Since 2015, all enterprises are required to submit reports in accordance with Form 4 of the Social Insurance Fund. New companies often have questions about the formation and submission of documents by period. How to fill out 4 FSS for six months and what awaits the organization in the absence of a report.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Who should report

All insurers are required to submit a calculation in form 4-FSS for the 2nd quarter of 2021: organizations and individual entrepreneurs paying individuals remuneration subject to contributions “for injuries” (Clause 1 of Article 24 of the Law of July 24, 1998 No. 125-FZ).

Individual entrepreneurs without employees who pay insurance premiums only “for themselves.” They do not need to submit 4-FSS for the 2nd quarter of 2021.

If for some reason an organization in the first half of 2017 did not make payments that are recognized as subject to insurance contributions to the Social Insurance Fund, and does not pay these contributions, then, despite this, it is necessary to submit a zero 4-FSS report for the 2nd quarter of 2021.

How to fill out the form

The report is provided in electronic or paper form.

Only organizations (including those created, reorganized) whose average number of individuals for the previous year did not exceed 25 people have the right to provide a report on paper.

Here are some features of filling out the form on paper:

- If there are no indicators, dashes are entered in the fields.

- Cost indicators are indicated in rubles and kopecks.

- All sheets must contain a registration code and a subordination code. Continuous numbering should only be on completed pages.

- Errors may not be corrected by correction or other similar means. The erroneous value is crossed out, the correct value is entered, certified with a signature and seal indicating the date of correction.

Organizations located on the territory of the constituent entities of the Russian Federation and participating in the pilot project fill out form 4-FSS taking into account the requirements set out in the appendix to the Order of the FSS of the Russian Federation dated March 28, 2017 No. 114.

The list of constituent entities of the Russian Federation in which pilot projects have been adopted can be found in paragraph 2 of Decree of the Government of the Russian Federation dated April 21, 2011 No. 294.

From 07/01/2017, the Republic of Adygea, the Republic of Altai, the Republic of Buryatia, the Republic of Kalmykia, the Altai and Primorsky Territories, the Amur, Vologda, Magadan, Omsk, Oryol, Tomsk regions and the Jewish Autonomous Region took part in the pilot project.

Moscow and St. Petersburg are not participating in the pilot project.

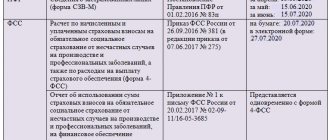

When to report: deadlines

Calculations must be submitted on 4-FSS forms based on the results of the reporting periods:

- I quarter;

- half a year;

- nine months;

- of the year.

“On paper,” 4-FSS reports must be submitted no later than the 20th day of the month following the reporting period. In electronic form - no later than the 25th day of the month following the reporting period (Clause 1, Article 24 of the Federal Law of July 24, 1998 No. 125-FZ). If the due date falls on a weekend, you must report on the next working day.

Thus, the deadline for submitting 4-FSS for the 2nd quarter of 2021 is no later than July 20 “on paper” and no later than July 25 – in electronic form.

As we have already said, 4-FSS is submitted based on the results of the reporting periods. Therefore, it is more correct to call the current reporting “4-FSS for the first half of 2021” rather than for the 2nd quarter.

What a responsibility

For violation of the deadline for submitting 4-FSS, a fine is provided - 5% of the amount of “injury” contributions accrued for payment for April, May and June, for each full or partial month of delay. However, the fine cannot be less than 1000 rubles and should not exceed 30% of the specified amount of contributions. Also, the employee of the organization responsible for submitting reports may be fined from 300 to 500 rubles. according to Part 2 of Art. 15.33 Code of Administrative Offenses of the Russian Federation.

In January 2021, all policyholders must submit Form 4-FSS for 2021 to social insurance. We will tell you how to report to the fund without any problems.

New calculation form

From 2021, the new 4-FSS form will be used. It was approved by order of the FSS of Russia dated September 26, 2016 No. 381. Report 4-FSS for the 2nd quarter of 2021 in Excel format.

