Can an enterprise combine modes when conducting activities for which different systems are used? What rules for combining UTII and OSNO apply in 2021?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

If a company conducts one type of activity, then it will not be difficult to decide on the choice of tax system, keep records and calculate taxes.

But what to do in the case when several types of operations are carried out for which UTII or another regime cannot be used?

And there is also no desire to completely switch to OSNO due to the high tax burden. If you are faced with such a problem, it’s worth figuring out how and when you can use UTII and OSNO at the same time.

Features of separate accounting when calculating income tax

If a taxpayer combines the general tax regime and the UTII regime, he must separately take into account income and expenses by type of activity that fall under different regimes (clauses 9, 10 of Article 274 of the Tax Code of the Russian Federation).

For such accounting, additional subaccounts are often introduced into the chart of accounts, allowing separate accounting of income and expenses for each type of activity, as well as income and expenses that cannot be directly attributed to one or another regime. Accounting for income, or more precisely revenue, usually does not raise questions, since it is always possible to clearly determine for what type of activity the funds were received or the revenue was reflected, and allocate the amounts to the necessary subaccounts.

The income tax base under the general regime is determined without taking into account income received when carrying out activities on UTII.

But to income received from imputed activities, in addition to the revenue itself, it is also necessary to include other income directly related to its conduct. These could be, for example:

- various bonuses or discounts received under contracts concluded as part of imputation (letter of the Ministry of Finance of Russia dated July 4, 2016 No. 03-11-11/38954);

- surpluses identified during inventory;

- fines and penalties for late payments accrued in court (letter of the Ministry of Finance of Russia dated May 22, 2007 No. 03-11-04/3/168).

Such income should not be taken into account when calculating income tax. They must also be taxed according to the provisions of Sec. 26.3, if the taxpayer does not conduct any activities other than those falling under UTII (letter of the Ministry of Finance of Russia dated July 1, 2009 No. 03-11-06/3/178).

Our “UTII calculator” service will help you calculate the tax on imputed income.

Accrual method

With the accrual method, the moment of recognition of revenue in accounting and tax accounting, as a rule, coincides (clause 5 of PBU 1/2008, clause 3 of Article 271 of the Tax Code of the Russian Federation). Therefore, data for the distribution of general business (general production) expenses between two types of activities can be taken from accounting (Article 313 of the Tax Code of the Russian Federation). To do this, organize a system for maintaining separate records of income and expenses by type of activity.

To organize separate accounting for cost accounting accounts (25, 26 or 44), open the corresponding subaccounts. For example, subaccounts to account 26 “General business expenses” may be called as follows:

- subaccount “General business expenses for the activities of an organization subject to UTII”;

- subaccount “General business expenses for the organization’s activities on the general taxation system.”

For the corresponding revenue accounting accounts (90-1 or 91-1), open, for example, the following subaccounts:

- subaccount “Revenue from the activities of an organization subject to UTII”;

- subaccount “Revenue from the activities of the organization on the general taxation system.”

Under the accrual method, the amount of revenue for tax purposes may differ from the amount of accounting revenue. Such a difference will arise, for example, due to different accounting procedures for interest received under a commercial loan agreement. In tax accounting, loan interest must be included in non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation). In accounting, they increase the amount of revenue (clause 6.2 of PBU 9/99). In such cases, it is necessary either to supplement the accounting registers with the necessary details, or to maintain separate tax accounting registers (Article 313 of the Tax Code of the Russian Federation).

General expenses: how to distribute them among different activities

Separate accounting of expenses is more difficult than accounting for income. Often, many expenses cannot be clearly divided by type of activity, so their correct distribution is required according to OSNO and UTII.

For example, an organization is engaged in wholesale (OSNO) and retail (UTII) trade. Goods are sold at retail by a salesperson on the sales floor; wholesale trade, with the execution of supply agreements and issuance of invoices, is carried out by the wholesale sales manager. In addition to them, the company employs a loader, a director and an accountant who are engaged in both types of activities.

The accountant immediately attributes the costs of paying wages and sick leave to the seller and manager to a specific type of activity. As for the expenses for wages and sick leave for the loader, director and accountant, they are subject to distribution, since these expenses cannot be specifically allocated by type of activity.

To learn how to differentiate between retail and wholesale trade, read the article “Is wholesale trade possible with UTII”

According to the financial department, the taxpayer can independently choose the method of distribution of expenses, fixing it in the accounting policy (letter of the Ministry of Finance of Russia dated October 4, 2006 No. 03-11-04/3/431).

The legislation provides for the principle of distributing expenses in proportion to income received from a particular type of activity (paragraphs 3 and 4 of paragraph 9 of Article 274 of the Tax Code of the Russian Federation). Some courts believe that taxpayers do not have the right to use any other methods for distributing total costs other than the method based on cost indicators (Resolution of the Federal Antimonopoly Service of the North-Western District dated May 22, 2012 No. A42-5489/2010).

However, the Russian Ministry of Finance is not against using the method of distributing costs in proportion to the area of premises used in a specific activity. This point of view is also supported by some courts (see resolution of the Federal Antimonopoly Service of the Moscow District dated December 7, 2009 No. KA-A41/13288-09).

Since there is disagreement on this issue, taxpayers should consult with their territorial tax authorities to avoid conflict situations.

