Home → Articles → Is it necessary to issue a cash receipt when transferring payment to a bank account?

The seller must use cash register systems even if buyers transfer money for goods by bank transfer to a current account through a bank by creating a payment order. In other words, the cash does not arrive at the cash register, but you still need to punch the check. This vision of the situation, which coincides with the position of the Ministry of Finance of the Russian Federation, was outlined by Federal Tax Service specialists in a letter dated July 6, 2017 No. ED-3-20 / [email protected] Is it necessary to issue a cash receipt when the buyer, a legal entity or an individual, transfers payment to the seller’s bank account through the bank?

What is non-cash?

A form of non-cash payment is the movement of funds through the accounts of clients of banking or credit organizations in electronic form. Any payment for goods by bank transfer is carried out only through specialized organizations that have licenses to perform banking operations.

Bank transfer is available to absolutely all persons, regardless of the form of their activity. As a rule, at the end of the working day, account holders are provided with a statement of their cash flow activity for the day, which allows them to control all transactions. But if necessary, such a statement can be requested from a credit institution at any time.

Mobile acquiring

Among all types of acquiring, mobile is the “youngest”. It is used by delivery services, taxis, and for traveling trade. This is also a suitable option for small businesses with a low flow of clients who carry out payments on a stationary basis.

MPOS terminals are designed for organizing mobile acquiring. These are small and convenient devices that connect to smartphones and tablets wirelessly and wired (via audio jack, Bluetooth). Another option for implementing mobile acquiring is the use of a compact online cash register with acquiring. This type of online cash register has a built-in pin pad and card reader. Mobile online cash registers with built-in acquiring are the most convenient and optimal option for out-of-state trade, couriers and deliveries, small service firms or micro and small businesses.

In the case of using a mobile cash register, a paper check is generated based on the calculation results, and if necessary, you can send its electronic equivalent to the buyer’s e-mail or phone number if they provide contact information. When using a smartphone or tablet as the main device, which does not have a built-in printer for printing receipts, only an electronic fiscal document can be sent to the client. To work successfully, you will have to install special software on the gadget.

The principle of using an MPOS terminal (mobile pin pad) is similar to others.

Mobile banking terminals have certain disadvantages:

- relatively low data processing speed;

- tariffs are often higher than other types of acquiring;

- does not print paper checks;

- If you accept payments on the go, you need two devices (cash register + terminal).

Devices for mobile acquiring are often used when it is not possible to carry out payments at a stationary location. In other cases, their use turns out to be inappropriate.

Regulation of non-cash payments

Payment by bank transfer is subject to only three regulatory documents that fully control their implementation. The main one is the Civil Code of the Russian Federation, Chapter 46 of which describes all the basic requirements for permitted non-cash forms of money circulation.

Further, the bank transfer obeys:

- regulations on the issue of payment cards;

- Regulations on the rules for making money transfers.

The first document was approved by the Central Bank on December 24, 2004 and reveals the procedure for the legal implementation of acquiring. This concept defines the non-cash payment for services or goods that is familiar to many ordinary citizens.

The second document was approved only on June 19, 2012 by the Bank of Russia and contains all the necessary detailed descriptions of possible forms of non-cash payments and requirements for them. Everything contained in the provision fully complies with the norms of the Civil Code.

Any payment by bank transfer must be carried out in strict compliance with all of the listed regulatory documents, but such control is not an obstacle to the growing popularity of non-cash money circulation among the entire population.

Principles of organization

The presented payment method is one of the important tools for the development of the country's market economy. It is voluntary in nature, allowing you to transfer and receive wages, savings from deposits and other income without visiting financial institutions. Continuity of money transfers is ensured by the principles on which the organization of non-cash payments is based:

- Enterprises and organizations participating in operations themselves choose their form, regardless of the scope of their activities.

- The client's rights to manage funds are not limited.

- Transactions are implemented on a first-come, first-served basis.

- Payments are transferred from account to account if funds are available.

- Meat zrazy: recipes with photos

- Propolis for children for immunity

- Lazy cabbage rolls in the oven - recipes. How to cook lazy cabbage rolls in the oven

Advantages of non-cash payments

First of all, payment by bank transfer requires minimal documents in comparison with regular cash payments between organizations. Many companies choose this form of payment because it makes it possible to avoid large fines due to errors in registering cash discipline and using cash registers.

