Deductions

You need to report on insurance premiums in 2021 to the Federal Tax Service, and not to off-budget agencies.

Fixed assets are buildings, structures, equipment, furniture, etc., useful life

We hope that everyone already knows about the Decree of the Government of the Russian Federation of April 24, 2021. No.

December 14, 2021 Ekaterina Pirogova All authors Appendix to the article: file for downloading B

The widespread introduction of online cash registers has led to a significant increase in expenses for the maintenance and servicing of cash registers.

Form 4-FSS is a report that is submitted quarterly by all payers of insurance premiums (they are also

Vacation time Nina Loginova Legal consultant Current as of June 11, 2020 Reflect vacation days in

Legislative measures taken to support business during the fight against COVID-19 apply only to

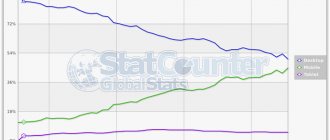

Home / Taxes / What is VAT and when does it increase to 20 percent?

Every person living in our country has heard about value added tax. This