The need to write off VAT stuck in accounting data and not accepted for deduction often arises. For whatever reason, deductions are denied, these amounts must be written off in a timely manner, otherwise the company will be forced to provide explanations to external users examining its financial statements. Significant amounts of non-deductible VAT may indicate careless accounting and negatively affect the prestige of the company.

In what cases is “input” VAT not deductible ?

Postings with example

Let’s assume that a company purchased materials from a supplier in the amount of 180,000 rubles, incl. VAT 20%. The supplier did not record the transaction in sales (the so-called tax gap), and as a result the company was denied a deduction. 180,000: 1.2 = 150,000 rub. 180,000 – 150,000 = 30,000 rubles.

Question: Is it permissible to include in the supply contract a provision for the supplier to reimburse the buyer for the amount of VAT not accepted for deduction by the buyer due to the supplier’s failure to fulfill its tax obligations? View answer

Postings:

- D10 K60 — 150,000 rub.

- D19 K60 — 30,000 rub. — inventory items are capitalized and VAT is allocated on them.

- D68 K19 — 30,000 rub. — input VAT is deductible.

After checking by the Federal Tax Service and refusing the deduction:

- D68 K19 — 30,000 rub. — the posting is reversed.

- D91 K19 - write-off of VAT as expenses.

Instead of 91, the score 99 can be used.

Please note that according to tax legislation, the counterparty can send a confirming invoice not immediately, but within 3 years. It is advisable to write off VAT no earlier than this period expires.

Question: Can the seller, in the event of the return of goods not accepted by the buyer for registration, reduce the tax base rather than deduct VAT in accordance with clause 5 of Art. 171 and paragraph 4 of Art. 172 of the Tax Code of the Russian Federation? View answer

By default, “stuck” VAT is not reflected in income tax calculations (Article 170 of the Tax Code of the Russian Federation):

- does not reduce the taxable amount;

- is not included in the costs of goods, services, and works.

The given wiring diagram complies with the norms of the Tax Code of the Russian Federation.

What are the conditions and procedure for applying VAT deductions ?

Exemption from separate accounting

It is possible not to distribute input VAT only in one case: if during the quarter the share of expenses for the acquisition, production or sale of goods (work, services, property rights), the sale of which is exempt from VAT, does not exceed 5 percent. Then the entire amount of input VAT presented by suppliers in this quarter can be deducted. This is stated in paragraph 7 of paragraph 4 of Article 170 of the Tax Code of the Russian Federation. For more information about the need to maintain separate accounting in certain situations, see How to maintain separate accounting for transactions subject to and not subject to VAT.

Calculate the share of expenses for the acquisition, production or sale of goods (work, services, property rights), the sale of which is exempt from VAT, using the formula:

| Share of expenses for the acquisition, production or sale of goods (work, services, property rights), the sale of which is exempt from VAT | = | Expenses for the acquisition, production or sale of goods (work, services, property rights), the sale of which is exempt from VAT, for the quarter _______________________________________________________ | X | 100% | |

| Total acquisition, production or distribution expenses for the quarter |

Situation: how to calculate the total costs of acquisition, production or sales. Does the organization determine the need to maintain separate accounting for input VAT?

To determine total expenses, an organization should develop its own procedure and consolidate it in its accounting policies for tax purposes.

An organization is required to maintain separate accounting for input VAT if the share of expenses on transactions exempt from taxation is equal to or exceeds 5 percent of the total expenses of the organization. This share must be determined using the formula:

| Share of expenses for the acquisition, production or sale of goods (work, services, property rights) exempt from VAT | = | Expenses for the acquisition, production or sale of goods (work, services, property rights) exempt from VAT for the quarter _______________________________________________________ | X | 100% | |

| Total acquisition, production or distribution expenses for the quarter |

This is stated in paragraph 7 of paragraph 4 of Article 170 of the Tax Code of the Russian Federation.

The procedure for accounting for total expenses for tax purposes is not established by law, therefore the organization has the right to determine total expenses based on accounting data.

When determining total expenses, take into account all costs (direct, indirect, general production, general business, other) that are associated with carrying out operations that are exempt from VAT. This includes expenses that qualify as non-operating expenses in tax accounting. For example, if an organization takes out a loan to carry out operations exempt from VAT, then interest on the loan (non-operating expenses) must be included in the calculation of the proportion: both in the numerator and in the denominator.

This follows from letters of the Ministry of Finance of Russia dated May 29, 2014 No. 03-07-11/25771, dated February 12, 2013 No. 03-07-11/3574 and dated August 2, 2012 No. 03-07-11/223 .

