Deductions

Since 2015, all enterprises are required to submit reports in accordance with Form 4 of the Social Insurance Fund. The new ones

Rules in force at the beginning of the year Let us note that the labor certification sample is currently in use

In this article we will figure out what documents are needed to transport cargo or goods by road.

The procedure for collecting insurance premiums The insurance system for citizens in case of temporary disability is presented in our

Let's look at the key features of drawing up and submitting a balance sheet in 2021 and provide a sample

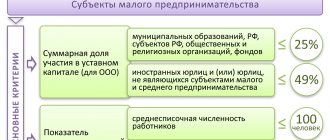

Simplified reporting can be submitted by small businesses, non-profit organizations and participants of the Skolkovo project that are not subject to

General approach From January 1, 2021, the Law of August 3, 2018 No. 303-FZ (hereinafter referred to as

According to Article 168 of the Labor Code of the Russian Federation, the following employee expenses for

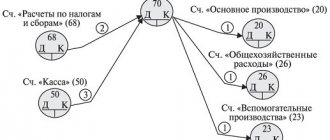

In the “accounting entries” section you will find a detailed description of all business transactions based on

What is a tax deduction? What can you get a property deduction for? The amount of the deduction when purchasing