Accounts receivable belong to the assets of the organization.

As an object of accounting, accounts receivable is a monetary assessment of the amount of debt of debtors (debtors) to an organization (creditor).

Accounts receivable are accounted for in active-passive settlement accounts: 60 (advances issued), 62, 68, 69, 70, 71, 73, 75, 76.

The following rules have been established for reflecting accounts receivable in the financial statements:

1. Offsetting between items of assets and liabilities is not allowed (clause 34 of PBU 4/99). For example, on the reporting date, the collapsed balance on account 71 “Settlements with accountable persons” is 50 thousand rubles. At the same time, the organization’s debt to employee Ivanov according to the advance report on travel expenses approved by the manager amounts to 10 thousand rubles. In the balance sheet as of the reporting date:

— accounts receivable (line 1230) reflects the debt of employees to the organization for advances issued to these employees on account in the amount of 60 thousand rubles;

— accounts payable (line 1520) reflects the organization’s debt to its employee in the amount of 10 thousand rubles.

2. In the case of the issuance of advances and prepayment for work, services, etc. related to the acquisition (manufacturing, construction) of objects (property, non-property rights), which will subsequently be accepted for accounting as part of non-current assets, the amount of advances issued and prepayment are reflected in the balance sheet in section I “Non-current assets” (see letter of the Ministry of Finance of the Russian Federation dated April 11, 2011 No. 07-02-06/42).

3. Accounts receivable expressed in foreign currency (including those payable in rubles), for reflection in the financial statements, are recalculated into rubles at the rate in effect on the reporting date (clauses 1, 5, 7, 8 PBU 3/2006 ).

The exception is accounts receivable that arise as a result of the transfer to counterparties of an advance, prepayment or deposit. Such debt is shown in the financial statements at the exchange rate valid on the date of transfer of funds (clauses 9, 10 of PBU 3/2006).

4. In the case of an organization transferring payment, partial payment for upcoming deliveries of goods (performance of work, provision of services, transfer of property rights), receivables are reflected in the balance sheet as assessed minus the amount of VAT subject to deduction (accepted for deduction) in accordance with the tax legislation (see appendix to the letter of the Ministry of Finance of the Russian Federation dated 01/09/2013 No. 07-02-18/01).

For example, in accordance with the terms of the contract, the organization transferred an advance in the amount of 118,000 rubles to the supplier. (Debit 60 Credit 51). Based on the supplier’s invoice, the organization accepted for deduction the VAT paid in the advance amount in the amount of 18,000 rubles. (Dt 68, subaccount “Calculations with the budget for VAT” Credit 76, subaccount “VAT on advances issued”). As of the reporting date, no goods were received from the supplier. In the balance sheet, the organization reflected on line 1230 the supplier’s receivables in the amount of 100 thousand rubles. (118,000 – 18,000).

5. In the balance sheet, data on accounts receivable for goods sold, products, work performed and services rendered are reflected, if significant, separately from the amounts transferred by the organization in accordance with advance payment agreements (see letter of the Ministry of Finance of the Russian Federation dated January 27, 2012 No. 07-02-18/01).

6. Fines, penalties and penalties recognized by the debtor or for which court decisions on their collection have been received are included in other income and, until they are received, are reflected in the balance sheet as part of accounts receivable on line 1230 (clause 76 of PVBU No. 34n).

7. Accounts receivable for which the statute of limitations has expired, other debts that are unrealistic for collection are written off for each obligation as other expenses or from the reserve for doubtful debts (if such a reserve for this obligation has been formed) on the basis of (clause 77 PVBU No. 34n):

— inventory data;

— (and) order (instructions) of the head of the organization.

8. Accounts receivable written off due to the insolvency of the debtor are accounted for in off-balance sheet account 007 for 5 years from the date of write-off (clause 77 of PVBU No. 34n).

What accounting balances does line 1230 of the balance sheet consist of?