An example of determining the share of expenses for the acquisition, production and sale of goods (work, services, property rights) exempt from VAT, according to accounting data.

The organization is a VAT payer and carries out VAT-taxable and non-VAT-taxable transactions

Alpha LLC produces and sells medical equipment. Among the goods produced are medical equipment included in the list approved by Decree of the Government of the Russian Federation of January 17, 2002 No. 19. The sale of such medical goods is not subject to VAT (subclause 1, clause 2, article 149 of the Tax Code of the Russian Federation).

To determine whether input VAT can be deducted in full, Alpha’s accountant calculated the share of expenses for the production and sale of goods exempt from VAT in the total amount of expenses.

Alpha’s accounting policy for tax purposes stipulates:

- the share of expenses for the production and sale of goods (work, services, property rights) exempt from VAT is determined according to accounting data;

- costs for the production and sale of goods (work, services, property rights) exempt from VAT, as well as total costs for production and sale are determined taking into account direct, general, general production and other costs associated with these operations;

- If it is impossible to attribute general business, general production, and other expenses to a specific type of activity (taxable or not subject to VAT), the amount of general business, general production, and other expenses related to the production and sale of products exempt from VAT is determined by the formula:

| General business, general production and other expenses related to the production and sale of products exempt from VAT | = | General business, general production and other expenses that cannot be attributed to a specific type of activity | × | Direct costs related to the production or sale of products exempt from VAT | : | Total direct costs |

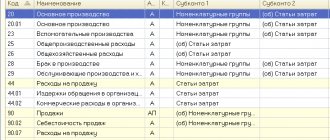

To allocate costs for the production and sale of medical equipment not subject to VAT, corresponding subaccounts have been opened to accounts 20, 23, 29, 44, 91-2.

During the quarter, the amount of direct expenses written off for sold products amounted to RUB 680,000. (500,000 rubles – for the production and sale of products exempt from VAT, 180,000 rubles – for the production and sale of products subject to VAT).

The amount of overhead costs written off for sold products amounted to RUB 170,000. These expenses cannot be attributed to a specific type of activity. They are distributed according to the methodology approved in the accounting policy: 170,000 rubles. × 500,000 rub. : 680,000 rub. = 125,000 rub.

The amount of general business expenses written off for sold products amounted to 130,000 rubles. These expenses cannot be attributed to a specific type of activity. They are distributed according to the methodology approved in the accounting policy: 130,000 rubles. × 500,000 rub. : 680,000 rub. = 95,588 rub.

The amount of other expenses (interest on a loan raised for the production of medical equipment) amounted to 100,000 rubles.

The total amount of production and sales expenses for the quarter amounted to RUB 1,080,000. (turnovers for the quarter according to accounts 20, 23, 25, 26, 29, 44, 91-2).

The share of costs for the production of medical equipment not subject to VAT was: (500,000 rubles + 125,000 rubles + 95,588 rubles + 100,000 rubles): 1,080,000 rubles. × 100% = 75%.

Since the share of expenses on transactions not subject to VAT is more than 5 percent, input VAT on expenses must be distributed.

An example of determining the share of costs associated with the sale of scrap metal that is exempt from VAT

LLC "Proizvodstvennaya" produces brass parts, the sale of which is subject to VAT. During the production process, metal shavings (returnable waste) are generated, which Master sells externally as scrap. Sales of scrap ferrous and non-ferrous metals are exempt from VAT (subclause 25, clause 2, article 149 of the Tax Code of the Russian Federation).

In the first quarter, the organization purchased brass in the amount of 590,000 rubles. (including VAT – 90,000 rubles). The cost of shipped parts produced in the first quarter amounted to RUB 826,000. (including VAT – 126,000 rubles). Production costs amounted to 650,000 rubles, including: – 500,000 rubles. - Cost of materials; – 90,000 rub. – direct labor costs;

– 10,000 rub. – depreciation of fixed assets (direct costs);

– 50,000 rub. – overhead costs (general production and general economic).

Metal waste generated during the quarter was sold in March at a contract price of 20,000 rubles. The organization has no work in progress at the end of the quarter.

