Calculation of insurance premiums from 2021 is provided to the Federal Tax Service. It displays accrued taxes on compulsory pension, health insurance and social insurance (for cases of temporary disability and in connection with maternity). The new form for calculating insurance premiums and recommendations for filling it out were approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/ [email protected]

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Who is required to take the RSV

Persons paying benefits to employees are required to report quarterly on accrued insurance premiums (Article 431 of the Tax Code of the Russian Federation). The absence of payments to employees does not exempt the organization from submitting the DAM to the inspection. The Ministry of Finance and the Federal Tax Service explain that in this case, a zero calculation for insurance premiums is filled out (letter of the Ministry of Finance No. 03-15-07/17273 dated March 24, 2017, letter of the Federal Tax Service No. GD-4-11 / [email protected] dated April 2, 2018) .

The need to submit the DAM is not canceled, even if the duties of the general director are performed by the sole owner without concluding an employment contract, and there are no other employees in the organization yet. In this case, section 3 of the report provides personalized information about the general director.

Use the free instructions for filling out insurance premium calculations from ConsultantPlus. Experts told us how to fill out forms correctly in different situations.

Comments

View all Next »

Irina 02/08/2017 at 15:22 # Reply

Hello. Tell me, if there is a registered separate division, but there is no activity there yet (that is, there are no employees, payments, etc.), then is it necessary to submit a report on it?

Natalia 02/08/2017 at 17:09 # Reply

Irina, good afternoon. Separate divisions that do not accrue payments and other remuneration in favor of individuals do not submit reports on insurance premiums for separate divisions. Federal Law No. 243-FZ of July 3, 2016 added a new paragraph to Article 23 of the Tax Code: 7) inform the tax authority at the location of the Russian organization that pays insurance premiums about the vesting of a separate division (including a branch, representative office) created on the territory of the Russian Federation, powers to accrue payments and remuneration in favor of individuals within one month from the date of vesting him with the relevant powers. The form of notification about vesting a separate subdivision with the powers specified in clause 7 - according to KND 112536. An order must first be issued to vest a separate subdivision with powers. You must submit reports after your separate division accrues payments and contributions to them.

Victoria 02/15/2017 at 09:20 pm # Reply

Zero calculation

Hello. Can you please tell me which sections need to be filled in for a zero calculation?

Natalia 02/16/2017 at 10:18 am # Reply

Victoria, good afternoon. Calculation of insurance premiums is completed and submitted only by insurance premium payers. If you did not make any transfers of insurance premiums during the reporting period, then you do not submit the calculation.

Irina 02/27/2017 at 07:29 pm # Reply

Hello again! Tell me, I didn’t find in the report in which section to put the organization’s seal? There is no index for printing on the title page, where the seal is usually located. Does this report need to be stamped anywhere? Also, if in the first quarter of 2021 we did not have payments to individuals, do we need to submit a report? If not, as you wrote above, then provide a link where this is stated. Otherwise, if you don’t submit it, the tax office will take it and block your account for not submitting reports. If necessary, how to fill it out? Register the data of the general director (he is the only one who is listed in the organization) and put zeros in the corresponding sections? Thank you in advance!

Natalia 02/28/2017 at 09:32 # Reply

Irina, good afternoon. In Appendix 2 of the procedure for filling out the calculation of insurance premiums, approved by order of the Federal Tax Service of Russia dated 10.10.2016 N ММВ-7-11 / [email protected] in paragraph 1.1 it is said: “Calculation of insurance premiums is filled out by payers of insurance premiums or their representatives.” Therefore, if you are not a payer of insurance premiums, then you do not need to prepare and submit a calculation. The legislation does not stipulate that it is necessary to submit a zero calculation for unified insurance premiums to the Federal Tax Service. But if you are temporarily not a payer of insurance premiums - for example, in the reporting quarter you had no accruals, but you are registered as an employer, then some Federal Tax Service Inspectors require you to submit a zero report. Therefore, this question must be clarified specifically with your tax office. The Federal Tax Service cannot yet block a current account for failure to submit a single calculation for insurance premiums (letter of the Ministry of Finance dated January 12, 2017 No. 03-02-07/1/556). There is no space to print on the title page of the report form. This is due to the fact that now the seal is not a mandatory detail of the report, so if you use a seal and there is information about it in the Federal Tax Service, then put it in the same place as before on the title page. If you don’t have a seal, then now you don’t need to put the abbreviation b/p.

