When applying for a job, an employee is primarily interested in monetary remuneration for his work. Most often, with a time-based form of remuneration, the employee’s monthly salary is agreed upon.

But the amount of money that a person receives in hand, that is, salary, almost always differs from salary . Therefore, an employee often really wants to check the accuracy of salary calculations, especially when it seems that it is less than what was expected.

How often to calculate and pay salaries

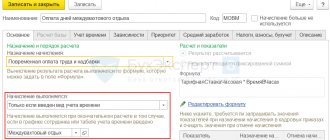

Salary is the amount a person earned in a particular month. Basically, salaries are calculated at the end of each month. But wages must be paid at least once every half month (Article 136 of the Labor Code of the Russian Federation). To do this, the monthly amount is divided into two parts. The first is given to employees before the end of the month, that is, in advance. The second part is after the end of the month, when the final salary amount will be known.

The employer has the right to approve its own dates for issuing advance payments and salaries. For example, you can transfer an advance on the 25th of each month, and a salary on the 10th of the month that follows the worked day. The main thing is to pay the money no later than 15 calendar days from the end date of the period for which it was accrued. It is also important to record the dates for issuing advance payments and salaries in the director’s order or in another internal document and strictly observe them. If the day of payment of an advance or salary falls on a weekend or holiday, then the money must be transferred the day before.

Main components of the calculation

Thus, when calculating wages based on a known salary, it is necessary to take into account both the main initial data and additional factors. The main parameters include:

- salary amount;

- number of days worked;

- income tax.

Additional factors include:

- availability of advance payment;

- alimony payments and other deductions;

- availability of additional payments (bonuses, allowances, coefficients).

What information is needed to calculate payroll?

To calculate an employee’s salary for the past month, you need to know:

- the employee’s salary or tariff rate;

- what kind of remuneration system is established for the employee - time-based or piece-rate;

- how much time the employee worked during the month using a time-based payment system. If the payment system is piecework, then in what volume the employee produced products or provided services.

- For a newly hired employee, you also need to know the date on which he started working. And for a dismissed employee - the date from which he stopped working.

Documentation

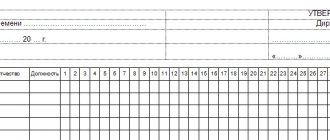

The main documents on the basis of which wages are calculated are:

- employment agreement or contract;

- The order of acceptance to work.

These documents must indicate the date of hire, salary, amount of allowances and additional payments.

In addition, when calculating wages, the wage regulations at the given enterprise and the time worked by the employee are taken into account.

How to calculate wages using a salary system

With a salary system, the employee receives a salary - a fixed amount of money for the month worked. If the month is not fully worked, then a portion of the salary is paid, proportional to the time actually worked.

Let's look at an example.

Administrator Alena's salary is 45,000 rubles.

She did not work the entire month of November: from the 12th to the 18th, Alena was on vacation, and from November 27th to 30th she took sick leave.

According to the time sheet, the employee was on duty for 12 working days. There are a total of 21 working days in November. Thus, Alena’s salary for November, not counting vacation pay and sick pay, amounted to 25,714 rubles (45,000 / 21×12).

Advanced formula: how to take into account additional payments

If, in addition to salary, an employee receives incentive and compensation payments, an expanded formula is used to calculate wages:

Moreover, if the employee worked all working days in the billing month (KRD = KOD), this formula takes the form:

How to calculate the salary amount if the employee is paid a bonus or other additional amounts? Let's continue the previous example, changing the conditions in it.

Let's assume that the janitor P. G. Samoilov worked in January without any comments or disciplinary sanctions. Then he will receive a bonus (15% of the salary) in addition to his salary. And to calculate wages, you can use an extended formula (without adjusting the salary for days worked):

Salary = 16,250 + 16,250 × 15% = 18,687.5 rubles.

How to calculate salary for part-time work? ConsultantPlus experts know the answer to this question:

Get trial access to K+ and you can see the calculation formulas and solution for this example.

How to calculate wages using a tariff system of remuneration

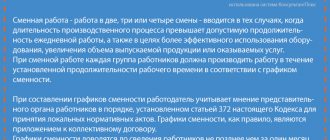

With a tariff system of remuneration, the employee is paid for the number of hours or days actually worked, based on the tariff. For night work - from 10 pm to 6 am - an additional payment of at least 20% is required. And if the shift falls on a holiday, then the payment should be at least double the amount.

Let's look at an example.

For the waiter Maxim, the tariff rate is set at 300 rubles per hour.

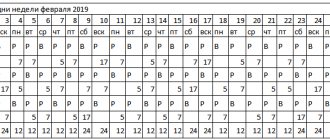

In February he worked 7 shifts of 24 hours. That is, in fact, 168 hours, of which 56 hours are at night.

- Let's multiply 168 hours by 300 rubles, we get 50,400.

- Let's multiply 56 hours by 300 rubles and 20%, and we get 3360.

- Let's add 50,400 and 3,360.