What documents are needed

To switch to combining several types of tax systems, you need to submit an application to government agencies in the UTII2 form. During the initial registration of an individual entrepreneur or its new direction, an application is submitted to the tax office at any time of the year. If work in two accounting systems is provided for the area of work used, then the transition will only be possible at the beginning of the new year.

form

The combination of OSNO and UTII is still beneficial for small firms, as it allows them to reduce the number of taxes. The difficulty is that it will not be possible to do general accounting, since accounting activities will have to be carried out separately for each type of reporting. It is important that in large cities the number of areas of individual entrepreneur activity that fall under imputed income is constantly decreasing.

How to maintain separate accounting for VAT purposes

Under the general regime, taxpayers must pay VAT to the budget, which can be reduced by the amount of tax on purchased goods, works and services (Articles 171, 172 of the Tax Code of the Russian Federation).

“Implementers” do not need to pay VAT, with the exception of those tax amounts that relate to imported goods, works and services. Therefore, they are not entitled to deduct input tax.

In this regard, taxpayers using both regimes must keep separate records of tax amounts for purchased goods (work, services, etc.) (paragraph 7, paragraph 4, article 170 of the Tax Code of the Russian Federation). To do this, additional sub-accounts are opened in which VAT amounts are taken into account separately under the general regime and separately under the UTII regime.

It must be remembered that the lack of separate accounting does not allow organizations and entrepreneurs to deduct amounts of “input” VAT and charge them as expenses when taxing profits (paragraph 8, clause 4, article 170 of the Tax Code of the Russian Federation).

True, the Tax Code of the Russian Federation has identified one case when separate accounting for VAT may not be maintained. This applies to those tax periods in which the share of GWS costs incurred during imputed activities does not exceed 5% of the total production costs. Then all amounts of VAT on acquired assets can be deducted regardless of the activity in which they were used (paragraph 9, paragraph 4, article 170 of the Tax Code of the Russian Federation).

For details, see the material “The 5% Rule Doesn’t Always Work.”

In all other cases, you will have to keep separate VAT records. We talked about this here.

Read this material on how to properly maintain separate VAT accounting.

See also “Procedure for maintaining separate accounting for VAT in a pharmacy.”

We talk about all changes in separate VAT accounting in a special section “Separate VAT accounting”

Combination of UTII and the general taxation system

LLC opens a store with an area of less than 150 square meters. m (UTII), but also plans to work with legal entities (i.e. with VAT), accordingly, registered with OSN.

How to keep separate records?

There are already receipts of goods, transport and other expenses, but there is no income yet. General rules

Article 7 346.26 Tax Code of the Russian Federation

established the obligation of UTII taxpayers carrying out, along with business activities subject to UTII taxation, other types of business activities,

to keep separate records of property, liabilities and business transactions

in relation to business activities subject to UTII taxation and business activities in respect of which taxpayers pay taxes in accordance with a different tax regime.

At the same time, accounting of property, liabilities and business transactions in relation to types of business activities subject to UTII taxation is carried out by taxpayers in the generally established manner.

Taxpayers who, along with business activities subject to UTII taxation, carry out other types of business activities, calculate and pay taxes and fees in relation to these types of activities in accordance with other taxation regimes provided for by the Tax Code of the Russian Federation.

According to paragraph 9 of Art. 274 Tax Code of the Russian Federation

When calculating the tax base for corporate income tax,

income and expenses related to the activities

in respect of which

UTII

.

UTII taxpayers are required to maintain separate records

income and expenses for such activities.

At the same time, expenses

organizations operating on UTII,

if it is impossible to separate them, are determined in proportion to the share of the organization’s income from activities on UTII in the total income of the organization for all types of activities

.

Taxpayers using UTII do not take into account

income and expenses related to activities on UTII (

clause 10, article 274 of the Tax Code of the Russian Federation

).

Organizations operating on the OSN and at the same time paying UTII should try to “distribute” all costs by type of activity as much as possible.

For example

, by order of the organization it is possible to establish which employees and what property are engaged in activities subject to UTII.

Thanks to such an order, it will immediately become clear that the salary

the employees specified in it are not an expense for profit tax purposes, and

the property

listed in the order is not subject to property tax, but depreciation charges on it do not reduce the profit tax.

The less property and workers will participate in several types of activities

(and equally, the lower the expenses required for both OSN and UTII), the better.

This will simplify the work of distributing “general” expenses (related to both OSN and UTII).

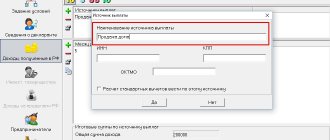

For the convenience of maintaining separate accounting, you need to enter second-order subaccounts in accounting

to synthetic accounts, which separately (separately) reflect assets, liabilities, income and expenses for different types of activities.

Income from sales

goods (works, services) can clearly be attributed to one of the types of activity, and it will not be difficult for the taxpayer to determine whether such income relates to activities on the special tax base or to activities on the UTII.

Regarding other income

(

for example, income in the form of a discount, premium, bonus

received from suppliers of goods for fulfilling certain conditions of the contract) The Ministry of Finance of the Russian Federation believes that income received in the form of a premium (discount, bonus) provided by the supplier organization for fulfilling certain conditions of the contract for the supply of goods in the form of an additional batch of goods,

can be recognized as part of the income received in connection with the implementation of activities in the field of retail trade, subject to UTII

, on the basis of appropriate separate accounting of property, liabilities and business transactions (letter dated February 16, 2010 No. 03-11- 06/3/22).

From paragraph 9 of Art. 274 Tax Code of the Russian Federation

it follows that those

expenses that can be clearly attributed

to activities taxed under the OSN must be taken into account when calculating the tax base for income tax in full.

Expenses incurred exclusively within the framework of activities subject to UTII are considered to be included in UTII in full.

