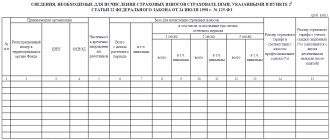

Form 4-FSS is a report that is submitted quarterly by all payers of insurance premiums (they are also policyholders) to the social insurance fund. Most often, this form is called a calculation of insurance premiums paid by the employer. All employers must pass 4-FSS, or more precisely:

- Legal entity, organization, regardless of form of ownership.

- Individual entrepreneur, if there is at least one employee on staff.

The calculation is completed for contributions for injuries. It should be noted that they are paid by employers for their employees only in certain situations. Firstly, if the need for payment is stipulated by the employment agreement. Secondly, when we are talking about citizens with whom an employment contract or civil contract has been concluded, as well as in situations where these persons are brought to work by court decision. In all of these cases, the corresponding amounts will need to be included in the insurance reporting.

The deadlines and methods for submitting calculations for 2021 remain the same. Employers are obliged, as before, to submit it to the territorial authority at their location (at the place of registration). The remaining features of preparing and passing the 4-FSS are summarized and presented below in the table.

| Some details of filling out 4-FSS | Deadlines for submitting 4-FSS | Methods of presenting 4-FSS |

| Each new form is filled out: in rub. and kop.; cumulative total; based on information from the chart of accounts | Paper version of the report: until the 20th day of the month that follows the specific reporting period. To submit an electronic payment, the above deadline is extended until the 25th | On paper: in person, by post or through an authorized representative if he has a certified power of attorney. Electronically - via TKS |

It should be remembered that an electronic report must be submitted by those policyholders whose average annual number of personnel exceeds the established limit of 25 people. However, the data is taken into account only for the past year.

Other employers who have the same number of employees less than 25 people have the right to submit 4-FSS both on paper and electronically. Grounds: clause 1 of Art. 24 Federal Law of the Russian Federation No. 125 dated July 24, 1998 (as amended in 2021).

Important! Failure to submit a calculation or refusal to do so, or violation of the filing procedure is punishable under Art. 26.31 Federal Law of the Russian Federation No. 125 of July 24, 1998 (fine 200 Russian rubles) or according to clause 3 of Art. 15.33 Code of Administrative Offenses (fine for officials from 300 to 500 Russian rubles).

Changes introduced to form 4-FSS from 2021

For the period from 2021 to 2021 no innovations were introduced into the 4-FSS form. Therefore, the changes that were introduced since June 2017, in fact, remain relevant today. These are the ones you should pay special attention to.

It should be noted that the template of the new form has generally been preserved. Minor changes affected only the content, the fields of the form (there are more of them) and the order of filling. In general, it should be noted that:

- the form still includes a title and 5 tables;

- a new field has been added to the title for state employees;

- there is no field for the OKATO code and the OKTMO code;

- The title and table are required to be completed. 1, 2, 5;

- table 1.1, 3 and 4 are filled out if there are indicators, and if they are absent, dashes are added accordingly.

Thus, in the updated form, only the sections that record information about contributions “for injuries” remain. Everything else was excluded from it.

How to fill out table No. 5 of the report

Table 5 concerns special labor assessments and mandatory medical examinations and contains information on indicators at the beginning of the year.

| Index | How to fill |

| Number of workplaces | This column contains information about the number of jobs in the company or entrepreneur. This is the total figure for all jobs |

| Conducting a special assessment | 3 columns are highlighted to indicate how many workplaces a special assessment was carried out. The total figure is indicated and broken down into classes 3 and 4 according to harmfulness. The number of such jobs is indicated at the beginning of the year and the figure does not change throughout the year. |

| Carrying out medical examinations | If there are harmful and dangerous conditions at the enterprise, then you need to indicate how many employees have undergone mandatory medical examinations |

Form 4-FSS in 2021

The standard 4-FSS report form, introduced back in 2021, has changed more than once. For the most part, the changes introduced to it are related to the transfer of powers to administer insurance premiums to the Federal Tax Service of the Russian Federation. For 2021, the form of the form is used, which is approved with the changes established by Order of the Federal Social Insurance Fund of the Russian Federation No. 275c on 06/07/2017.