So, Maxim’s salary for February was 53,760 rubles.

Receiving salary by proxy

Sometimes a person cannot show up for work and receive a salary in person. Such situations often occur in those organizations where cash payments to employees predominate. The way out of this situation will be to draw up a power of attorney for another person who will be able to receive the money in full and transfer it personally.

The power of attorney is drawn up in free form, but the document must contain the following information:

- date and place of compilation;

- passport details of the principal and attorney;

- an order to receive a salary at the enterprise's cash desk;

- validity;

- signature of the principal and attorney;

- employer's note on document certification.

It is important to remember that the power of attorney does not need to be certified by a notary; certification by the head of the organization will be sufficient.

Power of attorney of the principal for receipt of salary by an attorney from the cash desk

After meeting all the above conditions, the responsible person can safely transfer money from hand to hand to the attorney.

How to calculate personal income tax

Companies and entrepreneurs that pay salaries to their employees act as tax agents in relation to them. This means that they need to calculate personal income tax, withhold it from the employee’s income and transfer it to the budget.

Tax is assessed on wages, vacation pay, sick leave benefits, except for maternity benefits, as well as on payments in kind: lunches, participation in corporate events. The personal income tax rate in this case is 13%. If the employee is not a resident, then 30%. The amount of personal income tax withheld should not exceed 50% of the amount paid to the employee.

Let's look at an example.

In January, the employee received 35,000 rubles from the employer.

- Let's multiply 35,000 rubles by 13%, we get 4,550 rubles. This is the amount of tax on an employee’s salary.

- Let's subtract the tax amount from 35,000 rubles, we get 30,450 rubles. This is how much the employee received in his hands.

That is, the amount of tax withheld did not exceed the 50 percent limit.

Calculation of military personnel's salary

A serviceman receives a salary, which in the Armed Forces is called “salary.” It depends on the following factors:

- positions;

- ranks;

- length of service;

- conditions of service.

The military salary includes salary according to rank and salary according to position. Military personnel are subject to a 13% tax. There are special tax deductions for military personnel, which are written down in the Tax Code of the Russian Federation.

Calculation of monetary allowance is carried out as follows:

- salaries are summed up by rank and position;

- bonuses are added for length of service, conditions of service and others;

- Tax is deducted taking into account tax deductions.

Each employee has the right to receive severance pay upon dismissal due to staff reduction. If wages are delayed, the employer is obliged to pay compensation. If he refuses to do this, read our article, which describes in detail the employee’s rights in this case.

Providing a false sick leave certificate is a serious crime. Read here what punishment an employee can bear in this case.

How to transfer personal income tax and report to the Federal Tax Service

Individual income tax must be transferred to the budget no later than the day following the day the income is paid. The only exception is for vacation and sick leave, including for child care, when personal income tax must be paid before the end of the month in which benefits are paid.

To report for withheld personal income tax, the employer submits two forms.

- Once a year, before March 1, you must submit to the inspectorate certificates in form 2-NDFL, in which you provide information about income paid in the previous year. If 11 or more people received income, they must report online.

- In addition, every quarter during the year the employer submits Form 6-NDFL, where he indicates general data on all individuals who received income from him.

General salary provisions

The Labor Code of the Russian Federation deciphers the concept of wages (Wages) in Article 129. This article states that Wages are remuneration for work. Its size depends on the qualifications of the worker himself, as well as the complexity, quality and quantity of work done.

The structure of the PO is as follows:

- main part (OS);

- compensation payments (WSS);

- incentive payments (SV).

OS can be conditionally considered basic due to the fact that its payment is carried out according to the official salary in accordance with the time worked.

Water supply and sewerage services are carried out when work is carried out in conditions different from normal or usual ones. This category may include payments under special conditions.

Table: compensation payments and their amount

| Reasons for the emergence of water and wastewater services | Calculation of the payment amount |

| Working overtime for the first two hours of work | One and a half hourly wage rate |

| Working overtime for subsequent working hours | Double hourly wage rate |

| Night work (from 22:00 to 06:00) | Additional payment for each hour of work of at least 20% of the salary per hour of work |

| Work on holidays and weekends | One-day part of the salary within the monthly norm and a double part of the salary when working in excess of the monthly norm |

| Combining professions, increasing the volume of work, performing the duties of a temporarily absent employee | According to the written agreement of the parties |

| Difficult and harmful working conditions | Up to 12% of salary |

| Particularly difficult and harmful working conditions | Up to 24% of salary |

| Working in special climatic conditions | Regional coefficients |

| Labor in desert and waterless areas | Odds |

| Work in high mountain areas | |

| Work experience in the Far North, | Percentage allowances |

| Work in the southern regions of the Far East | |

| Labor activity in the Krasnoyarsk Territory | |

| Experience in the Irkutsk and Chita regions | |

| Work in the Republic of Buryatia | |

| Work experience in the Republic of Khakassia |

In addition to salary, an employee can receive various additional payments for his work.

