Does the organization have the right to withhold and transfer to the budget personal income tax amounts from wages for the first half of the month? In what order is income taxed in the form of the actual value of a share in the authorized capital of a company received by a participant upon leaving it? Is an organization recognized as a tax agent when paying an employee income for performing remote work abroad? What conditions are provided for the exemption of financial assistance amounts from taxation? How are daily allowances paid in foreign currency in excess of the established limit taxed? What is the procedure for reducing personal income tax by the amount of trade tax paid by individual entrepreneurs? You will learn about the opinion of the regulatory authorities on these issues from the presented article.

Introductory information

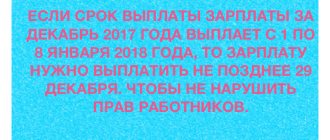

Employers must pay employees wages at least every half month (Part 6, Article 136 of the Labor Code of the Russian Federation). From October 3, 2021, salaries cannot be issued later than the 15th of the next month. See “New salary payment deadlines in 2021: what has changed.” In this case, 15 days should pass between salary and advance payment, no more (See “Salary and advance payment in 2021: how many days between payments”). Thus, the employer can issue an advance, say, on the 20th, and the basic salary for the second part of the month on the 5th.

Withholding personal income tax from the actual value of the share when a participant leaves the company.

In the event of a participant leaving the company in accordance with Art. 26 of Federal Law No. 14-FZ[1], his share passes to the company (clause 6.1 of Article 23 of this law). The company is obliged to pay the participant who submitted the application to leave the company, the actual value of his share in the authorized capital of the company, determined on the basis of the company’s financial statements for the last reporting period preceding the day of filing the application to leave the company, or, with the consent of this participant, to issue it to him in in kind property of the same value.

According to paragraph 1 of Art. 26 of Federal Law No. 14-FZ, a participant in a company has the right to leave it by alienating a share to the company, regardless of the consent of its other participants or the company, if this is provided for by the charter of the company.

The right of a participant to leave the company may be established by the charter of the company upon its establishment or amendments to its charter by decision of the general meeting of participants of the company, adopted by all participants unanimously, unless otherwise provided by federal law.

The issue of taxation of personal income tax on income in the form of the actual value of a share in the authorized capital of a company received by a participant upon leaving it was considered by the Ministry of Finance in Letter No. 03-04-06/40675 dated July 15, 2015.

Financial department specialists recalled that, by virtue of Art. 41 of the Tax Code of the Russian Federation, income is recognized as economic benefit in cash or in kind, taken into account if it is possible to evaluate it and to the extent that such benefit can be assessed, and determined for individuals in accordance with Chapter. 23 “Tax on personal income” of the Tax Code of the Russian Federation.

The rules of paragraph 1 of Art. 210 of the Tax Code of the Russian Federation provides that when determining the tax base, all income of the taxpayer that he received both in cash and in kind or the right to dispose of which he acquired, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Tax Code of the Russian Federation.

For income taxed at a rate of 13% established by paragraph 1 of Art. 224 of the Tax Code of the Russian Federation, the tax base is defined as the monetary expression of such income subject to taxation, reduced by the amount of tax deductions provided for in Art. 218 – 221 of the Tax Code of the Russian Federation (clause 3 of Article 210 of the Tax Code of the Russian Federation).

At the same time, in the current version of Ch. 23 of the Tax Code of the Russian Federation there is no provision that, when determining the tax base in the event of a participant leaving the company, reducing the income received by him in the form of the actual value of the share by the amount of the contribution to the authorized capital of the company.

Thus, when a participant leaves the company, the actual value of the share paid to him is subject to personal income tax on a general basis on the full amount of income paid.

In addition, the Ministry of Finance drew attention to the provisions of paragraphs 1 and 2 of Art. 226 of the Tax Code of the Russian Federation: Russian organizations from which or as a result of relations with which the taxpayer received income, with the exception of income for which tax is calculated and paid in accordance with Art. 214.3 – 214.6, 226.1, 227, 228 of the Tax Code of the Russian Federation, are obliged to calculate, withhold from the taxpayer and pay the amount of tax calculated in accordance with Art. 224 Tax Code of the Russian Federation. These organizations are tax agents. Since the taxpayer’s income in the form of the actual value of the share, received upon his withdrawal from the company, does not relate to the income provided for by the above-mentioned articles of the Tax Code of the Russian Federation, in relation to such income of the taxpayer, the organization is recognized as a tax agent and is obliged to calculate, withhold from the taxpayer and pay personal income tax in the generally established manner from the full amount of income paid, as well as submit the relevant information to the tax authority.