And if any expenses relate to both activities subject to UTII and activities in respect of which the OSN is applied (for example, the director’s salary, the cost of the chief accountant’s computer, etc.), then such expenses must be distributed

.

Clause 9 art. 274 Tax Code of the Russian Federation

prescribes the distribution of such expenses

in proportion

to the share of income from activities on UTII

in the total income

of the organization.

In this order, the distribution of the amount of expenses for the payment of temporary disability benefits to employees engaged in several types of activities (administrative and managerial personnel, junior maintenance and other support personnel) is also carried out between the types of activities transferred to the payment of UTII and the types of activities for which taxation carried out within the framework of the general taxation regime.

As the Ministry of Finance of the Russian Federation reported in letter No. 03-11-02/20 dated February 13, 2008, the calculated amount of temporary disability benefits for employees engaged in several types of activities is distributed

between types of activities transferred to the payment of UTII, and types of activities, the taxation of which is carried out within the framework of the general taxation regime,

in proportion to the share of

the organization’s income from activities subject to UTII

in the total income

of the organization for all types of activities received for the month in which temporary disability occurred .

When distributing expenses in proportion to shares of income, the question arises: is it necessary to take into account non-operating income

and income from the sale of used property when calculating the proportion?

The Ministry of Finance and the Federal Tax Service of the Russian Federation answer this question differently.

The Federal Tax Service of the Russian Federation believes that since clause 9 of Art. 274 Tax Code of the Russian Federation

the concept “type of activity” appears, then this term should be used in the meaning in which it is used in other areas of legislation.

The Federal Tax Service indicates that income from the sale of used property and non-operating income are not taken into account when determining the proportion

for the distribution of general business expenses as not related to the production of products (performance of work, provision of services).

Income from the sale of shares in the authorized capital and income from the sale of securities, according to tax authorities, are also not taken into account

when distributing expenses if such operations are not the purpose of creating a commercial organization (letter of the Federal Tax Service of the Russian Federation dated March 24, 2006 No. 02-1-07/27).

According to the Ministry of Finance of the Russian Federation, the amount of expenses related to activities subject to UTII taxation is determined in proportion to the share of income from this type of activity in total income

organizations for all types of activities,

which includes

income from the sale of goods (work, services) and property rights and

non-operating income, with the exception of

the amount of taxes charged by the taxpayer to the buyer (acquirer) of goods (work, services, property rights) (letter dated 18.02 .2008 No. 03-11-04/3/75).

True, literally two days later the financial department announced that for the purpose of calculating income tax, the amount of expenses

, calculated at the end of the month based on the share of revenue received from types of activities not transferred to the payment of UTII, in the total amount of revenue received from all types of activities, are summed up on an accrual basis for the period from the beginning of the tax period to the reporting date.

At the same time, officials noted that the distribution of the amount of expenses not related to specific types of activities between various types of activities is carried out monthly based on revenue indicators

(income) and expenses for the month (letter of the Ministry of Finance of the Russian Federation dated February 20, 2008 No. 03-11-04/2/40).

According to Art.

248 of the Tax Code of the Russian Federation, income for

profit tax purposes includes both income from the sale of goods (work, services) and property rights, and

non-operating income

.

Therefore, since when combining SST and UTII, non-operating income, income from the sale of used property and other similar “one-time” income are taken into account for profit tax purposes, it is logical to take them into account when calculating the proportion for the distribution of “general” expenses between types of activities

.

When determining income, taxes are excluded from them.

presented in accordance with the Tax Code of the Russian Federation by the taxpayer to the buyer (acquirer) of goods (work, services, property rights).

Therefore, income from activities on the OSN should be taken into account when proportionately distributing expenses excluding VAT

.

Thus, the share of “total” expenses

related to activities on UTII

is determined by the formula

:

Share of expenses related to UTII

= Income from activities on UTII / Total income.

According to paragraph 7 of Art. 274 Tax Code of the Russian Federation

When determining the tax base for corporate income tax,

profit

subject to taxation

is determined on an accrual basis

from the beginning of the tax period.

In this regard, the Ministry of Finance of the Russian Federation indicated that income by type

business activities transferred to the payment

of UTII

, it is also

advisable to determine the cumulative total

from the beginning of the year (letter dated November 17, 2008 No. 03-11-02/130).

In order to avoid distortion of the tax base for corporate income tax, it is necessary to distribute expenses between types of activities across reporting periods, also

on an accrual basis

from the beginning of the year.

In letter dated March 17, 2008 No. 03-11-04/3/121, the Ministry of Finance of the Russian Federation explained that in order to comply with the provisions of clause 9 of Art. 274

and

clause 4 of Art.

346.26 of the Tax Code of the Russian Federation, the distribution of the amount of expenses not related to specific types of activities between various types of activities

is carried out monthly based on revenue (income) and expenses for the month

.

For the purpose of calculating income tax , the amount of expenses calculated at the end of the month based on the share of revenue

received from types of activities not transferred to the payment of a single tax on imputed income,

in the total amount of revenue

received from all types of activities,

are summed up on an accrual basis for the period from the beginning of the tax period to the reporting date

.

And later officials reported that the procedure for maintaining separate records

when taxpayers simultaneously apply the taxation system in the form of UTII and other taxation regimes, the Tax

Code of the Russian Federation has not been established

.

Thus, the organization independently develops and approves the procedure for maintaining separate accounting

.

At the same time, the method of separate accounting used by the organization should make it possible to unambiguously attribute certain indicators to different types of business activities.

