Let's analyze the legislative acts regulating the system of payment orders.

There are two types of payment orders:

- Prepared for making payments of taxes and fees to budgetary or extra-budgetary government funds;

- Issued for an organization (conducting commercial or non-commercial activities) or for an individual entrepreneur, that is, the payment is intended for the counterparty.

The main errors in payment documents are:

- overpayments (for which you can almost always issue a refund),

- or underpayment of any amounts (when the solution to the situation would be to make an additional payment or, if possible, offset the overpaid funds).

If the payment is being processed by the bank, it is not too late to send a clarification letter to the operations department. They will check your details and there will be no trouble. It is more difficult with erroneous payments that have already been executed.

Usually, increased attention is paid to calculating the amounts required for payment, and filling out payment orders is considered a simple process, which is why it is entrusted to assistants and secretaries, leaving the more difficult work to the accountant. However, sometimes incorrectly filling out a payment document is no less expensive for a company than incorrectly calculating the amounts of taxes and fees.

Payment "for the wrong thing"

Let's look at the most insidious mistakes. For example, the purpose of the payment is incorrect, that is, the name of the goods or services is incorrect. Buyers clearly indicate the wrong name of goods or services on the payment order. For example, instead of “payment for installation” - “rent”. Sometimes instead of “ and vice versa. For example, they transfer money for the transportation of goods, but in the payment slip they indicate “payment for tools.” The larger your company, the higher the risk. And it’s really bad if the name of the goods for which the bank tracks cash withdrawals is mistakenly indicated. For example, a company receives payment for building materials. And he writes off money from the account mainly with the purpose of payment “for food products”, “rent of commercial equipment”. The bank will ask for clarification and may block the client-bank connection. In this case, it will refer to the Methodological Recommendations approved by the Central Bank of the Russian Federation on July 21, 2021 No. 18-MR.

And after comparing payment receipts with the company’s OKVED codes, bankers may be interested in a situation where the main receipts into the account are not related to the company’s activities. Sometimes questions arise from one-time payments, especially for large amounts. For example, if a wholesale company received payment for advertising services. And if deposits with an incorrect payment purpose become regular, suspicions will turn into confidence.

To reduce the likelihood of errors, it is better to include the text in the invoice that must be indicated in the purpose of payment. If your counterparty nevertheless manages to transfer money to you “for the wrong reason,” immediately inform him about it and try to get a written response in which the buyer confirms the correct purpose of the payment. You will forward this correspondence to the bankers if they have any questions.

Errors in the names of goods and services will also interest tax authorities. In this sense, such mistakes are especially risky for “simplifiers” and “imputers”, as well as entrepreneurs on the PSN. If the tax authorities see in the statement receipts for goods or services that do not fall under the special regime, they will demand that taxes be paid according to the general system. You will have to prove that the company or individual entrepreneur conducts only activities that fall under the special regime (Resolution of the Arbitration Court of the Volga District of October 25, 2021 No. F06-26038/2017). Therefore, for large payments, it is safer to agree with the supplier on the correct name of the goods.

But it is best to indicate the specific name of goods, works or services on the payment slip (Appendix No. 1 to the Central Bank Regulations dated June 19, 2012 No. 383-P). Take it from the contract, invoice or specification. If there are a lot of products, you can indicate a generic name, for example, “office supplies.” Or indicate the goods that make up the largest share of the purchase price.

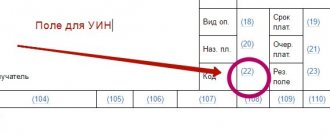

Why checkpoint must be indicated in the payment order

If the checkpoint is incorrectly indicated in the payment order, the paying company may not have problems making the payment at the bank. Troubles may arise when the payment is credited to the recipient's bank, and their scale depends on the type of payment and the category of the recipient.