If the payment is paid in installments

For various reasons, wages may be paid to employees in installments. This can happen if the organization, for example, does not have the money to pay on time and on the same day. In this case, personal income tax should be withheld gradually from each payment. There is no need to pay the entire personal income tax on all earnings that were accrued for the month worked. This is stated in the letter of the Ministry of Finance of Russia dated July 25, 2016 No. 03-04-06/43479. Let's give an example of how to withhold personal income tax in parts.

Example. The employer issues an advance on the 20th of the current month, and a salary on the 5th of the next. However, in August 2021, part of the salary was paid on the 5th, and part on the 11th.

Employee salary – 75,000 rubles. He received an advance of 25,000 rubles on July 20. On July 31, the accountant accrued his salary for July - 75,000 rubles. Personal income tax on this amount amounted to 9,750 rubles. (RUB 75,000 × 13%).

Thus, in addition to the advance payment for July, the employee is entitled to another 40,250 rubles. (RUB 75,000 – RUB 25,000 – RUB 9,750).

On August 5, the employee was paid part of the remaining amount:

20,000 rub. – (RUB 20,000 × 13%) = RUB 17,400 Thus, the accountant withheld only the tax calculated from the advance payment and the first part of the salary. On August 11, the employee was paid the remaining amount: 26,264 rubles - (26,264 × 13%) = 22,850 rubles. In total, on August 11, 2016, the organization fully repaid the salary debt to the employee in the amount of 40,250 rubles (17,400 rubles + 22,850 rubles) and gradually withheld personal income tax. This is exactly what needs to be done when salaries are paid in installments.

Personal income tax on paid salary before vacation

In your case, the employees’ vacation is transferable and after paying the advance, the employees may not have any other accruals until the end of the month.

Therefore, if you pay an advance to an employee without withholding personal income tax, and then it turns out that the salary accrued for the month is equal to the amount paid, then at the end of the month there will be nothing to withhold tax from. And the company has no right to transfer taxes to the budget from its own funds.

This is directly prohibited by paragraph 9 of Article 226 of the Tax Code of the Russian Federation. Therefore, it is safer to withhold tax when paying an advance. As we found out, the Ministry of Finance adheres to the same position. Source: Newspaper “Accounting. Taxes.

Income tax on wages Funds received for labor are income, which consists of many components - compensation and incentive payments, bonuses, allowances, salary, all this is stipulated in the employment agreement and local acts of the organization. Personal income tax is deducted from wages at the rate of 13%. After the accountant calculates the payment, the amount of income tax is subtracted from it and the employee receives the difference in his hands.

6-personal income tax: vacation pay with salary

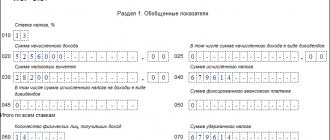

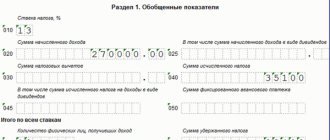

Personal income tax on personal income; line 020 – 517,700 / indicates the total amount of income (including vacation pay) accrued to individuals for the period January – June 2021; line 030 – 8,400 / indicates the amount of tax deductions provided to individuals for the period January – June 2021; line 040 – 66 209 / indicates personal income tax calculated from the income of individuals; line 060 – 2 / indicates the number of individuals who received income (including in the form of vacation pay) at all tax rates; line 070 – 55,965 / indicates personal income tax withheld from the total amount of income paid to individuals at all tax rates for the period January – June 2021. Please note! Since personal income tax on wages accrued for June 2021 will be withheld only in July when it is actually paid, this means that the corresponding amount of tax will not be included in the line 070 indicator.

Personal income tax from employee payments

If the early payment of wages is a one-time one, then, in our opinion, a statement written by the employee and endorsed by the employer, in which a request will be expressed to pay wages ahead of schedule, is sufficient. If it is planned to continue to pay wages ahead of schedule to those employees who are going on vacation , then we recommend that the corresponding condition be fixed in the internal labor regulations, other local regulations, a collective agreement or in employment contracts with employees. The answer was prepared by: Expert of the Legal Consulting Service GARANT Verkhova Nadezhda Quality control of the answer: Reviewer of the Legal Consulting Service GARANT Quote: And not June 2?