The procedure for maintaining separate accounting developed by the organization must be enshrined in the order on accounting policies

or in a local document approved by an order for the organization (order of an individual entrepreneur), or several documents that together will contain all the rules regarding the procedure for maintaining separate accounting by an organization (letter of the Ministry of Finance of the Russian Federation dated October 26, 2010 No. 03-11-06/ 3/148).

Rules for maintaining separate accounting of VAT amounts

taxpayers transferred to pay a single tax on imputed income are established

in clause 4 of Art.

170 Tax Code of the Russian Federation .

The taxpayer is required

to keep separate records of VAT amounts

on purchased goods (works, services), including fixed assets and intangible assets, property rights used to carry out both taxable and VAT-exempt transactions.

If the taxpayer does not have separate accounting, the VAT amount

for purchased goods (works, services), including fixed assets and intangible assets, property rights,

are not subject to deduction

are not included

in expenses accepted for deduction when calculating corporate income tax (personal income tax) .

Amounts of “input” VAT presented

sellers of goods (works, services), property rights:

– are included in the price

such goods (work, services), property rights, if they are used to carry out transactions

not subject to VAT

(in activities falling under UTII);

- accepted for deduction

, if the specified goods (works, services), property rights are used to carry out transactions

subject to VAT

.

And if goods (work, services), property rights are used both to carry out transactions subject to VAT, and in activities subject to UTII, then the “input” VAT on them is taken for deduction or taken into account in their cost in that proportion

, in which they are used for the production and (or) sale of goods (work, services), property rights, transactions for the sale of which are subject to taxation (not subject to VAT).

The specified proportion is determined based on the cost

shipped goods (work, services), property rights, transactions for the sale of which are subject to VAT (exempt from taxation),

in the total cost of

goods (work, services), property rights shipped during the tax period.

That is, in order to determine how much “input” VAT on goods (work, services) used simultaneously in taxable and non-VAT-taxable transactions can be taken

for deduction

, you need to

calculate using the following formula

:

[The cost of goods (work, services) shipped during the tax period, sales of which are subject to VAT /

The total cost of goods (work, services) shipped during the tax period]

x

The total amount of “input” VAT on goods, work and services used simultaneously in taxable and non-VAT-taxable transactions.

Fraction in square brackets

- is nothing more than

a proportion

determined in accordance with

clause 4 of Art.

170 Tax Code of the Russian Federation .

By multiplying it with the full amount of “input” VAT on “general” goods (works, services), we find out how much “input” VAT can be deducted.

To calculate what amount of “input” VAT on goods, works and services used simultaneously in taxable and non-VATable transactions must be taken into account in the cost

these goods (works, services), you need to apply

the following formula

:

[The cost of goods (work, services) shipped during the tax period, sales transactions of which are not subject to VAT (subject to UTII) /

The total cost of goods (work, services) shipped during the tax period]

x

The total amount of “input” VAT on goods, work, services used simultaneously in taxable and non-VAT-taxable transactions.

For fixed assets and intangible assets accepted for accounting in the first or second months of the quarter, the taxpayer has the right

determine the specified proportion based on the cost of goods shipped in the corresponding month (work performed, services rendered), transferred property rights, transactions for the sale of which are subject to taxation (exempt from taxation), in the total cost of goods (work, services) shipped (transferred) for the month , property rights.

In a letter dated October 18, 2007 No. 03-07-15/159, the Ministry of Finance of the Russian Federation emphasized that the distribution of VAT amounts presented

to the taxpayer for purchased goods (work, services) used to carry out both taxable and non-taxable transactions,

is carried out in the tax period in which the purchased goods (work, services) were registered on the basis of the relevant primary documents

.

In this case, the right to deduction

tax on these goods (works, services) arises subject to compliance with the conditions provided for

in Art.

171 and

172 of the Tax Code of the Russian Federation

.

The proportion is determined based on the cost of goods shipped

(works, services).

In letter dated March 10, 2005 No. 03-06-01-04/133, the Ministry of Finance indicated that the proportion calculated in accordance with clause 4 of Art. 170 Tax Code of the Russian Federation

,

should be determined based on all income that is revenue from the sale of

goods (work, services), both subject to VAT and not subject to this tax,

regardless of their reflection in the accounting accounts

(

both in account 90 and in account 91

).

It follows from this that the cost of goods, works, services to calculate the proportion should still be considered revenue

.

The same conclusion can be reached by looking at Art. 154 Tax Code of the Russian Federation

,

p.p.

8 clause 5 art. 169 of the Tax Code of the Russian Federation : these norms of the Tax Code of the Russian Federation, speaking about the cost of goods (work, services), clearly define it as revenue, and not as cost.

From paragraph 4 of Art. 170 Tax Code of the Russian Federation

It is not clear whether to take into account the cost of goods (work, services) with or without VAT to calculate the proportion.

Presidium of the Supreme Arbitration Court of the Russian Federation

in the resolution of November 18, 2008 No. 7185/08 indicated that when selling goods (work, services) subject to VAT, the taxpayer (seller), in addition to the cost of the goods (work, services), submits for payment to the buyer the amount of tax taken into account by this taxpayer when calculating the amount of tax payable to the budget.

The amount of indirect tax received by the seller is neither part of the cost of goods (work, services) shipped nor income from sales

goods (works, services), since VAT amounts and income amounts are subject to separate accounting for the purpose of calculating tax obligations arising from the requirements of Chapter 21 and Chapter 23 of the Tax Code of the Russian Federation.

If the sale of the same goods (work, services) does not fall under transactions subject to VAT, then the seller presents to the buyer for payment only the cost of the shipped goods (work, services) without tax.