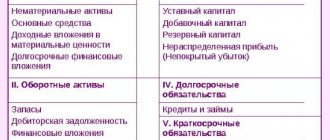

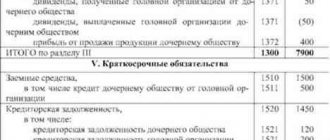

Data on line 1230 is reflected in the active part of the balance sheet, in the second section “Current assets” and includes indicators as of December 31 for the following accounting accounts:

- The debit balance (hereinafter referred to as D-tu) of account (hereinafter referred to as account) 60 “Settlements with suppliers and contractors” reflects the total indicator for advances issued to suppliers of goods, services, and work;

- Balance on the debit side of the account. 62 “Settlements with buyers and customers”, takes into account the debt on products, goods, work, services sold to the buyer;

- Account debit balance 68 “Calculations for taxes and fees,” speaks of the debt of budgetary authorities to the organization. Accounts receivable on this account may arise due to amounts transferred during the year, advance payments for taxes from budget funds. The amount of transferred advance payments exceeds the amount of calculated tax for a certain period of time;

- Debit balance by account 69 “Calculations for social insurance and security” tells us about the debt of the social insurance authorities to your company. It may arise, for example, due to the amount of excess expenses calculated by the organization on certificates of incapacity for work before accrued insurance premiums;

- Balance on the debit side of the account. 70 “Settlements with personnel for wages”. A debit balance is very rare. It may arise, for example, due to transfers of amounts to an employee (employee) for accrued leave (labour or pre- and post-natal leave). This happens when, at the beginning of the month, the organization’s employees are paid arrears of wages accrued on the last day of the month, and payment is also made for accrued maternity and postpartum leave. The accrual amount will be reflected in the accounting accounts only on the last day of the month, and payment will be made on the current date;

- Debit balance of the account. 71 “Settlements with accountable persons.” Payments to persons to account for funds, non-cash and cash are accounted for on the debit side of the account. 71. After payment, submits a report on expenses incurred to the company’s accounting department. This may include payment for business expenses, payment for purchased materials, expenses for staying in a hotel during a business trip, expenses for moving to and from the place of business trip, and others;

- Debit balance of the account. 73 “Settlements with personnel for other operations.” All relationships between employees of the organization are reflected in this active-passive account, except for payroll calculations and payments of funds to the account. The debit of the account reflects the employee's debt to the organization. An employee may be provided with borrowed funds for construction, rent, and other business needs. Also, the employee may have a relationship to compensate for material damage to the company. These are the situations that are reflected in the score 73;

- Balance on the debit side of the account. 75 “Settlements with founders.” The formation of the authorized capital is taken into account according to the D account. 75 and K-tu account. 80 “Authorized capital”. Until the founder deposits personal funds in the amount of the authorized capital, the debit balance will remain on account 75;

- Debit balance of the account. 76 “Settlements with various debtors and creditors.” Account 76 is active - passive, it reflects debts not reflected in account 60, 62 and other accounts. The account may reflect arrears of payment to the insurance company; claims settlements; withholding funds from employee salaries for third-party companies and persons under executive documents (acts).

It is advisable, for convenience in accounting, to open analytical accounting on account 76 on subaccounts. For example, on subaccount 1, reflect the debt for voluntary insurance in the context of employees (employees) of the organization, in subaccount 2 reflect the debt on claims in the context of counterparties, in subaccount 3, calculations of dividends in the context of founders, and so on.

Line 1230 of the balance sheet “Accounts receivable”

January 10, 2021 9277

Accounts receivable (line 1230)

This line of the balance sheet reflects the accounts receivable to the company, which was formed as of December 31, 2015. In this case, line 1230 includes debts whose repayment period is equal to or less than 12 months. If the repayment period of the debt exceeds 12 months, then its amount is included in non-current assets in line 1190 “Other non-current assets”. The amounts of advances transferred to contractors for future work related to capital construction are also indicated here.