Source: https://yurist123.ru/ndfl-svyplachennoj-zp-pered-otpuskom/

Filling out 6-NDFL

If salaries are paid in installments, then personal income tax is withheld in stages. If, as in our example, the salary is paid twice, then you need to fill out two blocks of lines 100-140 of the 6-NDFL calculation. After all, the dates when the accountant withheld and transferred personal income tax are different. In the first case, on August 5 and 8, in the second, on August 11 and 12. Accordingly, in our example, in section 2 of 6-NDFL for 9 months of 2021, the salary paid in installments will be reflected as follows:

Taxation of income in a situation where the employee’s place of work is another state.

Based on clause 2 of Art. 209 of the Tax Code of the Russian Federation, the object of personal income tax taxation is income received:

- for tax residents of the Russian Federation - both from sources in the Russian Federation and from sources outside its borders;

- for individuals who are not tax residents - only from sources in the Russian Federation.

For tax purposes, remuneration for the performance of labor or other duties, work performed, service provided, action performed outside the Russian Federation refers to income received from sources outside the Russian Federation (clause 6, clause 3, article 208 of the Tax Code of the Russian Federation).

The Ministry of Finance, in Letter No. 03-04-06/40525 dated July 15, 2015, considered the issue of an organization fulfilling the duties of a tax agent for personal income tax when paying income to citizens of the Republic of Belarus for performing remote work on its territory.

Officials pointed out: since in this case individuals perform work on the territory of a foreign state, the remuneration they receive for performing labor duties relates to income from sources outside the Russian Federation.

As for the duties of the tax agent, financiers drew attention to clause 2 of Art. 226 of the Tax Code of the Russian Federation: calculation of amounts and payment of tax are carried out in relation to all income of the taxpayer, the source of which is a tax agent (except for income in respect of which calculation of amounts and payment of tax are carried out in accordance with Articles 214.3, 214.4, 214.5, 214.6, 226.1, 227 and 228 of the Tax Code of the Russian Federation).

If individuals who receive income are tax residents of the Russian Federation, the provisions of paragraphs. 3 p. 1 art. 228 of the Tax Code of the Russian Federation, according to which individuals - tax residents of the Russian Federation, receiving income from sources located outside the Russian Federation, calculate, declare and pay personal income tax independently at the end of the tax period.

Taking into account the above standards, the Ministry of Finance concluded: with regard to the income of the organization’s employees in the form of wages received from sources outside the Russian Federation, the employing organization is not recognized as a tax agent. Such an organization cannot be assigned the responsibilities provided for tax agents in Art. 226 Tax Code of the Russian Federation. Moreover, if such persons are not tax residents of the Russian Federation in accordance with Art. 207 of the Tax Code of the Russian Federation, then their income from sources outside the Russian Federation in the form of remuneration under employment contracts for remote work, taking into account clause 2 of Art. 209 of the Tax Code of the Russian Federation are not recognized as subject to personal income tax in the Russian Federation.

Let us note that the Ministry of Finance previously held a similar opinion (see letters dated June 28, 2012 No. 03-04-06/6-183, dated May 10, 2012 No. 03-04-06/6-132, dated October 15, 2012 No. 03-132 04‑06/4-302, dated November 23, 2011 No. 03‑04‑06/6-317, etc.).

Similar clarifications were presented by the financial department regarding the taxation of personal income tax on the income of non-residents of the Russian Federation working under civil contracts, in particular, remuneration of individuals - citizens of the Republic of Belarus, performing work under such contracts on its territory.

In Letter No. 03-04-06/42985 dated July 27, 2015, the Ministry of Finance considered a situation where an organization entered into a civil contract with a citizen of the Republic of Belarus to perform work on the territory of the Republic of Belarus. Officials confirmed: if a person is not recognized as a tax resident of the Russian Federation, his income from sources outside the Russian Federation in the form of remuneration under a civil law agreement is not subject to personal income tax.

Also, issues of taxation of personal income tax on the income of citizens of the Republic of Belarus performing remote work on its territory, including in the form of average earnings saved for the period of business trips and vacations, compensation for early termination of an employment contract, temporary disability benefits, are considered in letters from the Ministry of Finance of the Russian Federation dated 04.08. .2015 No. 03‑04‑06/44849, 03‑04‑06/44852, 03‑04‑06/44855, 03‑04‑06/44857.