Large organizations are also increasingly invoicing their clients by bank transfer, instead of taking cash from them. This allows companies to save significantly, since servicing such operations is much cheaper.

The obvious benefit of such calculations for ordinary citizens is the convenience of transactions. The fact is that you can carry them out simply by having a payment bank card and the ability to access the Internet, and commissions for money transfers between accounts are not always charged or amount to minimal losses.

Such virtual settlements also have benefits for the state, because it allows you to constantly monitor all cash flows in real time. In addition, a decrease in the turnover of the living money supply reduces the possibility of inflation in the country.

In general, the advantages of non-cash payments are clearly visible to everyone, and most importantly, they can be carried out at any time of the day, on any day of the week and completely regardless of the geography of the transfer.

Ready solutions

Let's consider well-known models of online cash registers with the option of paying by card:

| aQsi 5 with acquiring Mobile cash register, recognizes cards such as EMV chip, Magstripe, NFC. Has a free cash register program, touch screen and prints receipts. Find out more |

| Evotor 5i Smart terminal, optionally available with a built-in battery, provides reading of magnetic cards and with a chip. Find out more |

| MTS 5 with acquiring Mobile smart terminal with a built-in card reader, reads magnetic, contactless, smart cards, for all areas of activity. Find out more |

| mSPOS E F Modular cash register with acquiring, has a built-in battery that supports operation for up to 24 hours, and is capable of reading all types of cards. Find out more |

Do you need an online cash register with card payments? Products in the Multikas online store are a favorable combination of price and quality. A full range of related services for business automation is provided. Delivery is available in all regions of Russia.

Types of bank transfer payments for individuals

Ordinary citizens may think that bank transfers are only transfers between accounts, but in fact there are 6 types of them. Most are available only to legal entities and organizations and are controlled by the same regulatory documents.

The most common form of payment available to civilians is in the form of an electronic transfer. It represents the transfer of funds from the payer’s personal bank account to the recipient’s account through a banking operator. The recipient can be an individual or an organization, the main thing is that such a right is described in the agreement between the account holder and the bank. The payer can only be a private person.

Another form of payment, which, like the previous one, is regulated by the law “On the National Payment System” is direct debit. It represents the debiting of funds from the owner’s account at the request of the recipient, but only if this is permitted by the agreement between the account owner and the credit institution. Most often, such payments are mandatory fees for servicing a bank card or account.

What is the difficulty of punching and issuing a cash receipt to the buyer when paying into a bank account?

Indeed, many trade and service enterprises accept payments for goods and services not at a regular cash register, but to a current account - using a receipt or using other tools that are used to make a transfer using the bank details of the enterprise (for example, using payment forms in the interfaces client-bank systems - in which the necessary details of the supplier of goods or services can be registered by default - or specified manually). Payment can also be made through a cashier-operator at a bank, through a payment terminal, etc.

A variety of categories of business entities can work according to this scheme. But all of them, as a rule, are united by the sale of goods and services online - without direct contact with the consumer at the time of sale of the goods (often without contact at all by default), which makes it difficult (in practice, often impossible) to determine the moment of settlement. The scheme for accepting payments to a current account is widespread, in particular, among:

- travel agencies selling travel packages online;

- trading enterprises selling goods wholesale and retail through online catalogues.

The “to-account” payment scheme should be fundamentally distinguished from the scheme in which the buyer of goods and services pays the seller directly on his website - using a bank card or other electronic means of payment.

In this case, on the one hand, there is a lack of direct “contact” between the seller and the buyer. On the other hand, it remains possible to record the moment of settlement - which, obviously, is set by various electronic instruments when trying to conduct an electronic transaction from a card (or other payment instrument).

Thanks to the ability to record the moment of settlement on the site, the transaction can be fiscalized - that is, “punched” at an online cash register, which is connected to the site in a certain way (usually automatically - using online cash registers specially adapted for sales via the Internet). To carry out a transaction on the website, the payer almost always provides certain contact information - as a rule, this is e-mail and telephone. The seller sends an electronic cash receipt to them using an online cash register - in fact, this is a legal requirement.

