We will continue to talk about:

- On what (advance, deposit or security payment) VAT is charged and under what conditions. In what cases is VAT not charged (VAT savings occur)?

- How does the tax inspectorate look at each type of payment and what to do about it?

- How are advances, deposits and payments used in tax accounting using the example of customer-supplier relations?

- How can you benefit from tax planning?

And “Teapot” and “Coffeepot” will continue to help us with this. And we started the adventure by explaining the terms and how an advance, deposit and security deposit are reflected in accounting here.

Be careful, there are a lot of subtleties and details!

Advance and VAT. Theory

In addition to Chapter 21 of the Tax Code, VAT on advances is regulated by the Decree of the Government of the Russian Federation dated December 26. 2011 No. 1137 and Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

VAT is not charged on the advance received if:

- the seller is under a special tax regime and is not a VAT payer (Chapter 26.1–26.5 of the Tax Code of the Russian Federation)

- the seller is exempt from paying VAT (Articles 145 - 145.1 of the Tax Code of the Russian Federation)

- the prepayment was for a transaction not subject to VAT (Article 149 of the Tax Code of the Russian Federation)

- an advance was received for a transaction, the implementation of which will take place abroad (Article 147, Article 148 of the Tax Code of the Russian Federation)

- the advance payment was transferred for a transaction subject to a zero VAT rate (clause 1 of Article 164 of the Tax Code of the Russian Federation)

- prepayment is made for operations with a long production cycle - more than six months (clause 13 of article 167 of the Tax Code of the Russian Federation)

- the seller forgot to charge VAT on the advance payment, but regularly paid the tax upon sale. In such cases, you will have to defend yourself in court. The prognosis is favorable, but a fine will be charged (Resolution of the Central District Court of December 11, 2018 No. F10-5158/18 in case No. A54-9694/2017).

Didn't find yourself on this list? Then you will have to pay VAT on the advance payment. Consider these other nuances:

- The Ministry of Finance believes that advance VAT deductions cannot be postponed . They are declared only in the period when the basis for them arose (Letter dated 04/09/2015 No. 03-07-11/20290).

- The tax office is confident that VAT is charged on the advance payment received in any case , even if the periods of receipt of the advance payment and the sale coincide (Letter of the Federal Tax Service dated July 20, 2011 No. ED-4-3/11684). The courts believe that it is not necessary to “drive” advance VAT within one tax period, and it is enough just to reflect the implementation (Resolutions of the Administrative District of the North Caucasus District dated July 14, 2017 No. F08-4349/2017, dated July 7, 2016 No. F08-4155/2016 , FAS North-Western District dated 02/20/2014 No. Ф07-10666/2013, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 03/10/2009 No. 10022/08, dated 02/27/2006 No. 10927/05).

- If the sales amount is less than the advance payment, then only VAT on sales can be deducted.

- In order for the buyer to offset advance VAT, the prepayment condition must be in the contract, and the fact of transfer of money must be documented. You also need a correctly completed invoice for the advance payment (clause 9 of Article 172 of the Tax Code of the Russian Federation). VAT may not be restored if the advance payment was transferred from a terminated contract to another concluded with the same seller (Letter of the Ministry of Finance dated 02/08/2019 No. 03-07-11/7650).

The provisions on the framework, option and subscription agreements will come into force

From June 1, 2015, provisions on contracts will appear, which, in principle, still apply now, but do not have sufficient legal regulation. So, for example, provisions will come into force that clarify the concepts of the following agreements:

- a framework agreement is an agreement that defines the general terms of the relationship, which can be specified and clarified in the future (Article 429.1 of the Civil Code of the Russian Federation);

- option agreement - when one party has the right to demand, within the period established by the agreement, from the other party to perform actions provided for by the agreement (including, to pay money, transfer or accept property; Article 429.3 of the Civil Code of the Russian Federation);

- subscription agreement - an agreement providing for the payment by the subscriber of certain (including periodic) payments for the right to demand from the contractor the provision of the performance provided for in the agreement (Article 429.4 of the Civil Code of the Russian Federation).