What if the personal income tax from the advance payment is transferred before the payday for the month?

If you transfer 13% to the treasury before the deadline established by law, you may encounter the following problem. The Tax Service does not recognize the transferred amount as tax, and will consider the obligation of the tax agent - employer not fulfilled in accordance with paragraph 9 of Article 226 of the Tax Code of the Russian Federation. Such an explanation is given in the Letter of the Ministry of Finance dated September 16, 2014 N 03-04-06/46268, the Federal Tax Service dated September 29, 2014 N BS-4-11 / [email protected] Ministry officials also point out that the amount of tax paid in advance should be taken into account future payments will not work - you will have to issue a refund. After all, the interest will be paid not from the employee’s income, but from the employer’s own funds. Personal income tax in full will need to be paid again - on time. As a general rule, interest is transferred to the budget on the day of actual payment of the second half of the salary (the day of final payment) or the next day after it (no later). Otherwise, debt will form with all the ensuing consequences.

How are employee bonuses taxed?

Like wages, any types of bonuses to employees are subject to personal income tax without any exceptions, since they relate to incentive payments (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation).

Personal income tax on the bonus must be calculated on the date of its actual receipt (clause 3 of Article 226 of the Tax Code of the Russian Federation).

The date of actual receipt of the bonus depends on whether it was paid to employees for production results or for other non-production reasons (for example, for an anniversary).

The bonus for production performance relates to the employee’s remuneration (Article 129 of the Labor Code of the Russian Federation). Therefore, the date of actual receipt of such a bonus is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

This rule does not apply to quarterly and annual bonuses. The date of their actual receipt is determined in a special manner.

The date of actual receipt of non-production bonuses is determined as the day they are paid to the employee (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated September 17, 2018 N BS-4-11/18094, Ministry of Finance of Russia dated April 4, 2017 N 03-04 -07/19708).

It is necessary to withhold personal income tax from the premium upon its actual payment (clause 4 of Article 226 of the Tax Code of the Russian Federation).

The deadline for transferring personal income tax from the bonus to the budget is no later than the day following the day of actual payment of the bonus (clause 6 of Article 226 of the Tax Code of the Russian Federation).

How to calculate and pay personal income tax on quarterly or annual bonuses

Personal income tax on the bonus must be calculated on the date of its actual receipt (clause 3 of Article 226 of the Tax Code of the Russian Federation).

We believe that this date is the day the bonus is paid. Basis – pp. 1 clause 1 art. 223 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of Russia dated May 30, 2018 N 03-04-06/36761, dated September 29, 2017 N 03-04-07/63400 (sent by Letter of the Federal Tax Service of Russia dated October 6, 2017 N GD-4-11/20217) . This means that the tax must be calculated and withheld on the day the bonus is paid to the employee (clause 4 of Article 226 of the Tax Code of the Russian Federation).

At the same time, there is another point of view, reflected in the Letter of the Federal Tax Service of Russia: the date of actual receipt of the bonus based on the results of work for the quarter (year) is recognized as the last day of the month in which the order was issued to pay it to employees (Letter dated January 24, 2017 N BS-4 -eleven/). That is, with this approach, the tax must be calculated on the last day of this month, and withheld when the bonus is actually paid to the employee (clause 4 of Article 226 of the Tax Code of the Russian Federation).

Difficulties do not arise if the bonus is paid in the month following the one in which the bonus order was issued.

But if the quarterly (annual) bonus is paid to employees before the end of the month in which the order was issued, then the question arises: when to withhold and transfer personal income tax from it. After all, the date of payment of the premium comes earlier than the obligation to calculate tax on it.

Following this logic of the Federal Tax Service of Russia, you need to pay the premium without deducting personal income tax from it. Because it is impossible to withhold personal income tax before it is calculated. Personal income tax must be calculated on the last day of the month in which the bonus order was issued. Thus, personal income tax must be withheld and transferred to the budget when paying other cash income.

However, this approach may cause complaints from tax authorities, since it does not agree with the opinion of the Russian Ministry of Finance. To avoid them, we recommend:

- calculate and withhold personal income tax on the day the bonus is paid to the employee;

- transfer the withheld tax to the budget no later than the next day (clause 6 of article 226 of the Tax Code of the Russian Federation).

