The movement of material assets from one structural unit of an organization to another requires mandatory documentation. Inventory materials can be moved to production, to another warehouse or to the sales floor, while the financially responsible persons and the storage location of the inventory materials change. To complete this operation, an invoice according to the TORG-13 form is used, a sample of which can be filled out below. The full name of the document is “Invoice for internal movement, transfer of goods, containers.”

What data does it include?

To account for internal movement, an organization has the right to develop its own document form or use the unified TORG-13 form . If an organization develops its own document form, it must be approved by order of the enterprise and contain the following data:

- Name of the organization;

- Title of the document;

- information about the sender and recipient of goods and materials;

- information about the transferred goods (its name and quantity in physical and value terms).

How to fill out the TORG-13 form

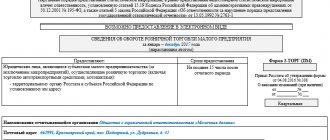

The header part of the TORG-13 form contains information about the legal entity within which the movement is carried out, as well as the number and date of the invoice.

The top table of the form is intended to reflect information about the sending unit and the receiving unit of the MPZ.

The lower table contains data on the provided MPP, the main of which are:

- unit of measurement;

- quantity;

- accounting (planned) price, usually established by the company's accounting policy;

- total cost of transfer at discount prices.

Read about the specifics of using accounting value in the material “How are finished products reflected in the balance sheet?” .

Below the bottom table there are spaces for MOL signatures.

The TORG-13 form can be downloaded from our website.

Also on the website there is a sample of filling out the TORG-13 form, available for download.

Features of compilation

The document for the movement of inventory items within the organization is drawn up by the materially responsible person from whose warehouse the inventory items are released. Vacation without documentation is not permitted.

TORG-13 is drawn up in two copies , one remaining with the person who released the goods, and the second with the person who accepted them. The executed documents serve as the basis for writing off inventory items from the materially responsible person releasing them, and the department that received the inventory items accepts them for accounting on the basis of the invoice.

Numbering is carried out according to the rules established in each specific enterprise. As a rule, each type of document has its own continuous numbering; for ease of recording, a letter prefix can be added to the document number.

When filling out documents, special attention must be paid to the columns where the names of the sender and recipient should be indicated. Errors in the names of issuing and receiving structural units lead to distortion of data in accounting and to discrepancies between the actual availability of inventory and materials and data in accounting.

Errors in the name of inventory items are not allowed ; for better identification, it is recommended to keep records not only by name, but also using a code. If goods of the same name differ in grade, it is necessary to indicate the grade of the goods and materials being sold.

Some types of inventory items can be accounted for in different units of measurement (for example, in kilograms and linear meters). When releasing such goods, it is necessary to indicate the unit of measurement in which they were accepted for accounting. The responsible person cannot transfer goods from one unit of measurement to another, bringing all sold goods and materials into a single form.

Columns indicating the quantity of goods sold are required . When transferring inventory items in packages, you must indicate the number of piece products in one package and the number of such packages. The weight of the goods is indicated not only net, but also gross, if the financially responsible person has such information.

Data on the price and cost of inventory items at accounting prices are also indicated. The columns indicating quantity and amount are summed up and a total is summed up. The quantity of commercial products in various units of measurement is summed up for the purpose of control checking the quantity of products supplied.

Without specifying data on the exact name and quantity of goods and containers, the invoice for internal movement is invalid.

TORG-13 is signed by financially responsible persons who released and accepted the goods and materials. Be sure to indicate the names of their positions and the transcript of the signature.

Without the signatures of financially responsible persons, the document is invalid . It is not allowed to endorse the invoice by a person who does not have the right to do so. The right to sign is assigned by order of the organization.

The unified form does not provide for the affixing of a seal, however, if materially responsible persons have seals in structural units, then in order to provide greater control and prevent forgery of signatures, it is recommended to affix them additionally. The absence of a seal is not a violation unless it is established by a local act of the organization.

Features of the form, general points

If you are faced with the task of filling out the TORG-13 form, read the recommendations below and look at an example document. Based on our tips and sample, you can easily enter the necessary data into this form.

Before moving on to a detailed examination of the form, we will provide here general information about this document.

The use of single unified forms of primary forms is currently abolished by law. This means that employees of organizations and enterprises can draw up such invoices in free form or, if the company has its own document template developed and approved in local regulations, by its type.

Many, in the old fashioned way, prefer to use the previously commonly used and mandatory form TORG-13. This is explained by the fact that it contains all the necessary lines, is understandable and convenient to fill out. In addition, if necessary, you can easily customize this form to suit yourself by including or, conversely, removing some columns in the main table.

The chosen method for issuing such invoices must be recorded in the company’s accounting policies.

You can fill out the document manually or on the computer - it doesn’t matter. However, in the second case, it must be printed, since it must necessarily contain the “live” signatures of the person who transferred the goods and accepted them.

