Deductions

For the convenience of filling out personal income tax returns 3-NDFL and 4-NDFL Federal Tax Service

Last modified: January 2021 When faced with financial difficulties, an enterprise is forced to make unpopular decisions and

Individual entrepreneurs and organizations using the simplified tax system do not pay VAT. But there are exceptions to this rule,

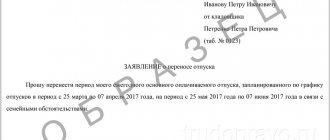

In accordance with Article 114 of the Labor Code (LC RF), the employer annually provides the employee with paid

depreciation must be calculated from the 1st day of the month following the month the property was put on the market

Validity of a taxi waybill Someone may say that one day is too little, that

The Russian economy is undergoing significant changes, which have a significant impact on the activities of all enterprises. Expensive

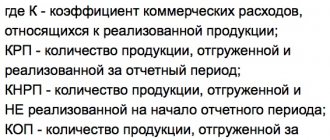

Any business involves certain types of costs. Among them, a significant place is occupied by the so-called commercial

One of the types of rest guaranteed to the working population by Article 107 of the Labor Code is vacation. According to

Accounting Alexey Borisov Leading expert on labor relations Current as of March 25, 2020