Quite often, when an accountant enters into an agreement for the purchase of goods, expressed in currency or in conventional units (cu), problems arise with the formation of their value and reflection in accounting.

This article will help you not to get lost in dates, rates, and the cost of registering goods when converted to ruble valuation. Let's consider:

- legislative aspects of the acquisition of goods under a contract in monetary units;

- an action diagram in 1C to reflect the purchase of goods under a contract in cu;

- practical examples that provide a logical chain and order of execution of 1C documents.

After studying the article, you will never be confused about how to capitalize goods under these “notorious” contracts expressed in monetary units.

When can you issue an invoice in foreign currency?

According to paragraph 7 of Art.

169 of the Tax Code of the Russian Federation, an invoice in foreign currency can be drawn up if the terms of the transaction in the contract are expressed in foreign currency. At the same time, in parallel with this norm of the Tax Code, there is another one in the legislation: sub-clause. "m" clause 1 section. Resolution II of the Government of the Russian Federation “On filling out documents for VAT calculations” dated December 26, 2011 No. 1137 states that if the obligation under the contract is fixed in currency equivalent, but the payment currency is rubles, the invoice should be issued in rubles. Thus, ambiguity arises when applying these rules to transactions between residents of the Russian Federation:

- on the one hand, it seems that it is possible to issue an invoice in foreign currency if the obligation is expressed in foreign currency (conventional units);

- on the other hand, this violates the procedure for issuing invoices according to the rules established for residents of the Russian Federation, which are necessary for their acceptance in tax accounting for VAT.

This point is actively used by tax authorities who check the legality of deducting VAT. The tax accepted for deduction on an invoice issued in foreign currency is not confirmed and an understatement of VAT is registered with all the ensuing consequences. From time to time, the Federal Tax Service reinforces its position with its own explanatory letters. For example, one of the latest - letter No. ED-4-3/12813 dated July 21, 2015 - once again refers to the procedure for issuing VAT documents, approved by Resolution No. 1137 (in rubles), as the only correct one.

NOTE! Buyers have problems with deductions for foreign currency invoices. Tax authorities usually do not try to apply any sanctions to the seller who issued documents in foreign currency. Exceptions occur only in cases where the seller, reflecting data in tax registers, incorrectly recalculated the amount of revenue in rubles on such invoices and thereby underestimated the VAT base.

Who should issue an invoice in foreign currency?

If you look at the lawsuits in which VAT on foreign currency invoices was ultimately accepted for deduction, you can note that the peak occurred in 2011–2013. Then, by 2016–2017, the consideration of such cases practically disappeared.

Most likely, this is due to the fact that residents simply stopped filing VAT documents in foreign currency under agreements under which they are calculated in rubles.

Thus, the answer to the question “In general, is it possible for a resident of the Russian Federation to issue an invoice in foreign currency to a counterparty resident of the Russian Federation?” like this: theoretically possible, but not necessary. Unless, of course, the goal is to make it difficult for the resident partner to deduct VAT on such documents.

To whom exactly can VAT documents be issued in foreign currency?

1. To a counterparty (including a resident), with whom settlements are also carried out in foreign currency. This option is limited by the currency legislation of the Russian Federation. The list of transactions between residents of the Russian Federation that qualify for this option is listed in clause 1 of Art. 9 of the Law “On Currency Regulation” dated December 10, 2003 No. 173-FZ.

2. To yourself. For export transactions (for which the rate is 0%), the resident exporter is not exempt from the obligation to keep VAT records. The exporter must issue an invoice (with zero VAT) and register it in the sales ledger.

Accountant's Directory

TKS.RU Forums > Sections > Customs > Account in foreign currency

View full version : Account in foreign currency

Gentlemen, experts, tell me. Can a Russian carrier company issue invoices in foreign currency? currency to your customers? But all our payments to them are in rubles, they work with us on an advance payment basis, and then after we have “cleared customs” for the cargo, they issue us an invoice in rubles. I probably didn’t explain it very clearly, but as the conversation progresses I will comment on our difficult situation.

passing by

26.04.2009, 14:45

Gentlemen, experts, tell me. Can a Russian carrier company issue invoices in foreign currency? currency to your customers? But all our payments to them are in rubles, they work with us on an advance payment basis, and then after we have “cleared customs” for the cargo, they issue us an invoice in rubles. I probably didn’t explain it very clearly, but as the conversation progresses I will comment on our difficult situation.

