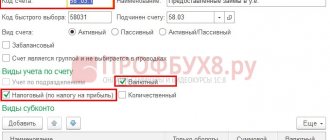

In retail commodity organizations where goods are accounted for at sales prices, account 42 “Trade margin” is used. Passive account, loan balance. Formula for calculating the final account balance 42 = Beginning loan balance + loan turnover. Account 42 is not reflected in the balance sheet. And the balance of account 42 is subtracted from account 41 (balance of account 41 - Balance of account 42). We write it down in the RESERVES Assets section of the balance sheet. (since on account 41 the goods are reflected at sales prices and the accounting records of goods should be reflected at the actual cost, subtract the trade margin on account 42 and get the actual cost)

Trade margin value

In order to obtain the planned profit, the seller, when selling goods, forms the cost using the amount of markup on the original cost. The resulting difference must cover all estimated costs, including the following:

- VAT and other indirect taxes;

- sales costs (third-party services, employee salaries);

- other expenses.

At the same time, the markup ensures not only the covering of expenses, but also the profit of the seller. At the same time, the value of the trade margin should not impede the further competitiveness of the product on the market in comparison with other similar items.

Existing subaccounts of account 41

According to the order approving the Chart of Accounts for the account. 41 you can open at least 4 sub-accounts for product classification:

- Account 41-01 - the subaccount takes into account products that are in the warehouse, base, or pantry.

- 41-02 - this subaccount reflects the presence and movement of material assets (including glassware) that are directly put up for sale in a store, kiosk, tent or stall.

- 41-03 - this subaccount takes into account all containers: currently occupied or empty, standing separately (except for glassware).

- 41-04 - this subaccount is used in organizations that conduct industrial or production activities. At 41-04, they take into account products that are purchased specifically for sale or when the cost of components for finished products is not included in the cost of the final product, but is reimbursed separately by buyers.

Accounting has the right to open other, additional sub-accounts to the account. 41 taking into account the specifics of the enterprise’s operations, if the need arises for more detailed account details.

Note! For account 41 analytical accounting can be maintained in the accounting department in the context of product names, places of their storage, as well as persons responsible for it.

Subaccounts 41

Determination of trade margin

To determine the final cost of goods in wholesale and retail trade, different algorithms are used.

When selling wholesale, the trade margin is the difference between the wholesale selling price and the purchase price.

To account for retail trade, it is allowed to accept goods not only at cost, but also at final selling prices. Such actions are permissible, since sometimes it is impossible to determine the natural value of a unit of goods. An exception is a unit of large products, for example, household appliances. But when selling smaller goods (office supplies, food), detailed accounting is impossible. In retail companies, it is preferable in such cases to account for goods at selling prices.

The selling price of a product consists of the cost price and an added margin. The latter value can be established by organizations independently, with some exceptions indicated below.

It is allowed to set a markup using the Register of Retail Prices, approved by the manager. For any type of product, information is provided about the supplier, the purchase price, the amount of markup in % terms, and the final market price. Each place of subsequent sale can have its own price.

The approved register may look like this:

| Product | Provider | Cost price | Markup 1 | Retail price 1 | Markup 2 | Retail price 2 |

| Pen | LLC "Prestige" | 45.00 rub. | 30% | 58.50 rub. | 35% | 60.75 rub. |

| Pen | LLC "Titan" | RUB 54.00 | 30% | 70.20 rub. | 35% | RUB 72.90 |

| Pencil | LLC "Dream" | 25.00 rub. | 30% | RUB 32.50 | 35% | 33.75 rub. |

The markup can also be uniform for all types of goods or depend on their type. It is recommended that the chosen method of determining retail prices be fixed in the current accounting policy.

Correspondence of account 41 with other accounts in accounting

Account 41 by debit corresponds with the accounts of the following sections:

- Section 2 - 15.

- Section 4 - 41, 42, 43.

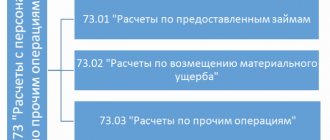

- Section 6 - 60, 66, 67, 68, 71, 73, 75, 76, 79.

