In the era of widespread development of information technologies, the need for them among legal entities is only increasing. If we turn to the events of twenty years ago, then we would hardly be able to come across such a concept as “submitting documents in electronic form” or “sending an email with an attachment”; you would not have heard a request to “send a print screen” and much the like. Now this is part of our reality and, willy-nilly, relevant departments have to adapt to this. True, somehow this is all happening belatedly for them once again...

We will talk to you about scans of documents, which are so in demand in document flow between companies and government agencies. If a company, in dialogue with its partners, has the right to independently put forward requirements for documents sent and received, then in interaction with officials it is still necessary to adhere to the rules that they themselves dictate. Further in our article: why did the Federal Tax Service refuse to accept electronic documents for a long time and forced people to “stand in lines” with papers? Why do different departments have different requirements for the design of scans? What should we not forget when sending material to the Tax Office? What conversations are going on in the offices of the Federal Tax Service now?

Document formats for exchange with the Federal Tax Service

To ensure electronic interaction between the tax authority and the taxpayer, by order of the Federal Tax Service of Russia dated January 18, 2017 No. ММВ-7-6/ [email protected] (hereinafter referred to as Order No. 16), a document format was approved that describes the requirements for exchange files for data transfer via TCS or through the taxpayer’s personal account.

According to Order No. 16, documents can be sent to the tax authority in the following formats:

- xml – for documents that have an approved format;

- tif, jpg, pdf, png – for scanned images of documents compiled on paper.

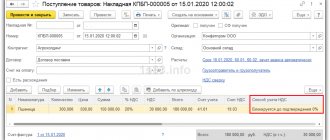

uploading scans of documents in 1c

Currently, the Federal Tax Service of Russia has approved formats for the following documents:

- invoice;

- adjustment invoice;

- waybill (TORG-12);

- act of acceptance and delivery of works (services);

- document on the transfer of goods during trade operations;

- document on the transfer of work results (on the provision of services);

- deed of transfer of rights;

- invoice and document on the shipment of goods (performance of work), transfer of property rights (document on the provision of services), including an invoice (UPD);

- an adjustment invoice and a document confirming changes in the cost of goods shipped (work performed, services rendered), transferred property rights, which includes an adjustment invoice (UCD);

- Book of purchases;

- sales book;

- additional sheet of the purchase book;

- additional sheet of the sales book;

- journal of received and issued invoices;

- waybill (waybill);

- act of discrepancies (TORG-2);

- document confirming the change in value.

1C:Accounting 8 users who electronically exchange documents with their counterparties through the 1C-EDO

or

1C-Taksk

.

A number of documents that have an approved format are not used in the electronic exchange of documents with counterparties. These are a purchase ledger, a sales ledger, an additional sheet of the purchase ledger, an additional sheet of the sales ledger, and a journal of received and issued invoices. In this case, these documents can be sent to the Federal Tax Service in xml format directly from the 1C: Accounting 8 accounting documents.

At the same time, electronic document management can use documents for which there are no approved xml formats:

- contract;

- addition to the contract;

- price specification.

Such documents are prepared and sent to counterparties in familiar formats (doc, pdf, etc.).

If an organization does not carry out electronic document flow with its counterparties or there is no approved format for the requested documents, such documents are sent to the Federal Tax Service in the form of scanned images. According to the format, approved. By Order No. 16, you can send any documents that the tax authority requests from the taxpayer in the form of scanned images.

Scanned images of documents can be stored as external files on disk, but it is much more convenient to have them at hand, especially if they are often requested by external users (in addition to the Federal Tax Service, these can be credit and other organizations). For these purposes, it is recommended to attach scanned documents to infobase documents.

Bottom line

In conclusion, I would like to once again wish our clients and those official authorities to which they have to turn in the course of their duties, for now, to leave everything as it is now. The fact is that the transition to all this “digital research” took place with great difficulties both on the part of departments and on the part of regular users. Let's get used to what we have today, and tomorrow we can start preparing for the transition to a qualitatively new level of document flow. In any case, we will not lose anything, because... The current system is generally well established.

