Salary income of citizens is subject to taxation.

The employer in this case acts as a tax agent who deducts personal income tax from the employee’s salary and transfers it to the budget. In this case, the employer should strictly adhere to the deadlines established by law for transferring personal income tax. Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

8 (800) 350-31-84

It's better not to list

Let us say right away that it is not recommended to pay personal income tax before the actual payment of wages. This approach may lead to claims from tax authorities. Therefore, before we talk about reflecting the situation when the tax is transferred before the payment of wages in 6-NDFL, we will warn readers about the risks.

Tax inspectors may not qualify the transferred amounts of money as personal income tax due to the fact that (clauses 4, 9 of Article 226 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 13, 2019 No. 03-04-06/8932):

- tax withholding must come from the employee’s income;

- Payment of tax from the organization’s own funds is not allowed.

According to officials, prematurely transferred personal income tax cannot be offset against the payment of this tax (letter of the Federal Tax Service dated March 29, 2014 No. BS-4-11/19714). Therefore, the employer must pay the tax on time, and the funds transferred as “tax” before the payment of wages can be returned in the general manner by submitting a corresponding application to the INFS (letter of the Ministry of Finance dated December 15, 2017 No. 03-04-06/84250).

These funds can also be offset against debts on other federal taxes. Such clarifications are contained in the letter of the Federal Tax Service dated 02/06/2017 No. BS-4-11/19716.

Tax liability under Article 123 of the Tax Code of the Russian Federation does not apply to the employer - tax agent. This is explained by the fact that there is no fact that the amount of tax was not transferred to the budget (letter of the Federal Tax Service dated September 29, 2014 No. BS-4-11/19716).

Deadlines for transferring personal income tax to the budget

When transferring personal income tax to the budget, the employer should take into account the deadlines specified in the current tax legislation. The deadlines for transferring personal income tax depend on the form in which earnings are paid: in cash or non-cash form to bank cards.

The day of receipt of salary is considered to be the last day of the month for which it was accrued. Therefore, personal income tax is not withheld or transferred from the advance payment. It is paid monthly upon final payment for the month. This position is given in the explanatory letters of the Ministry of Finance and the Federal Tax Service: Letter of the Ministry of Finance of 2013 No. 03-04-05/25494; Federal Tax Service of 2014 No. BS-4-11/ [email protected]

Based on the above, personal income tax, which is paid at the time of payment of the advance, is also considered to be paid ahead of schedule, since the employee has not yet received income for the month at that moment.

When paying wages to a bank card, personal income tax is paid on the day of payment according to paragraphs. 4, 6 tbsp. 226 Tax Code. That is, the payment order for the payment of the final settlement is submitted to the bank simultaneously with the payment order for the transfer of tax.

If an employer withdraws money from his bank account to pay wages, then he submits a payment order to transfer personal income tax to the budget on the day of cash withdrawal by check on the basis of clause 6 of Art. 226 Tax Code.

Even if on the specified day the employee did not receive a salary in cash because he was absent from the workplace, the employer’s duties as a tax agent when transferring personal income tax on that day are considered to be fulfilled in a timely manner. In this case, the salary is deposited, and the employer has no obligation to return personal income tax from the budget.

Thus, if a salary was received by an employee late, this does not in any way affect the employer’s settlements with the budget.

Court decisions also prove that depositing wages does not relieve the employer from the need to pay personal income tax on time. If he does not do this, he faces a fine of 20% of the amount to be withheld and a late fee.

If the organization had cash revenue at the cash desk for issuing salaries, then it is not obliged to withdraw money from the account for this (according to clause 2 of the Central Bank Directive No. 3073-U of 2013). In this case, personal income tax is paid no later than the next day after the payment of wages to employees in cash according to paragraph. 2 clause 6 art. 226 of the Tax Code and Letter of the Ministry of Finance of 2014 No. 03-04-06/33737. But in this case, it is also possible to transfer the tax on the same day; there is no need to wait for the next one: this will not be considered early payment. After all, at the time of withholding personal income tax, the income had already been received by the employee.