Deposit and VAT. Theory

Tax authorities believe that the deposit performs a payment function. Therefore, its receipt should be considered an advance on the basis of subparagraph. 2 p. 1 art. 167 NK. When a deposit is received to secure an obligation under an agreement, the subject of which is a sale subject to VAT, VAT should be calculated on the deposit. The point at which the tax liability arises is controversial.

The Ministry of Finance (Letter dated 04/10/2017 No. 03-07-14/21013) and the Federal Tax Service (letters dated 02/02/2011 No. 03-07-11/25, dated 01/17/2008 No. 03-1-03/60) assure that, according to paragraph 1 of Art. 154 of the Tax Code, the deposit is included in the VAT tax base in the period when the money is received .

This position is reflected in judicial practice. Cognitive Ruling of the Supreme Court of the Russian Federation dated July 18, 2019 N 301-ES19-10310 in case N A82-20708/2017. The organization included a clause in the deposit agreement according to which the money was counted as payment for the purchase and sale agreement for the rabbit breeding complex project. The depositor transferred the money in two installments with the payment basis being “partial payment (then full) of the deposit under the purchase and sale agreement for the rabbit breeding complex No. 15-09 dated September 21, 2015, not subject to VAT.” There are more than enough grounds to recognize the sale and charge additional VAT. There is no need to do this.

The court also indicated: failure to subsequently conclude a purchase and sale agreement and failure to sell may be grounds for applying a tax deduction, but in the period when the basis for it appears.

Despite the “guiding clarifications of the authorities,” the security nature of the deposit, which is not subject to VAT at the time of receipt , is confirmed by judicial practice. Let's look at how to handle the deposit correctly using the example of the Resolution of the Arbitration Court of the Central District dated January 19, 2018 N F10-49/2017 in case N A09-11694/2015.

The preliminary agreement for the purchase and sale of goods included the payment period and the amount of the deposit with the wording “the buyer undertakes to transfer to the seller to ensure the execution of this preliminary agreement.” The fate of the deposit was determined after the expiration of the preliminary agreement. “If neither party took the initiative to conclude the main contract, the deposit will not be returned to the buyer.” It was agreed that if the buyer refuses the main contract, the deposit remains with the seller. We set a deadline for concluding the main contract. The recipient took into account the transferred funds as a deposit received under a preliminary agreement , not subject to VAT. The Federal Tax Service was unable to prove the legality of additional VAT charges.

Interest calculation will change

Interest on the use of other people's funds

In case of unlawful withholding of funds, evasion of their return, other delay in their payment, or unjustified receipt or savings at the expense of another person, interest is paid for the use of other people's funds (clause 1 of Article 395 of the Civil Code of the Russian Federation). Now, if the amount of interest is not specified in the agreement, they are calculated based on the refinancing rate, which today is 8.25% (instruction of the Bank of Russia dated September 13, 2012 No. 2873-U).

From June 1, 2015, the approach to calculating interest is changing. It will be necessary to take into account not the refinancing rate, but the average bank interest rates on household deposits published by the Central Bank of the Russian Federation and in effect during the relevant periods of time. Let's give an example. Currently, the average rate on deposits of individuals published by the Central Bank is 14%. This means that if the amendments were in effect now, it would be beneficial to creditors seeking interest payments.

Interest on penalty

From June 1, 2015, the rule will apply: if the parties to the contract stipulate a penalty, then interest on the basis of Article 395 of the Civil Code of the Russian Federation (that is, for the use of other people’s money), as a general rule, will not be collected. However, this rule will be applied with an important caveat - “unless otherwise provided by law or agreement” (clause 4 of article 395 of the Civil Code of the Russian Federation). It turns out that the parties can provide for both penalties and interest in the contract.

Previously, the simultaneous receipt of both penalties and interest was controversial. Some judges believed that the parties had the right to choose - either they would collect a penalty or interest for the use of other people's funds (clause 6 of the resolution of the Plenum of the Supreme Court of the Russian Federation No. 13, the Plenum of the Supreme Arbitration Court of the Russian Federation No. 14 of 08.10.98).

Interest on interest

Also, from June 1, 2015, it will be possible to charge interest on interest (that is, apply compound interest) on business obligations, if this is provided for by law or contract. However, as a general rule, such accrual will be prohibited (clause 5 of Article 395 of the Civil Code of the Russian Federation). Therefore, it will be necessary to stipulate the corresponding condition in the text of the contract.

