Withholding and paying income tax to the budget is the responsibility of individuals and tax agents. But as a result of mistakes made, there may be an overpayment of personal income tax. Let's figure out what we can do with it in 2021.

Organizations are recognized as tax agents in relation to the calculation and payment of personal income tax if the following conditions are met (according to paragraph 1 of Article 226 of the Tax Code):

- located on the territory of the Russian Federation;

- paying income to the taxpayer.

The income tax is calculated in accordance with Article 224 of the Tax Code, taking into account the provisions of Article 226 of the Tax Code.

Also read: How to fill out the new form 2-NDFL in 2021?

How to return (offset) an overpayment of personal income tax to an organization - a tax agent?

According to paragraph 7 of Art. 78 of the Tax Code of the Russian Federation, an application for offset or refund of overpaid personal income tax can be submitted within three years from the date of payment of the specified amount, unless otherwise provided by the legislation of the Russian Federation on taxes and fees. Please note that the procedure for the tax agent organization depends on the reason for the overpayment:

- Personal income tax was excessively withheld from the income of an individual and transferred to the budget;

- overpayment of personal income tax arose for other reasons, for example, due to an error in the payment order or transfer of tax earlier than the date of payment of personal income tax to the budget (thereby it is not recognized as a tax).

Let us consider in detail the procedure for returning personal income tax in each of the above cases.

Options

Once a case of overpayment has been recorded and the citizen has been notified about it, the question of how to dispose of the personal income tax contributed to the budget in excess should be resolved. There are two options:

- offset the overpayment against payments for other taxes, penalties and fines;

- return the overpayment from the budget.

To do this, the Federal Tax Service must first, in accordance with Letter No. GD-4-8/ [email protected] , must determine whether these amounts are recognized as tax. Payers are required to make personal income tax payments after payment of income. Accordingly, if the transfer of the fee to the budget occurred before the date of payment of income, then its amount is not recognized as tax. Then the organization remains obliged to re-pay it to the budget. But the amount paid earlier can only be returned.

Offsetting against future personal income tax payments is possible only if the organization has over-deducted the amount of tax and transferred it to the budget. This clarification on the offset is given by the letter of the Ministry of Finance dated January 22, 2018 No. 03-02-07/1/3224.

The amount of the fee, the overpayment of which was due to an error during the transfer, cannot be offset against future revenues for this type of tax.

The procedure for returning personal income tax, which is excessively withheld from the income of an individual and transferred to the budget.

A situation where a tax agent organization excessively withheld personal income tax from an individual’s income and transferred it to the budget may arise, for example, when providing an employee with a property or social deduction not from the beginning of the year. In this case, according to paragraph 1 of Art. 231 of the Tax Code of the Russian Federation, the amount of tax excessively withheld by a tax agent from the taxpayer’s income is subject to refund by the tax agent on the basis of a written application from the taxpayer. In this case, the organization is obliged to inform the taxpayer about each fact of excessive tax withholding and the amount of excessive tax withheld within 10 days from the date of discovery of such a fact.

Note:

The return of the tax amount to the taxpayer in the absence of a tax agent (for example, in the event of liquidation of an organization) or in connection with recalculation at the end of the tax period in accordance with the status of a tax resident of the Russian Federation acquired by him is carried out by the tax authority with which he was registered at the place of residence (place stay), and not an organization - a tax agent (clauses 1 and 1.1 of Article 231 of the Tax Code of the Russian Federation). The refund to the employee-taxpayer of the excessively withheld amount of tax is made by the tax agent organization at the expense of the amounts of this tax subject to transfer to the budget system of the Russian Federation on account of upcoming payments both for the specified taxpayer and for other taxpayers from whose income the tax agent withholds tax, within three months from the date the tax agent receives the relevant application from the taxpayer. Such a refund can only be made by transferring funds to the taxpayer’s bank account specified in his application (Article 231 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated July 18, 2016 No. BS-4-11 / [email protected] , Ministry of Finance of the Russian Federation dated May 16. 2011 No. 03 04 06/6-112 (clause 2)).

Here are examples of the return of excessively withheld personal income tax and transferred to the budget.

We are waiting for a statement from the employee

In order for the overpayment to be refunded, the taxpayer must contact the tax agent with a corresponding application in writing (clause 1 of Article 231 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 19, 2012 No. 03-04-05/10-1206). You have the right to determine the procedure for its presentation (on paper or in electronic form) yourself (letter of the Ministry of Finance dated 07/08/2019 No. 03-04-06/51172).

