Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

Belarus is part of the EAEU, and all members of this union have a single customs territory. This means that in mutual trade there are no customs duties, tariff regulation measures, declarations or state control. Importing goods from the EAEU countries is easier than from other countries, but there are also some peculiarities: concluding a contract, paying VAT, preparing documents for the tax office. Read the article on how to legally import goods from Belarus.

At what rate is Belarusian VAT calculated?

When importing goods from Belarus, the Russian importer is obliged to pay import VAT, regardless of the territory of which country they were produced (this is evidenced by the letter of the Ministry of Finance of the Russian Federation dated September 8, 2010 No. 03-07-08/260). No exceptions are made for anyone: in this case, taxpayers pay VAT regardless of the chosen taxation system.

However, there is a list of goods exempt from import VAT. First of all, these are the lists given in Art. 150 of the Tax Code of the Russian Federation and the Decree of the Government of the Russian Federation dated April 30, 2009 No. 372, issued in accordance with it. The exemption under Art. 149 of the Tax Code of the Russian Federation.

For a list of cases when you do not need to pay VAT on imports from Belarus, see ConsultantPlus. Trial access to the system can be obtained for free.

For non-tax-exempt goods, the usual rates for import from Belarus are 20% or 10%, depending on the type of goods. A reduced 10% rate is provided for goods included in special lists established by the Government of the Russian Federation. In particular, for food products and children's products, such lists were approved by Decree of the Government of the Russian Federation dated December 31, 2004 No. 908. Imported products for which no benefits are established are taxed at a rate of 20%.

For shipments during the transition period (2018-2019), it was necessary to choose the VAT rate based not on the date of shipment of goods by the foreign seller, but on the date of their acceptance for registration by the Russian buyer. If the goods were shipped in 2021 and registered in 2019, the rate should be 20%.

A ready-made solution from ConsultantPlus will help you calculate VAT on imports from Belarus. You can view the material for free by obtaining demo access to the system.

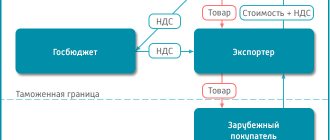

Customs Union

The Customs Union of the EAEU is a form of trade and economic integration of the member states of the Union, providing for a single customs territory within which customs duties (other duties, taxes and fees having an equivalent effect), non-tariff regulation measures are not applied in mutual trade; a single customs tariff of the Eurasian Economic Union and unified measures to regulate foreign trade in goods with third parties.

In other words, the countries are united into a single customs territory of the Customs Union.

Within the framework of the Customs Union, the internal market of goods operates, unified customs regulation is carried out, and free movement of goods is carried out between the territories of the member states without the use of customs declaration and state control (transport, sanitary, veterinary and sanitary, quarantine phytosanitary) (Article 25 of the Treaty on the EAEU) .

When should VAT on imports from Belarus to Russia be transferred to the budget?

VAT must be paid by the 20th day of the month following the one in which the imported goods were registered.

Important! Tip from ConsultantPlus, when importing under a leasing agreement (if the transfer of ownership of the leased item is provided), pay VAT on each leasing payment no later than... For more details, see K+. This can be done for free.

KBK for payment: 182 1 0400 110.

You should pay the tax to your Federal Tax Service.

If a company has overpaid federal taxes, they may not remit import VAT at all. However, in this case, inspectors must submit a corresponding application requesting offset of the overpayment.

It should be borne in mind that, according to paragraph 4 of Art. 78 of the Tax Code of the Russian Federation, tax authorities are given 10 working days from the date of filing such an application to make a decision on the offset. And if the organization sends it without taking into account the fact that payment must be made by a certain day, it is quite likely that the inspectorate will carry out an offset when the VAT payment deadline has already passed, and then penalties will be charged.

What an accountant needs to know about declarations

The Tax Code of the Russian Federation establishes the obligation of VAT taxpayers to submit a tax return for the expired tax period no later than the 25th day of the month following the expired tax period. And pay the VAT amount for the expired tax period in equal installments no later than the 25th day of each of the three months following the expired tax period.