The 4-FSS report form includes:

- title page;

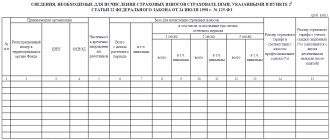

- table 1 “Calculation of the base for calculating insurance premiums”;

- Table 1.1 “Information required for calculating insurance premiums by policyholders specified in paragraph 21 of Article 22 of the Federal Law of July 24, 1998 No. 125-FZ.” (for situations where employees are temporarily employed in another organization or with an individual entrepreneur);

- table 2 “Calculations for compulsory social insurance against accidents at work and occupational diseases”;

- Table 3 “Expenses for compulsory social insurance against accidents at work and occupational diseases”;

- table 4 “Number of victims (insured) in connection with insured events in the reporting period”;

- Table 5 “Information on the results of a special assessment of working conditions and mandatory preliminary and periodic medical examinations of workers at the beginning of the year.”

Electronic format

The electronic format of 4-FSS and control ratios are approved by Order of the FSS of Russia dated 03/09/2017 No. 83.

The FSS has changed the form of the report on accrued and paid insurance premiums “for injuries” (4-FSS). The amendments were made by Order No. 275 of the Social Insurance Fund dated 06/07/2017. The updated calculation form comes into force on 07/09/2017. But what has changed in the form? Let me explain.

A new field has appeared on the title page, which will need to be filled out by budgetary organizations. Also, Table 2 “Calculations for compulsory social insurance against industrial accidents and occupational diseases” has been supplemented with two new lines:

- 1.1. “Debt owed by a reorganized policyholder and/or a separate division of the organization deregistered”;

- 14.1 “Debt from the territorial body of the Fund to the policyholder and/or to a separate division of a legal entity that has been deregistered.”

But in what form will the Social Insurance Fund accept payments for the first half of 2017 (old or new)? Will they even accept 4-FSS for the 2nd quarter of 2017 on the old form if the report is submitted before July 9? The FSS provided an explanation on its website that Order No. 275 dated 06/07/2017 came into force on the date after the start of the reporting campaign for the 2nd quarter of 2021. Therefore, this order should be applied starting with reporting for 9 months of 2021. However, it is not entirely clear on what basis such a conclusion was made. From a legal point of view, from July 9, only the new form 4-FSS can be used.

Fine for violating the deadline for submitting Form 4-FSS

The fine for violating the deadlines for submitting 4-FSS is provided for by Federal Law No. 125-FZ of July 24, 1998. So, if the policyholder does not report to the fund on time, then he faces a fine of 5 percent of the amount of injury premiums accrued for payment for each full or partial month of delay. The maximum fine is 30 percent of the calculated amount of contributions, the minimum is 1 thousand rubles.

For failure to comply with the method of submitting the form electronically, a sanction has also been established - 200 rubles.

In addition, there is administrative liability for violating the deadline for submitting the form: the official can be fined in the amount of 300 to 500 rubles (Part 2 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

Form 4-FSS reflects not only the calculation of insurance premiums in case of injury, but also data on accident benefits, medical examinations of employees and special assessment of workplaces.

Form 4-FSS for the 1st quarter of 2021 must be submitted on a new form, taking into account the adopted changes. The calculation and procedure for filling it out are approved in Appendix No. 1 to Order No. 381 of the FSS of the Russian Federation dated September 26, 2016. The latest changes were made relatively recently (06/07/2017) by Order of the FSS of the Russian Federation No. 275. We recommend downloading the new form of Form 4-FSS for the 1st quarter of 2021 free in excel format, you will need it more than once.

4-FSS reporting should be completed on an accrual basis from the beginning of the reporting period, that is, the year. Consequently, policyholders submit this report to Social Insurance only four times a year: at the end of the previous year, for the 1st quarter, for the 1st half of the year, for 9 months of the current year.

FSS form for the 1st quarter of 2021

The report form to the Social Insurance Fund for the 1st quarter of 2021 contains mandatory and additional sheets. Mandatory sheets are filled out for all insured persons, and additional sheets are filled out only if data is available.

Mandatory sheets include the title page, tables 1, 2 and 5. Additional sheets include tables 1.1, 3 and 4.

The essence of the form to be filled out has not changed compared to previous reporting periods, but some new values have been added.

A new code field “Budgetary Organization” appeared on the title page. In it, public sector organizations must indicate the source of funding.