Lines 1230 and 1190 indicate the debit balance of accounts for accounting for settlements:

60 “Settlements with suppliers and contractors” in terms of advances transferred on account of the upcoming supply of material assets, performance of work, provision of goods, works or services in terms of the cost of goods, work or services shipped but not paid for by buyers and customers;

68 “Calculations for taxes and fees” regarding taxes excessively transferred to the budget or collected by the tax authority;

69 “Calculations for social insurance and security” in terms of contributions to compulsory social insurance, excessively transferred or collected to extra-budgetary funds;

70 “Settlements with personnel for wages” regarding overpaid wages;

71 “Settlements with accountable persons” in terms of accountable amounts issued to employees of the company and unspent or unreturned at the end of the reporting period;

73 “Settlements with personnel for other transactions” in terms of the amount of loans provided to the company’s employees and their debt for compensation for material damage;

75 “Settlements with founders” in terms of debt of founders for contributions to the authorized capital in terms of sanctions accrued and recognized by debtors for violation of the terms of business contracts, dividends due from other organizations, accrued income from joint activities, the amount of issued interest-free loans, third-party debts persons for other transactions.

The company can provide details of the amounts of receivables by type and composition (for example, debt from buyers or customers; budget or extra-budgetary funds; personnel of the organization; shareholders or participants, etc.) in Section 5 of the Explanations to the Balance Sheet and Statement of Financial Results. Table 5.1 is intended for this purpose.

For doubtful accounts receivable related to payments for goods, works or services supplied, which are not repaid within the time limits established by the contract and are not provided with appropriate guarantees, the company is obliged to create a special reserve. This is provided for in paragraph 70 of the Regulations on Accounting and Financial Reporting. Whether the creation of such a reserve is provided for by the company’s accounting policy or not is not important. It is reflected in the credit of account 63 “Provisions for doubtful debts” in correspondence with account 91 “Other income and expenses” subaccount 2 “Other expenses”. If such a reserve is created, then the balance sheet indicates the accounts receivable minus the amount of the reserve (that is, the debit balance on accounts 62 and 76 minus the credit balance on account 63).

Please note: in the balance sheet, accounts receivable and accounts payable are indicated in detail. The receivable is in the asset, and the creditor is in the liability. That is, these debts do not balance. Even if there were both debit and credit balances for the analytical accounts of the same account.

The company received materials worth RUB 1,180,000 from its counterparty. (including VAT - 180,000 rubles). At the same time, she transferred an advance to the same supplier for the upcoming delivery of goods in the amount of 2,000,000 rubles. Goods are not subject to VAT.

These transactions were reflected in the entries:

DEBIT 19 CREDIT 60 subaccount “Settlements with suppliers”

– 180,000 rub. — “input” VAT on capitalized materials is taken into account;

DEBIT 10 CREDIT 60 subaccount “Settlements with suppliers”

– 1,000,000 (1,180,000 – 180,000) — materials were capitalized;

DEBIT 68 CREDIT 19

– 180,000 rub. — accepted for deduction of VAT on materials;

DEBIT 60 subaccount “Settlements for advances issued” CREDIT 51

– 2,000,000 rub. — funds are transferred as advance payment for goods.

In this situation, accounts receivable in the amount of 2,000,000 rubles. indicated on line 1230 of the balance sheet. At the same time, line 1520 reflects the amount of accounts payable in the amount of RUB 1,180,000. (1,000,000 + 180,000).

Formation of accounts receivable.

The procedure for generating receivables depends on the terms of the transaction within which they arose. In general, its amount is equal to the contract price of the goods, works or services sold. Moreover, in a number of situations it is formed in a special order. Thus, the amount of debt can be increased or decreased if the company provides customers with a commercial loan, if the debt is expressed in conventional monetary units or foreign currency, if it arose as a result of the transfer of an advance, etc. In addition, a special procedure has been established for debts on commodity exchange transactions.

Deadlines

The deadlines for submitting mandatory reporting on the wage fund are established by regulatory government bodies. Typically, reporting is submitted based on the following results:

- next quarter;

- calendar year.

Note:

When preparing reports on payroll, it is necessary to draw up a tax return for the Unified Social Tax no later than 30.03 of the year following the reporting period.

When preparing and submitting reports, the company goes through the following stages:

- The accountant sends regulatory documents establishing the form of the report and including instructions for generating reports in the automation department.

- Technicians update and customize reporting forms.