You can also contact your tax office for further clarification on this issue.

How are holiday bonuses taxed?

Any types of bonuses to employees are subject to personal income tax, as they relate to incentive payments (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation). In addition, as payments not subject to personal income tax, Art. 217 of the Tax Code of the Russian Federation they are not named.

Holiday bonuses can be:

- production, that is, related to production indicators.

Such a bonus is part of the remuneration, therefore personal income tax must be calculated from it on the last day of the month for which the employee’s income was accrued (Article 129 of the Labor Code of the Russian Federation, clause 2 of Article 223 of the Tax Code of the Russian Federation).

The tax must be withheld upon actual payment of the bonus to the employee, and paid no later than the day following the payment (clauses 4, 6, Article 226 of the Tax Code of the Russian Federation).

If the bonus is paid before the end of the month of issue of the bonus order, the date of payment of the bonus occurs earlier than the obligation to calculate tax on it. In this case, in order to avoid claims from the tax authorities, we recommend withholding personal income tax upon actual payment of the premium (clause 4 of Article 226 of the Tax Code of the Russian Federation);

- non-productive, if the bonus is paid regardless of production results.

It is necessary to calculate and withhold personal income tax from such a bonus when the bonus is actually paid to the employee (clause 1, clause 1, article 223, clause 4, article 226 of the Tax Code of the Russian Federation). The withheld tax should be transferred to the budget no later than the day following payment (clause 6 of Article 226 of the Tax Code of the Russian Federation).

How to calculate and pay personal income tax on bonuses for the organization’s anniversary

Any types of bonuses to employees are subject to personal income tax, as they relate to incentive payments (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation). In addition, as payments not subject to personal income tax, Art. 217 of the Tax Code of the Russian Federation they are not named.

The bonus paid to an employee for the organization’s anniversary is not related to production results.

It is necessary to calculate and withhold personal income tax from such a bonus when the bonus is actually paid to the employee (clause 1, clause 1, article 223, clause 4, article 226 of the Tax Code of the Russian Federation). The withheld tax should be transferred to the budget no later than the day following payment (clause 6 of Article 226 of the Tax Code of the Russian Federation).

How to calculate and pay personal income tax on an employee’s anniversary bonus

Any types of bonuses to employees are subject to personal income tax, as they relate to incentive payments (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation). In addition, as payments not subject to personal income tax, Art. 217 of the Tax Code of the Russian Federation they are not named.

The bonus paid to an employee on his anniversary is not related to production results.

It is necessary to calculate and withhold personal income tax from such a bonus when the bonus is actually paid to the employee (clause 1, clause 1, article 223, clause 4, article 226 of the Tax Code of the Russian Federation). The withheld tax should be transferred to the budget no later than the day following payment (clause 6 of Article 226 of the Tax Code of the Russian Federation).

| See also: How to reflect the bonus in the calculation of 6-NDFL |

Personal income tax taxation of excess daily allowances paid in foreign currency.

When the employer pays the taxpayer expenses for business trips both within the country and abroad, the income subject to taxation does not include daily allowances paid in accordance with the legislation of the Russian Federation, but not more than 700 rubles. for each day of a business trip in the Russian Federation and no more than 2,500 rubles. for each day of being on a business trip abroad (clause 3 of Article 217 of the Tax Code of the Russian Federation).

Amounts of daily allowance paid to an employee in excess of the amounts established by clause 3 of Art. 217 of the Tax Code of the Russian Federation are subject to personal income tax.

In Letter No. 03-04-06/44919 dated 04.08.2015, financiers considered the issue of taxation of daily allowances paid when sent on a business trip abroad in rubles at the exchange rate of the Central Bank of the Russian Federation on the date of payment, if the amount of daily allowances is established in a local regulation in foreign currency.

Officials pointed out: since daily allowance payments are made in rubles and not in foreign currency, the exchange rate of the Central Bank of the Russian Federation on the date of payment of daily allowances does not matter for personal income tax purposes.

Earlier, in the Letter of the Ministry of Finance of the Russian Federation dated April 24, 2015 No. 03-04-08/23689, it was explained that income subject to taxation, taking into account the provisions of clause 3 of Art. 217 of the Tax Code of the Russian Federation is determined by the tax agent organization at the time of approval of the employee’s advance report. When a tax agent determines the tax base for daily allowances paid in foreign currency, amounts in foreign currency are recalculated into rubles at the rate of the Central Bank of the Russian Federation effective on the date of approval of the advance report.