We wish you success!

Receiving a request from the Federal Tax Service and confirming its receipt

1C-Reporting service built into 1C programs

allows you not only to send regulated reports to regulatory authorities, but also ensures the receipt of documents from them in electronic form, and also provides convenient tools for preparing a response to the requirements of the Federal Tax Service, including the requirement to submit documents (information).

1C:ITS

For instructions on using the 1C-Reporting service in 1C programs, see the section “Instructions for accounting in 1C programs,” including on submitting documents as required by the Federal Tax Service.

Requirements received from the Federal Tax Service are displayed in a single workplace 1C-Reporting

in

the Inbox

and

New

(Fig. 1).

In the list of incoming documents, the newly arrived request is highlighted in bold, and its status is set to Confirm receipt

.

Rice. 1. Receipt of request

If acceptance of the request is not confirmed within 6 business days from the date of sending, then the tax authority has the right to block the organization’s current account (clause 5.1 of Article 23, subclause 2 of clause 3 of Article 76 of the Tax Code of the Russian Federation).

The requirement is considered accepted by the taxpayer if the tax authority has received an acceptance receipt signed with the taxpayer’s electronic signature (clause 10 of Order No. 448).

To confirm receipt of a request from the Inbox

You can immediately follow the link

Confirm your appointment.

Or you can open the request form (Fig. 2) to first familiarize yourself with its contents, and only then confirm acceptance.

Rice. 2. Request form

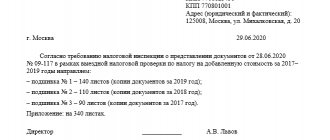

The essence of the requirement is set out in a separate pdf file, which is attached to the electronic requirement and which can be opened using the link located under the caption Attached files

. The pdf file indicates the requested documents point by point, as well as the deadlines within which these documents must be submitted.

If there are grounds, the taxpayer generates a notice of refusal to accept, signs it with an electronic signature and sends it to the tax authority. To do this, just click on the Refuse

.

A notice of refusal is generated only in the following cases (clause 17 of order No. 448):

- the demand was sent to the taxpayer by mistake (it was intended for another addressee);

- the requirement does not comply with the established format;

- the requirement does not contain (does not correspond to) the electronic signature (ES) of an authorized official of the tax authority.

If there are no grounds for refusing to accept the request, then click on the Confirm Acceptance button.

The requested documents must be sent to the Federal Tax Service within the prescribed period, otherwise the taxpayer may be subject to a fine of 200 rubles. for each document not submitted (clause 1 of Article 126 of the Tax Code of the Russian Federation).

Options for responding to the Federal Tax Service’s request to provide documents

Next, the accounting service should estimate the time for the upcoming preparation of documents and click on the Prepare response

choose one of the options (Fig. 3):

- Response to requests for documents (information)

– to answer the requirement on the merits in a formalized form in accordance with Order No. 16;

- Notification of failure to respond on time -

to send a notification about the impossibility of submitting documents (information) in electronic form within the established time frame (clause 3 of Article 93 of the Tax Code of the Russian Federation). The form and format of such a notification are approved by order of the Federal Tax Service of Russia dated April 24, 2019 No. ММВ-7-2/ [email protected] ;

- Register of documents confirming VAT benefits

– to reduce the volume of requested documents during a desk audit. Instead of a package of documents confirming the VAT tax benefit, the taxpayer can send a register of these documents in electronic form. The recommended form, format and procedure for filling out the register are given in the letter of the Federal Tax Service of Russia dated November 12, 2020 No. EA-4-15/18589.

Rice. 3. Options for responding to the requirement

When selecting the option Response to request for documents (information)

The Response to request for documents submission

form opens (Fig. 4).

Rice. 4. Options for selecting documents

Depending on where documents are stored, their selection in response to a requirement can be performed in two modes:

- by loading from files from disk - using the button Load from disk

;

- by selecting documents from the 1C:Accounting 8 information base - using the button Select from database

.

