Sometimes a change in an agreement leads to the fact that in one personal account the balances will be reflected in two different agreements (on the old and on the new). Such situations can lead to various difficult situations, for example, when calculating penalties or when uploading payment documents to the Housing and Communal Services GIS.

In this article we:

- We will find out where debts that are not visible to the average user are actually hidden.

- Let's look at how to ensure correct utility accounting in terms of contracts

- Let's talk about adjusting mutual settlements

- Let's look at situations that you may encounter due to incorrect distribution of contract balances.

- We’ll show you how you can fix everything and handle mutual settlements correctly

How to conduct accounting in a management company

Accounting entries in the housing and communal services management company often concern only two actions:

- Purchasing resources from supply companies.

- Sale of resources to residents of houses.

In the first action, accountants form accounts payable and expenses of the management company, in the second - accounts receivable and profit. Therefore, it is better to conduct accounting in housing and communal services in the following way - create an accounting policy. This refers to the nuances of accounting for assets and liabilities, profits and losses. The more correctly and accurately the accounting entries are drawn up, the more elementary the work of accountants will be. Why this is needed is clear, but what it should include in a little more detail. This is an accounting of the following transactions:

- settlements with companies providing resources;

- consumption of materials;

- settlements with tenants-buyers of utilities;

- income and expenses;

- performers' salaries;

- tax calculations;

- settlements under other counterparty agreements.

All the basic provisions that help to correctly conduct the accounting policy in the housing and communal services management company regarding expenses and income are in the Accounting Regulations 1/2008. In addition to accounting, the management company also maintains tax accounting in public utilities, the policy of which complies with the criteria of the Tax Code of Russia.

The chart of accounts is necessary directly for accounting, therefore such activities are approached with full responsibility. The work plan is created on the basis of a legislative act of the Ministry of Finance. It is necessary to enter into the plan only accounts that are actually used by the management company. And, for example, postings related to animals and other similar ones should not be included.

In many cases, management companies use a unified form for accounting purposes, which is approved by Goskomstat. But since 2013 it may not be used. In any situation, management companies approve their forms in their accounting policies. Samples can be found for free on the Internet.

The accounting policy, chart of accounts and accounting forms must be drawn up in one order, which is signed by the management of the management company and the chief accountant. Such an act should be rewritten every year, since laws change and accounting policies become outdated.

The accounting records of enterprises must be maintained without interruption, regularly, all actions are reflected in the postings, which will be discussed below, and in primary documents. Accountants must prepare reports in accordance with the required standard, which is written in the Federal Law “On Accounting”. In addition, statistics are also calculated. The accounting policy processes described above are mandatory in the accounting department of the management company.

Mistake number 5: the director and individual manager have the same functions

Immutability of functions Tsareva D.V. in the organization, despite the change in the legal structure of legal relations... (case No. A76-10654/2019).

From the primary documents it is clear that when the company replaced the employment contract with Vinokurov P.V. to a civil contract, his labor function for managing the current activities of Prim-DV LLC has not undergone significant changes. The scope of his employment and accountability remained the same (clause 5.2 of the Charter). This agreement is not aimed at achieving an independent commercial result by an individual entrepreneur; the work he performs is systematic and lengthy in nature and involves a continuous process of work (Resolution dated August 8, 2021 N 06AP-3013/ 2018).

OSNO or simplified

The general tax system (OSNO) is more suitable because of its simplicity for all management companies. But the rather large amount of income tax - 20 percent and VAT make this type not very profitable. When paying VAT to OSNO, management companies have benefits in comparison with other commercial organizations, since, in accordance with tax legislation, utility bills that are provided to residents and repair work with hired accounting personnel are not subject to VAT.

But legal standards in reality do not provide any economic benefits to utility management organizations. When purchasing resources, this is impossible, since the purchase is carried out at a single tariff, so the tax base for VAT is zero. When providing paid services to owners and tenants, VAT is not charged only in a situation where the profit is equal to the costs to the contractors.

Therefore, it is often beneficial to use a simplified taxation system, but there are also restrictions on its use:

- if the profit exceeds 60 million rubles, then simplification is impossible;

- if a utility company has more than 100 people on its staff, then such a simplified tax system is also impossible;

- You cannot use the simplification even if the cost of fixed assets is less than 100 million rubles.

But in reality, most criminal codes correspond to the data for the simplified tax system. You can make the simplified form the main form for taxation at the tax service; you just need to write a proper application before the end of the year. Under the simplified tax system, companies are exempt from VAT and income tax, but at the same time they pay the tax that is necessary for this regime.