- Section 7 - 80, 86.

- Section 8 - 90, 91, 98.

For loan 41, correspondence goes through the following sections:

- Section 2 - 10.

- Section 3 - 20, 29.

- Section 4 - 41, 44, 45.

- Section 6 - 76, 79.

- Section 7 - 80.

- Section 8 - 90, 94, 97, 99.

State regulation of pricing

Prices for certain products are controlled by the state. The government determines the acceptable price for certain goods that have special social significance. If a product is on the List of Price-Controlled Products, then their final cost, including markup, must be formed in accordance with current laws and regulations at the federal and local levels.

If there is a steady increase in prices for goods of social importance, the Government has the right to temporarily limit their maximum limit. But this can be done if the price increase level exceeds 30% over a 30-day period. The maximum permissible value of the cost of such goods, established by the Government, can be maintained for up to 90 days.

Socially significant goods include the following: meat, milk, sunflower oil and butter, flour, eggs, sugar, salt, bread, cereals, potatoes, some types of fruits and vegetables. In addition to food products, the list of goods for which control over selling prices can be established includes children's products, medicines, medical products, goods intended for sale in the Far North and regions equivalent to it.

If cases of overpricing are detected for goods regulated by states, the responsible persons and organizations will face fines. For management, fines of up to 50,000 rubles are provided, for legal entities - in the amount of twice the amount of revenue exceeded as a result of overstatement for the entire period of overstatement, but for a total duration of no more than a year.

Analysis of account 41 and card

Before you begin accounting for a commercial enterprise, you need to find out whether the account is 41 active or passive. Since it aggregates information about the property, cash and assets of the enterprise, therefore, it is an active account. At the account 41 the balance is only debit (positive), it cannot result in a negative balance. Debit account 41 reflects the receipt of goods, containers, materials or resources at the warehouse or store of the enterprise. Credit account 41 reflects the disposal of goods, a decrease in their value in accounting, due to sale, transfer to other needs, return to the supplier, write-off of defects or inventory shortages.

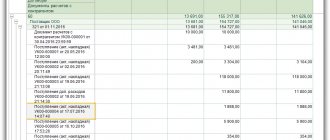

Account card 41

The card for account 41 is similar in content to a balance sheet and is used in accounting to verify the correct entry of data into the software. When this report is displayed, it becomes easy to track the appearance of information on the account, as well as verify the turnover and balance of the account. 41. The report can be generated by the program for any period, up to its generation for one shift.

Note! The count should not be confused. 41 in accounting and accounts. 41, opened at the Federal Treasury. The latter is required only for making payments under some government programs for which the company is the executor. Opening such a personal account is not mandatory for all enterprises, but is required only for some tender participants.

Thus, accounting for products intended for further resale must be carried out to correctly reflect changes in the assets of the enterprise. After all, information about it, as well as trade margins on it, have a direct impact on the formation of the enterprise’s profit.

https://www.youtube.com/watch?v=enPNNAytRJY

Sales of goods: retail postings

Direct sales of products to consumers are most often carried out using cash payments, but bank cards, settlement checks, commission agreements or installment payments can also be used. Cash registers, which are mandatory for use in enterprises working with the public, help track the volume of revenue at the cash register. The machine’s performance at the end of the day forms the amount of money brought in by the sale of goods. Postings - an example of attributing account amounts 50 to the financial result - are compiled as follows:

- Dt "Cashier" Kt "Revenue" - includes revenue from the sale of goods at sales prices, including VAT;

- Dt “Cost of sales” Ct “Retail goods” - the amount of the purchase price of goods is written off;

- Dt "Sales" (subaccount "VAT") Ct "Calculations for VAT" - allocated VAT for payment.

We must not forget about the overhead costs of a trading enterprise, which are written off in this way:

- Dt “Cost of sales” Kt “Sales expenses” - the cost of sales includes the amount of distribution costs.