It may take several days for a company to prepare a response to a request. The response to the request can be saved by clicking the Write

and continue working with it at another time. You can open a response to a requirement for viewing and editing both from the list of requirements form and from the requirement card.

Regulatory regulation of the provision of electronic explanations for the VAT return

From January 1, 2021, all clarifications requested by the tax office on the VAT return in the form of an electronic request must be provided in the format of an electronic response , regardless of the period for which the declaration was provided. This provision is enshrined in amendments to the Tax Code of the Russian Federation, as well as information letters from the Federal Tax Service posted on the Federal Tax Service website. In this case, explanations for requirements received under other declarations are sent in the usual manner (on paper, or, if desired, in the form of a scanned letter along with documents sent via electronic channels). How the format of the electronic explanation for the VAT return differs, we will consider further.

Selection of documents for the Federal Tax Service by downloading from disk

the Load from disk button

The user has a choice (Fig. 5):

- on command Scanned document -

upload image files (scanned documents);

- on command Documents from another database

– upload an archive with images or xml files downloaded from another database.

Rice. 5. Options for loading files from disk

Uploading scanned documents

Command Load from Disk – Scanned Document

is used if the scanned documents were not attached to the infobase documents in advance. This opens a standard dialog for selecting files from disk (Fig. 6).

Rice. 6. Selecting a file from disk

Selected scanned documents are included in response to a request for the Open

.

This opens the form Preparing a document for sending

, where the selected documents should be pre-processed as follows (Fig. 7):

- add pages of a scanned document if the document is multi-page (button Add

);

- fill in the field Name, details or other characteristics of the source document

. You can manually enter the document details or select a document from the information base using the selection button;

- fill in the field Name, details or other characteristics of the base document (optional)

, if the added document has a basis document (agreement, invoice for payment or other primary document confirming the emergence of contractual relations between the parties to the transaction);

- in field Notary's signature

select a notary’s electronic signature file if the electronic document contains such a signature (for example, a document related to the registration of a legal entity (IP), power of attorney, etc.).

Rice. 7. Preparing a scanned document for sending

After filling out the required document description, click on the Add button in response to the requirement

(Fig. 7).

This opens the Requirement Item

, where you need to indicate the point of the original requirement from the pdf file, in response to which a scanned document is sent (Fig. 8).

Rice. 8. Item requirement

Click OK

The document data will be stored in the request response form.

Loading an archive of documents from another database

If xml documents or scanned documents that need to be sent in response to the request of the Federal Tax Service are located in another information database, then they can be downloaded from this database into a special archive file (exchange file), and then loaded into the information database from which the response is being prepared to the requirement.

To load documents from another database, click the Load from disk

and select

the Documents from another database

(Fig. 9).

Rice. 9. Loading documents from another database

In this case, a form appears where the Load

You can choose one of two download options:

- Loading 1C-EDO or 1C-Taksk xml documents from another database.

- Uploading scanned documents from another database

.

When you select the first option, a form for downloading electronic documents from the exchange package appears and a standard dialog for selecting files from disk opens. The archived file should be highlighted and selected using the Open

.

The electronic document download form displays a list of xml files from the archive file. The required documents should be marked with flags and added in response to the requirement, having previously indicated the item of the original requirement from the pdf file.

In this case, not only the xml documents themselves are loaded, but also the files of electronic signatures for them.

If you select the second option Upload scanned documents from another database

a form for downloading scanned documents from an external source appears and a standard dialog for selecting files from disk opens.

The exchange file should be highlighted and selected using the Open

.

The Upload Scanned Documents from External Source form will display a list of scanned documents from the exchange file that can be included in response to the request.

Details of the scanned document and its image can be viewed in a separate form, which opens by double-clicking.

The required documents should be marked with flags and added in response to the requirement, having previously indicated the item of the original requirement from the pdf file.

To edit details and other features of a document, as well as the base document, just double-click on the document line. This opens a document editing form, as in Figure 7, where you can make the necessary adjustments.