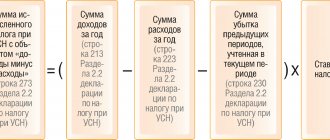

For the “income” section, the amount of this tax is 6 percent, and for the “income minus expenses” section - 15 percent. A feature of this form of taxation is the establishment of profit using the cash method, which means that income is determined only by the inflow of money and its outflow from the management account.

To select a system, the income and expenses of utility management companies should be taken into account and compared by the accounting service. When they are often in the red, it is more profitable to use the simplified taxation system “income minus expenses”, because you will only need to pay minimal fees in the amount of one percent of the profit for a specific period of time. But it is also worth considering that such figures may differ greatly from income and expenses using the accrual method.

Features of taxation in the housing and communal services sector

The housing and communal services complex of Russia consists of many enterprises of different organizational and legal forms, departmental subordination and forms of ownership. Creating uniform rules for everyone is not easy. The same applies to the taxation system. After all, housing and communal services are a socially significant activity; its services should be available to all social strata, no matter what income they have.

Another feature of the housing and communal services system is that one of the sources of its financing is tax revenues. After all, many of its enterprises and organizations are municipal or regional property, which means they are financed from the budget, that is, from taxpayers. On the other hand, all structures providing housing and communal services are required to pay taxes and fees to extra-budgetary funds.

At the same time, there has long been a struggle in the government between supporters and opponents of providing significant tax benefits to housing and communal services enterprises. The need for such an approach is motivated precisely by the fact that the “communal apartment” performs an important social function in our country. However, the economic bloc of the government repeatedly rejects this possibility.

Postings in the accounting of the management company

Now let's look at the accounting entries, the number of which exceeds other calculations in the management company. To make it more convenient, we will divide them into two subsections, which we outlined earlier:

Purchasing resources:

- D20 K60 – purchase of electricity, water and gas from resource supply organizations;

- D19 K60 – VAT on purchased resources is reproduced;

- D68 K19 – VAT is omitted for deduction;

- D60 K51 – money was transferred as payment for purchased resources.

Providing services to residents of apartment buildings:

- D62 K90/1 – invoicing of utility organizations;

- D 90/2 K20 – displays the cost of the provided CG;

- D90/3 K68 – VAT calculated by the company;

- D51 K62 – payment from residents;

D60 K62 – transfer of money transferred from residents to resource supply companies.

This posting example is effective for management companies that use OSNO. When accounting using simplified accounting, the third and seventh points are excluded. VAT benefits under the general system are reflected in calculations in the following way:

- D20 K19 – VAT on purchased resources is reflected in the cost price.

The third and seventh points are also excluded. All these operations occur more often than others at the management company, but other transactions also occur. If such cases arise, please refer to the instructions for the chart of accounts, which is included in Order No. 94n of the Ministry of Finance.

We have prepared a set of documents for you to make it easier for you to justify working with an individual entrepreneur

To make it easier for you to prove your integrity and so that you can work calmly with the manager, we have developed a completely ready-to-implement set of documents for working with an individual entrepreneur. This kit includes:

- comprehensive instructions on how to properly work with individual entrepreneurs and avoid mistakes that would allow the inspectorate to declare it fictitious (16 pages);

- template of the agreement with the manager, justifying the remuneration (16 pages).

The contract specifies how the document flow occurs. In addition, a remuneration system is prescribed: it is made dependent on various company indicators and the manager’s performance. This gives you the opportunity to justify the cost of the individual entrepreneur’s work. If the inspection makes claims regarding the price of the manager’s work, then you will have all the tools to “repel” these claims.

- changes to the company's Charter (1 page);

- example of an act of services rendered/work performed (1 page);

- example of a manager’s report on his work (3 pages);

- example of calculating manager's remuneration (2 pages);

- example of an individual entrepreneur's expense report (1 page);

- interaction guide (9 pages);

- OKVED for individual entrepreneur (1 page);

- minutes of the general meeting on the signing of an agreement with the individual entrepreneur (4 pages);

- judicial practice on attempts by the inspectorate to declare that an individual entrepreneur is a scheme for illegal tax evasion (5 cases).

The entire kit is aimed at maximizing all the risks associated with working with an individual entrepreneur.

A set of documents for safe work with an individual entrepreneur

Find out more about the ready-to-implement set of documents with which you can safely work with an individual entrepreneur.

Find out more

OKVED

When a management company is registered, you need to select a code in the All-Russian Classifier of Types of Economic Activities (OKVED). This is necessary so that regulatory authorities are aware of the company’s activities. For management companies, this is code 70.32.1 (Management of housing stock activities). But often management companies set the value 70.32 (Real estate management), which connects three subtypes of activity.