In the agreement on the EAEU, the deadlines for paying and filing a tax return are calculated completely differently:

- Payment of VAT on imports - no later than the 20th day of the month following the month the imported goods were accepted for accounting.

- Submitting a declaration - similar to payment - no later than the 20th day of the month following the month the imported goods were accepted for accounting.

It is necessary to pay VAT before filing a tax return, since a statement of payment must be attached to the tax return.

Interesting! For non-payment, incomplete payment of VAT amounts when importing goods, or late payment, the Treaty on the EAEU does not establish liability similar to the fine for non-payment of tax under Article 122 of the Tax Code of the Russian Federation. At the same time, when paying VAT on late imports, the taxpayer is required to pay a penalty. If the tax authority identifies delays, it has the right to collect arrears and penalties.

Import from Belarus to Russia: what is submitted to the tax office

For imported goods and materials, a special declaration on indirect taxes is filled out. In addition, tax officials should send a number of papers confirming the fact of import and payment of VAT to the budget.

The declaration is completed for the month in which the imported goods and materials were recorded. Moreover, if there was no fact of import, there is no need to compile it.

This declaration is sent to the inspectorate no later than the 20th day of the month following the one in which the assets were recorded. If the company had 100 or fewer employees last year, the declaration can be submitted in paper form. It should be remembered that the mandatory electronic form is provided only for regular (quarterly) VAT returns. The tax authorities themselves speak about this (letter from the Federal Tax Service of the Russian Federation for Moscow dated March 11, 2014 No. 16–15/021948).

In case of import of non-excise goods, only section 1 will be required to be completed in the declaration (in addition to the mandatory title page). In this case, the amount of import tax payable to the budget will be reflected in line 030 of section 1.

Documentation confirming import

Along with the tax declaration, it is necessary to submit a certain package of documents, or rather their certified copies (with the exception of the application for the import of goods, which is submitted in the original):

- Bank statements as confirmation of payment of import VAT (naturally, if the tax authorities decided to offset the overpayment, then it will not be needed). If we talk about how this situation works in practice, then tax officials prefer copies of payment slips with a bank mark and seal to bank statements.

- An agreement for the supply of imported goods concluded with a Belarusian counterparty. If the goods and materials were supplied through an intermediary, it is necessary to attach the corresponding intermediary agreement, as well as an information message with information about the supplier.

- Transport and accompanying papers.

- Invoices.

- Applications for the import of goods and payment of indirect taxes. It is submitted in paper form (in 4 copies), as well as in electronic form (its format is approved by order of the Federal Tax Service of the Russian Federation dated November 19, 2014 No. ММВ-7-6 / [email protected] ).

For information on the basis of which documents can be used to deduct import VAT paid by an intermediary, read the material “How to deduct VAT if an intermediary paid it at customs?”

Contract currency

Tax lawyer Gordon Andrey Eduardovich

Member of the Chamber of Tax Consultants

Read new publications (click to go):

Get ready! Mandatory requirements for foreign trade contracts from 2018

The nuances of fulfilling deliveries with Belarus and Kazakhstan - how to avoid large fines

Customs documents - deliveries with Belarus and Kazakhstan

Export VAT from July 2021

Documents to confirm the VAT rate of 0%

Features of the supply agreement to Kazakhstan

Get advice on the topic

Application for import when importing from the Republic of Belarus

Importing companies fill out section 1 of the application, entering information about the supplier and buyer, information about the contract and the cost of imported goods and materials. Section 2 of the application is filled out by the inspectors themselves (here they also put their mark on payment of VAT). In some situations, for example, during mediation, the importer must also complete the third section.

You can download the application form on our website:

Explanations and a sample from ConsultantPlus experts will help you fill out the application, which you can view for free after receiving trial access to the system.

Inspectors review the application within 10 working days and confirm payment of VAT:

- A mark on a paper application. In this case, one copy of the application remains with the controllers, and the rest are returned to the importing company. Of these, one document is intended for the company itself, and the other 2 must be transferred to the Belarusian supplier so that he can confirm the zero export rate on his territory.