Lydia 03/02/2017 at 06:58 # Reply

how to add a person to section 3 if there are 80 employees?

how to add a person to section 3 if there are 80 employees?

Natalia 03/14/2017 at 05:43 pm # Reply

Lydia, good evening. If you have 80 hired employees, then you must generate and submit calculations only electronically, in a special program.

Vera 03/14/2017 at 01:51 pm # Reply

Hello, I am an individual entrepreneur without employees. Please tell me which sections to fill out in code 1151111?

Natalia 03/14/2017 at 05:38 pm # Reply

Vera, good afternoon. Form 1151111 must only be completed by employers. If you do not have employees, then you do not need to submit this report.

Anastasia 03/16/2017 at 01:07 pm # Reply

Good afternoon. The organization has had employees since February 1, 17. Salaries were not paid in March. And it’s unlikely to happen in April. Since there is no activity in the organization, it is just beginning. What reports should I submit to social security? Zero, as I understand it?

Natalia 03/21/2017 at 12:12 # Reply

Anastasia, good afternoon. You need to submit reports not only to the Social Insurance Fund, but also to the Pension Fund of the Russian Federation and the Federal Tax Service if you are an employer, even if your employees were not accrued or paid wages. Every month you must submit the SZV-M to the Pension Fund by the 15th day of the month following the reporting month. You had to submit the first report by March 15, 2021. Next, you must submit quarterly - Unified calculation of insurance contributions to the Federal Tax Service; quarterly to the FSS report 4-FSS; quarterly report to the Federal Tax Service 6NDFL. At the end of the year, 2NDFL is submitted to the Federal Tax Service. Accordingly, if the salary was not accrued, the reports will be zero.

Christina 03/21/2017 at 10:55 am # Reply

Do I need to submit form 1151111 to the Garden Non-Profit Partnership

Hello. The Garden Non-Profit Partnership has no employees, there is a chairman who works free of charge. what pages need to be submitted? Is there a dash on pages 1,3,4?

Natalia 03/21/2017 at 12:26 pm # Reply

Christina, good afternoon. If during the reporting month your organization did not have a single employment or civil contract with an employee in respect of whom insurance premiums may be charged, then you do not need to submit a report. If such an agreement has been concluded, but there have been no accruals or payments, then a single calculation of insurance premiums must be submitted. In this case, it is necessary to fill out the title page; section one, indicate the KBK; the remaining columns are dashes; Appendix one, indicate the payer's tariff code, the remaining columns are dashes; Appendix two - indicate the payment attribute, put dashes in the remaining columns; Appendix 3 - put dashes. There is no need to submit other applications.

Valentina 03/22/2017 at 08:27 pm # Reply

Hello. I am an accountant for the Council of War and Labor Veterans. We have no agreement with anyone. Nobody receives a salary. We don't pay any fees to anyone. We are a public organization and provide all possible assistance to pensioners/war and labor veterans/. We submitted zero reports to the Pension Fund and Form 4-FSS, but now do we need to submit reports to the tax office?

Natalia 03/23/2017 at 11:01 am # Reply

Valentina, good afternoon. Public organizations submit reports on insurance premiums according to the general rules that apply to organizations regardless of their form of ownership. Therefore, if you are not registered as an employer, if you do not have employment or civil contracts, then you do not have to submit reports on insurance premiums. But then it is not clear on what grounds you submitted reports to the Pension Fund and the Social Insurance Fund. Apparently, you still need to conclude employment contracts, and in this case, even without accruing income and insurance contributions, you will need to submit reports on contributions to the Pension Fund of the Russian Federation, the Federal Tax Service and the Social Insurance Fund. Read part three of Article 11 of the Labor Code of the Russian Federation, which states that all employers (individuals and legal entities, regardless of their organizational and legal forms and forms of ownership) in labor relations and other directly related relations with employees are obliged to be guided by the provisions of the labor legislation and other acts containing labor law norms.

