Deductions

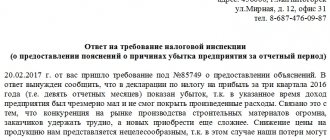

Commercial enterprises quite often face the need to provide explanations to the tax office regarding any

Every successful company hires employees sooner or later. If you design them improperly

Sales costs are one of the main indicators that an enterprise must take into account to form

The Labor Code provides several grounds on which the employing organization can make deductions from wages

Regular interaction of business entities with partners, employees, budgetary structures and other persons is inevitable

Documents for deductions for your own education Documents for deductions for your child’s education Documents for

The balance sheet (form No. 1) is the main financial annual report, mandatory for everyone.

Combining positions in one organization (internal combination) is a very common phenomenon today. Applicable

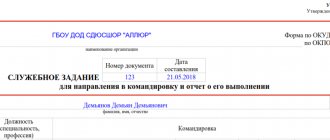

It is not at all necessary to fill out a work assignment for a business trip in 2021. You can send an employee

Payers have the right to return overpaid amounts of taxes and fees or send them to