The checkpoint consists of 9 digits and is indicated only in relation to legal entities and budgetary institutions. The first 4 digits are the code of the tax office with which the taxpayer is currently registered, the next 2 digits are the registration code and the remaining 3 are the registration order number on the appropriate basis.

The checkpoint payment order indicates:

- for the sender of the payment - in field 102;

- for the payee - in field 103.

When sending a payment, individual entrepreneurs enter 0 in the sender’s checkpoint column or leave this field empty.

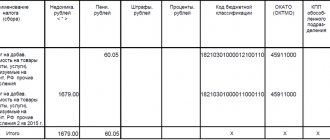

There are 2 main types of payment orders:

- Payments for taxes, fees, etc. to the Federal Tax Service and funds, when the recipient is the Federal Treasury Department (UFK) in a particular region.

- Payments to commercial and non-commercial companies, suppliers, buyers, other counterparties, including individuals.

For budget payments, additional fields are provided. Incorrectly indicating the checkpoint when generating budget payments is fraught with much greater trouble than when sending payments to other counterparties. Let's consider the consequences for each type of bank documents drawn up and the algorithm for subsequent actions.

The insidiousness of numerology

The next point in our program is the inaccurate contract or account number. It will cause particular suspicion when purchasing goods from suppliers that inspectors consider to be at high risk. However, it is possible to make excuses. If the mere fact of an inaccurate contract or invoice number does not mean that the inspectors will consider the expenses unpaid. Provided that it is possible to determine which expenses the payment actually relates to. Confusion is possible if a company has several agreements with a counterparty. So it’s safer to indicate a specific contract or account number on the payment slip.

For example, a company has two contracts with a buyer. He must transfer payment for goods shipped under one contract. But he indicated the details of another agreement in the payment slip. It is not necessary to specify the purpose of the payment if it can be identified. That is, the receiving company can determine which contract and invoice the payment actually relates to. For example, if the buyer missed a digit in the invoice number.

If buyers often make mistakes in the purpose of payment, you can create a register. Indicate in it which payment purpose is correct. The register will come in handy if the bank requests an agreement or account specified in the payment order.

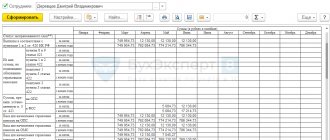

Errors when sending payments to the budget

A payment order for payments to the budget has many fields, which is prone to errors. However, among these fields there are those that control structures pay little attention to. Specifically, these are the following lines:

- Taxable period.

- Tax payer status.

- Order number and date.

- Reason for payment and its type.

If errors are made in these lines, it is not necessary to correct them. The line “priority of payment” is also unimportant. An exception is that orders are sent by companies whose activities involve financial difficulties: restrictions on expense transactions, insufficient funds in a bank account. If these circumstances are present, the “priority” line is checked first.

Incorrect VAT rate

Now, during the transition period, due to the increase in VAT, buyers confuse the rate in their payments - they reflect 18% instead of 20% or vice versa. In this case, a letter stating that there is an error in the payment may not be required from the counterparty. The main thing is to calculate VAT at the correct rate. That is, if you shipped goods to the buyer in 2021, apply the new VAT rate - 20%, even if in the payment slip the buyer mistakenly indicated the previous rate and the amount of tax calculated based on 18% (clause 4 of article 5 of the Federal Law of August 3 2021 No. 303-FZ).

note

Recently, bankers, in accordance with the instructions of the Central Bank of the Russian Federation, have taken payment for such goods as cars and spare parts, medicines, tobacco products, vegetables, fruits, confectionery and other food products under close “anti-money laundering” control

If the buyer made a payment for goods shipped in 2018, you should have calculated VAT at a rate of 18%. There is no need to make any recalculations on the payment date. This also applies to the situation where the buyer mistakenly indicated a 20% rate on the payment order.

In general, such an error in the payment order does not entail tax risks for the buyer. But it is worth checking that the supplier has indicated the correct VAT rate on the invoice. If he confuses the rate, the inspectors will refuse the deduction (Clause 2 of Article 169 of the Tax Code of the Russian Federation).