Inna 04/04/2017 at 16:17 # Reply

Good afternoon. Is it necessary to submit calculations of insurance premiums for the 1st quarter of 2021 to the tax office to the head of a peasant farm if he has neither employees nor members of the peasant farm. That is, he is alone.

Natalia 04/05/2017 at 14:39 # Reply

Inna, good afternoon. I couldn’t find an answer to your question with reference to legislation. The general procedure is as follows: the head of a peasant farm does not belong to a legal entity, but to an individual entrepreneur. For individual entrepreneurs who are not registered as an employer and who do not have employees in the reporting period, the RSV-1 report does not need to be submitted. If an individual entrepreneur is registered as an employer, but there are no employees in the reporting period, then a zero report is submitted. I think you need to clarify this issue with the tax office at your place of registration to avoid a fine.

Guzel 04/04/2017 at 18:12 # Reply

zero settlements LLC

Tell me whether I need to submit a report on form 1151111. If not, then on what basis??

Natalia 04/05/2017 at 12:42 # Reply

Guzel, good afternoon. The Ministry of Finance of the Russian Federation, Department of Tax and Customs Tariff Policy, issued a letter dated March 24, 2017, n 03-15-07/17273, regarding zero reports on insurance premiums. I quote: “Clause 7 of Article 431 of the Code provides for the obligation payers of insurance premiums making payments and other remuneration to individuals must submit, in the prescribed manner no later than the 30th day of the month following the billing (reporting) period, to the tax authority at the place of registration the calculation of insurance premiums (hereinafter referred to as the Calculation). The Code does not provide for exemption from the obligation of the payer of insurance premiums to submit Calculations in the event of the organization’s failure to carry out financial and economic activities. By submitting Calculations with zero indicators, the payer declares to the tax authority that in a specific reporting period there are no payments and remunerations in favor of individuals who are subject to insurance premiums, and, accordingly, the absence of amounts of insurance premiums payable for the same reporting period. In addition, the submitted Calculations with zero indicators allow the tax authorities to separate payers who do not make payments and other remuneration to individuals in a specific reporting period and do not carry out financial and economic activities from payers who violate the deadline established by the Code for submitting Calculations, and, therefore, not hold them accountable in the form of a fine provided for in paragraph 1 of Article 119 of the Code. Otherwise, failure by the payer of insurance premiums to submit settlements within the period established by the legislation of the Russian Federation on taxes and fees, including those with zero indicators, entails the collection of a fine provided for in paragraph 1 of Article 119 of the Code, the minimum amount of which is 1000 rubles. Thus, if the payer of insurance premiums does not have payments in favor of individuals during a particular settlement (reporting) period, the payer is obliged to submit a calculation with zero indicators to the tax authority within the prescribed period.”

View all Next »

How to fill out a report for organizations affected by COVID-19

For payers operating in the industries most affected by the spread of the new coronavirus infection, a zero rate of insurance premiums has been established for April - June 2021 (Article 3 of Federal Law No. 172-FZ of 06/08/2020).

Instructions on how to correctly fill out the calculation of insurance premiums for companies that are exempt from social contributions (letter of the Federal Tax Service No. BS-4-11/9528 dated 06/09/2020):

- Fill out the RSV title page as usual.

- In section 1, enter zeros in all totals.

- In lines 001 “Tariff code” of appendices 1 and 2 to section 1, enter “21”.

- When indicating the amount of payments, the tax base and the amount of accrued insurance premiums in Appendices 1 and 2, follow the rule: in the first column reflect the amounts of the first quarter, in the second, third and fourth columns enter zeros.

- When filling out line 130 of section 3 “Category code of the insured person”, indicate “KV”. In lines 140, 150, 160 and 170, enter zeros.

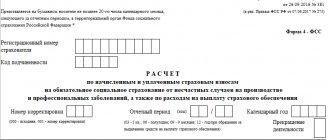

KND form 1151111

Calculation of insurance premiums in the form of KND 1151111 was approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/ [email protected] This type of reporting replaced the previously used document forms - RSV-1 and 4-FSS (this report is used only in part of the reflection of contributions “for injuries”).