The updated form in Excel format is presented in Appendix. No. 1 to Order of the Federal Social Insurance Fund of the Russian Federation No. 381 dated September 26, 2016 (as amended on June 7, 2017). This order also includes the procedure for filling it out in sections. The 4-FSS calculation itself includes 5 tables and contains the following information:

- Total and other indicators for calculating the base for the purpose of calculating contributions (Table 1).

- Contribution base, tariff with a discount (surcharge) and according to the risk class, as well as details of the host organization (Table 1.1).

- Calculations performed for contributions “for injuries” (Table 2).

- Total expenses for social insurance against occupational diseases and during industrial emergencies (Table 3).

- The number of insured persons injured in a specific period, by insured events (Table 4).

- The results of the special assessment of working conditions and mandatory medical examinations of workers as of the beginning of the current year (Table 5).

The same Order of the FSS introduced the procedure for filling out the calculation (see Appendix No. 2 to the order). Insurers are obliged to comply, first of all, with the general requirements determined by this procedure. These are standard requirements for reporting, which provide for the possibility of filling out a standard form manually or by printing on a computer. When filling out manually, as a rule, you should use a fountain or ballpoint pen with black (or blue) ink. The text part of the calculation is written in block letters.

In the calculation, as is customary, continuous numbering is indicated (the “page” field). The policyholder (or his legal successor) must certify each page with a personal signature, putting the corresponding signature date. If some of the pages are not completed, then it is not necessary to attach them to the report and submit it along with it. Please note that the policyholder will be able to submit an electronic settlement only if he has a qualified signature.

Table 4

Submit Table 4 as part of the 4-FSS report for the 2nd quarter of 2017, if from January to June there were industrial accidents or occupational diseases were identified.

| Rows of table 4: decoding | |

| Line | What needs to be shown |

| 1 | The number of employees who were injured at work in the first half of 2021. |

| 2 | How many died due to accidents? |

| 3 | The number of workers who were diagnosed with occupational diseases from January to June. |

| 4 | The sum of rows 1 and 3 of table 4. |

| 5 | The number of cases at work or occupational diseases that resulted in temporary disability. |

Instructions for filling out 4-FSS

So, all the requirements for filling out the calculation form are contained in the Appendix. No. 2 to Order of the Federal Social Insurance Fund of the Russian Federation No. 381 dated September 26, 2016 (as amended on June 7, 2017). They must be observed when entering information into a calculation form filled out manually on paper, as well as when completing its electronic version.

| Calculation section | Instructions for filling out (what to write down) |

| Title (required) | Registration No.; subordination code; the name of the organization, its division in full (full name for individual entrepreneurs) and its details; data on the number of personnel and completed application pages; information about the head of the organization or other authorized person |

| Table 1 (for all policyholders) | All necessary indicators are recorded (for remunerations accrued to the employee, non-taxable amounts, etc.), namely: over the last 3 months. specific period, as well as the total amount on an accrual basis. The tariff size is determined by professional class. risk |

| Table 2 (for all policyholders) | Data on accrued and paid contributions “for injuries” for the required intervals of a specific period; return (offset) of excess amounts, debts at the end of the stated period |

| Table 3 (to be completed if data is available) | Social insurance expenses, namely: social benefits for temporary disability due to occupational disease (in case of an emergency at work); vacation pay for treatment in Russian health resorts; funds for carrying out preventive measures to reduce injuries at work and occupational diseases |

| Table 4 (to be completed if information is available) | Number of insured persons injured in the performance of work duties at the workplace (i.e. in insured events) |

| Table 5 (for all policyholders) | Results of the special assessment already carried out, as well as medical examinations (required indicators for the assessed workplaces, workers employed in them, etc.) |

Thus, in the absence of the necessary indicators in Table. 1.1, 3 and 4 are not completed or submitted. In general, indicators are recorded in columns according to the principle of one column - one indicator. If they are absent, dashes are placed in the columns.

Errors can be corrected, but only in the prescribed manner. Corrective agents must not be used for these purposes. First, the incorrect indicator is crossed out. Then write down its correct value. Finally, the date of the amendment and the signature of the policyholder (another authorized person) are indicated next to it.