Selection of documents for the Federal Tax Service by selecting from the information base

Click the Select from database button

In response to a request, the user can select documents from the current information database, that is, from the database where the EDI with the Federal Tax Service is configured, and from where the response is sent. In this case, the user has options regarding which documents to add (Fig. 10):

- xml documents received as a result of exchange with counterparties 1C-EDO

and

1C-Takskom

- by command

Electronic documents 1C-EDO, 1C-Takskom

; - xml documents of purchase books, sales books and invoice journals - by command Purchase/sales books, invoice journals

;

- other scans and xml documents - by command Documents from the database

.

Rice. 10. Selection of documents from the database

To add xml documents received as a result of exchange with 1C-EDO

and

1C-Takskom

, a special form is available

Selecting a source document

, where an accountant can quickly select the necessary documents by type, amount, date, number, organization, counterparty and source document (Fig. 11).

Rice. 11. Selection of electronic documents 1C-EDO and 1C-Takskom

To insert the required document into the request response form, select it in the list and click on the Select

. In this case, you will need to indicate the requirement item from the pdf file.

When using the Select from database command – Purchase/sales books, invoice journals

VAT reports in xml format can be attached to the response to the request:

- shopping book;

- sales book;

- journal of received and issued invoices;

- additional sheet of the purchase book;

- additional sheet of the sales book.

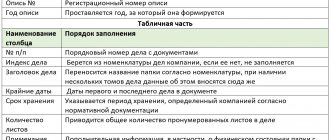

To add the specified documents in response to a request, a special selection form is used (Fig. 12), where you can apply selection by period, organization, and set any other search. The list of VAT documents displays the date, number, document type, tax period, organization and comment.

Rice. 12. Selection of electronic VAT reports

If documents for the selected tax period are not in the list, they should be created using the Generate for period

.

To move documents in response to a request, select them in the list and click the Select

, then indicate the requirement item from the pdf file.

When using the Select from database – Documents from database

You can attach arbitrary documents in xml format and scanned documents attached to the information base documents to the response to the request.

To select a document from the database, first select its type (Fig. 13).

Rice. 13. Selecting the type of document

Let’s assume that the document type is Receipt (act, invoice) –

A list of documents of the specified type opens (Fig. 14).

Rice. 14. List of documents of the specified type

Documents from the list can be selected by date, number, organization, counterparty, amount and other key fields. Infobase documents may have attached scans or corresponding xml documents - these are what are needed to be included in response to the requirement. To do this, select them in the list and click the Select button.

For selected documents, a description is automatically generated and attachments are added - xml documents or scans (Fig. 15).

Rice. 15. Preparation of documents of the specified type

From the same form you can add missing scanned documents by selecting them from the disk.

Click the Add button in response to a request

the selected documents are transferred in response to the request. In this case, you should indicate the number of the requirement item from the pdf file.

Recommendations from Synerdocs experts

1. Work on electronic document formats is carried out for a reason. If there is a format, it is definitely better to use it. There will definitely be no problems with submitting formalized documents.

2. Submit informal documents on paper. This is what the Ministry of Finance itself recommends in letters dated 01/11/2012 N 03-02-07/1-1 and dated 01/11/2012 N 03-02-07/1-2. That's it for now. Let’s wait and see which option the Federal Tax Service implements.

3. Resolve issues together with the operator and inspection. Typically, operator representatives are always ready to answer your questions. And tax authorities are now very loyal to companies that are switching to electronic document exchange. Market innovators, together with representatives of government authorities, could well influence the legislative process and consolidate the best practices of primary exchange at the level of regulations.

Source: Clerk.ru

Editing the response to the Federal Tax Service's request to provide documents

Documents to be submitted is filled out in the response form

.

To edit the tabular part, select the line(s) and use the command bar buttons located above the tabular part (Fig. 16):

- Change

– to edit a document line;

- Remove current item

– to delete a document line from a response to a requirement or the entire requirement item with all document lines;

- Change requirement clause –

to change the number of the claim item;

- Move current element...

– to move a document line up or down within a requirement item group. To move a document to another requirement item, simply drag it while holding down the mouse button.

Rice. 16. Ready answer