To summarize, let's say that the accounting policies of the housing and communal services management company do not cause difficulties in calculations, since they are the same type of operations. The main thing is to maintain order and conduct housing and communal services and accounting at enterprises regularly without interruptions, and also act in accordance with the regulations and current laws. Then the controlling organizations will not ask any questions.

Normative base

The procedure for the activities of a voluntary association of owners of residential premises is determined by the third paragraph of Article 50 of the Civil Code. It indicates the possibility of association for management, which considers the common property of the residents of apartment buildings, on a collegial basis. Joining the HOA is carried out on a voluntary basis.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

The Housing Code (Article 135) determines the procedure for the activities of this structure as a legal entity. The Tax Code of the Russian Federation considers the taxation procedure.

List of taxes paid

The homeowners' association, despite its status as a non-profit organization, necessarily makes tax contributions to the state budget. To the list of taxes in the HOA:

- Tax on profit received by the structure.

- Deductions imposed on added value.

- Payment made on the basis of property tax.

- Payment of transport tax.

- Direction of funds for land tax.

The need to pay taxes is associated with the HOA conducting various commercial activities. The taxable base does not include permanent and one-time targeted payments to members of the partnership. Those residents who refuse to join this non-profit organization must also pay utility bills. Such payments received by the management organization are not targeted and must be taken into account for tax purposes.

Tax is also assessed on the conduct of commercial activities of the HOA associated with the receipt of profit from the use of premises and local area.

Which system is more beneficial for a particular organization?

Each HOA independently chooses the optimal taxation system for itself. To determine the optimal parameters, a table is used to help determine the final tax burden:

The following is entered into the table:

| Indicators (rub) | BASIC | simplified tax system |

| Income | ||

| Expenses | ||

Taxes including

| ||

| Profit received at disposal | ||

| Tax burden as a percentage |

When filling out the columns of the table, the management of the HOA can determine the optimal type of taxation for itself. Waiving the simplified tax system is convenient for homeowners’ associations that have significant additional commercial income. For example, from making payments by residents who are not owners, or from commercial use of the areas of an apartment building.

HOA Insurance Premium Options

The final amount of insurance premiums paid by the partnership is determined by the provisions of the Tax Code of the Russian Federation. Insurance premiums are required to be paid for each full-time employee of this organization.

The size is determined in Article 426 of the Tax Code:

- 22% is being sent to the Russian Federation.

- 2.9% of the amounts accrued to full-time specialists are sent to the Social Insurance Fund.

- It is required to send 5.1% of the salary to compulsory medical insurance.

Attention:

Amounts are created through the payment of membership fees by HOA members. Their size is determined at the general meeting. There may also be one-time payments. For example, a payment for the creation of the non-profit structure itself. But these amounts cannot be used to pay salaries to full-time specialists. Consequently, wage insurance premiums are not charged on these funds. Regular contributions are paid monthly. They are included in the personal account of HOA members.

Cases of non-payment of taxes by HOAs

A non-profit structure that brings together homeowners for the successful management of a property has the official right not to pay taxes. This applies to targeted income. The HOA also has the right to take advantage of the invitation of specialized organizations that will carry out maintenance activities on the territory of the building and the surrounding area on the basis of an agreement.

The fact of the existence of an agreement automatically transfers all tax payments to the executing organization. In other cases, payments must be made.

Options for tax payment nuances

The list of nuances of HOA taxation includes:

- Mandatory formation by the board of a complete accounting report of all financial receipts and expenses. The report is compiled by the board and submitted for consideration and approval by all members of the partnership. The accepted report must be published for review on the official website of the partnership, if available, and on the website reformagkh.ru. The reports are checked by employees of the territorial housing inspection. The documentation is prepared according to the official form approved by the Ministry of Labor of the Russian Federation.

- By default, the HOA is on the general taxation scheme. To switch to a simplified system, an application for transfer to the tax office is being prepared. It is reviewed and approved within five days after submission.

- In the case of collecting funds for operations in which the HOA is the performer, they are considered as non-operating income. Payments become non-operating expenses of the organization.

- Funds allocated for capital repairs fall into the category of targeted financing and can be provided with government support. Funds spent on major repairs using all payments are accounted for in a separate report.

Attention

The nuances of accounting for a homeowners' association are based on the type of activity of the association, the decisions of which are made collectively. Tax payments must also be under public control.

Comments Showing 0 of 0