- The accountant prepares, consolidates and verifies data for reporting.

- The accountant generates reports for the current reporting period.

- The accountant checks the accuracy of the generated reports.

- The accountant prints a set number of copies of reports.

- Prepared reports undergo a second review cycle.

- The accountant submits reports signed by clients to regulatory authorities.

- The enterprise receives reports with a mark from the regulatory authority on delivery.

To summarize, we note that payroll is a fixed salary for employees.

The employer must pay 26% of the payroll, 13% (personal income tax) - the employee from his income.

Payroll reporting is almost the same for all small businesses, regardless of the form of organization.

Only the tax regimes differ, but this difference is insignificant.

Reflection of accounts receivable on the balance sheet

share on: Facebook

The state of the company's assets and liabilities is reflected in the main document - the balance sheet. Each of the assets is important. It is necessary to analyze the sources of funds and the availability of loans.

Based on mobile and liquid working capital, the efficiency and solvency of the enterprise can be assessed. Particularly important in this matter is accounts receivable on the balance sheet.

The registration of this type of asset must be correct. It can be used to determine the company's debt obligations. Therefore, the work is carried out by experienced accountants. To compose correctly, you need to study the various intricacies of the process.

Decoding

Until recently, line 1230 was displayed as code 240 , which contains a decoding regarding accounts receivable.

The line displays the amount of debt obligations that the organization has to its direct partners, counterparties and other persons for a certain time period.

It is worth noting that until recently line 230, which reflected debt subject to repayment no earlier than in a year, also belonged to this category.

Code displays of balance sheet lines include certain information :

- the first number indicates that it belongs to the balance sheet and not to another type of documentation;

- the second number indicates that the asset belongs to a certain category;

- third number – displays the location of the asset in the liquid ranking (the greater the liquidity, the greater the code value);

- the fourth number is used to directly detail the rows.

Thanks to this, you can easily find out all the necessary information that is encrypted in the code.

Definition and types

All companies that do business have receivables and payables. Their presence is determined by supply contracts, the taxation system, and company calculations. Accounts receivable on the balance sheet is the amount that reflects the obligations of various entities, both legal entities and individuals, to date. It is included in the general working fund.

Debt obligations are formed from the issuance of loans by a company. To maintain financial stability, it is important to increase their size so that accounts payable do not exceed their volume.

The concept includes several components:

- repayment of debt on loan obligations;

- goods sold but not paid for;

- current assets for financing from personal accounts and loans.

Accounts receivable are divided into several types. It can be short-term, when the amount is returned within a year. If we are talking about long-term debt, then the period is from 12 months.

If the fact of debt repayment is taken as a basis, the division can be made differently:

If the debt is expected, the products have already been transferred to the buyer

At the same time, the company received an advance, but the final payment did not occur. The debt will be considered normal if repaid within the period specified in the agreement.

Doubtful debt is one of the types of overdue

It occurs when there is no transfer of funds from an individual or organization that is a tax payer. If the debt is overdue, it cannot be confirmed by bank guarantees or guarantors. This type has a statute of limitations.

A bad debt is one that is not repaid by the borrowers.

Central provisions and boundaries of action

When forming accounts receivable, it is important to determine some points. It is necessary to find out which accounts may be included in the documentation, the conditions for filling out papers and processing debt. After this, analysis and forecasting are carried out.

Basic rules of reflection

When forming accounts receivable, it is necessary to focus on active and passive settlement accounts. These include: 62, 68, 69, 70, 71, 73, 75, 76 and advances issued 60.

There are several rules according to which debt is reflected:

- It is important to separate where the asset or liability is for a particular debt. An item from each balance sheet cannot be counted into one.

- If an advance was issued during settlement, the funds will be considered non-current assets. They must be indicated in the appropriate section.

- When reflecting foreign currency debt, a recalculation is necessary. Currency is calculated using the exchange rate at the reporting date.

- Accountants cannot always determine whether a debt for which partial payment has been made is reflected in VAT or not. It is necessary to document the amounts, subtracting VAT in accordance with the Tax Code.