How to fill

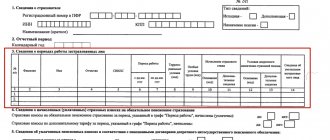

Now we’ll tell you how to reflect tax transferred ahead of schedule in 6-NDFL. The algorithm for filling out the form will be as follows:

- line 100 – the last day of the month for which the salary was calculated;

- line 110 – salary payment day;

- line 120 – the next business day after the date on line 110;

- line 130 – amount of income;

- line 140 – amount of tax withheld.

Now you know how it is reflected in 6-NDFL when the tax is paid before the salary is issued.

Read also

12.09.2016

Fulfillment of the obligation to pay tax also applies to tax agents

It was not so easy for the court to refute the logic of the tax authorities’ conclusions in purely legal terms. Nevertheless, he did it.

By virtue of clause 4 of Art. 24, pp. 1 clause 3 art. 44 and paragraphs. 1 clause 3 art. 45 of the Tax Code of the Russian Federation, the duty of a tax agent to transfer tax is considered fulfilled from the moment of presentation to the bank of an order to transfer funds from a bank account to the budget system of the Russian Federation to the appropriate account of the Federal Treasury if there is a sufficient cash balance on it on the day of payment.

In the same paragraph 1 of Art. 45 of the Tax Code of the Russian Federation establishes that the obligation to pay taxes must be fulfilled within the period established by the legislation on taxes and fees. However, the taxpayer has the right to fulfill the obligation to pay tax ahead of schedule . At the same time, the rule on early payment of tax also applies to tax agents (clause 8, article 45 and clause 2, article 24 of the Tax Code of the Russian Federation).

Next, the court referred to Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 17, 2002 N 2257/02, which dealt with the issue of early payment of tax. There, the judges indicated that this rule refers to the payment of tax if there is a corresponding obligation, but before the deadline established by law . Since Art. 45 of the Tax Code of the Russian Federation is used to fulfill tax obligations, then another payment in accordance with the general rules is considered to have taken place only if funds are received into the budget.

There is also Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 27, 2011 N 2105/11. It also said that the rule on early payment of tax refers to the payment of tax if there is a corresponding obligation after the end of the tax or reporting period, when the tax base is formed and the amount of tax to be paid is determined, but before the payment deadline established by law. Since this provision applies only to bona fide taxpayers, the provisions of Art. 45 of the Tax Code of the Russian Federation are applied taking into account the circumstances characterizing the taxpayer and his conscientiousness in fulfilling his tax obligation, including its existence.

Let us note on our own that all this talk about the integrity of the taxpayer was largely caused by the fact that in the cases under consideration we were talking about tax payments stuck in problem banks, and tax officials suspected taxpayers of creating artificial tax evasion schemes.

In the case considered in the commented Resolution, the amount of personal income tax to be transferred to the budget, calculated on the basis of primary documents, was determined by the company correctly. Based on this, the court found that at the time the tax was transferred to the budget, the amount of the tax had already been determined.

Since the payment was transferred to the appropriate account of the Federal Treasury, there were no debts with the company as a tax agent. Therefore, it is impossible to talk about the presence of arrears.

Consequences

What are the consequences of paying personal income tax before paying wages?

The transferred funds before the salary is calculated will not be counted by the tax service as fulfillment of the organization’s obligation. This means that after the transfer date, penalties will be applied to the organization.

What does the labor inspectorate check: how to prepare for the visit and successfully pass the inspection?

Additionally, in order to return the funds, the organization will have to administratively contact the tax service with a request for a refund.

If employees' salaries were paid earlier than the end of the month: 6 personal income tax details of filling out

The income item in Form 6 includes various accruals in favor of individuals. However, its main component is wages. The employer is obliged to accrue and pay it 2 times a month in the form of an advance payment and transfer of the principal amount.

Sometimes the company's financial position allows it to pay earnings ahead of schedule.

Are there any peculiarities in the reflection, if the salary was paid before the end of the month, in Form 6 of the personal income tax? Let us consider in detail the early transfer of income and their reflection in the declaration.

Introduction

The procedure for paying wages is regulated in Labor Code Article 136. The dates of settlements with employees are approved by the employer in its local acts, orders and contracts. He is obliged to familiarize all employees with each document. In some cases, it is possible to pay employees ahead of schedule. How should this be reflected and by what rules should personal income tax be taken into account?