When determining the proportion of VAT amounts

, subject to inclusion in the relevant tax return as tax deductions provided for in

paragraph 4 of Art.

170 of the Tax Code of the Russian Federation, it is necessary to use comparable indicators .

Comparable in this case are the amounts reflecting the cost of goods (work, services) excluding VAT

.

Therefore, the proportion is calculated based on revenue amounts excluding VAT

.

The taxpayer has the right not to apply the provisions of paragraph 4 of Art. 170 of the Tax Code of the Russian Federation for those tax periods in which

the share of total costs for the acquisition, production and (or) sale of goods (works, services), property rights, transactions for the sale of which are not subject to taxation,

does not exceed 5% of the total total costs

for the acquisition, production and (or) sale of goods (works) , services), property rights.

In this case, all tax amounts presented

such taxpayers who sell goods (works, services), property rights in the specified tax period

are subject to deductions

in accordance with the procedure provided for

in Art.

172 Tax Code of the Russian Federation .

If, when purchasing goods, the taxpayer does not yet know, for example, whether he will sell them at retail (UTII) or under a supply agreement (OSN), then he has the right to deduct the entire amount

“input” VAT (assuming that it sells them in bulk).

Then, if these goods (or part of them) are sold at retail (UTII)

or otherwise used in activities subject to UTII, then

the “input” VAT on them (already accepted for deduction) will need to be restored

.

This is the requirement of paragraph 2

and

3 tbsp.

170 Tax Code of the Russian Federation .

VAT amounts subject to recovery are not included

in the cost of the specified goods (works, services), including fixed assets and intangible assets, property rights, and are taken into account

as part of other expenses

in accordance with

Art.

264 Tax Code of the Russian Federation .

Restoration of VAT amounts is carried out in the tax period in which

goods (work, services), including fixed assets and intangible assets, and property rights

have been transferred or are beginning to be used

by the taxpayer to carry out VAT-free transactions (

clause 3 of Article 170 of the Tax Code of the Russian Federation

).

That is, it is necessary to restore VAT on goods that are used in activities subject to UTII not when these goods are actually sold

at retail (or otherwise used in activities taxable to UTII), but in the tax period when they were

transferred

or just

began

to be used in activities taxable to UTII.

For example

, if goods were transferred from a warehouse to a store for retail sale, then VAT on them must be restored at the time they are transferred to the retail store, without waiting for the moment of sale of these goods.

This follows from paragraph 3 of Art. 170 Tax Code of the Russian Federation

.

In Resolution No. 14996/05 dated May 3, 2006, the Presidium of the Supreme Arbitration Court of the Russian Federation

noted that the norms of Chapter 21 of the Tax Code of the Russian Federation

do not establish the dependence of tax deductions

on purchased goods (work, services)

on the actual calculation of tax

for specific transactions for which these goods (work, services) were purchased.

Implementation

goods (works, services) for specific transactions

in the same tax period is not

, by force of law,

a condition for the application of tax deductions

.

The Presidium of the Supreme Arbitration Court of the Russian Federation explained that the tax authorities’ conclusion

that

the object of VAT taxation is formed at the time of transfer of goods

(work, services) and

the tax amounts

presented by suppliers of goods (work, services)

are subject to reimbursement in the reporting period, when the date of implementation

(performance) of these works occurs,

is erroneous

, since the object taxation are sales operations, which are activities extended over time aimed at the sale (direct transfer) of goods, results of work performed and services.

By virtue of Art. 167 Tax Code of the Russian Federation

The moment of sale is associated with the emergence of the taxpayer’s obligation to calculate the tax base and the obligation to pay tax from this base.

Therefore, in a letter dated February 28, 2012 No. ED-3-3/ [email protected] , the Federal Tax Service of the Russian Federation reported that in order to apply tax deductions for the past tax period, the following conditions must be met

:

– availability of invoices

on purchased goods (works, services), property rights;

– registration

purchased goods (works, services), property rights, as well as the availability of relevant primary documents confirming their acceptance for accounting;

– availability of settlement documents

, confirming the actual payment by the taxpayer of tax amounts when importing goods into the customs territory of the Russian Federation and other territories under its jurisdiction;

– goods (work, services), property rights acquired by the taxpayer to carry out transactions recognized as an object of taxation under VAT, with the exception of transactions provided for in clause 2 of Art. 170 Tax Code of the Russian Federation

.

If the above conditions are met, the taxpayer has the right to deduct VAT amounts in the corresponding tax period

, presented to him when purchasing goods (work, services), property rights, or paid by him when importing goods into the customs territory of the Russian Federation and other territories under its jurisdiction.

If the taxpayer has in the expired tax period

, for which a VAT tax return is being submitted,

there are no taxable transactions

, then this taxpayer

has the right to deduct in this declaration the amounts of tax

presented to him upon the purchase of goods (work, services) in the expired tax period.

The Ministry of Finance of the Russian Federation also explains that in order to eliminate tax disputes on this issue, it is advisable to be guided by the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation, on the basis of which the absence of a tax base for VAT in the corresponding tax period should not be a reason for refusing to accept VAT for deduction

(letter dated November 19, 2012 No. 03-07-15/148).

Therefore, you have the right to deduct the amounts of “input” VAT

.

No income yet

When transferring goods to a retail store, you will restore the VAT amounts on these goods.

According to paragraph 1 of Art.

252 of the Tax Code of the Russian Federation, expenses are recognized as

expenses, provided that they are incurred to carry out activities aimed at generating income.