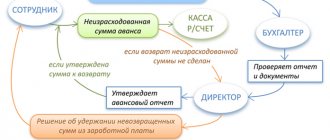

In the case of receiving payment “to a bank account,” the situation is completely different. Here, as we noted above, it is extremely difficult to determine the moment of calculations. In addition, with the scheme in question, there is a problem with a well-functioning mechanism for obtaining the buyer’s contact information in order to send a check, at least in electronic form. That is, having received funds into the current account, an economic entity:

- will not have a real opportunity to quickly generate a cash receipt at the time of settlement (the buyer deposits funds into the cash register), since he simply will not know that the payment has been made (and this can happen long before the funds arrive in the current account);

- with a high probability, will not be able to send a cash receipt to the buyer - no matter in what form, paper or electronic, due to the lack of contacts.

Until recently, namely, before the new version of Law No. 54-FZ came into force on July 3, 2018, the legislation itself did not regulate the conditions for the fiscalization of transactions under the “current account” scheme, although it formally required such fiscalization to be carried out - since, one way or another otherwise, there was a settlement between a business entity and an individual. And this fiscalization had to be carried out “at the moment of settlement.”

From the point of view of the provisions of Law No. 54-FZ as amended, the fact that the payment took place remotely and without a guaranteed opportunity to determine the moment of its execution (especially if the payment took place through a cashier-operator - from whom the seller, if desired, was not able to obtain information about the transaction payment) did not matter. Payment “to the bank account” had to be entered at the online cash register - and it is completely unclear how. The seller was forced to violate the requirements of Law No. 54-FZ, according to which a cash receipt must be sent to the buyer when accepting payment from an individual.

In its letter No. 03-01-15/73999 dated 08.24.2020 (LINK), the Russian Ministry of Finance further explains that if an individual paid for the goods through a bank cash desk (to the seller’s bank account), then in this case the seller is obliged to use an online cash register ( issue a cash receipt).

The explanations of the regulatory authorities on this issue were quite contradictory and in some cases not entirely logical and justified in principle.

Thus, the Ministry of Finance of Russia, in a letter dated August 15, 2017 N 03-01-15/52356 (LINK), confirmed that payment “to a current account” is subject to mandatory fiscalization and, at the same time, recommended that business entities receive contact information at all costs customer data even before they make a payment - so that at the first opportunity they can punch out receipts and send them electronically to the contacts received. For these purposes, the Ministry of Finance advised businesses to negotiate with banks on the transfer of customer contacts immediately before paying the receipt for the goods. And this, quite obviously, was practically impossible to implement in practice.

With the entry into force of Law No. 54-FZ as amended on July 3, 2018 (amendments were made by Federal Law 192-FZ on July 3, 2018), the situation became noticeably clearer. The federal law has introduced more or less clear rules for the fiscalization of transactions characteristic of the “to-account” payment scheme.

Most common form

Individual entrepreneurs pay by bank transfer most often by means of a payment order. Even individuals who do not have a current account with a credit institution can use this form. Payment involves the preparation and transfer to the bank of a certain document - an order, detailing the amount, recipient and time frame within which the transfer must be made. All this is carried out at the expense of the payer.

The validity period of the order is officially 10 days, not taking into account the moment of submission of the document, but in practice everything happens much faster. Only incorrect execution of the order can slow down the receipt of funds.

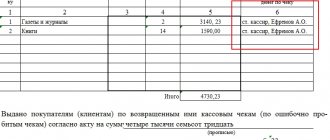

Refund of non-cash payment

By law, it is permissible for clients served by a bank to revoke their payment documents. However, in practice, returning a non-cash payment entails a whole series of procedures.

- If the money was transferred incorrectly, the transaction was carried out and the funds were credited, the return of money via non-cash payment is made in court. At the same time, it is important to prove that no services were provided (when funds were credited to the company’s account).

- If a return is required by a store customer returning an item, then several options are possible: transfer of the required amount by the seller to the buyer by non-cash method (for example, return transfer to a card) or in cash.

Attention. Often, companies operating in the trade sector enter into an agreement with the bank that services the terminals about the possibility of returning funds for non-cash payments.

From the client in whose favor a refund is to be made, a current account number, bank name and correspondent account number, INN and BIC of the recipient, and his full name are usually required.

The most secure form

The most secure form of non-cash payment is payment through a letter of credit. It represents an inconvenience for the payer, since it requires a separate opening of a letter of credit, even if this bank already has a current account, but all this is for the sake of security.