Early transfer of income

According to NK Art. 223 clause 2, the date of payment of income should be recognized as the last day of the calendar month for which the accrual was made. For reflection in the calculation, it does not matter whether it falls on a weekend or a holiday. This standard was established in letter BS 3-11/ [email protected] dated May 16, 2021.

The Tax Code does not explain the moment of taxation when reflecting early wages. When filling out page 100, you must adhere to the norms established by law and indicate the date of the last day of the reporting month.

When do you need to withhold personal income tax?

In NK art. 226 clause 4 also clarifies that a business entity withholds income tax at the time of payment of earnings. If the salary is paid ahead of schedule, income is not recognized as received; the situation is similar to the advance payment of income. This means that the tax cannot be calculated and accrued by a business entity. These amounts are not recognized as underpaid.

Income tax withholding must be performed upon the first transfers of income. This may be the last day of the month or during the first transfers in a future period. This measure was established in letter BS-4-11/7893 dated April 29, 2021.

How should tax be reported?

Income tax is not allowed to be transferred until the end of the month of its deduction. This payment will be regarded as payment at the expense of the business entity. This is enshrined in the Tax Code, Art. 226 clause 9. Calculation of income tax should be performed no later than the working day following the day of payment of earnings, from which the actual deduction will occur (TC Article 226 clause 6 and Article 6.1 clauses 6-7).

Despite the fact that the law does not allow advance calculation of personal income tax, tax authorities do not apply sanctions to organizations if payments arrive to the treasury in the current month ahead of schedule.

How to reflect the transfer of earnings ahead of schedule in 6-NDFL

Declaration 6 consists of a title and 2 sections. In the first section, all types of remuneration applied for the entire period, deductions and withheld personal income tax should be reflected on a cumulative basis from the beginning of the calendar year. Form 6 of the second section is filled out according to the reporting quarter, indicating the dates of transfer.

Filling out section 1:

- The salary with accruals issued earlier should be included in the total amount on line 020;

- all deductions used to calculate income are entered in line 030;

- The calculated income tax, and also from earnings, which is issued ahead of schedule, is indicated in line 040.

In order to correctly reflect taxes on line 070, it is necessary to do an analysis of deductions. For example, if personal income tax on earnings for June was withheld from an advance payment for July, these amounts should be excluded from the half-year report.

If tax is withheld and paid prematurely, these amounts should be included on line 070.

Filling out section 2 of section 6 of personal income tax when paying early wages.

Wages received earlier than the established dates should be reflected in a separate block of the section. This can be done as follows:

- 100 – the last date of the month when wages were paid;

- 110 is the day when income tax must be withheld. In case of transfer ahead of schedule, you need to indicate the date of the nearest payment for wages (for example, the nearest advance payment calculated based on average earnings);

- 120 – the next working day after the date indicated on page 110, in accordance with the requirements of Tax Code Art. 226 paragraph 6);

- 130 – wages;

- 140 – withheld income tax.

Example 1 of filling out report 6

The organization issued wages for April on the 28th before the weekend. 16.05 employees received an advance minus taxes for April.

- Accruals of income for April amounted to 250.00 thousand rubles;

- when calculating wages, deductions in the amount of 14.00 thousand rubles were applied;

- income tax - 30.68 thousand rubles.

We will reflect the early salary in the calculation of 6 personal income taxes for the six months.

1st section:

- The amounts reflected on line 020 must include accrued wages for April;

- on page 030 - include deductions applied in this period;

- Wage tax for April is included in lines 040 and 070.

2nd section.

Earnings received in advance are reflected in a separate block:

- 100 – April 30;

- 110 – May 16;

- 120 – May 17;

- 130 – 250,00;

- 140 – 30,68.

The sample clearly demonstrates filling out 6 personal income tax calculations when paying salaries in installments.

It is important! In the case of withholding personal income tax upon early payment of wages and transferring it to the treasury the next day, in the declaration the date of withholding will be earlier than the day of transfer.

Example 2 of reflection in the calculation of wages paid ahead of schedule

For June, salaries were issued ahead of schedule on June 29, with the simultaneous transfer of personal income tax to the treasury.