Thus, if the expenses incurred by the organization meet the criteria of Art. 252 Tax Code of the Russian Federation

, such

expenses are taken into account when determining the tax base

for income tax in the manner established by the Tax Code of the Russian Federation,

regardless of the presence or absence of income from sales

in the corresponding tax period (letter of the Ministry of Finance of the Russian Federation dated September 5, 2012 No. 03-03-06/4/ 96).

Therefore, you have the right to take into account the expenses you make in the absence of income (except for expenses for the purchase of goods) for profit tax purposes

.

In a letter dated May 20, 2010 No. 03-03-06/1/337, the Ministry of Finance of the Russian Federation reported that p.p. 34 clause 1 art. 264 Tax Code of the Russian Federation

It has been established that

other expenses associated with production and sales

include taxpayer expenses

for the preparation and development of new production facilities, workshops and units

.

Therefore, economically justified and documented expenses associated with the organization of structural divisions of the organization (in your case

–

store), including

:

– expenses for renting premises for a newly opened store;

– expenses for renovation of the premises of a new store;

– operating costs for maintaining the premises of the new store;

– costs of paying employees hired to the store staff;

– travel expenses of office workers employed in both taxation systems related to organizing the work of the store;

– expenses for preparing documents for real estate for registration of a lease agreement, payment for registration of a lease agreement for non-residential premises, etc.

taken into account for profit tax purposes in the manner prescribed by the Tax Code of the Russian Federation for specific types of expenses

, as well as in accordance with the method used by the organization for recognizing income and expenses.

In particular, this type of expense can be taken into account as part of other expenses.

based on

clauses 34 clause 1 art.

264 Tax Code of the Russian Federation .

In accordance with paragraphs

3 p. 1 art. 268 of the Tax Code of the Russian Federation, when selling purchased goods,

the taxpayer has the right

to reduce income from such transactions by the cost of acquiring these goods

, determined in accordance with the accounting policy adopted by the organization for tax purposes by one of the established methods for valuing purchased goods.

At the same time, according to Art. 320 Tax Code of the Russian Federation

the cost of purchasing goods sold in a given reporting (tax) period, and the amount of expenses for delivery (transportation costs) of purchased goods to the warehouse of the taxpayer - buyer of the goods, if these expenses are not included in the purchase price of these goods, relate to direct expenses and

are taken into account as implementation progresses

.

Therefore, before selling the goods you purchased, you cannot take into account these expenses.

When will you have income from sales

both in wholesale and retail trade, you can

organize separate accounting of income and expenses in the manner described above

.

Why do you need to distribute the amounts of insurance premiums when calculating income tax and UTII?

When paying benefits to their employees, all employers must calculate and transfer contributions for compulsory insurance.

Such contributions include:

- compulsory social insurance in case of temporary disability and in connection with maternity;

- compulsory social insurance against industrial accidents and occupational diseases;

- compulsory pension insurance;

- compulsory health insurance.

For more information about insurance premiums, read the article “Insurance premium tariff for 2021 in the table”

When calculating income tax, the amount of contributions for compulsory insurance must reduce the tax base (clause 2 of Article 263 of the Tax Code of the Russian Federation). However, this applies only to those contributions that relate to the general regime.

Contributions related to imputation, as well as fixed payments to the Pension Fund (paid by individual entrepreneurs who do not accrue any remuneration in favor of individuals) directly reduce the tax on imputed income itself (clause 2 of Article 346.32 of the Tax Code of the Russian Federation).

Thus, when combining two regimes, in order to correctly calculate income tax and UTII, the taxpayer needs to distribute the amounts of insurance contributions by type of activity, which, in turn, requires the distribution of all payments in favor of employees by regime.

Distributing the benefits of employees engaged in one activity is not a difficult task. It is best to indicate what type of activity a given employee serves in an employment contract or other similar documents.

But if an employee serves both modes (for example, administrative and management personnel), questions may arise.

To maintain separate accounting, it is necessary to provide additional sub-accounts to the accounts for accounting for costs and insurance premiums, which will reflect accrued remunerations and contributions separately for employees on OSNO and UTII, as well as remunerations and contributions that cannot be attributed to a specific regime.

General information ↑

Let's turn to the letter of the law, which contains information about each of the regimes, and also contains a list of conditions when OSNO and UTII can be used by taxpayers.

Concepts

UTII is a single tax on imputed income. This is a special preferential regime that companies can operate under in relation to certain types of activities (Article 346.26 of the Tax Code).

When using such a system, the company does not pay:

- income tax;

- personal income tax;

- on property;

- UST;

- VAT (except in some situations).

Instead of such payments, the company must calculate and transfer a single tax to the state treasury.

There also remains an obligation to transfer insurance contributions to funds (PFR, Social Insurance Fund), water tax, land tax, transport tax and other taxes according to the general rules.

In addition to reducing the tax burden, the company has the opportunity to reduce the number of reports submitted.

The decision to introduce or abolish the tax system in the territorial district is made by regional self-government bodies.

What to do if an organization conducts activities that are subject to UTII, and also conducts operations that are not subject to taxation?

It will use OSNO for this activity unless it promptly submits notice of changeover.

OSNO is a general taxation system on which the following are paid:

- income tax (except for some preferential categories of companies);

- on property;

- VAT;

- personal income tax;

- insurance amounts, regional taxes, etc.

For all types of activities in relation to such taxes, it is worth reporting to the tax office.

Transition conditions

The transition to OSNO is carried out in the following cases:

- if the organization does not meet the requirements of the preferential treatment or has violated them when using the special regime;

- if the company must issue invoices with the allocation of VAT, that is, it is a payer of such tax;

- if the company is one of the beneficiaries of income tax;

- if the company simply does not know about the possibility of using other tax systems;

- if an entrepreneur worked on a patent simplified tax system, but did not pay for the patent on time.