The same conclusions are contained in letters of the Federal Tax Service of the Russian Federation dated 04/07/2015 No. BS-4-11/5737, and the Ministry of Finance of the Russian Federation dated December 29, 2014 No. 03-04-06/68074.

From January 1, 2021, for the purpose of personal income tax assessment, excess daily allowances will be recalculated at the rate of the Central Bank of the Russian Federation on the date of their receipt. This is due to amendments to clause 3 of Art. 226 of the Tax Code of the Russian Federation, adopted by Federal Law No. 113-FZ of May 2, 2015 “On amendments to parts one and two of the Tax Code of the Russian Federation in order to increase the responsibility of tax agents for non-compliance with the requirements of the legislation on taxes and fees.”

The first case is payment of an advance at the end of the month

[B=63]

If a company establishes a remuneration schedule in its internal regulations in which the first installment will be paid on the last day of the month, then personal income tax will have to be transferred to the budget in a different order. It turns out that the date of payment of the advance and receipt of income in the form of wages will coincide, which means the employer is obliged to transfer the percentage to the treasury. These are the conclusions of the Supreme Court of the Russian Federation, which are presented in the ruling dated May 11, 2016 No. 309-KG16-1804. The court found fair the demands of the tax service to pay income tax immediately after the advance payment. The organization transferred the amount to the budget once a month after the date of final payment. As a result of this legal dispute, the company was fined under Art. 123 of the Tax Code of the Russian Federation and assessed penalties for late payment of taxes. So now, taking into account judicial practice, organizations paying advances at the end of the month will have to transfer the tax twice. If your company adheres to such a schedule, then it is easier to establish a different remuneration scheme and transfer personal income tax in the usual manner.

An example of personal income tax payment when paying an advance on the last day of the month

LLC "Gorod" pays the first part of wages for June on the last day of the month - June 30, and the final payment of wages occurs on July 15. The company is obliged to transfer personal income tax to the treasury twice:

- no later than July 1

- no later than July 16.

Otherwise, Gorod LLC faces fines and penalties.

How are child care benefits taxed?

Childcare benefits for children under 1.5 and under 3 years of age are not subject to personal income tax (Clause 1, Article 217 of the Tax Code of the Russian Federation).

Is child care benefits up to 1.5 years subject to personal income tax?

Allowance for child care up to 1.5 years is not subject to personal income tax, since it is a state benefit (Clause 1, Article 217 of the Tax Code of the Russian Federation).

Are benefits for child care up to 3 years old subject to personal income tax?

In practice, monthly compensation for child care up to 3 years is often called an allowance. Compensation is not subject to personal income tax (clause 1 of Article 217 of the Tax Code of the Russian Federation; clause 1 of Decree of the President of the Russian Federation of May 30, 1994 N 1110).

How to calculate personal income tax when paying alimony

If, when paying wages to an employee, it is necessary to withhold alimony, then the following procedure should be followed:

- pay the employee's salary;

- calculate and withhold personal income tax from the amount of income;

- withhold alimony from the remaining amount (part 1 of article 99 of the Federal Law of October 2, 2007 N 229-FZ, clause 4 of the List approved by Decree of the Government of the Russian Federation of July 18, 1996 N 841);

- pay the employee the remaining amount of income after all deductions.

Alimony payments themselves are not subject to personal income tax (Clause 5, Article 217 of the Tax Code of the Russian Federation), so there is no need to withhold anything from their recipient.

An example of personal income tax taxation when withholding alimony

The organization accrued wages to the employee in the amount of 70,000 rubles for March; payment for the second half of March is made on April 5, while 30,000 rubles were previously paid for the first half of the month. advance The amount of calculated personal income tax is (40,000 + 30,000) x 13% = 9,100 rubles. The amount to be paid is 40,000 – 9,100 = 30,900 rubles.

The organization withholds alimony in the amount of one quarter of the earnings for the employee’s only child: 60,900 x 1/4 = 15,225 rubles, where 60,900 rubles. will be the total amount of wages for the month minus the withholding tax.

The personal income tax amount is 9,100 rubles. must be transferred to the budget either on the day of salary payment - April 5, or on the next working day (clause 6 of Article 226 of the Tax Code of the Russian Federation).