- A separate electronic document when sending an electronic application. In this case, the buyer must provide the seller with electronic or paper copies of his application and the supporting document received from the Federal Tax Service.

See also the material “When importing from Belarus, the Russian Federal Tax Service puts a mark on the application .

How is VAT deducted?

After the importer receives his copy of the application with the mark of the tax authorities, he can claim a deduction (letters of the Ministry of Finance of the Russian Federation dated 07/02/2015 No. 03-07-13/1/38180, dated 08/17/2011 No. 03-07-13/01-36) . Tax legislation (clause 2 of article 171, clause 1 of article 172 of the Tax Code of the Russian Federation) contains 3 conditions, if simultaneously met, the importer has the right to declare a VAT deduction when importing from Belarus:

- The goods were purchased for VAT-taxable transactions.

- Inventory and materials have been registered.

- Import VAT paid.

However, the rules for maintaining a purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, put forward one more additional requirement: an application for the import of goods with a mark from controllers must be recorded in the purchase book indicating the number of the payment document on the basis of which VAT was paid to the budget (the date and number of the application are entered in column 3 of the book, and the details of the payment order - in column 7).

Attention! The deduction of import VAT is declared in the regular (quarterly) declaration - do not confuse it with the declaration of indirect taxes. The declared deduction amount will be reflected in line 190 of section 3 (letter of the Federal Tax Service of Russia dated October 20, 2010 No. ШС-37-3/ [email protected] ).

See also the material “What is the procedure for refunding VAT when importing goods?” .

However, there are cases when VAT paid when importing goods from the EAEU must be taken into account in their cost. Check out such cases in the Ready-made solution from ConsultantPlus for free.

Provide statistical form

You need to report not only to the tax office, but also to the customs office of your region. To do this, entrepreneurs send a statistical form to record the movement of goods.

The form is submitted if:

- entered into an agreement on the import of goods;

- the contract was concluded by the representative;

- if there was no transaction, but they formalized the right to dispose of the goods.

You can get acquainted with the peculiarities of calculating VAT in certain situations on our forum. For example, in this thread you can find out whether transport costs when importing goods from Belarus are included in the VAT tax base.

What to do with deadlines

In practice, there are often situations when VAT on imports from Belarus is paid in one quarter, and the importer receives a tax mark on the application in the next. According to officials, in this case, VAT is deducted only after the appropriate mark is made (letter of the Ministry of Finance of the Russian Federation dated July 2, 2015 No. 03-07-13/1/38180).

However, judges in such situations often take the side of taxpayers who claim a deduction during the period of actual payment of VAT to the budget, without waiting for the inspectors’ mark (Resolution of the Federal Antimonopoly Service of the Moscow District dated July 25, 2011 No. KA-A41/7408–11). However, if you don’t want to argue with the tax office, then it would be more advisable to wait for the mark.

Results

Goods imported from the EAEU countries (including from Belarus) are subject to VAT at regular rates (20 and 10%), unless they are exempt from tax. Payment of such tax is mandatory for all importers, regardless of the tax regime they apply. The deadline for payment and reporting of tax accrued on imports from the EAEU expires on the 20th day of the month following the reporting month.

The reporting is presented by an indirect tax declaration and an import statement, accompanied by copies of documents confirming the import and payment of tax. For a month in which there are no import transactions, reporting is not submitted. The paid tax, subject to the acceptance by the Federal Tax Service of the import documents, is subject to deduction.

See also our articles:

- “VAT on imports from Kazakhstan to Russia”;

- “VAT on the import of goods from Kyrgyzstan to Russia”;

- “VAT on the import of goods from Uzbekistan to Russia”;

- “Payment and restoration of VAT when importing goods from China to Russia.”

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation of April 30, 2009 N 372

- Decree of the Government of the Russian Federation of December 31, 2004 N 908

- Order of the Federal Tax Service of Russia dated November 19, 2014 N ММВ-7-6/ [email protected]

- Decree of the Government of the Russian Federation of December 26, 2011 N 1137

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.