SV - various incentive allowances and additional payments, the purpose of which is material incentives. Every exemplary employee at least once in his career received a bonus for successfully completed work. The psychological factor of such a payment is that a person feels important in the eyes of management and begins to work better.

Salary is a certain amount of remuneration for the work duties performed by an employee. Payments for performing labor functions are usually calculated for one calendar month.

Basic salary is the minimum wage for a state or municipal employee in accordance with his qualifications. Therefore, the higher the qualifications of the employee, the higher his base salary will be.

The main difference between a salary and a basic salary is that a regular salary is assigned to non-governmental organizations, while a basic salary is determined for employees working in government agencies.

A completely different category of remuneration can be called an advance. An advance is partial labor costs for the first half of the month (Labor Code of the Russian Federation, Article 136). Therefore, if an employer pays salary once a month, this is a direct violation in accordance with the Labor Code of the Russian Federation.

Advance is a colloquial term familiar to both employees and employers; you will not find it in the Labor Code of the Russian Federation.

It is worth highlighting such a concept as the minimum wage (minimum wage). The minimum wage is a fixed amount established by the state. The salary assigned to an employee cannot be lower than this amount. The value of the concept under consideration is also needed to calculate various benefits at the expense of the Social Insurance Fund.

From January 1, 2018, the minimum wage is 9,489 rubles, and from May 1, 2018, the minimum wage will increase to 11,163 rubles.

Video: minimum wage

https://youtube.com/watch?v=i5I9TZBulXw

The maximum amount of wages for employers can be any: the manager sets a different amount of wages for the employee at his discretion (not lower than the minimum wage, of course). The only point will be the fact that every year the state sets the maximum indicator for labor protection for the purpose of calculating Social Security benefits and Pension Fund contributions. This year you need to adhere to the limit of 876,000 rubles. When calculating FSS benefits, this indicator is a cash limit, and therefore, the employer will not be able to pay the employee a benefit amount greater than that established. Pension Fund contributions, on the contrary, will be lower if during the year the amount of earnings exceeds this limit.

I would also like to note the fact that employers use various forms to pay labor costs, which are initially negotiated with the employee and documented. Based on the chosen form, the salary will be accrued in a certain way: piecework (the value does not depend on the volume, the time spent on work is taken into account) or time-based (the time factor does not matter, the volume of work is important).

The influence of the regional coefficient on wages

In regions where working conditions are considered special due to climatic conditions, terrain or increased radiation levels, a regional coefficient is added to employee salaries. It should not be confused with northern allowances for employees of the Extreme Server. The area of application of the regional coefficient is much wider.

The size of the coefficient is established by the Government of the Russian Federation specifically for each region. There is no single regulatory act; a separate resolution is issued for each district. The lowest coefficient - 1.15 - is in the Vologda region, as well as in most regions of the Ural Federal District: Perm, Sverdlovsk, Orenburg, Chelyabinsk, Kurgan regions. A similar coefficient applies in Bashkortostan and Udmurtia.

The regional coefficient is applied not to the salary, but to the actual amount of the salary before personal income tax is deducted from it. To calculate, you need to sum up the salary with all allowances and bonuses, with the exception of one-time payments (such as sick leave and financial assistance), and multiply the resulting total by a coefficient. For example, in one of the cities of the Chelyabinsk region, with an employee’s salary of 30,000 and a bonus of 7,500 rubles, the salary calculation will look like this:

(30,000 + 7,500) × 1.15 = 43,125 rubles (salary before personal income tax);

43,125 –13% = 37,518.75 rubles (take-home salary).

○ What time is excluded from the billing period?

An exhaustive list of time excluded from the billing period is provided by law.

Clause 5 of the Regulations on the specifics of the procedure for calculating average wages: When calculating average earnings, time is excluded from the calculation period, as well as amounts accrued during this time, if:

- The employee retained his average earnings in accordance with the legislation of the Russian Federation, with the exception of breaks for feeding the child, provided for by the labor legislation of the Russian Federation.

- The employee received temporary disability benefits or maternity benefits.

- The employee did not work due to downtime due to the fault of the employer or for reasons beyond the control of the employer and employee.

- The employee did not participate in the strike, but due to this strike he was unable to perform his work.

- The employee was provided with additional paid days off to care for disabled children and people with disabilities since childhood.

- In other cases, the employee was released from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation.

What you need to know to correctly calculate wages

When applying for a job, the applicant must negotiate the salary amount with the employer.

And when an employee hears the amount, he does not think that in reality the payments will be different. The amount that is agreed upon during employment is the salary (fixed wage). It will be reflected in the employment contract. But how much an employee will receive depends on many factors. Here's what to take into account:

- Income tax is deducted from the employee's funds, while the employer makes insurance contributions from his own funds.

- The employee can receive an advance.

- An employee may have obligations to pay alimony or other payments under writs of execution.

- Supplements and coefficients may be applied to the employee’s salary; he may be awarded a bonus and other additional payments.

All these factors either increase take-home pay or decrease it. If you forget about them, you cannot correctly calculate the amount to be paid.