The TORG-13 form is drawn up in two identical copies (if in natural form, then this is best done through a copy sheet), one of which remains with the transmitting employee, the second with the receiving one.

Subsequently, on the basis of these documents, inventory items are written off in one department, and their receipt is recorded in another.

There is no need to stamp the TORG-13 form with a seal, since it relates to the internal documentation of the enterprise. But the very fact of its existence should be reflected in a special journal for recording this kind of documentation (most often it is located in the accounting department).

When preparing a document, you must ensure that there are no errors in it, much less deliberately incorrect or unverified information. We must not forget that on the basis of this form, accounting operations are subsequently carried out, which are strictly supervised by government regulatory agencies.

Is it necessary to record the document in the accounting journal?

Documents reflecting the movement of inventory items within the enterprise are recorded in the accounting journal . A record of an invoice for internal movement is reflected for both the issuing and receiving parties.

The form of the journal can be arbitrary, but it must contain data that allows you to identify the documents specified in it:

- document number and date of issue;

- name of the unit - the second party to the business transaction for the movement of inventory items;

- the total quantity and amount of inventory items indicated in the invoice.

The materially responsible person reflects data on the movement of inventory items in warehouse accounting cards, and the invoices themselves are transferred to the accounting department of the enterprise according to the register .

Where is the TORG-13 consignment note used?

The invoice in question is used by organizations when it is required to transfer goods or containers from the financially responsible person of one structural unit to the financially responsible person of another structural unit of the same organization.

The main purpose of the TORG-13 form is to confirm movements within one enterprise.

This invoice is not used when distributing goods and containers to other enterprises; to formalize these operations, another standard form is used - consignment note TORG-12. Read also the article: → "".

Based on the TORG-13 form, you can move any material goods - goods, semi-finished products, containers, raw materials. This form does not apply to the movement of fixed assets, for which there is its own OS-2 form.

Who fills out the document TORG-13

The invoice is filled out by the materially responsible representative of the department from which the goods or containers are being disposed of. Form TORG-13 is generated in two copies. Next, both copies are signed by the person who issued them and transferred to the financially responsible representative of the department where the goods arrive.

This person puts his signature on acceptance on each copy of the invoice, after which one form is returned to the deliverer, the second is retained by the recipient. Later, both copies are transferred to the accounting department for postings on write-off and capitalization and further filing for storage.

Rules and possible errors

The completed invoice is the primary accounting document and is therefore stored for at least 5 years. After this, the organization has the right to dispose of it according to the rules established by Russian legislation.

When filling out the sample, special attention should be paid to the correct spelling of the names of the departments that handed over and accepted inventory items.

Attention. Errors in product names are also unacceptable, so when filling out the table you should indicate product codes.

Discrepancies in the preparation can lead to inconsistencies during the inventory and to the emergence of questions for responsible persons during the tax audit.

Recommendations for filling out TORG-13

The standard invoice form for the internal movement of goods was put into effect by Resolution of the State Statistics Committee No. 132 of December 25, 1998. Since the beginning of 2013 organizations are not obliged to strictly use standard primary forms; companies have the right to choose a convenient type of accounting document themselves.

If the enterprise is not satisfied with the unified form, then its own form can be developed. For development, you can use a standard form, supplementing it with necessary information.

For example, in the unified TORG-13 form there are no fields for indicating the addresses of structural units, and this can be important in the process of transporting goods and containers between them. In this case, the invoice form for internal movement can be supplemented with such a field.

The TORG-13 consignment note should indicate the name of the legal entity within which the cargo is being moved. The code of the main activity of this enterprise is also entered. The invoice is assigned a personal unique number; numbers should not be repeated within the same reporting period. The day the document was issued is indicated next to the number.

The following is information about the parties involved and the corresponding accounts:

- The name of the structural unit sending the goods and the direction of its activity;

- The name of the structural unit receiving the materials and the type of its activity;

- The number of the accounting account where the goods are sent (if analytical accounting is maintained for this account, then the corresponding code is indicated).

The table contains data on those items of inventories that are subject to internal movement between financially responsible persons:

| Column number | Procedure for filling out the column |

| 1 | Name of the valuables being moved (goods, semi-finished products, raw materials, containers). The main characteristics of the MPZ are also given. |

What is internal movement?

The internal movement of goods and materials within one organization is understood as a transfer between divisions and warehouses of an enterprise, after which responsibility for these material assets passes to the recipient unit. In the future, it prepares financial statements, which must be submitted to the accounting department every month. Valuable property can be moved in an enterprise in several directions:

- For use for production purposes.

- For warehousing.

- For sale in the sales area.

In all cases, to document the movement of each batch of raw materials, semi-finished products or finished products, the TORG-13 consignment note is filled out. This document is intended to control and record internal movement in all directions.