KND 1151111 contains only 24 sheets, divided into three sections:

- Section 1 for recording summary information about the obligations of the insurance premium payer. This section is the most voluminous, since it contains complete information about all accrued amounts of insurance contributions by type - pension, medical and social insurance (without contributions “for injuries”, which are still reflected in 4-FSS);

- Section 2 to reflect information on the heads of peasant farms;

- Section 3 to include information on individual accounting for insured persons. The section is filled out individually for each individual.

Do entrepreneurs without employees rent out the DAM?

Not only organizations, but also individual entrepreneurs are recognized as payers of social contributions. An entrepreneur has the right to hire employees, but sometimes conducts business without hiring employees. You will not have to submit calculations for insurance premiums if the individual entrepreneur does not have employees. In this case, tax officials have the right to demand an explanation. Explain to them in writing that you are working without hiring employees.

If an individual entrepreneur has employees, but they are not working (on leave without pay, on maternity leave), then the entrepreneur submits a zero RSV.

Why is a single fee needed?

In accordance with the Decree of the President of the Russian Federation, the Federal Tax Service developed a new bill. Based on the new regulatory act, insurance premiums (pension, social and compulsory health insurance) were combined into a single social insurance premium (ESS), subject to mandatory payment by all individual entrepreneurs and organizations from 2021.

The main task of the ESS is to stimulate the growth of contributions to higher incomes, which is of greatest relevance given the instability of the modern economy. At the same time, the size of citizens’ wages does not affect the ESSR rate. That is, the contribution rate remains the same, but the fiscal burden does not increase. Before the adoption of this law, distribution was carried out according to the following algorithm:

- Pension Fund: 22% if the annual salary does not exceed 796 thousand rubles, 10% if the annual salary is more than the specified amount;

- FSS - 2.9% if the annual salary is less than 718 thousand rubles, 0% if it is above 718 thousand rubles;

- FMS - 5.1%, regardless of the level of annual salary.

Another reason why this type of collection was introduced is to simplify and eliminate the repetition of unnecessary information.

Today, it is still difficult to say what organizations and individual entrepreneurs will gain from such innovations. But one way or another, from the point of view of the Federal Tax Service, accountants will have to strain less at the end of the reporting period, because the number of reports has decreased.

Nevertheless, the task of the Federal Tax Service is not to make life easier for accountants, but to achieve maximum collection of contributions. This function was performed ineffectively by the funds, but the tax function showed good results. And now all fees are received by the Federal Tax Service, and it is already engaged in their subsequent distribution.

Again, we are talking only about these three types of contributions. Other fees remain the responsibility of the Funds. For example, for injuries - a contribution paid by FSS firms.

What actually happened? Enterprises continue to collect and submit reports to extra-budgetary funds. Only now another one has been added to the pile of documents - KND 1151111. Violations in its execution, as well as untimely submission of the Federal Tax Service, are fraught with penalties for the company.

In what form is the RSV submitted?

The form used to submit a zero calculation for insurance premiums to the tax office was approved by Federal Tax Service Order No. ММВ-7-11/ [email protected] dated 09.18.2019 as amended by Order No. ED-7-11/ [email protected] dated 10.15.2020. It also, in Appendix 2, describes in detail the rules and procedure for filling out the reporting form.

IMPORTANT!

Submit reports for the 4th quarter of 2021 using the updated form. The new form was approved in the order of the Federal Tax Service No. ED-7-11 / [email protected] dated 10/15/2020. The main change in the structure of the report is the inclusion of information on the average number of employees on the title page.

The reporting form is submitted to the tax office at the location of the organization. In addition to this report, payers of insurance premiums must submit two more personalized accounting forms to the Pension Fund of the Russian Federation:

- monthly SZV-M;

- annually SZV-STAZH.

This might also be useful:

- How to calculate the simplified tax system?

