Deductions

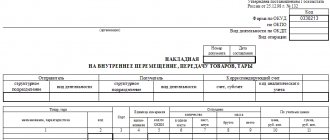

The movement of material assets from one structural unit of an organization to another requires mandatory documentation.

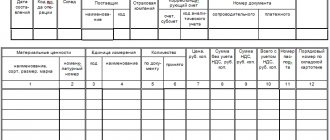

Standard intersectoral Form M-4 – Receipt Order and Instructions for its use and completion

Drawing up a Statement of Reconciliation of Mutual Settlements is usually necessary in the case when two legal entities need

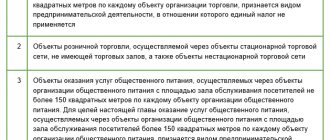

Since 2011, the Federal Tax Service of Russia has set out to increase the efficiency of control activities in the field of

From July 1, 2021, the bulk of Russian trade and service enterprises are switching to

As a rule, inspections by control and supervisory authorities are planned in advance. However, there are times when it occurs

UTII is a preferential tax regime in which cash register equipment has not been used for a long time.

In the payment order, instead of OKATO, from January 1, 2014, OKTMO is indicated (even if payments

Withholding and paying income tax to the budget is the responsibility of individuals and tax authorities.

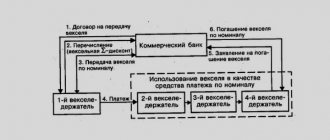

A bill of exchange received from a counterparty can generate additional income. For accounting and tax purposes income