There is no need to notify about using OSNO. An organization switches to this mode by default from the moment it opens or loses the right to work on a special system.

There are no restrictions on the use of OSNO, that is, it can be used by all legal entities and individuals without exception.

The transition to UTII is voluntary, but for this it is necessary to submit the appropriate notification (Form 1 or Form 2) to the tax office.

There are a number of restrictions for using imputation:

| By number of employees | Up to 100 people |

| By OS cost | Up to 100 million rubles |

| Share in the authorized capital of other companies | Up to 25% (this does not apply to companies that operate under a simple partnership or trust agreement, as well as companies whose authorized capital consists of 50% of contributions from organizations of disabled people) |

The following are not entitled to use the tax system:

- largest taxpayers;

- educational institutions, organizations providing medical services and social security, if the activities cannot be done without catering.

There are also restrictions on types of activities. There is a closed list that includes catering services, retail trade, advertising, etc. You can view it in Art. 346.26 Tax Code.

Legal grounds

When using UTII, you should be guided by Chap. 26.3 NC:

| Article | Content |

| 346.25 | Features of using the mode |

| 346.28 | Single tax payers |

| 346.26 | List of taxes payable, reporting, fees |

| 346.29 | Paza and the object of taxation |

| 346.30 | Period |

| 346.31 | Rate used |

| 346.32 | The procedure for determining and paying tax amounts |

The rules for using the regime are also contained in Law No. 94-FZ of June 25, 2012.

When working on OSNO, you should rely on regulatory documents that regulate the procedure for calculating and paying taxes to be transferred to the system. This:

| Regarding personal income tax | Ch. 23 Tax Code, Order of the Ministry of Taxes of October 31, 2003 BG - 3-04/583 |

| Regarding income tax | Parts 1 and 2 of the Tax Code, Presidential Decree No. 685 dated May 8, 1996, Resolution No. 660 dated July 1, 1995, Letter No. 02-1-16 dated November 24, 1999 |

| For property tax | Ch. 30 Tax Code and local laws |

Remunerations in favor of which employees are subject to distribution when calculating insurance premiums

If an employee is involved in or serves both types of activities that fall under both OSNO and UTII, then his wages (and other remunerations) are subject to distribution.

Thus, it is necessary to distribute payments:

- in favor of employees engaged in activities related to different taxation regimes (for example, a salesperson carries out wholesale sales);

- in favor of administrative, managerial and other support personnel serving the business.

Determination of distribution proportion

It is generally accepted to distribute total expenses depending on the share of income from a particular type of activity in total revenue. Revenue, according to officials, should be taken into account without including indirect taxes. The period for determining income begins from the beginning of the year and is calculated on an accrual basis. Distribute expenses according to this formula:

Total expenses (TOS) = Total expenses * Income from TOS / Total income

You can divide the costs for UTII using the same formula or simply subtract the result obtained from the total costs.

The Ministry of Finance and the Federal Tax Service do not allow non-operating income to be taken into account when determining the proportion of distribution, because they are not related to production and cannot relate to income from a specific type of activity. The courts do not always agree with their position, but in order to avoid problems it is better to listen to the regulatory authorities.

Results

When combining the UTII and OSNO regimes, it is necessary to keep separate records of income, expenses, assets and physical indicators used to calculate the imputed tax. While the procedure for accounting for income raises virtually no questions, the algorithm for distributing costs is not regulated by law and is explained in numerous letters from officials.

We talk about all the innovations and clarifications of officials in the special section “UTII.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

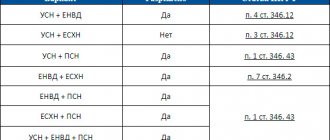

Tax regimes that operate in the Russian Federation

The thing is that in Russia there is simultaneously one general regime and several special regimes, called taxation systems. According to the degree of increase in the tax burden, they can be arranged in the following sequence:

Types and features of individual entrepreneur taxation systems:

- Patent taxation system (PTS), which can only be used by individual entrepreneurs. It is permitted for small retail trade and personal services to the population with an annual income of up to 1 million rubles. You can hire up to 15 workers.

- The taxation system in the form of a single tax on imputed income (UTII) is applied to the fourteen most common types of activities among small businesses. Entrepreneurs carrying out such activities must use this system without fail; legal entities may refuse. At the same time, individual entrepreneurs do not have to keep full accounting records, and there are no concessions for enterprises. The amount that will have to be paid to the state increases. It does not depend on actual income, but is determined by municipal authorities.

- The simplified taxation system (STS) can be considered as an alternative tax regime. It cannot be used together with the general one, but only instead of it, unlike previous cases. There are restrictions on revenue and the value of the company’s property. There are restrictions on types of activities. The tax amount depends on income. Individual entrepreneurs must maintain simplified accounting records.

- The general taxation regime (GRT) does not have any exceptions for the possibility of application, since it is the “default regime” when registering an individual entrepreneur or legal entity. Accordingly, it requires full accounting and implies maximum payments to the budget. This tax regime is often called the general taxation system (OSNO), but it should be noted that such a concept is not in the Tax Code of the Russian Federation, and its use is not entirely correct.

There is also a separate regime for agricultural producers, but it cannot be used by everyone else, so it will remain “behind the scenes”.

If you look closely, you will notice that tax regimes resemble the rungs of a ladder along which entrepreneurs persistently climb to success. But the higher they rise, the more complicated the accounting, and the more they have to give to the state. But not everyone is ready for such a development of events. To reduce additional costs when developing a business, it is often more profitable to use a combination of different taxation regimes.