- When creating a separate subaccount on the account. 90 account assignment looks like this: Dt 90 (business expenses) Kt 44.

During the reporting month, accounting may make the described transactions more than once. Account 90 data broken down by subaccounts is accumulated for the period and then written off. The totality of debit turnover of the account. 90.2, 90.3, 90.4 and amounts on the loan account. 90.1 and is written off by posting Dt 90.5 Kt 99 or Dt 99 Kt 90.5. Account 90 has no balance at the end of the month.

HIGHLIGHTS OF THE WEEK

01/20/202111:18 Personnel

New labor protection rules – new responsibilities of the employer

21.01.202109:00

Litigation

How did a “penny” test purchase ruin an individual entrepreneur, a pensioner?

19.01.202112:00

Checks

On-site tax audit in 2021: what do you need to know?

19.01.202113:00

Contributions

How to transfer insurance premiums to the cost of a patent?

yesterday at 14:5814:58

Business organization

Debtors will retain a minimum income

PODCAST 4.12.2020

What has changed in taxes and reporting since 2021?

All episodes

Comments on documents for an accountant

Do I have to pay personal income tax if the employer pays for the issuance of bank cards for employees?

01/26/2021 Payment by the employer of the bank commission for issuing and servicing employee salary cards is not…

Payment of income to a foreign company that does not have the actual right to it: tax consequences

01/26/2021 A foreign organization that directly receives income and is not a private income fund cannot claim...

Is the New Year bonus for employees not subject to insurance contributions?

01/25/2021 The court supported the Pension Fund of Russia, which fined an organization that paid bonuses to all employees and did not accrue...

‹Previous›Next All comments

Commission sales of goods: postings, characteristics

The main feature of the sale of non-food products accepted for commission is that with the transfer of property, the rights to its ownership are retained by the principal. Relations between the parties are regulated by agreement.

For accounting purposes of products accepted for commission, account 004 is used. When goods are accepted for commission, the amount is reflected as a debit, and when written off, as a credit. The commission agent's remuneration is reflected by posting Dt 76 Kt 90.1.

Implementation and its recording in documents is an important component of accounting. Distortion of data will entail incorrect calculation of the tax base and incorrect assessment of financial results.

Features of accounting for buyer's prepayment at retail

In retail trade, the concept of advance payments for goods is not provided; the transaction is considered completed when the product and ownership of it are transferred to the end consumer. As a result, all advance payments from buyers are shown in the seller's accounting as follows:

- As accounts payable on account. 62, subaccount for accounting for advance payments (Dt50 Kt62).

- Then, at the time of transfer of the product to the buyer, an entry is made with the allocation of revenue - Dt62 Kt90.01.

- Final payment for goods: Dt50 Kt62.

- Transfer of advance payment to payment for goods Dt62 (subaccount for settlements on advances) Kt62.

Victor Stepanov, 2018-04-21

Accounting for sales of goods at sales prices

The commodity margin is taken into account on account 42. When receiving products into the warehouse, the accountant reflects the amount of the difference between the purchase and sales value in a debit. After sales are made and the results are written off to account 90, the red reversal method is used, which involves reflecting a negative amount. The operation is characterized by posting Dt 90.2 Kt 42 (red reversal). Amounts written off include VAT. After the tax amount is allocated, the remaining funds are distributed to cover expenses. Further account assignments are carried out similarly to the purchase price accounting method.

As you can see, the sale of goods is directly related to VAT. The entries characterizing the allocation of tax and its payment to the budget are drawn up as follows:

- Dt “Sales” (subaccount “VAT”) Kt “Calculations for VAT” - the amount of tax that was received from buyers and is subject to payment has been identified;

- Dt “Calculations for VAT” Ct “Current account” - the tax amount is transferred to the state. budget.

Sales of goods: postings to wholesalers

The company acting as a supplier agrees with the buyer of the goods using a contract. In addition, the seller must generally send the following documents:

- accompanying or merchandise;

- payment request;

- invoice.