The deadline for filing an application is set in clause 7 of Art. 78 of the Tax Code of the Russian Federation and is 3 years from the date of payment of the tax (letter of the Ministry of Finance dated March 1, 2017 No. 03-04-05/11548). If this deadline is missed, the tax agent is not required to return the tax.

In the application, the employee must indicate the details of his bank account, to which the employer will have to transfer funds, since the overpayment is refunded in non-cash form (paragraph 4, paragraph 1, article 231 of the Tax Code of the Russian Federation).

Important! Tip from ConsultantPlus There is no approved form for such an application. You can accept an application from an individual, drawn up in free form, or offer to fill it out according to your sample. . Trial access to the system is provided free of charge.

See also the material “A taxpayer cannot return personal income tax by bypassing the tax agent .

Example

V.P. Smirnov is an employee of April LLC. In March 2020, he was given financial assistance in the amount of 2,000 rubles; from January to February 2021, financial assistance was not accrued or paid. The accountant mistakenly calculated and withheld personal income tax from financial assistance. The next day she discovered the error, recalculated the tax and determined the amount to be refunded. On the same day, the employee was informed about the fact of withholding and the amount of tax that the organization was obliged to return to him.

V.P. Smirnov must write a statement so that April LLC returns to him the excessively withheld amount of personal income tax.

If the amount of upcoming personal income tax payments is greater than the amount that must be returned to the employee.

Example 1 . On 02/20/2017, the employee submitted an application for the return of the excessively withheld personal income tax amount in the amount of 23,000 rubles. The amount of tax to be transferred to the budget on all income paid by the organization to individuals was: – as of March 10, 2017 – 18,000 rubles; – as of April 10, 2017 – 18,000 rubles.

How to offset personal income tax in this case? As already mentioned, you first need to transfer the amount of over-withheld personal income tax to the employee’s account specified in the refund application. Then, by the amount of the returned tax, you need to reduce the amount of current personal income tax payments, calculated from payments to all individuals who received income from the organization, until the returned amount is fully credited. The entire amount of tax excessively withheld from the employee’s income in the amount of 23,000 rubles. transferred to his card on the day of salary payment - 03/10/2017. Part of the refunded tax in the amount of RUB 18,000. the organization will count towards the reduction of personal income tax due on March 10, 2017. Thus, the organization will not transfer personal income tax to the budget on March 10, 2017.

For the remainder of the personal income tax returned to the employee in the amount of 5,000 rubles. (24,000 - 18,000) the organization will reduce the personal income tax due to be transferred on 04/10/2017. As a result, the organization will pay a tax in the amount of 13,000 rubles to the budget. (18,000 - 5,000).

Example 2. On February 20, 2017, an employee submitted an application for the return of the excessively withheld amount of personal income tax in the amount of 63,000 rubles. The amount of tax to be transferred to the budget on all income paid by the organization to individuals is equal to: – as of March 10, 2017 – 18,000 rubles; – as of April 10, 2017 – 18,000 rubles; – as of May 10, 2017 – 18,000 rubles. How to offset personal income tax in this case?

From the conditions of the example it follows that the amount to be returned to the personal income tax officer is greater than the upcoming payments for this tax, since the excessively withheld personal income tax must be returned within three months from the date the tax agent receives the corresponding application from the taxpayer. In this case, the organization must contact its tax office for a refund of excess personal income tax. To do this, within 10 working days from the date of receipt from the employee of an application for the return of excess personal income tax, the organization must be submitted to the tax office (clause 1 of Article 231 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of the Russian Federation dated September 20, 2013 No. BS-4-11/17025): 1) an application for the return of excess tax withheld; 2) an extract from the tax register for personal income tax for the period when the tax was excessively withheld; 3) certificate 2-NDFL for this person for the period when the tax was excessively withheld. If an organization applies for a refund of personal income tax that was excessively withheld in previous years, it is necessary to submit two certificates: an initial one and a corrected one; 4) documents confirming the excessive transfer of tax (for example, payment order, extract). Within a month from the date of submission of these documents, the controlling authority must return the overpayment of personal income tax to the organization’s current account (Clause 6, Article 78 of the Tax Code of the Russian Federation).

Exceptions to the rules

As with any rule, there are also exceptions to the procedure for returning “extra” personal income tax, when the employer does not have to return the money to the employee and the latter needs to apply for “his hard-earned money” to the tax office.