Responsibility for violation of deadlines

4 FSS for the six months should be taken from 1.07. to 20.07. In the situation of providing an electronic version, the time range increases to the 25th.

Before submitting information, the company must pay 2.9% of the established salary of one employee who goes on sick leave due to temporary disability. In the situation of reporting for maternity, the same percentage deductions are approved.

If there are cases with injuries, recalculation is carried out based on the specific conditions of disability, but the smallest and largest amounts of payments are 0.2% and 8.5%, respectively.

When there is a violation of deadlines for submitting documentation, penalties are provided:

- an additional 5% of the amount of contributions will be charged;

- if the amount of the fine is less than 1000 rubles, the employer still has to pay 1000 rubles;

- the largest amount payable is 30% of the amount of contributions.

In addition to applying the penalty system to the enterprise itself, a fine may be imposed on the employee of the organization involved in the generation of data.

Correct completion and timely submission of the report on Form 4 FSS allows you to avoid problems when making claims from the Social Insurance Fund.

The half-year form has changed after June 2021, but the filling out procedure has not changed much. In case of difficulties, you can read the Appendix to Order No. 381 or contact specialists.

Preparation of the electronic version of 4-FSS

You can generate and prepare an electronic version of the calculation on the portal of the FSS of the Russian Federation (link to view the information: https://portal.fss.ru). Users are invited to take advantage of the service, which allows them to fill out calculations electronically even without registering on the site. Simply enter the required data in the form provided and then save it on your computer. The calculation generated in this way is automatically checked. Please note that the service is used only for preparing 4-FSS. You can find it at the link https://portal.fss.ru/fss/f4input.

In addition, the FSS portal has another service called “Calculation Reception Gateway. Form 4-FSS with electronic signature.” It is designed to accept electronic statements sent by policyholders. You can use it only if you have an electronic signature. Link to the service: https://f4.fss.ru.

All incoming electronic payments undergo format and logical control. The Fund does not accept them if the policyholder's electronic signature is not valid or if they do not comply with the required format. Considering this fact, it is recommended to submit the calculation in advance. If it is received on the last day, then you will have to submit the corrected version later than the deadline, which is fraught with “penalty” consequences.

When to report: deadlines

Calculations must be submitted on 4-FSS forms based on the results of the reporting periods:

- I quarter;

- half a year;

- nine months;

- of the year.

“On paper,” 4-FSS reports must be submitted no later than the 20th day of the month following the reporting period. In electronic form - no later than the 25th day of the month following the reporting period (Clause 1, Article 24 of the Federal Law of July 24, 1998 No. 125-FZ). If the due date falls on a weekend, you must report on the next working day.

Thus, the deadline for submitting 4-FSS for the 2nd quarter of 2021 is no later than July 20 “on paper” and no later than July 25 – in electronic form.

As we have already said, 4-FSS is submitted based on the results of the reporting periods. Therefore, it is more correct to call the current reporting “4-FSS for the first half of 2021” rather than for the 2nd quarter.

Common mistakes when preparing 4-FSS calculations

Error 1. The presence of a round seal in the calculation (for LLC or JSC) is not necessary. The FSS will accept the report without it, since refusal is not provided for in such situations. From 04/07/2015, it is not necessary to manufacture or have a seal, since for the named structures this requirement has been canceled due to the Federal Law of the Russian Federation No. 82 of 04/06/2015.

Typically, corrections made in form 4-FSS and other statements (about returns, offset of excess amounts) are also not required to be certified with a seal.

Error 2. If errors are made in the submitted 4-FSS form, then the employer is obliged to draw up and submit its clarifying correct version, noting the correction number “001”. So, for example, it is necessary to clarify the information if inaccurate amounts are indicated in the primary calculation, incomplete or distorted data are recorded, etc. The 4-FSS update calculation is submitted upon detection of errors.

Page 1

All details of the policyholder are filled in, data on the number of employees and people with disabilities is indicated, the budget level for the budgetary organization is indicated, and a mark is given by the representative of the fund who accepted the report.

If a report is submitted for a given period for the first time, then in the field:

The code is set to 000.