- Accounts receivable for goods and work sold are recorded separately from the amounts transferred as an advance or prepayment.

- Other income that has not yet been received are fines and penalties recognized by the debtor or the court. They are defined on page 1230, where other things are reflected.

- When the statute of limitations has expired, the debt is written off from the reserve for doubtful debts according to inventory data, provided there is a written justification and an order from management.

- After the receivables are written off, they remain in off-balance sheet account 007 for the next five years.

Conditions for filling out and contents of papers

To reflect accounts receivable, there is a long-term line 1230, which records the debit balance for several accounts.

These include calculations:

- with suppliers and contractors (60) in rubles, c.u. and foreign currency advances;

- with buyers and customers (62) on shipped orders in rubles, bills, c.u. and currency;

- on taxes and fees (68), which were excessively transferred by the tax service or enterprise;

- on social insurance and security (69), which were excessively transferred to the Social Insurance Fund, Pension Fund, and Compulsory Medical Insurance Fund;

- with payroll personnel (70);

- with accountable persons (71);

- with personnel for other transactions (73) when issuing loans to employees or material compensation;

- with the founders (75) on contributions to the authorized capital;

- with debtors and creditors (76) on personal and property insurance, claims, dividends and income in ruble and currency equivalent.

If revenues from goods supplied or services provided do not arrive on time, the company may create a reserve for doubtful debt. This is a right and not an obligation of the company.

The reserve is needed only to pay off debt that is considered bad. The amount written off for a doubtful debt for which an advance was made will be considered incorrect.

In case of bad debt, cancellation will not be made. Cash funds are reflected for five years in off-balance sheet account 007.

Stages of organization and analysis

All budgetary institutions have accounts receivable. It consists of debt obligations of individuals or firms in relation to an enterprise.

After repaying the debt, the company experiences economic benefits. It will be considered an asset if the probability of return is high. If this is not possible, debits are made from your own accounts.

An important point for every organization is accounts receivable management.

There are several measures to work with it:

- company size planning;

- calculation of customer credit limits;

- exercising control;

- personal motivations of managers.

Some explanations about the amount of debt and the number of debtors are important for management.

You can find out information at:

- information about unpaid invoices issued by debtors;

- time of delay;

- the amount of debt recognized as doubtful and hopeless;

- credit history of debtors.

Such information is contained in the company's accounting records.

Management is carried out subject to several important points:

- It is imperative to plan the size of accounts receivable.

- At the second stage, the amount of debt is controlled. It is required to compare planned and actual indicators.

- The third stage is to investigate the causes of accounts receivable.

- At the next stage, solutions are developed to eliminate debt.

- The fifth point is the implementation of decisions that have been made.

It is important to analyze accounts receivable. First, large debts, which may be doubtful or hopeless, are taken under control. More minor debts are discussed below. The analysis can be current or long-term.

To determine the level of debt obligations, the following are taken into account:

- types of products;

- market saturation;

- turnover;

- enterprise calculations.

The analysis is possible if management or auditors want to ensure that the debt is reflected correctly.

In simple words, outsourcing is the transfer of secondary functions of the company to outside specialists who have the appropriate professional skills.

How to reflect received loans and borrowings, as well as expenses on them, in accounting, you can read here.

Design details

Sometimes the buyer wants to pay off a payment that has a past due status using a promissory note. It cannot be accepted as repayment of a debt. The bill system is allowed for deferment of payment. Then the debt obligations are entered in a special section of line 1230. To account for debt, a sub-account is opened with received bills of exchange.

It contains a transcript of the transfer of funds in the form:

Credit 62 subaccounts Settlements on bills received.

An example of reflecting property in the balance sheet

In practice, it turns out that the bill is worth more than the debt that the person or company has. The difference in amounts is taken into account as interest paid on the late payment. Due to this, the amount can be increased. Based on this, an additional code is entered into line 1230 of the balance sheet.

What you should pay attention to

The reserve for doubtful debts can be formed for any type of receivables; it is enough just to recognize them.

In addition, not only a debt obligation with a closing period has come into question, but also one whose term has not yet arrived, but which has a high probability of non-payment in full or in part.