- How to register as a UTII payer

- Restrictions on the use of UTII

- New form SZV-M “Information about insured persons”

- New form 6-NDFL 2021

- OKVED codes 2021 with breakdown by type of activity

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

How to pass a zero RSV

Starting from 2021, the DAM is provided to the tax office at the location of the organization. Previously, the report was submitted to the Pension Fund.

Here's how to send a zero calculation for insurance premiums (Article 431 of the Tax Code of the Russian Federation):

- by mail;

- in electronic form via TKS;

- submit it during a personal visit to the tax office.

The DAM is submitted on paper only if the number of employees of the company does not exceed 10 people (clause 10 of Article 431 of the Tax Code of the Russian Federation).

Example

LLC “Company” does not operate. The company has 26 employees. All of them have been on leave without pay since 01/01/2020.The LLC sends the RSV in electronic form through the TKS operator, signing with an electronic digital signature of an authorized person. The report sending service checks how correctly the report is completed. If after filling out the zero calculation for insurance premiums is not uploaded, you need to check the correctness of filling.

When to take it

The DAM is submitted to the tax office no later than the 30th day of the month following the reporting quarter. If the last day of delivery falls on a non-working weekend or holiday, then the deadline is postponed to the next first working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). This is when zero reporting is submitted for calculation of insurance premiums (clause 7 of Article 431 of the Tax Code of the Russian Federation):

| Period | Last day of delivery |

| 4th quarter 2020 | 01.02.2021 |

| 1st quarter 2021 | 30.04.2021 |

| Half year 2021 | 30.07.2021 |

| 9 months 2021 | 01.11.2021 |

| 4th quarter 2021 | 31.01.2022 |

What are the sanctions for failure to submit the DAM?

In Art. 431 indicates how to submit a zero calculation for insurance premiums - in paper and electronic form. If an organization violates the deadline, procedure or form of submission, tax authorities will issue a fine.

Despite the fact that a company that does not carry out activities reflects zero indicators in the report, tax authorities have the right to apply the following sanctions to it:

- The minimum fine for failure to submit a report is 1000 rubles. (Article 119 of the Tax Code of the Russian Federation);

- administrative fine for an official of an organization - from 300 to 500 rubles. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation);

- suspension of transactions on bank accounts (clause 6 of Article 6.1, clause 3.2 of Article 76 of the Tax Code of the Russian Federation);

- fine for failure to comply with the electronic form for submitting a report - 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation).

Penalties for failure to report

The form is considered not provided if:

- the amounts broken down for each hired employee do not match the total amount of contributions;

- there are errors in personal data.

Then the tax authorities send notifications to policyholders on the day the report is received or the next day. If the form is provided in paper form, the tax inspection period is extended to 10 days.

Within 5 days after receiving notification of refusal to accept the report, the policyholder is obliged to correct all errors and submit the FSN form for re-verification.

If the form is not submitted within the deadlines established by current legislation, the following penalties are provided:

- if contributions were paid on time - 1,000 rubles;

- contributions were not paid - 5% of the amount of mandatory payments that were accrued taking into account the calculations made, for each full or partial month, starting from the date that is the beginning of the provision of the FSN form. In this case, the fine cannot exceed 30% of the calculated amount and be at least 1,000 rubles.

How to fill out the RSV correctly

Order No. ММВ-7-11/ [email protected] indicates which zero RSV sheets should be submitted to taxpayers:

- title page;

- section 1;

- subsections 1.1 and 1.2 of Appendix 1 to Section 1;

- appendix 2 to section 1;

- section 3.

The report must indicate the name, INN and KPP of the organization, the period for which the DAM is submitted, and the tax authority code. Enter zeros in all fields with amount indicators. Section 3 indicates the data of the organization’s employees (at least the general director). Due to the lack of accruals, subsection 3.2 does not need to be filled out.

How to fill out a zero calculation for insurance premiums

Ppt.ru LLC did not operate in 2021. The organization has only one employee with an employment contract - the general director, who has been on leave without pay for the entire year. No accruals or payments were made to the director during the year. Here is an example of filling out a zero calculation for insurance premiums for the 4th quarter of 2020:

(form)

for the 4th quarter of 2021 (completed example)