Fill out section 2:

- pp. 100 – 30.06;

- pp. 110 – 29.06;

- pp. 110 – 30.06.

Tax for June must be included in 040 and 070 of the first section.

If income tax is paid to the treasury in the next quarter, the calculation is completed as usual.

Example 3 of reflection in the annual report

For the year, the organization made calculations for wages for 5 employees:

- Payroll for 1 month - 210.00 thousand rubles;

- Payroll for the calendar year – 2520.00 thousand rubles;

- applied deductions 30.80 thousand rubles;

- Deadlines for advance payment and settlement: 20th and 5th.

In November, management decided to pay the salary for November ahead of the 25.11 deadline, in a calculation where only the previously paid advance was offset.

For November, personal income tax was not transferred; it was withheld from the advance payment for December.

Filling out the annual declaration of the first section:

- 010 – 13%;

- 020 – 2520,00;

- 030 – 30,80;

- 040 –323.60 (additional income tax accrual on employee earnings);

- 060 – 5;

- 070 – 296.30 (tax withheld from the total amount of earnings paid for the calendar year).

Unpaid wages for December will be transferred to employees in January. Then income will be withheld from wages for December. Therefore, there is no need to include it on page 070.

Filling out the second section 6 of personal income tax with early salary.

For this example, it is important to remember that the report includes the carryover salary for September, paid in October. Wages for December must be included in the declaration for the 1st quarter of the future period. If it was included in the annual declaration, it must be reversed.

October:

- 100 – 30.09;

- 110 – 05.10;

- 120 – 06.10;

- 130 – 210,00;

- 140 – 26.94 (tax withheld when paying wages).

Filling out the block in November if the salary is paid in installments:

- 100 – 31.10;

- 110 – 05.11;

- 120 – 07.11;

- 130 – 210,00;

- 140 – 26,94.

December for the option if there is no accrual of income for a given month:

- 100 – 30.11;

- 110 – 20.12;

- 120 – 21.12;

- 130 – 210,00;

- 140 – 26,94.

Below is a sample of filling in with early salary for this example.

Conclusion

In order to avoid errors when filling out Form 6, it is better not to pay wages ahead of schedule. Only then will the taxpayer of the legal entity not have problems. If early payment was made, it is necessary to consider this as an option to reflect the salary as an advance payment. Accordingly, the withholding and calculation of income tax must be carried out in accordance with the law.

If employees' salaries were paid earlier than the end of the month: 6 personal income tax details of filling out Link to the main publication

Source: https://ndflexpert.ru/6/kak-zapolnit-6-ndfl-esli-zarplata-vyplachena-ranshe-kontsa-mesyatsa.html

What does the law say?

So, before answering the question of whether it is possible to pay personal income tax before paying wages, you need to understand what personal income tax is, who should transfer it to the budget, and also what is the deadline for its transfer.

Personal income tax is a tax levy paid by payers recognized as residents of the Russian Federation in the amount of 13% of the amount of income they received for a certain period.

Such a fee is usually transferred by the employer after the employee’s wages are calculated.

In the case where a person is independently engaged in entrepreneurial activity, the obligation to transfer the tax payment rests with him.

In accordance with the provisions of the Tax Code of the Russian Federation, personal income tax must be transferred no later than the date that follows the date of payment of funds. The law does not contain other provisions.

Early payment of taxes by individuals

A paradoxical situation has arisen regarding the issue of early payment of taxes by citizens:

- On the one hand, the Art. already mentioned above applies. 45 of the Tax Code of the Russian Federation, according to which they have every right to pay taxes ahead of schedule.

- On the other hand, Art. 409 (2), 397 (4), 363 (3) of the Tax Code of the Russian Federation allow an individual to pay property tax, as well as land and transport tax, only on the basis of a tax notice.

The existing legal conflict can soon be eliminated by introducing the concept of “tax contributions”, i.e. the possibility of advance payments of taxes for citizens. The corresponding bill has already been sent by the Government to the State Duma.

Individual entrepreneurs and individuals – personal income tax payment deadline in 2021

The table below also reflects the deadlines for tax payment by taxpayers themselves - entrepreneurs and individuals who are not individual entrepreneurs.