In parallel with this, if in relation to the overdue receivables at the date of the reporting period there is confidence in the closure of debt obligations, then there is no need to create a reserve.

Loans and debts mentioned

Loans that were transferred to other organizations are recorded in account 58, Appendix “Financial Investments”.

Assets can be considered financial if:

- documentary confirmation of the right to the asset and receipt of funds;

- transfer of financial risks when receiving assets (price changes, insolvency, liquidity);

- generating income in the future.

With interest-free loans, the last criterion may not be met. It is important to meet the condition of return on investment. Therefore, such loans are entered in line 230 or 240.

If the loan is denominated in rubles and is not considered an investment, then it can be recorded in account 76. When issuing a loan to employees of an organization, it is reflected in account 73.

Accounts receivable are not recognized for debts that cannot be collected.

The main content of accounts receivable in the balance sheet

Accounts receivable are reflected in the balance sheet based on its active part. Maturity period is paramount in determining debt obligations.

Line 240 includes short-term debts that can be repaid within 11 months. The coefficient is written in account 62. If we are talking about long-term liabilities, then line 230 is selected. Such debts are repaid after one year.

A similar division is made in column 1230. Short-term (1231) and long-term (1232) liabilities are referenced.

The analysis of the company’s financial activities and further forecasting depend on how correctly the balance sheet is filled out. Therefore, it is important to separate types of debt by form.

The reserve for outstanding debts is made on account 63. Next, the formula for calculating receivables is carried out without these funds.

Debts that cannot be repaid are reflected as debts that cannot be collected from the created reserve (D63 K62). The amount is recorded in off-balance sheet account 007. It is determined for each debtor based on his solvency and repayment risks.

Sources of risk and insurance

If there are accounts receivable, certain risks arise for the enterprise.

- credit risk associated with failure to fulfill their obligations by debtors;

- risk of loss of liquidity. in which obligations are not fulfilled by debtors to creditors;

- operational risk due to insufficient control and management.

To eliminate risks, work is carried out at the initial stage before concluding a contract. It is important to assess the client’s reliability by analyzing information about him in relation to litigation and tax disputes. Due diligence will be required.

It is important to introduce a prepaid system. But market conditions dictate a deferred payment in order to find a compromise between the seller and the buyer.

To reduce the risk of loss of liquidity, cash flow forecasts for deferred payments are used. In order to reduce operational risks, it is possible to build a clear management system.

Distribution of debt on the balance sheet

19 PBU 4/99 clearly states that the balance sheet must specifically differentiate liabilities and assets into short-term and long-term.

For this reason, if a receivable suddenly appears in column 1230, then it is necessary to provide a link to the explanation.

In interim reporting, indicate, for example, two additional lines to specify the type of debt:

- 1231 – short-term receivables;

- 1232 – long-term receivables.

Financial analysis and further planning depend on the correctness of filling out the balance sheet.

Therefore, it is recommended to separate these two types when entering into f-1. The distribution of debt on the balance sheet is not only based on time frames, but also based on the liquidity of assets.

Accounts receivable itself is a highly liquid asset, but in particular, payment arrears are more liquid than delivery arrears.

Find out more about how to draw up a balance sheet? What is accounts receivable?

And advances given for construction are, in principle, difficult to liquidate.

Therefore, it is recommended to include them in non-current assets in the line “Construction in progress”. In any case, the options for reflecting such advances in the balance sheet should be explained.

Let's get acquainted with the balance sheet items for 2021: their codes and explanations

Everyone who has ever held a balance sheet in their hands, much less drawn it up, paid attention to the “Code” column. Thanks to this column, statistical authorities are able to systematize the information contained in the balance sheets of all companies. Therefore, it is necessary to indicate codes in the balance sheet only when this report is submitted to state statistics bodies and other executive authorities (Article 18 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, clause 5 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n). If the balance is not annual and is needed only by owners or other users, it is not necessary to indicate the codes.

ATTENTION! As of June 1, 2019, changes have been made to the form of the balance sheet and other accounting records!