The first such exception is related to the type of overpayment. It can arise not only as a result of an error, but also due to a change in the status of the employee himself from non-resident to resident. Then the tax withheld during the current year at a rate of 30% must be recalculated at a rate of 13%, and the tax surplus must be offset. This must be done by the tax agent. But if the current year has ended, and the excessively withheld personal income tax has not been fully offset, the tax agent has no right to return the balance. The employee must receive such a balance through the tax office, after submitting the appropriate declaration (letter of the Ministry of Finance of Russia dated February 27, 2018 No. 03-04-06/12086; see “How to deal with personal income tax if an employee has become a tax resident of the Russian Federation during the year”).

The second exception is related to the tax agent, or more precisely, to the absence of one. In this case, the employee must also apply for a refund to the tax office. Here you need to remember that the tax is always returned by the same agent that withheld it. This means that if an employee was transferred within a group from company to company with the subsequent liquidation of one of them, then the tax “for the liquidated” company cannot be returned.

If the tax agent did not transfer the over-withheld personal income tax to the employee on time.

So, if the refund of the overly withheld tax amount is carried out by the tax agent in violation of the deadline established by Art. 231 of the Tax Code of the Russian Federation (within three months from the date the tax agent receives the corresponding application from the taxpayer), the tax agent for the amount of over-withheld tax that is not returned to the taxpayer within the prescribed period is obliged to accrue interest, which is also payable to the taxpayer, for each calendar day of violation of the deadline return.

Please note: The interest rate is assumed to be equal to the refinancing rate of the Central Bank of the Russian Federation, which was in effect on the days the repayment deadline was violated.

Results

The tax agent is obligated to return the personal income tax that was excessively withheld from the employee within 3 months from the date of receipt of the corresponding application from the employee.

Refunds can only be made by bank transfer. If there are not enough funds for payment, the tax agent has the right to request a refund from the tax service. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The procedure for returning personal income tax overpayments that arose for other reasons.

According to paragraphs 1 and 2 of Art. 78 of the Tax Code of the Russian Federation, the offset of amounts of overpaid federal taxes and fees, regional and local taxes is carried out according to the corresponding types of taxes and fees, as well as accrued penalties. The offset or refund of the amount of overpaid tax is carried out by the tax authority at the place of registration of the taxpayer. Clause 5 of Art. 78 of the Tax Code of the Russian Federation provides that the offset of the amount of overpaid personal income tax to repay arrears on other taxes, arrears of penalties and (or) fines subject to payment or collection in cases provided for by the Tax Code of the Russian Federation is carried out by the tax authorities independently. By virtue of paragraph 14 of Art. 78 of the Tax Code of the Russian Federation, the rules established by this article apply to tax agents, payers of fees and the responsible participant in a consolidated group of taxpayers. Tax department employees, as already mentioned, believe that transferring to the budget an amount exceeding the amount of personal income tax actually withheld from the income of individuals does not constitute payment of tax. They consider this amount as funds mistakenly transferred to the budget. In this regard, controllers can return the tax to the tax agent in the manner established by Art. 78 of the Tax Code of the Russian Federation, provided that such a tax agent should not have debts on other federal taxes. In this case, the tax agent has the right to contact the tax authority with an application for the return to the current account of an amount that is not personal income tax and was mistakenly transferred to the budget system of the Russian Federation. Please note that the fact of erroneous transfer of amounts using personal income tax payment details, as well as the fact of excessive withholding and transfer of tax, is confirmed on the basis of an extract from the tax accounting register for the corresponding tax period and payment documents in accordance with paragraph. 8 clause 1 art. 231 Tax Code of the Russian Federation.

Accounting certificate No. 17

| Moscow | April 30, 2014 |

On April 30, 2014, accountant O.V. Bubnova revealed the fact of excessive withholding of personal income tax from the income of manager I.V. Tsvetochkina for January-March 2014.

The taxable base for personal income tax mistakenly included material assistance in the amount of 3,000 rubles. For January-March 2014, the employee’s income amounted to 54,000 rubles, the amount of standard tax deductions was 4,200 rubles, and the withheld and transferred personal income tax was 6,864 rubles. After recalculation, the amount of personal income tax subject to withholding for the period from January 1 to March 31, 2014 is 6,474 rubles. The amount of excess tax withheld was 390 rubles. (6864 rubles - 6474 rubles).

The following entry must be made in accounting:

Debit 70 Credit 68 subaccount “Settlements with the budget for personal income tax”

— 390 rub. — the excessively withheld amount of personal income tax was reversed.

Chief accountant Vetrova A.A. Vetrova

April 30, 2014

The tax agent must inform the former employee about the fact of excessive personal income tax withholding. Chief accountant A.A. Vetrova drafted an official letter, registered it in the outgoing correspondence journal and sent it to I.V. A letter to Tsvetochka by mail with acknowledgment of delivery. See a sample letter below.