The payer must transfer a certain amount for goods or services to an open account and oblige the bank to pay them to the recipient only if certain conditions are met. That is, until the recipient gives the credit institution confirmation that he has fully fulfilled his obligations under the transaction, he will not receive the money. In this case, the bank acts as an uninterested third party and guarantees the legality of the transaction.

Cash-non-cash payment

Conventionally, cash/non-cash payment determines settlements through checkbooks, since after debiting funds from the drawer’s account, it may imply issuing them in cash or transferring them to a bank account. This form of payment is more common in Europe and the USA and is carried out only after confirming the identity of the bearer of the check and receiving information about the presence of an amount sufficient for the transfer in the drawer’s account, and, of course, after confirming the authenticity of the check.

Another form of non-cash payment is a transfer through collection or collection order. It is carried out only when the recipient of the funds provides the bank with confirmation of the account owner’s monetary obligations to it. In essence, this is debt collection and it occurs even without timely notification to the account owner. As a rule, the debtor learns about the withdrawal after the transfer has been made.

Problems of non-cash payments

The main problems of non-cash payments are:

- the difficulty of establishing a settlement and payment system,

- risks arising in connection with payments,

- the presence of non-payments (their changes affect the budget deficit),

- speed of payments (including taking into account failures and delays, errors made by both senders and recipients of funds, and the payment centers themselves),

- priority of payments and its regulation, causing damage to other creditors,

- insufficient development of the regulatory framework for making non-cash payments (for bills of exchange and letters of credit).

In addition, enterprises are responsible for compliance with loan agreements, as well as established payment discipline. If an organization does not fulfill its payment obligations, it may be declared insolvent.

What is non-cash based on?

First of all, all non-cash payments must be carried out in accordance with laws and regulations. In addition to the general rules, each credit institution is obliged to act only within the framework of a valid agreement between the bank and the account owner. Going beyond the scope of the document is allowed only when signing a new agreement. In addition, the bank does not have the right to influence the choice of payment form for the participants in the transaction.

Any invoice issued for payment by bank transfer, a sample of which can be obtained directly from a credit institution, must be supported by a sufficient amount of funds in the payer’s account. In addition, money transfer operations must be carried out within a specified period, otherwise sanctions or fines may be imposed on the culprit. And, of course, every account owner has the right of acceptance, which means that even the state is prohibited from debiting money from the account without prior notification.

Types of accounts

Any non-cash payment is permissible only if you have a bank account with the required amount on it. The only exception is payment by means of a payment order, which is permitted by law and can be carried out even in the absence of a bank account, but only by individuals. To conduct business, you must have a bank account.

There are several varieties of them:

- Current account. Available for use by ordinary citizens and has no relation to business activities.

- Deposit. Allows individuals and organizations to receive income from their own funds.

- Checking account. Opens for commercial activities of citizens, entrepreneurs or organizations, except for credit.

- Budget. Used only by legal entities for the distribution of budget funds.

- Special accounts. These include clearing, collateral, letters of credit and other accounts. They can open to everyone.

- Correspondents. Available only to credit institutions.

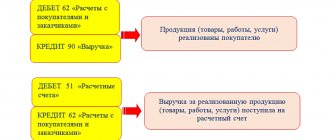

Accepting non-cash payments

Non-cash payments are accepted in several ways: either by crediting to the organization’s account through a bank, or through a terminal (cash register, bank pinpad). In addition, today organizations are trying to automate the transfer of funds as much as possible in order to eliminate errors and the “human factor”. The commission for non-cash payments, in contrast to payment systems that charge up to 5%, is 0%. To accept non-cash payments, organizations solve several problems:

— preparation of invoices and contracts (optional),

- control over the transfer of funds,

- preparation of closing documents.

To accept payments, you need the organization's INN, current account number, BIC of the servicing payer bank, legal and postal address.

Funds control

For individuals, keeping track of the movement of funds in an account allows them to keep bank statements, but for organizations it is more and more difficult. They use books of income and expenses, in which they record data on payment orders, collection transactions, memorial orders, and so on. Analytics of special accounts is carried out using statements of letters of credit, deposits, check transactions and other forms of payments.

The bank should tell you in detail how to issue an invoice for payment by bank transfer to the account holder, as well as inform about possible fines. They are imposed both on the credit institutions themselves and on paying agents if they fail to fulfill their obligations on time.