The situation is familiar. Almost everyone works this way. You should have a clause in your agreement with them that invoices are issued in foreign currency (dollars or euros), payment at the rate in rubles on the day of payment (which is more common) or on the day of invoice (which is less common). That's all. And if the invoice is in rubles, then I don’t understand, why are you worrying?

Gantenbein

26.04.2009, 14:47

…..all our payments to them are in rubles, they work with us on an advance payment basis, and then after we have “cleared customs” for the cargo, they issue us an invoice in rubles…

If they work on an advance payment basis, then what invoice is then issued in rubles?

The situation is familiar. Almost everyone works this way.

How to issue an invoice in foreign currency

You should have a clause in your agreement with them that invoices are issued in foreign currency (dollars or euros), payment at the rate in rubles on the day of payment (which is more common) or on the day of invoice (which is less common). That's all. And if the invoice is in rubles, then I don’t understand, why are you worrying?

So on the day of filing the customs declaration, we had neither an invoice nor an invoice, but there was a certificate for customs purposes stating that the cost of transportation was 1000 EUROS, the customs released us, they gave us a normal document, and we still got it from the carrier we can't for now.

If they work on an advance payment basis, then what invoice is then issued in rubles? So we have an advance payment in rubles.

Gantenbein

26.04.2009, 15:23

Gentlemen, experts, tell me. Can a Russian carrier company issue invoices in foreign currency? currency to your customers? But all our payments to them are in rubles, they work with us on an advance payment basis, and then after we have “cleared customs” for the cargo, they issue us an invoice in rubles. I probably didn’t explain it very clearly, but as the conversation progresses I will comment on our difficult situation.

I am forced to quote your post again and in full. You write that you are working with a carrier “on an advance payment basis.”

How does your company pay this “prepayment”, on the basis of what document does your company transfer funds to the carrier? If there is an “advance payment”, then why is there no financial document confirming the “advance payment” made? And if an “advance payment” was made, then for what services does your company receive an invoice after the cargo is cleared through customs? We need to deal with this first.

I am forced to quote your post again and in full. You write that you are working with a carrier “on an advance payment basis.”

How does your company pay this “prepayment”, on the basis of what document does your company transfer funds to the carrier? If there is an “advance payment”, then why is there no financial document confirming the “advance payment” made? And if an “advance payment” was made, then for what services does your company receive an invoice after the cargo is cleared through customs? We need to figure this out first. I’ll try to explain. This company X provides us with forwarding services by hiring third parties Y (foreign companies), and for all our transportation, we “drive” money to them (company X) at the beginning of the month, they draw us a certificate of the cost of transportation in foreign currency, and invoices are issued after they have apparently been invoiced by Y companies they hired.

passing by

26.04.2009, 16:21

So on the day of filing the customs declaration, we had neither an invoice nor an invoice, but there was a certificate for customs purposes stating that the cost of transportation was 1000 EUROS, the customs released us, they gave us a normal document, and we still got it from the carrier we can't for now.

Keep shaking. What taxation system do you use - the general one, with VAT? Hardly on UTII.

They are required to issue you an invoice for prepayment (you can use a general invoice), and close each shipment with an invoice and a certificate of completion of work.

If the certificate contains only the cost of delivery to the border, try another one: the total cost and breakdown from the place of loading to the border + from the border to the place of unloading. Let the certificate in foreign currency be normal.

27.04.2009, 04:57

If I'm not mistaken, the s/f must be issued no later than 5 days after the sale of the goods/services.

So on the day of filing the customs declaration, we had neither an invoice nor an invoice, but there was a certificate for customs purposes stating that the cost of transportation was 1000 EUROS, the customs released us, they gave us a normal document, and we still got it from the carrier we can't for now.

And how is it stated in your contract with the carrier when he is obliged to provide an invoice and sf. For example, with us, payment does not depend on “customs clearance”, within 10 days after receipt at the temporary storage warehouse, and if I did not have time to “clear customs” before this period, then customs will charge me with a payment order.