New rows have been added to Table 2:

- line 1.1 “Debt owed by a reorganized policyholder and (or) a separate division of a legal entity deregistered”;

- line 14.1 “Debt of the territorial body of the Fund to the policyholder and (or) a separate division of a legal entity deregistered.”

These lines are “mirror” - the value is shown depending on who owns the debt. The line reflects the amount of transferred debt from a reorganized insurer or a separate division deregistered.

Let's look at an example of filling out 4-FSS for the 1st quarter.

Let's assume that payments to individuals for the period amounted to 90,000 rubles. (monthly 30,000 rubles). The organization's outstanding contributions to the Social Insurance Fund as of January 1, 2019 amounted to 100 rubles. Contributions were promptly transferred in full to the Social Insurance Fund (monthly - 60 rubles, the debt was fully repaid as of 01/01/2019). The insurance rate is 0.2%.

Completed form 4-FSS for 1 quarter. 2019

Where to send the report

If the organization does not have separate divisions, then 4-FSS for the 2nd quarter of 2021 must be submitted to the territorial branch of the FSS of Russia at the place of registration of the company (Clause 1, Article 24 of the Federal Law of July 24, 1998 No. 125-FZ).

If there are separate divisions, then Form 4-FSS for the 2nd quarter of 2021 must be submitted to the location of the separate division. But only on the condition that the “isolation” has its own current (personal) account in the bank and it independently pays salaries to employees.

Deadlines for submitting Form 4-FSS for 2021

Companies submit Form 4-FSS to the branch of the FSS of the Russian Federation at the place of their registration within the following deadlines:

- no later than the 25th day of the month following the reporting period, if reporting is sent electronically;

- no later than the 20th day of the month following the reporting period, if it is submitted in paper form.

Thus, you must submit the calculation in form 4-FSS for 2021 no later than:

- January 22, 2021, if the policyholder reports on paper (the postponement is due to weekends);

- January 25, 2021, if the policyholder submits reports electronically.

Let us remind you that policyholders whose average number of employees exceeds 25 people send Form 4-FSS to social insurance in electronic form. Policyholders with this indicator of 25 people or less can submit the form on paper.

Federal Law of July 24, 1998 No. 125-FZ (as amended on July 29, 2017).

Completion rules and required sections

The rules for filling out the 4-FSS calculation are contained in the Procedure approved by Order of the FSS of Russia dated September 26, 2016 No. 381. This document (in paragraph 2) stipulates that the calculation (including for the 2nd quarter of 2021) must include:

- title page;

- tables 1, 2 and 5.

The remaining tables are filled in only if there is information that needs to be recorded in these tables.

Even if the organization did not operate during the reporting period, the “zero” 4-FSS for the 2nd quarter of 2021 still needs to be submitted. You only need to fill out the required sections:

- title page;

- Table 1 “Calculation of the base”;

- table 2 “Calculations for social fear.";

- Table 5 “Information on the assessment of working conditions.”

Next, we provide samples of filling out 4-FSS for the 2nd quarter of 2021, which was formed using a specific example (with line-by-line explanations).

Title page

If you are submitting the first payment in form 4-FSS for the 2nd quarter of 2021, then enter “000” in the “Adjustment number” field. If you are clarifying the semi-annual report, then indicate the adjustment number (for example, “001”, “002”, etc.)

When you fill out the calculation for the 2nd quarter of 2021, indicate “06” in the “Reporting period” field, and put dashes in the next two cells.

Indicate the name of the organization. For individual entrepreneurs, you must indicate your last name, first name and patronymic. Also indicate the TIN and KPP, postal code and registration address.

In the “OKVED Code” field, show the main code of the type of economic activity of the policyholder according to the OKVED2 classifier OK 029-2014.

In the “Average number of employees” field, indicate the average number of employees. In the fields “Number of working disabled people”, “Number of employees engaged in work with harmful and (or) dangerous production factors” - indicate the list number of working disabled people and employees employed in hazardous working conditions. Form all indicators as of the reporting date - June 30, 2021 (clause 7 5.14 of the Procedure, approved by Order of the Federal Tax Service of Russia dated September 26, 2016 No. 381).