The following entries were made in the Master's accounting:

Debit 10-1 Credit 60 – 500,000 rub. – metal is capitalized;

Debit 19 Credit 60 – 90,000 rub. – input VAT is reflected;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 90,000 rubles. – input VAT is accepted for deduction;

Debit 20 Credit 10-1 – 500,000 rub. – metal is written off for production;

Debit 20 Credit 70, 69 – 90,000 rub. – expenses for remuneration of workers of the main production are written off;

Debit 20 Credit 02 – 10,000 rub. – depreciation of production equipment has been accrued;

Debit 20 Credit 70 (02, 10, 25, 26, 69...) – 50,000 rub. – overhead costs are written off;

Debit 62 Credit 90-1 – 826,000 rub. – revenue from the sale of parts is reflected;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – 126,000 rubles. – VAT is charged on the cost of parts sold;

Debit 90-2 Credit 20

– 650,000 rub. – the cost of products sold is written off;

Debit 62 Credit 91-1 – 20,000 rubles. – income from the sale of scrap is reflected.

To correctly apply the tax deduction at the end of the quarter, the accountant determines which part of the input tax relates to the sale of main products subject to VAT, and which part to the sale of scrap metal, which is exempt from taxation.

Let's consider two options.

First option

The accounting policy of “Master” for tax purposes states that the cost of returnable waste (scrap metal) is determined in proportion to the share of income from the sale of scrap metal in the total income of the organization. Accounting data is used for calculations.

First, the accountant calculated the share of revenue from sold scrap in total sales revenue excluding VAT:

20,000 rub. : (RUB 826,000 – RUB 126,000 + RUB 20,000) = 0.028.

Then he determined the amount of expenses attributable to the parts sold:

650,000 rub. × (1 – 0.028) = 631,800 rub.

The amount of expenses attributable to sold scrap is equal to:

650,000 rub. – 631,800 rub. = 18,200 rub.

The share of expenses attributable to scrap was:

18,200 rub. : 650,000 rub. × 100% = 2.8%.

Since the share of expenses attributable to scrap was less than 5 percent, the organization is not obliged to keep separate records of input VAT and adjust the amount of tax deduction. The entire tax presented to the organization in the first quarter (90,000 rubles) is accepted for deduction.

Costs related to sold scrap metal are reflected in the accounting records as follows:

Debit 10-6 Credit 20 – 18,200 rub. – production costs have been reduced by the cost of returnable waste (scrap);

Debit 90-2 Credit 20 – 18,200 rub. – the cost of goods sold was reversed for the cost of returnable waste (scrap);

Debit 91-2 Credit 10-6 – 18,200 rub. – the cost of waste sold is written off.

Second option

For tax purposes, Master's accounting policy states that the cost of returnable waste (scrap metal) is determined by the price of possible sale. Accounting data is used for calculations.

The ratio between the cost of scrap metal and the organization’s total costs for the quarter will be:

20,000 rub. : 650,000 rub. × 100% = 3.1%.

Since the share of expenses attributable to scrap was less than 5 percent, the organization is not obliged to keep separate records of input VAT and adjust the amount of tax deduction. The entire tax presented to the organization in the first quarter (90,000 rubles) is accepted for deduction.

Costs related to sold scrap metal are reflected in the accounting records as follows:

Debit 10-6 Credit 20 – 20,000 rub. – production costs have been reduced by the cost of returnable waste (scrap);

Debit 90-2 Credit 20 – 20,000 rub. – the cost of goods sold was reversed for the cost of returnable waste (scrap);

Debit 91-2 Credit 10-6 – 20,000 rub. – the cost of waste sold is written off.

How to avoid denial of deductions

VAT accounting practice shows that the Federal Tax Service may refuse to deduct in the following cases:

- the invoice from the supplier contains errors;

- there is no invoice from the supplier, and the tax is highlighted in the receipt documents;

- the supplier did not reflect the transaction in tax documentation (in the sales book);

- The three-year period for submitting VAT for deduction has expired.

The risk of failure can be minimized if:

- carry out preliminary reconciliation with counterparties, primarily permanent, large transactions associated with the company;

- store primary accounting and tax documents in full;

- do not miss the deadlines specified in the legislation for VAT deductions.

Invoice with incorrect rate

There are situations when the seller does not know exactly what VAT rate to apply and, in order to avoid risks for himself, decides to apply the maximum rate of 18%, reflecting it in the issued invoice.

This happens, for example, in relation to freight forwarding services associated with international deliveries, for which in most cases a zero VAT rate is applied. Of course, by indicating the maximum rate, forwarders will protect themselves from possible claims from tax authorities, but at the same time they are “setting up their” customers.