If an error is found in an already submitted report, then after correcting it, code 001 is set. With each correction, the code will increase by 1.

Consider the following field:

If the form is filled out for a certain period, the first two cells contain the numbers corresponding to this period, as indicated in the explanation. If you apply for insurance compensation, then indicate the serial number of the application (01 if it is the first, 02 if it is the second)

In the field: the letter “L” is written if the organization is in the process of liquidation or the individual entrepreneur ceases its activities. In all other cases it remains empty.

Answers to frequently asked questions

Question No. 1: Is it necessary to submit a zero calculation 4-FSS if the organization did not conduct activities?

Need to. In the absence of activity, the zero calculation is still given; there are no relaxations or exceptions to this rule. In this case, you must fill out the title and table in the form. 1, 2, 5.

Question No. 2: Should an individual entrepreneur draw up and submit a 4-FSS calculation if he has no employees and works alone?

No, you shouldn't. Since there are no employees, there is no one to pay mandatory insurance premiums for. Accordingly, since he does not pay contributions, he has nothing to report for. You should also know that an individual entrepreneur without employees is not required to submit Form 4-FSS for himself.

Which department should I submit reports to?

If the organization does not have separate divisions, then 4-FSS for the 2nd quarter of 2021 must be submitted to the territorial branch of the FSS of Russia at the place of registration of the company (Clause 1, Article 24 of the Federal Law of July 24, 1998 No. 125-FZ).

If there are separate divisions, then Form 4-FSS for the 2nd quarter of 2021 must be submitted to the location of the separate division. But only on the condition that the “isolation” has its own current (personal) account in the bank and it independently pays salaries to employees.

Example 1. Completed sample of zero calculation 4-FSS

Trajectory LLC was opened in Kazan quite recently, at the end of the 3rd quarter of 2021. The company will be engaged in the construction of residential and non-residential buildings (OKVED code “41.20”). Registration address: Kazan, st. Academician Parina, 10, bldg. 2, apt. 5.

Meanwhile, activities have not yet begun, there are no employees, so contributions for the 3rd quarter. were not paid. There is one director on staff (Marat Olegovich Gusarov). The tariff for contributions “for injuries” has been determined: 2.3%. A special assessment of working conditions at Trajectory LLC is scheduled for November 2021.

Despite the fact that activities in Q3. was absent, Trajectory LLC is obliged to prepare and submit a 4-FSS report for this period (in October 2021). Since there is no data, then a zero calculation should be submitted, filling out only the title and table. 1, 2, 5.

The sample below is presented in Excel format. When filling it out, conditional data was used.

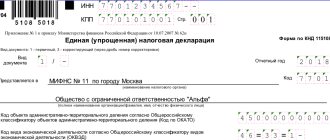

Filling out the report title page

Completing any document and report begins with the title page. It contains basic information about the organization.

The following information must be reflected on the title page:

- We begin filling out the title page by indicating the registration number of the company under which it is listed in the Social Insurance Fund system (10 digits) and subordination code (5 digits)

- You should then indicate whether the form is being submitted for the first time (original) or whether an adjustment report is being submitted. In case of resubmission, the correction number is indicated.

- The field where you need to indicate the reporting period consists of two parts. In the first, we indicate directly the code of the reporting period, and after a fraction the number of applications for insurance payments. If there were no such payments, the field remains empty.

- Here we enter the year for which the report is being submitted.

- If the company decides to cease its activities, a mark is placed in the appropriate field.

- In the next line you need to enter the full name of the organization or entrepreneur

- The next block contains information about the Taxpayer Identification Number (TIN), KPP, OGRN, OKVED code and telephone number of the head of the company. Here, for budgetary organizations, it is indicated from which budget the funding comes from. In the TIN and OGRN fields, companies leave the first 2 squares empty, so you need to put zeros there.

- The next block concerns the company address. We enter the registration address of the company or entrepreneur there.

- Next, you need to provide information on the number of workers, disabled people and those who have harmful and dangerous working conditions in the workplace.

- In the footer of the document, as always, we indicate who draws up and submits the document. If this is done through a representative, then a power of attorney is drawn up and its details are entered. The date and signature are put, and the signature is deciphered.

This completes filling out the title page of the report.