Procedure for collecting insurance premiums

The insurance system for citizens in case of temporary disability is represented in our country by the Social Insurance Fund. Every employer with employees must pay contributions to the fund. If an entrepreneur or organization has at least 1 employee, the company is considered the citizen’s insurer in case of illness, injury, occupational disease or maternity leave.

What is the essence of the social insurance system? If an employee is sick, injured, or an employee becomes pregnant, then they cannot work during illness or maternity leave. The state has provided a procedure for financial support for such citizens, obliging employers to pay insurance contributions from employees’ wages. This money goes to the Social Insurance Fund and is then not only distributed among sick people, those injured at work and women on maternity leave, but also goes to finance measures to protect labor and ensure safety in the workplace.

The employer pays 2 social security contributions:

- In case of temporary disability and in connection with maternity. The contribution rate is set in the range from 0 to 2.9% of wages (depending on the company’s activities and available benefits).

- From industrial accidents and occupational diseases. The contribution amount is from 0.2 to 8.5%. It depends on the degree of injury in the main type of activity at the enterprise.

Important! Even if your company is on the list of beneficiaries and does not pay contributions in case of temporary disability (for example, a simplified individual entrepreneur producing food), then you, as an employee, still have the right to pay for sick leave and parental leave.

Contributions are transferred to the fund monthly from the wages of each employee and are included in the costs of the enterprise. Merchants using the simplified tax system “income minus expenses” can accept the amount of paid contributions as expenses, and on imputation and the simplified tax system “income” they can partially reduce the tax payable.

The employee has the right to count on average earnings during the period of incapacity, but the final amount of the benefit depends on his length of service.

Note! In some cases, other rules for paying average earnings apply. For example, if an employee’s illness or injury was the result of intoxication, then the amount of benefits is limited to the minimum wage, regardless of the guard.

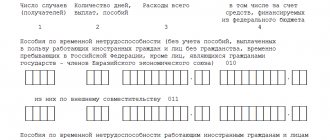

Section II, Table 8, Table 9

The indicators in Table 8 reflect data on the amount of expenses associated with industrial accidents and occupational diseases, as well as the number of days paid in connection with these cases.

Table 9 reflects the number of people affected by industrial accidents and occupational diseases.

The procedure for registration, investigation and recording of accidents is regulated by Articles 227-231 of the Labor Code.

Read more about the procedure for investigating, recording and registering accidents at work in the article “Accidents at work and compulsory insurance”