Pitfalls: going beyond UTII when requalifying a transaction

It happens that, as a result of a tax audit, the UTII payer is unexpectedly held accountable for non-payment of taxes under OSNO. This situation arises when crossing the line separating UTII from other regimes within the framework of a specific transaction.

All areas of this special regime are characterized by the purpose of satisfying consumer demand. If the other party to the transaction is an organization or individual entrepreneur and this is clear from the primary documents, the question arises whether the transaction corresponds to the specified purpose.

Not in all cases, such a transaction will go beyond the scope of UTII, since business entities have the right to purchase goods for consumption (stationery, for example) under retail sales contracts. Art. 492 of the Civil Code of the Russian Federation does not limit them in this. But there are signs that take the deal beyond retail:

- The name of the contract is a supply contract (according to Article 346.27 of the Tax Code of the Russian Federation, only a retail contract is subject to UTII), in combination with other circumstances.

- Coordination of conditions that go beyond normal work: delivery times, multiple batches, product range (availability of specifications), liability measures.

- Transfer of invoices instead of a sales receipt.

- Conclusion of an agreement not by accepting a public offer, but in another way (an agreement that is not public, Article 426 of the Civil Code of the Russian Federation).

Such signs became the reason for conclusions not in favor of the taxpayer in the resolution of the AS UO dated December 29, 2015 No. F09-8997/15 in case No. A47-10443/2014.

So, the use of 2 tax regimes for UTII payers is not only possible, but also necessary in cases provided for by the Tax Code of the Russian Federation. Particularly careful attention is required in borderline situations associated with the determination of a physical indicator or a high risk of reclassification of a retail transaction into a commercial one.

Transition to UTII in one of the directions

The main option for the combined use of the 2 regimes is the one in which the taxpayer, immediately after registration or during work, decides to transfer one of the areas to a special regime. To do this you need:

- make sure that the necessary activity codes of the organization are available in the state register and in compliance with the requirements for single tax payers according to the norms of Chapter. 26.3 of the Tax Code of the Russian Federation (no restrictions);

- make sure that in the territory where the work will be carried out, a trade tax has not been introduced for the desired direction (this excludes the possibility of introducing this special regime for it, clause 2.1 of Article 326.26 of the Tax Code of the Russian Federation);

- submit to the tax authority an application for registration as a UTII payer at the location of the organization or the corresponding unit (clause 2 of Article 346.28 of the Tax Code of the Russian Federation).

It is advisable to carry out a preliminary tax calculation. To do this, you will need to study the regulations establishing the K_2 coefficient in the corresponding locality.

The question of the distribution of employees by number for calculating UTII

To determine the possibility of applying a special regime, the number of workers is counted throughout the entire organization, including divisions operating at both UTII and OSNO. This follows from the text of paragraph. 1 clause 2.2 art. 346.26 of the Tax Code of the Russian Federation, and from the clarifications of the Ministry of Finance of the Russian Federation (for example, given in letter dated January 11, 2013 No. 03-11-06/3/1).

Taxpayers have a question: how to distribute the number of employees when calculating tax payable? One of the physical indicators for calculating profitability is the number of employees, which is determined in accordance with Art. 346.27 of the Tax Code of the Russian Federation, on average per month according to the same principle as given above, i.e. including those working under the GPA.

However, in the staffing structure of an enterprise that uses 2 modes, there are often several divisions that perform functions related to the organization as a whole, and do not serve exclusively individual areas of work. These may include administration and accounting.

The following example can be given.

Example

The division working for UTII for household services employs 10 people, the division for OSNO - 60 people, and the administration of the organization - 30 people. The basic profitability of this type of activity, according to clause 3 of Art. 346.29 of the Tax Code of the Russian Federation, amounts to 7,500 rubles.

If we multiply this figure by 10, we get 75,000 rubles, and if we multiply by 40, that is, sum up the number of units on UTII and the administration (10 + 30), the result is 300,000 rubles. The amount of UTII payable varies significantly.

So what indicator should be taken into account?

Number of employees when using 2 modes

With OSNO there are no restrictions on the number of employees, and with UTII it is limited to 100 people. The calculation of the average number must be carried out in accordance with the Instructions for filling out forms..., approved by Rosstat Order No. 428 dated October 28, 2013 (hereinafter referred to as the Instructions).

Considering the difficulty in determining the validity of this document (it was canceled and then restored, the statistical forms approved by it were cancelled), the Ministry of Finance of the Russian Federation in a letter dated 04/07/2016 No. 03-11-06/3/19830 gave a clear explanation of the need for payers to use UTII to establish number of employees, clause 77 of the Instructions.

According to the document, this indicator includes the following data:

- Average staff composition.

- External part-time workers (internal part-time workers are counted in the first group).

- Persons involved in work under civil law contracts (CLA).

The Ministry of Finance of the Russian Federation gave an additional clarification that this indicator also includes citizens employed in the organization on the basis of an agreement on the provision of personnel labor (letter dated April 28, 2016 No. 03-11-09/25903). Such an agreement is sometimes called an outsourcing or outstaffing agreement, although outsourcing is the assignment of part of the work to a third party. Art. is devoted to this type of activity. 18.1 of the Law of the Russian Federation “On Employment in the Russian Federation” dated April 19, 1991 No. 1032-I. Characteristics of such an agreement:

- workers are sent to the customer;

- work under the control of the customer;

- perform for the customer the function specified in the employment contract with the contractor.