Table 1

In Table 1 of the 4-FSS report for the 2nd quarter of 2021 you need to show:

- payments subject to insurance premiums for half a year and separately for April, May and June;

- payments from which contributions “for injuries” are not accrued;

- basis for calculation;

- tariff rate;

- discount and surcharge to the insurance rate;

- tariff including discount/surcharge.

Let's decipher the content of the rows of table 1:

| Table 1 rows | |

| Line | What needs to be shown |

| 1 | The calculation base for calculating insurance premiums (that is, the amount of payments subject to insurance premiums). |

| 2 | Payments that are not subject to insurance premiums. |

| 3 | The basis for calculating contributions (this is the difference between lines 1 and 2). |

| 4 | The amount of payments in favor of disabled people. |

| 5 | Insurance rate. |

| 6 | The percentage of discount on the tariff (if you are eligible for a discount). |

| 7 | The percentage of the premium to the insurance rate (if established). |

| 8 | The date of the order of the Social Insurance Fund authority to establish the premium. |

| 9 | The final rate of insurance premiums. |

Table 1.1 should be compiled exclusively by those insured employers who temporarily transfer their employees to other organizations or entrepreneurs. If so, then the table needs to reflect:

- number of assigned workers;

- payments from which insurance premiums are calculated for half a year, for April, May and June;

- payments in favor of disabled people;

- the insurance premium rate of the receiving party.

table 2

Table 2 should contain the following information:

- on arrears of insurance premiums at the beginning of 2021 and as of June 30, 2021;

- about insurance premiums “for injuries” accrued and paid in April, May and June and for the entire six months;

- amounts accrued based on the results of inspections;

- expenses that were not accepted by the Social Insurance Fund for offset in the first half of the year;

- returns from the Social Insurance Fund;

- expenses reimbursed by the Social Insurance Fund.

As for row-by-row filling, show the following information in the main rows of this table:

- in line 1 - debt on accident insurance contributions at the beginning of 2021;

- in lines 2 and 16 - accrued and paid amounts of accident insurance premiums since the beginning of 2021;

- in line 12 - the debt of the FSS body of the Russian Federation to the policyholder at the beginning of 2021;

- in line 15 – accident insurance expenses incurred since the beginning of 2021;

- in line 19 – arrears in accident insurance contributions as of June 30, 2021, including arrears in line 20;

- in other lines - the remaining available information.

Table 3

Please fill out Table 3 as part of Form 4-FSS for the 2nd quarter of 2021 if in the first half of the year you paid hospital benefits in connection with work-related injuries and occupational diseases, financed injury prevention measures, and incurred other expenses for insurance against accidents and occupational diseases. An exhaustive list of such expenses is given in paragraph 1 of Article 8 of the Federal Law of July 24, 1998 No. 125-FZ. The table is formed on a cumulative basis from the beginning of 2021.

| Table rows 3 | |

| Line | What needs to be shown |

| 1 | Paid temporary disability benefits due to industrial accidents. |

| 2 | Information about benefits for external part-time workers. |

| 3 | Information about benefits for citizens who suffered in other organizations. |

| 4 | Information on benefits related to occupational diseases. |

| 5 | Information about benefits for external part-time workers. |

| 6 | Information about benefits for citizens who suffered in other organizations. |

| 7 | Data on payment of vacations for sanatorium-resort treatment of employees. |

| 8 | Amounts of payments and other remuneration accrued in favor of foreign citizens and stateless persons temporarily staying in the Russian Federation, except for persons who are citizens of the EAEU member states. |

| 9 | Data on preventive measures to reduce industrial injuries and occupational diseases (if any). |

| 10 | Summarizing data as a result of adding rows 1 + 4 + 7 + 9. The sum must coincide with row 15 of table 2. |

Procedure for filling out form 4-FSS

Form 4-FSS and the procedure for filling it out were approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381.

All policyholders must submit to the fund a title page, tables 1, 2, 5. The remaining tables do not need to be filled out or submitted if there are no indicators.

When filling out the title page, you should first of all pay attention to the “Subordination Code” indicator. Here you need to indicate the 5-digit code assigned to the policyholder, which indicates the territorial body of the fund in which the policyholder is currently registered.