In the balance sheet, line codes from 2014 must correspond to the codes specified in Appendix 4 to Order No. 66n. At the same time, outdated codes from the expired order No. 67n with the same name, dated July 22, 2003, are no longer applied.

It is not difficult to distinguish previously used codes from modern ones - by the number of digits: modern codes are 4-digit (for example, lines 1230, 1170 of the balance sheet), while outdated ones contained only 3 digits (for example, 700, 140).

For information on what the form of the current balance sheet with line codes looks like, read the article “Filling out Form 1 of the balance sheet (sample).”

Options for reflection in the balance sheet

The required detail is shown in lines 12301 to 12305 of the transcript for Form-1.

In these lines you must indicate the debit balance of the following accounting accounts:

- account No. 60 “Settlements with suppliers and contractors” in connection with prepayments made for the upcoming execution of work, provision of services, delivery of goods or materials;

- account No. 62 “Settlements with buyers and customers” in connection with the shipment of goods, performance of services and work overdue for payment by customers and customers;

- account No. 68 “Calculations for taxes and fees”, where there is a surplus of the amount transferred to the tax authority from the calculation of taxes and fees;

- account No. 69 “Calculations for social insurance and security” in connection with the surplus paid to the Social Insurance Fund;

- account No. 70 “Settlements with personnel for wages” in terms of overpaid wages;

- account No. 71 “Settlements with accountable persons” in connection with funds paid to employees of the organization;

- account No. 73 “Settlements with personnel for other transactions” in connection with credits, borrowings and advances issued to the organization’s personnel, or for compensation of material damage to the company;

- account No. 75 “Settlements with founders” in connection with the debt of the founders for contributions to the authorized capital of the organization;

- account No. 76 “Settlements with various debtors and creditors” in connection with accrued income from joint activities, sanctions recognized by debtors for failure to fulfill contractual terms, debts of other persons on transactions, dividends that must be paid by other companies.

It is necessary to make a reserve for outstanding overdue payments in terms of accounts receivable - it is best to make it on account 63

It is necessary to provide for a reserve for outstanding payments in terms of accounts receivable for services, work, goods or materials provided, which most likely will not meet the deadlines specified in the contract, or do not have guarantees that payment will be made on time.

It is most reasonable to make a reserve on account No. 63 “Provisions for doubtful debts”, in correspondence with account No. 91 “Other income and expenses”, subaccount 2 “Other expenses”.

Accounts receivable are entered into the balance sheet minus this reserve, if one has been created.

The reserve is reflected by posting:

D 91-2 K 63 – a provision was made for doubtful debt.

The write-off of a debt that is impossible to repay, for which a provision has been made, is recorded as follows:

D 63 K 62 - uncollectible debt for which a reserve was created has been written off.

The amount written off under this posting must be reflected in off-balance sheet account 007 “Debt of insolvent debtors written off at a loss”:

D 007 – doubtful debts are taken into account.

The amount of such a reserve is calculated for each specific debtor depending on its solvency and the share of risk for full and partial repayment.

What kind of reporting is submitted?

If you are an individual entrepreneur and work in a simplified taxation system, filing payroll reports will not be particularly difficult.

Income and expenses of the wage fund are traditionally reflected in the corresponding book.

In the seventh column of the document, the income received during the month and the expenses that the company incurred in the same period are recorded, and the resulting difference is taken into account.

The book is submitted for control in December of each financial year.

Quarterly reporting on payroll involves filling out forms from the social insurance fund and pension fund. But there is no separate form for the health insurance fund.

Calculation by categories of this fund is also submitted to the Pension Fund.

If this month your individual entrepreneur suffered losses, for example, income was 10 thousand rubles, and expenses were 15 thousand, in the “difference” line, indicate 1% of the amount received, the minimum profit, or simply “zero”.

If your company operates under the general taxation system, reporting will be more difficult.

You will have to draw up a balance sheet, report on funds received and losses incurred, and at the end of the reporting period, submit an appendix to the balance sheet, reports on the flow of money and the intended use of all funds.

When reporting wages, you can use the same forms as individual entrepreneurs working under a simplified method.

The only difference will be in the timing of reporting.