The fact is that in such cases, customers almost always have problems with deducting VAT. Officials believe that if services are taxed at a rate of 0%, then it is impossible to apply a deduction for improperly billed tax amounts. This position can be seen, for example, in the letter of the Ministry of Finance of Russia dated April 25, 2011 No. 03-07-08/124. In it, officials explain: an invoice in which the tax rate is indicated incorrectly does not comply with the requirements of tax legislation, and therefore cannot be recognized as a basis for accepting the presented VAT amounts for deduction.

Unfortunately, in this case, judicial practice is far from being in favor of companies.

Proof of this is, for example, the decisions of the Far Eastern District AS dated October 4, 2016 in case No. A51-1939/2015, the Ural District FAS dated March 28, 2013 No. F09-1830/2013 in case No. A47-3202/2012 (determined by the Supreme Arbitration Court of the Russian Federation dated July 25 .2013 No. VAS-9132/13 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation).

Nuances

Let us highlight some features of accounting for unrecovered VAT. If VAT is highlighted in the purchase document, but it is clear to the accountant that it will not be confirmed by an invoice (for example, in a document, invoice), the tax office, with a high degree of probability, will not accept this amount for deduction. It is advisable to write it off to account 91 immediately when a bad amount is discovered.

VAT on business trips is deductible (Article 264-1(12) of the Tax Code of the Russian Federation). It must be clear from the supporting documents that these costs are related to production activities. If such information is missing, you can immediately write off the tax to 91 accounts, since the Federal Tax Service will not reimburse it.

Another nuance related to business trips. The tax office insists that the transaction for which the tax is refunded must be confirmed by an invoice presented to the company, or a strict reporting form, issued similarly to cash register checks, where VAT must be highlighted. Judicial authorities enter into controversy with regulators and a number of their decisions cancel this requirement, indicating that something that is not marked as a separate line in a VAT document (for example, in a receipt) can be accepted for deduction. This decision was announced, for example, by the FAS MO (No. KA-A40/6657-11 dated 07/26/11), this is not the only court case.

VAT refund procedure.

Let's talk about the VAT refund procedure. When submitting a declaration to the tax service, the taxpayer must indicate the amount to be reimbursed, and the tax office reviews this declaration and carries out a (desk) audit, the purpose of which is to justify the amounts declared in the declaration. If, as a result of such an audit, no violations are revealed, then the tax service must make a decision on refunding the tax amount within 7 days. If there are violations, then the tax office must draw up an audit report, which, with the documents attached to it, goes to the head of the tax service for consideration and making a decision: or not to hold the taxpayer accountable for a tax offense. Also at the same moment, a decision must be made on a partial or full refund of the tax amount, or a refusal to refund.

If the taxpayer is in debt for other federal taxes, then the tax service has the right to offset the amount of tax that is subject to reimbursement against the debt on fines or penalties, etc.

When can VAT be included in expenses?

We said earlier that VAT cannot be taken into account in a company’s expenses. There are, however, exceptions to this rule. In some cases, it is not possible to claim VAT for deduction, but it is possible to write it off as expenses (according to the text of Article 170 of the Tax Code of the Russian Federation, paragraph 2.5, Article 169-3(1), letters of the Ministry of Finance No. 03-07-07/72 dated 02/11/10, 03-07-08/195 from 01/10/09, 03-11-06/3/227 from 03/09/09):

- The VAT amounts actually paid at the time of import of goods into the territory of the Russian Federation, if they will be used, in turn, in the production of tax-free goods. The same applies to works and services.

- Amounts of VAT on purchased goods, works, services, if they are subsequently used in production or sales outside the Russian Federation.

- The company is in a special regime and is exempt from paying taxes. Here you need to keep in mind that invoices may not be issued to such companies upon purchase, however, provided that an agreement on this is concluded between them and the seller.

- The acquisitions will be used in operations that are not sales under the Tax Code of the Russian Federation.

- In certain cases of the Tax Code of the Russian Federation, VAT is included in the profit costs of banks, pension funds (non-state), insurance companies, clearing firms, stock market participants, etc.

When creating transactions, it would be correct to first allocate VAT and then charge it to expenses.

Example

The company purchased raw materials for the production of goods for export in the amount of 240,000 rubles, including VAT 20%

Postings:

- D10 K60 — 200,000 rub.

- D19 K60 — 40,000 rub.

- D10 K19 — 40,000 rub.

VAT is fully included in the cost of goods and materials.

Attention! VAT on expenses under the simplified tax system “income minus expenses” is reflected only after the sale of an asset or product (Articles 346.16, 346.17, letter of the Ministry of Finance No. 03-11-09/6275 dated 17/02/14).