Reflection of the sales process in accounting documents depends on the method of recognizing the transfer of ownership of shipped goods. Let's consider a situation where an organization recognizes it at the time of shipment, regardless of the terms of payment. The accompanying papers must contain information about the selling price of the goods, as well as the amount of VAT on it. The buyer forms a debt in the amount of the cost of the supplied products plus the amount of VAT. The operation requires simultaneously compiling the following for the sale of goods:

- Dt “Settlements with customers” Kt “Revenue” - the amount of receivables from customers is recorded, including VAT.

- Dt “Cost of sales” Ct “Goods” - the amount of shipped products at the purchase price is written off.

- Dt “VAT on sales” Ct “VAT obligations” - accepted for payment.

Basic postings with examples

If we consider typical transactions and account entries, we can use several options

. The amount of the trade margin that has been accrued is carried out on the loan. The debit is used to write off the markup associated with the sale of goods, reducing the amount.

- Dt 41 Kt 42

. This operation characterizes the fact that the accrual of the trade margin has been reflected. - Dt 90-2 Kt 42

implies the fact of writing off the amount of the markup on product items that were sold. - Dt 91-2 Kt 41

– the excess of the markdown amount over the markup amount was written off.

Now you should pay attention to a real practical example and consider not only the transactions, but also the amounts of transactions.

The organization Pelican LLC bought a consignment of 100 washing machines for a total amount of 1,000,000 rubles. VAT amounted to 180,000 rubles, and the size of the trade margin was 35%. Determining the value of this parameter, as well as the cost of goods for sale, the accountant made the following calculation measures

:

- The trade margin is a value that can be found using the following equation: (1,000,000 – 180,000) * 35% = 287,000 rubles. for the entire consignment.

- The selling price of a batch of goods is (1,000,000 – 180,000 + 287,000) = 1,107,000 rubles.

- The retail cost of a commodity unit is 1,107,000 / 100 = 11,070 rubles.

Now you should pay attention to the underlying entries compiled for the transactions in question. It turns out that when reflecting all transactions in accounting, the accountant made the following entries:

:

- Dt 41 Kt 60

. This posting reflects the fact that Pelican LLC received a shipment of goods worth RUB 8,200,000. - Dt 19 Kt 60

. Here we are talking about a situation where the amount of value added tax on incoming product items was reflected; the amount is 180,000 rubles. - Dt 60 Kt 51

. The posting reflects the fact of transfer of funds as payment for the item. - Dt 68 Kt 19

. This indicates the fact that value added tax has been deducted. - Dt 41 Kt 42

. As part of this posting, the value of the trade margin is reflected.

These entries are directly involved in business transactions and are the most accurate for recording.

If product items are no longer in circulation, measures are taken to write off the trade margin. For example, in case of sale, damage, free transfer to third parties.

If implemented

The amount is reversed in correspondence with account 90 “Sales”, subaccount “Cost of sales”. General wiring looks like Dt 90-2 Kt 42

.

What to do in case of markdown of goods

In the course of trade-related activities, some product items may lose their consumer properties, as well as their presentation. In this case, it is possible to make a decision to mark down the goods.

The amount for which this occurs is written off by posting: Dt 41 Kt 42

.

If the value of the markdown is higher than the TN indicator, wiring Dt 91-2 Kt 41

.

In the process of using goods for personal needs

If product items were used as own elements, it is necessary to write them off to account 44; as a result, the posting will take the form Dt 44 Kt 42

.

If there is a disposal of goods due to damage, shortage

If the disposal of commodity items occurred for the specified reasons, their price is written off to account 94 at the realizable value. As a result, the wiring takes the form Dt 94 Kt 42

.

Thus, account 42 plays a colossal role in the balance sheet and reflects a large number of transactions on trade margins.

Additional information on this account is provided in the instructions.

One of the types of entrepreneurship is trade in products and goods wholesale and retail. In this case, the seller’s profit is considered to be the trade margin, which is the difference between the initial cost of the product and the final selling price. In the article we will analyze the meaning and definition of trade margins, as well as accounting entries for account 42.