Security deposit and VAT. Theory

The level of tax risks will be reduced if the basis, procedure for using and returning the security are specified in detail in the contract.

De facto, the security payment, which was called guaranteed, was used until 2015. This gave rise to ambiguity in law enforcement practice. 4 years have passed since the appearance of the legal structure in the Civil Code of the Russian Federation. The established position on VAT on a security deposit can be considered the opinion of the Ministry of Finance, which expresses:

- Letter of the Ministry of Finance of Russia dated December 28, 2018 N 03-07-11/95829

- Letter of the Ministry of Finance of Russia dated February 11, 2019 N 03-07-11/8176).

The occurrence of an obligation to charge VAT on a security deposit depends on the type of transaction. Receipt and return of security without subsequent offset as payment under the contract does not require VAT.

If the tax office can prove that the security is related to the sale, i.e. is counted towards payment for goods, works, services, then they will try to charge additional tax (Letter of the Ministry of Finance dated November 3, 2015 No. 03-03-06/2/63360). For example, a security deposit for the last month of rent often qualifies as an advance. Moreover, they can use sub. 2 p. 1 art. 162 of the Tax Code, which causes difficulties for both parties to the lease agreement with deducting accrued VAT.

Results

Security payment is an amount that guarantees the fulfillment of its obligations by a party to the agreement (tenant, buyer, etc.). The VAT taxation of the security deposit depends on the type of transaction being carried out. If a security payment is made as a guarantee of payment for goods/services (in advance), which will subsequently be sold, then VAT is charged. In other cases, there is no need to pay VAT.

Read more about objects subject to VAT here.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How can you benefit from tax planning?

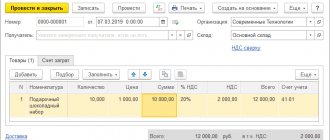

Prepaid expense

With significant amounts of advance payments, the buyer can not only reduce the amount of VAT in the current period, but also reimburse the tax from the budget. This allows you to regulate the uniformity of tax payments. An advance deduction for several supplies can be received one-time and restored in parts in several tax periods.

Deposit

In case of emergency, a deposit can be used as a way to transfer funds free of charge from one company to another or as an interest-free loan. However, when using a deposit in this capacity, you should approach the paperwork very responsibly, since the tax office will try to prove the sham nature of the transaction.

Like an advance, a deposit is convenient to use to regulate the schedule of tax payments. This will allow, on the one hand, to evenly spend working capital (defer the payment of VAT), and on the other hand, to avoid suspicious situations if the amount of one-time VAT deductions is too large.

Security payment

The funds transferred as a security payment are in free circulation with the recipient. Essentially, this is an interest-free loan. A variety of conditions for the occurrence of obligations that require collateral make it possible to insure risks. For example, changes in exchange rates or excise tax rates for long-term cooperation.

The most convenient option to monitor tax planning is a special application that shows the burden for each type of tax and also gives recommendations for reducing them directly in your smartphone in real time.

Fewer conditions will need to be included in the preliminary agreement

The parties have the right to enter into an agreement of intent. Such an agreement is called a preliminary agreement. According to it, the parties undertake to conclude a main contract in the future on the terms and conditions that were specified in the preliminary one. Moreover, today the preliminary agreement must determine all the essential terms of the main agreement. This is required by paragraph 3 of Art. 429 of the Civil Code of the Russian Federation.

However, from June 1, 2015, not all essential conditions will need to be included in the preliminary agreement. The main thing is that it stipulates the conditions on the subject and the conditions on which, when concluding a preliminary agreement, at the request of one of the parties, an agreement must be reached.

Reporting false information

From June 1, 2015, a party to a contract that provides false information about circumstances significant for the conclusion, execution or termination of the contract will have to compensate for losses or pay a penalty stipulated by the contract to the other party. The relevant provisions will be spelled out in Article 431.2 of the Civil Code of the Russian Federation. If, for example, one party provides knowingly false information about the powers of the person signing the contract, then in addition to recognizing the contract as not concluded or invalid, the second party may recover a penalty or damages.