Sample letter about incorrect purpose of payment to the Federal Tax Service

When composing a notice, it must indicate:

- sender's details (name, address, TIN, OGRN);

- tax office details;

- data of the payment document in which there was an inaccuracy;

- details that need to be corrected with their correct values.

Sample letter about the correct purpose of payment to the tax office

You can send a notification:

- in writing in person to the Federal Tax Service or by mail;

- in electronic form through an EDF operator.

Incorrect VAT amount

The buyer allocated VAT by transferring payment to the “simplified” supplier. The tax authorities will have a question: why did the supplier fail to submit a VAT return? The supplier should inform them that he did not issue a VAT invoice to the buyer. Therefore, you are not required to transfer VAT to the budget and submit a declaration. You can support your position with a reference to the letter of the Ministry of Finance of Russia dated February 15, 2018 No. 03-07-14/9470. And correspondence with the buyer stating that VAT was allocated by mistake would not be out of place.

In general, it is safer to draw up an additional agreement to the contract. Agree with the buyer whether you will reduce the price by the amount of VAT. Indicate in the additional agreement that the supplier does not pay VAT because it uses a simplified procedure. This way, we will at least eliminate the possibility that the buyer, “waking up”, will suddenly request a VAT invoice or demand a price reduction by the amount of tax.

Consequences of mistakes made

Payment orders must be drawn up carefully. Even if the error does not lead to the loss of funds, it will still take a lot of time to correct it. Let's look at the consequences of the error:

- Not paid taxes on time. Consequences: accrual of penalties, fines, risk of repaying the full amount of tax.

- The tax is considered unpaid. Consequences: penalties, fines.

- The payment went to another fund. There is no offsetting of amounts between different funds. Therefore, you will have to pay the tax in full again.

The error will have to be corrected. And this entails separation from employees’ activities, the need to draw up additional documents, and legal proceedings.

“Advance” or “payment”?

The risks in case of confusion in these terms (if the second is indicated instead of the first) are high. And for both the payer and the recipient. It is a risky situation for the supplier when the buyer mistakenly indicated “prepayment” on the payment slip, transferring money after the goods have been shipped. If the tax authorities analyze the extract, they will check whether the supplier has reflected VAT on this advance in the declaration. You will have to explain that the buyer paid for the shipped goods. Therefore, it is safer to agree with the buyer in correspondence that he indicated “advance” in the payment slip by mistake.

Inspectors may refuse to deduct VAT from the advance payment for the payer if the buyer has not indicated in the payment slip that he is making an advance payment (clause 9 of Article 172 of the Tax Code of the Russian Federation). There are chances to defend your case in court, but they are not very high (Resolution of the Federal Antimonopoly Service of the Ural District dated April 4, 2014 No. F09-114/14). In this case, either do not reflect the deduction in the purchase book, or agree on the correct purpose of payment in correspondence with the supplier.

By the way, in addition to “misunderstandings” with government agencies, friction between the partners themselves is also possible. Due to an incorrect purpose of payment, the supplier may offset the payment in a different way than the buyer intended. For example, he may decide that he did not receive an advance payment and, because of this, does not ship the goods. If you notice that you indicated “advance” instead of “payment” or vice versa, it is better to immediately inform the supplier about this.

How and for how long to store a letter

After sending, all letters about clarification of the purpose of payment must be registered in the journal of outgoing documentation, and one copy must be placed in the folder of the current “primary” company. Here it must remain for the period established for such documents by law or internal regulations of the company, but not less than three years . After losing its relevance and expiration of the storage period, the letter can be transferred to the archive of the enterprise or disposed of in the manner prescribed by law.