In the “Average number of employees” field, you should indicate the average number of employees for 2021. This indicator is calculated in accordance with Rosstat Order No. 498 dated October 26, 2015.

In the field “Number of working disabled people” you need to reflect the number of such workers as of December 31, 2017.

Table: “Structure of Form 4-FSS”

| Table | How to fill |

| Here you need to calculate the base for calculating accident insurance premiums on an accrual basis from the beginning of the billing period and for each of the last three months of the reporting period. Determine the size of the insurance rate taking into account the discount or surcharge | |

| The table is filled out by insurers sending their workers temporarily under an agreement on the provision of labor for workers (personnel) in the cases and on the conditions established by the Labor Code of the Russian Federation | |

| The table should reflect the following information according to accounting data: - in line 1 - debt on contributions for accident insurance at the beginning of the billing period. This information must correspond to the information about the insured's debt at the end of the previous billing period specified in the form for such period; - in lines 2 and 16 - the amounts of contributions for accident insurance accrued from the beginning of the billing period and paid; - in line 12 - the debt of the territorial body of the FSS of the Russian Federation to the policyholder at the beginning of the billing period. These data must correspond to information on the debt of the territorial body of the fund at the end of the previous billing period, given in the form for such a period; - in line 15 - expenses incurred for accident insurance since the beginning of the year; - in line 19 - debt on contributions for accident insurance at the end of the reporting (calculation) period, including arrears - on line 20; — line 1.1 reflects the amount of debt of the reorganized insurer and (or) the deregistered separate division to the Federal Social Insurance Fund of the Russian Federation; — line 14.1 indicates information about the debt of the Federal Social Insurance Fund of the Russian Federation to the reorganized policyholder and (or) to the deregistered separate division. These lines are filled in by insurers-successors and organizations that included such separate divisions. Other lines contain the rest of the available data. | |

| The insurer's expenses for compulsory social insurance against accidents at work and occupational diseases are reflected. In addition, this table includes data on expenses incurred by the insurer to finance preventive measures to reduce industrial injuries and occupational diseases | |

| Data is reflected based on reports of industrial accidents and cases of occupational diseases at the enterprise | |

| This table must reflect the following information: — on the total number of jobs subject to a special assessment of working conditions, and on the results of the special assessment, and if the validity period of the certification results of the jobs has not expired, then information based on this certification; — on mandatory preliminary and periodic medical examinations of employees. All data in this table must be indicated as of 01/01/2017. That is, information about special assessments and medical examinations that were carried out during the year does not need to be reflected. Therefore, Table 5 in Form 4-FSS for all reporting periods in 2021 will be the same |

Order of the Federal Insurance Service of the Russian Federation dated September 26, 2016 No. 381.

Table 4

Submit Table 4 as part of the 4-FSS report for the 2nd quarter of 2017, if from January to June there were industrial accidents or occupational diseases were identified.

| Rows of table 4: decoding | |

| Line | What needs to be shown |

| 1 | The number of employees who were injured at work in the first half of 2021. |

| 2 | How many died due to accidents? |

| 3 | The number of workers who were diagnosed with occupational diseases from January to June. |

| 4 | The sum of rows 1 and 3 of table 4. |

| 5 | The number of cases at work or occupational diseases that resulted in temporary disability. |

Report submission deadline

The completed form is submitted to the territorial body of the Social Insurance Fund at the place of registration of the organization.

In accordance with paragraph 1 of Art. 24 of Law No. 125-FZ of July 24, 1998, the deadline for submitting the report is set as follows:

- on paper - no later than the 20th day of the month following the expired quarter;

- in the form of an electronic document - no later than the 25th day of the month following the expired quarter.

If the reporting date falls on a holiday or weekend, you can report on the first working day after it. However, inspectors strongly do not recommend postponing reporting until the last day.

Share your opinion on the article or the experts to get a response

Each enterprise, individual entrepreneurs, and companies with employees must provide quarterly reporting in Form 4-FSS. It contains data on contributions to the Social Insurance Fund.

Below we have prepared a file with the new 4-FSS form in excel format, which can be viewed and downloaded for free and without registration.