Sample 2. Notification of an employee about excessive withholding of personal income tax

Limited Liability Company "Vesna"

| Ref. 30/14-b April 30, 2014 | Tsvetochkina I.V. |

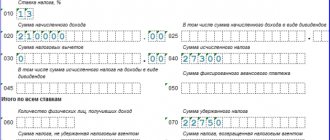

Rules for filling out form 2-NDFL

2-NDFL consists of certificates for each employee. The certificate reflects information about income, deductions, calculated, withheld and transferred tax.

Rules for filling out 2-NDFL

- The calculated tax is 13% of the difference between income and tax deductions.

- Withheld tax - how much personal income tax you withheld from the employee’s salary.

- Transferred tax - how much personal income tax you transferred to the tax office.

Most often, difficulties arise when filling out the amount of the transferred tax. Throughout the year, you pay the total amount of personal income tax for all employees, and in 2-personal income tax it must be distributed separately for each. If you have always transferred exactly as much as you owe, there will be no problems - the calculated, withheld and transferred tax will be equal. But there are situations when these amounts differ. There are different reasons. For example, when recalculating tax in the event of an employee’s dismissal, you cannot withhold tax, and if tax is not transferred to the budget on time, an underpayment will result.

What to do if you underpaid personal income tax

If you can withhold underpaid personal income tax, do so before filing 2-personal income tax. This way you will first pay off the arrears, and then distribute the transferred tax among employees. Then in 2-personal income tax the accrued, withheld and transferred tax will be equal.

If you underpaid and cannot withhold tax, for example, an employee has already quit, prepare a 2-NDFL certificate with the “2” feature. In it, the accrued tax will differ from the withheld and transferred. Also fill out the line “Amount of tax not withheld by the tax agent.”

Notification of discovery of the fact of excessive withholding of personal income tax

Dear Irina Vyacheslavovna!

We notify you that from your income for January-March 2014, an amount of personal income tax in the amount of 390 rubles was excessively withheld.

In accordance with paragraph 1 of Article 231 of the Tax Code of the Russian Federation, you have the right to submit a written application for the return of the excessively withheld amount of personal income tax.

In the application, please indicate the details of the bank account to which Vesna LLC will transfer the excessively withheld amount of personal income tax.

We notify you that in the absence of an application, Vesna LLC will not be able to refund the excessively withheld personal income tax. But at the end of 2014, you have the right to contact the tax office at your place of residence with a tax return in Form 3-NDFL and an application for the return of over-withheld personal income tax.

Chief accountant Vetrova A.A. Vetrova

April 30, 2014

I have read this notice and received one copy

Tsvetochkina I.V. Tsvetochkina

April 30, 2014

The former employee returned the second copy of the notice with a signature indicating its receipt and sent an application for a tax refund.

Sample 3. Application for the return of over-withheld personal income tax

To the accounting department, General Director of Vesna LLC, G.B. Travkin.

make a return from I.V. Tsvetochkina, registered

Travkin 04/30/2014 at the address: 141282, Moscow region,

Ivanteevka, st. Sadovaya, 15 apt. 3,

passport series 96 081 N 124789,

issued by the Federal Migration Service for the Moscow region

Ivanteevka 10/15/2012, TIN 509300004156

Lists of documents for obtaining tax deductions

Letter No. ED-4-3/ [email protected] approved the following lists of documents that the tax authorities have the right to require for receipt by the taxpayer:

- property tax deduction when purchasing an apartment (or room) on the secondary market;

- property tax deduction when purchasing an apartment under an agreement on shared participation in construction (investment), an agreement on the assignment of the right of claim;

- property tax deduction when purchasing a land plot with a residential building located on it;

- property tax deduction for the cost of paying interest on a targeted loan (credit) aimed at purchasing housing;

- social tax deduction for treatment;

- social tax deduction for education.

The same Letter from the Federal Tax Service approved a sample application for the distribution of a property tax deduction between spouses, which is provided in a set of documents for obtaining a standard, social and (or) property tax deduction.

What is personal income tax

Personal income tax is a tax on personal income. It is paid by every person who receives income. But most often he does not pay himself, but the organization in which he works does this.

By hiring an employee, you become his tax agent. Now you must count, withhold and transfer to the personal income tax office from his salary. Important: you do not pay personal income tax from your own money, but deduct it from the employee’s salary. That is, you are an intermediary between him and the state. Typically, personal income tax is 13% of income. But there is more. For example, you need to pay 35% on lottery winnings.

Submit reports in three clicks

Elba will help you work without an accountant. She will prepare reports, calculate taxes and will not require any special knowledge from you.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months