Having received the first income on OSNO, individual entrepreneurs and private practitioners declare to the Federal Tax Service about their expected income (declaration 4-NDFL), on the basis of which inspectors calculate the amount of tax advances, and the individual entrepreneur must pay them within a year. According to the notification from the Federal Tax Service, the tax is paid in three payments: July 15, October 15 and January 15 of the following year (clause 9 of Article 227 of the Tax Code of the Russian Federation). In subsequent periods, the Federal Tax Service calculates advances based on the 3-NDFL declaration. If the actual income of an individual entrepreneur exceeds the expected one, he will have to calculate the tax and pay it no later than July 15 of the next year.

For individuals who do not have individual entrepreneur status, there is a single deadline for paying personal income tax on the income they receive. When the tax was not withheld by the tax agent, or income was received from other sources (sale of property, winnings from 4,000 to 15,000 rubles, etc.), an individual submits a 3-NDFL declaration and pays “income tax” no later than July 15 (Art. 228 of the Tax Code of the Russian Federation).

Ahead of schedule and without problems?

The taxpayer exercised his right to pay taxes early and was subject to sanctions from the tax service - an absurd situation at first glance. It was reviewed by several courts before a final decision was made in favor of the taxpayer.

It was as follows:

- An entrepreneur working on the simplified tax system paid tax for 2 quarters in advance, without submitting a declaration, the filing deadline for which has not yet arrived. The taxpayer argued his actions by saying that the amount of tax was known to him based on the calculated tax base.

- The payments were recorded and processed, but then the bank's license was declared invalid. The Federal Tax Service saw contradictions with the law in the entrepreneur’s actions and demanded that the tax be paid again, since the money had not been received into the budget.

- In a series of legal proceedings and decisions taken either in favor of the Federal Tax Service or in favor of the taxpayer, the Supreme Court put an end to it. He pointed out the right to pay the tax ahead of schedule (Article 45 of the Tax Code of the Russian Federation). An important argument was the fact that the individual entrepreneur had only one account in the specified bank.

Important! When paying taxes early, it is important to track whether the money actually went to the budget. Otherwise, disputes with the Federal Tax Service and demands for repayment of the tax are possible.

As can be seen from the information provided, in practice, courts in most cases are guided by the Tax Code of the Russian Federation and the interests of the taxpayer. If a dispute arises with the Federal Tax Service, there is a high probability of winning it in court.

Is there any liability for paying personal income tax before salary?

If personal income tax is transferred before the salary payment deadline, inspectors may consider personal income tax unpaid, and the funds transferred by the employer to the budget as an erroneous payment. Moreover, the employer may be refused to offset this erroneous payment against his personal income tax debt.

In such a situation, the employer will have to re-transmit income tax to the budget, pay penalties and fines for late payment.

There have been precedents in judicial practice when employers managed to prove that they were right and that the income tax transferred in advance was paid by them not from their own money, but from the funds of their employees. If the employer is ready to sue the Federal Tax Service, then he can transfer personal income tax in advance. But in order to avoid controversial situations, it is worth transferring the tax only after it has been deducted from the employees’ salaries.

Thus, the obligation to transfer income tax to the budget arises for the employer as a tax agent only after the actual deduction of personal income tax from funds that are payable by the taxpayer. Therefore, according to the position of the Federal Tax Service, an employer who paid personal income tax before the payment of wages must pay the tax again, despite the fact that an overpayment actually occurs. For early payment of income taxes, the employer may be held liable in the form of fines and penalties.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call:

Today, tax legislation obliges all taxpayers to transfer established fees within the period prescribed by law. Despite this, many employers have a question: is it possible to transfer personal income tax before paying wages?

Main

- The right to early payment of tax is enshrined in Art. 45 clause 1 of the Tax Code.

- Despite the established practice of paying tax after filing a declaration (calculation), the legislation does not impose such strict limits on the taxpayer.

- On the issue of early payment of personal income tax, contradictions remain between the position of the Federal Tax Service and the taxpayer. The dispute that arises is resolved in court, most often in favor of the latter. The legislation intends to provide the possibility of early tax payments to individuals in the near future.