And how is it stated in your contract with the carrier when he is obliged to provide an invoice and sf. For example, with us, payment does not depend on “customs clearance”, within 10 days after receipt at the temporary storage warehouse, and if I did not have time to “clear customs” before this period, then customs will charge me with a payment order.

“And that’s right, comrades!” ©

Source: https://1atc.ru/schet-faktura-v-valjute/

How to issue a foreign currency invoice in 2020-2021

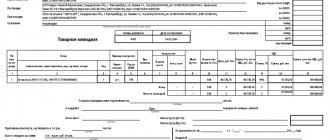

Let's consider the nuances of drawing up a foreign currency invoice from the seller:

- line 7 - enter the name and currency code of the account (according to OKV - the All-Russian Classifier of Currencies);

- then the “standard” lines of the document are filled in in the specified currency.

As you can see, it is not so difficult for the seller to issue an invoice. Questions usually arise at the stage of deciding whether the document will be in foreign currency or in rubles.

IMPORTANT! You can enter additional information into the currency invoice. This is allowed to be done between line 7 and the rest of the tabular part to be filled in, as well as in the tabular part itself, provided that the form of the invoice is preserved and the sequence of filling out its columns is not disrupted. This rule is enshrined in Federal Tax Service letter No. SD-4-3/ [email protected] and is especially relevant for those who work with counterparties in the EAEU. This letter was issued before additional line 8 “Government contract identifier (if any)” was introduced into the invoice form, therefore we believe that additional information must be indicated without violating the structure of the invoice between line 8 and the tabular part.

Let us remind you that from July 1, 2016, it is mandatory to indicate the product code in invoices to a counterparty in the EAEU in accordance with the unified product nomenclature of the EAEU. The product code is indicated in column 1a “Product type code” of the tabular part of the invoice, applicable from 10/01/2017. Until October 2021, the code of the type of goods when exported to the EAEU was indicated in the invoice in a self-entered column.

For more details, see: “Export to the EAEU: where to indicate the code of non-taxable goods in the invoice?” .

ConsultantPlus experts explained which codes to indicate on the invoice. To avoid mistakes, get trial access to the system and go to the Ready-made solution.

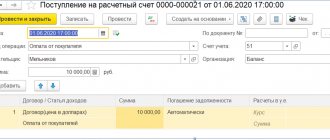

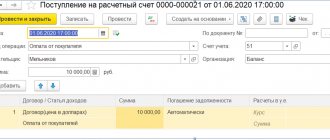

How to generate invoices in foreign currency in 1C

First of all, it is necessary that the “Currencies” directory be filled out in “1C”. You can select the desired currency or add it manually.

NOTE! If the terms of the agreement provide for a “special” conversion into rubles (a currency clause has been made), for example, “payment at the rate of 1 euro plus 3%,” then you can enter the following new position into the directory:

- create a “new currency”;

- link to the euro exchange rate (check the box in the form that opens);

- set the required “surcharge”;

- save with a name that will allow you to quickly find the position if necessary.

Read about the nuances of currency clauses in the article “Sample of a currency clause in a contract and its types .

Then you need to correctly enter information about the contract into the database. In the “Calculations” section of the contract being drawn up, you need to select the desired currency from the directory. Save changes.

When entering a document (for example, a sale) under an agreement, the required currency will be automatically selected and converted into rubles at a given rate for accounting purposes.

The easiest way to issue an invoice is through the “Create based on” option, which is available in all accounts receivable documents. The invoice created on the basis of the source document (sale or payment) will automatically take into account all the nuances of the reflected transaction, including the currency of the contract.

Formal actions

Foreign exchange transactions carried out in Russia are subject to foreign exchange control. In this case, compliance with currency laws is mandatory. The starting point for cooperation is the preparation and signing of a contract, which is drawn up in two languages - Russian and the language of the foreign supplier.

The next step is opening a foreign currency account. Since payment will be made in foreign currency, a foreign currency account is a prerequisite. To do this, contact an authorized bank to conclude a banking agreement. Payments from a ruble account to a foreign currency account are not made.

After the foreign currency account is opened, fill out an application to purchase foreign currency in the required amount. Currency is purchased at the bank's current exchange rate.