Inflated payment amount

The buyer transfers an amount greater than indicated in the contract or invoice. This is by no means a cause for joy. The negative consequences of such “generosity” will not be long in coming, as they say. For example, according to the contract, the buyer must transfer an advance in the amount of 30% of the cost of goods, but in fact transferred 50%. The supplier will have to charge VAT on the entire amount of the advance received, otherwise the inspectors will have claims when they check the bank statement. The overpayment, by the way, may be an advance payment against the next shipments, but this does not change the essence.

If you rely on the clarifications of the Russian Ministry of Finance in letter No. 03-07-11/8323 dated February 12, 2021, the buyer has the right to claim VAT deduction from the advance payment, even if its amount is greater than that provided for in the contract. But inspectors can pretend that they don’t know anything about them (or really don’t know). To avoid disputes with tax authorities, it is better to draw up an additional agreement to the supply agreement, indicating in it the amount of the advance payment transferred upon delivery. By the way, in this case, as in the previous one, disputes between counterparties cannot be ruled out - if the overpayment is incorrectly offset or not returned. Check the terms of the contract.

It may tell you how to offset the overpayment. For example, these amounts are considered an advance against future shipments. Or they are offset against the debt. In this case, apply the rules of the contract, and also inform the buyer how you offset the overpayment.

If there are no such conditions in the contract, judges allow the supplier to offset the overpayment against the debt (clauses 2, 3 of Article 319.1 of the Civil Code of the Russian Federation, Resolution of the Administrative Court of the Ural District of December 21, 2015 No. F09-9691/15). But it is worth agreeing on the offset with the buyer.

If the buyer has no debt, it is safer to return the overpayment to him. If the supplier does not return the overpayment, the buyer has the right to go to court and demand interest at the key rate of the Central Bank of the Russian Federation (Article 395, paragraph 2 of Article 1107 of the Civil Code of the Russian Federation). Companies can also agree that the overpayment is considered an advance towards future shipments.

Results

Summarizing the above, we can conclude that there is no direct prohibition on making changes to the purpose of payment in Russian legislation. You can correct the information in this column even after the payment has been made, if it does not correspond to the content of the transaction and was indicated by mistake or carelessness.

If making changes to the purpose of the payment does not infringe on the interests of the recipient of the money, but, on the contrary, helps to establish fairness and clarify unclear points, then obtaining consent from the recipient of the funds may not be required. But it is still better to enlist the written support of the counterparty.

Nuances of completing and submitting an application for clarification of payment

Since the legislative acts do not specify the form of an application for clarification of payment, it can be completed on the company’s letterhead or on a simple A4 sheet.

The application is drawn up in 2 copies. One is transferred to the inspectorate for execution, and the 2nd with the date and visa of acceptance by the inspector remains with the taxpayer.

The method of submitting an application to the Federal Tax Service is also not regulated by law. Therefore, the taxpayer has the right:

- submit the form to the tax authorities in person or through a representative acting on the basis of a power of attorney;

- send the application by registered mail, having previously made a list of the attachments, preferably with notification;

- submit the form via telecommunication channels, endorsed with an electronic digital signature.

An application for clarification of payment is considered by the Federal Tax Service within 10 working days. Tax authorities also have the right to reconcile calculations. After the expiration of the above period, the Federal Tax Service makes a decision to clarify the payment on the date of actual payment of the tax. This means that penalties accrued for the period between payment and payment confirmation are reversed.

If you need to clarify the payment for insurance premiums paid to the Federal Tax Service after 01/01/2017, then the actions of the tax authorities will be slightly different from the previous option:

- the taxpayer must similarly draw up an application for clarification of payment;

- tax authorities will send a request to the Pension Fund;

- Pension Fund specialists will review it within 5 days and send a message to the Federal Tax Service about the possibility / impossibility of clarifying the payment;

- Based on the positive response from the Pension Fund of Russia, the tax authorities will decide to clarify the payment, of which the taxpayer will be notified.

Attention! If it is necessary to clarify the payment of insurance premiums made before 01/01/2017, the application should be sent to the Pension Fund.