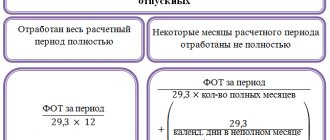

Deductions

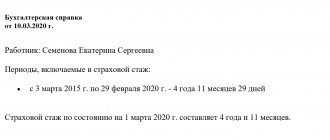

Calculation of length of service from 2021 An important change in sick leave has occurred for all employers since

When applying for a job, an employee is primarily interested in monetary remuneration for his work.

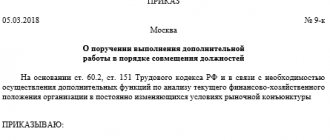

In modern economic conditions, many workers are not limited to one position and workplace. IN

Author: Ivan Ivanov The legislation of the Russian Federation does not prohibit combining work and study, but in some cases

What types of tax audits are there? Individual entrepreneur is a business entity that is obliged to conduct tax

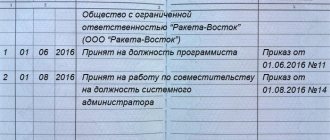

Registration of labor relations in the proper form plays a significant role in the further process of labor activity.

A shift schedule is a document that approves the duration and frequency of shift rotation. He is not

The tax deduction for treatment is a refund of 13% of the cost of paid medical services. IN

The concept of “total length of service” (GTS) cannot be found in the current legislation of the Russian Federation. This is a certain

Part-time work is a phenomenon that occurs all the time. The desire to earn extra money, especially if