New form 4-FSS 2021 -

On June 7, 2021, Order No. 275 of the Ministry of Justice of the Russian Federation was issued, which approved the new form 4-FSS. The order comes into force on July 9, 2017. The amendments affected the title page and table No. 2.

Order of the FSS of the Russian Federation dated 06/07/2017 No. 275 on amendments to form 4-FSS -

The title page began to contain a special field “Budgetary organization”. This field indicates the funding source code. 2 new rows were added to table No. 2. As a result, the new form became significantly smaller in volume.

Changes to the title page of the new form 4-FSS 2019

- the only code left is OKVED (main activity);

- it is not required to indicate on the title page the number of working women;

- it is required to indicate the number of disabled people working and employees in hazardous work;

- There is no need to enter a payer code.

Changes to 6 tables of the new form 4-FSS

- the number of employees must be determined on the last day of the reporting quarter;

- you need to describe how many contributions were accrued for the 2nd quarter and separately for each month;

- it is necessary to reflect accruals from January to March 2021 and the total amount for the six months;

- data on special assessments for the 1st half of the year and the 1st quarter must match.

Important!

If the number of employees for 2021 exceeded 25 people or exceeds 25 people in a newly created organization, then the new Form 4-FSS for the 2nd quarter of 2021 should be submitted electronically. If you submit it in paper form, you will be fined 200 rubles. for organization plus 300-500 rubles. on officials. If the number of employees is less than 25 people, then you have a choice: submit in paper form or electronically, it’s up to you.

Table 5

In Table 5, record:

- total number of jobs;

- the number of workplaces where a special assessment of working conditions was carried out (the certification results are valid), and harmful and dangerous conditions were identified;

- the number of workers who work in hazardous conditions and must undergo periodic medical examinations, and how many of them have undergone such medical examinations.

In Table 5 as part of the 4-FSS report for the 2nd quarter of 2021, show the information:

- on the total number of workplaces subject to a special assessment of working conditions, and on the results of the special assessment, and if the validity period of the workplace certification results has not expired, then information based on this certification;

- on mandatory preliminary and periodic medical examinations of employees. For more information about filling out Table 5 line by line, see “Filling out Table 5 of Form 4-FSS.”

Results

4-FSS is submitted by all policyholders, regardless of the presence or absence of reporting indicators. The minimum required composition of the report: title page, sections 1, 2 and 5. The remaining tables are filled out if the relevant information is available (on the number of victims of accidents in the reporting period, the amount of expenses for the payment of benefits for social security and labor protection, etc.).

You must report in electronic form (if the average number of employees is more than 25 people) or choose between an electronic and paper form of the report (if there are less than 25 employees).

Reporting deadlines for the 2nd quarter: 07/20/2020 for reports on paper and 07/27/2020 for 4-FSS in electronic form. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Completed sample

Now let’s look at filling out 4-FSS using a specific example:

Example conditions

The LLC Charodeyka organization has only five employees. Among them is one disabled person. As of the beginning of 2021 (as of January 1), the arrears (debt) on contributions for “injuries” amounted to 290 rubles. For the first half of 2021 (from January to June inclusive), contributory payments and benefits to all employees amounted to 898,000 rubles, in particular:

- for January, February, March, April and June – 150,000 rubles each;

- for May – 148,000 rubles;

- In May, one employee was awarded temporary disability benefits in the amount of 2,000 rubles.

Insurance premiums for “injuries” are determined at an insurance rate of 0.2%. And for a disabled person at a reduced (preferential) rate of 0.12 percent (0.2 × 60%). For the period from January to June 2021, insurance premiums were paid to the Social Insurance Fund: 1,666 rubles. (for December 2021 - May 2017), including April 12 - 276 rubles, May 15 - 276 rubles, June 5 - 272 rubles.

There were no accidents in the organization, and measures to prevent injuries and occupational diseases were not funded. In the second quarter of 2021, the organization conducted a special assessment of working conditions.

We present a completed sample 4-FSS for the 2nd quarter of 2021 based on the above example with indicators for the first half of 2021.

If there is a pilot project in the region, then do not fill out line 15 of Table 2 and Table 3 in Form 4-FSS for the 2nd quarter of 2021. See “Participants in the FSS pilot project in 2021.”