Employer reporting

Alexey Borisov

Leading expert on labor relations

Current as of October 23, 2020

Despite the apparent simplicity of this report, difficulties may arise with the preparation of the supplementary SZV-M. It is important for the employer to take into account a number of nuances - regarding filling out sections of the form, the timing of its submission and possible sanctions from the Pension Fund for late submission of the report. Our material will help you understand these nuances and introduce you to ready-made samples of complementary SZV-M for different situations.

Protocol with an error as a result of checking SZV-M

Starting from 2021, companies submit monthly reports to the Pension Fund about insured persons SZV-M.

This form is required to track working retirees who do not need to index their pension. Submit reports to the Pension Fund online

Watch the video on how to form SZV-M and SZV-STAZH in the program.

If the company has 25 or more employees, the report is sent via the Internet (clause 2 of Article 8 of Federal Law No. 27 of 04/01/1996).

To send electronic reports, sign an agreement on electronic document management with the Pension Fund.

The report is sent to the Pension Fund by the 15th of each month.

The deadlines for submitting reports for June-November of the current year are shown in the table below

| Month | Deadline |

| June 2019 | 15.07.2019 |

| July 2019 | 15.08.2019 |

| August 2019 | 16.09.2019 |

| September 2019 | 15.10.2019 |

| October 2019 | 15.11.2019 |

| November 2019 | 16.12.2019 |

Deadlines for submitting reports (June-November)

After sending the report, the company receives a reception protocol, which shows how correctly the SZV-M was filled out. If the report has passed, the program will indicate the status “Document Accepted”.

A green checkmark in the program means that the report was submitted on time, but it contains serious errors that need to be corrected.

As a result of the verification, the company will receive an acceptance protocol with the following statuses:

"Document not accepted"

Status “Document not accepted”

“The document was partially accepted”

Status “Document partially accepted”

The period for receiving the protocol is 4 working days.

Employees of the Pension Fund can find 14 inaccuracies; they are listed in Table 7 to the Resolution of the Pension Fund Board of December 7, 2016 No. 1077p. You can see this table in the figure below.

Table 7 to the resolution of the Pension Fund Board

There are 3 types of error codes: “20”, “30”, “50”.

Code “20” means that the report has been accepted by the fund and does not require clarification. But pay attention to minor flaws.

Error “30” means that the report has been partially accepted and requires revision for employees with erroneous data.

Error with code “50” - the report must be completely retaken for all personnel. There is a possibility that a negative protocol for SZV-M will come due to a technical error in the Pension Fund. In this situation, contact the Pension Fund.

In the following blocks, we will consider the types of errors, how to correct and clarify information after submitting a report with errors, whether there is an adjustment report, and the possible outcome of disputes in court with the Pension Fund of the Russian Federation.

Frequent mistakes when submitting to SZV-M

When submitting the SZV-M report, the most common errors include:

Typo in period

Example. In SZV-M for June you indicated the period “July”. The Pension Fund did not find this error. But next month you send a report for July, and the fund does not accept it, because they already have a form with the “Original” type. The Pension Fund considers the June report to be overdue and fines for it. Convincing the Foundation that they are right is a problem.

To correct the error, submit the original form for June, correct the July data (submit a canceling and supplementing form for July).

You can challenge your position in court if the reporting was submitted on time. The court understands that there was a typo in this situation. For example, in case No. A81-6455/2016, the court sided with the company and, as a result, canceled the fine.

Wrong type of shape

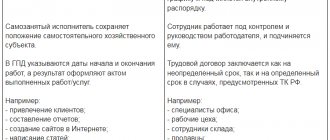

The program has 3 forms: the original “outcome”, o and the complementary “extra”.

The first report is submitted with the “Initial” type.

You need to use the “Cancel” form if previously submitted information needs to be cancelled. For example, the report contains data about an employee who quit in June. The report for July should not include information about the dismissed employee.

“Additional” corrects errors in the previous report.

It is not allowed to indicate the type “out” for secondary submission.

If you mistakenly specified the type of form “Cancelling” instead of “Initial”, then the canceling form will appear in the Pension Fund of Russia database, but the original one will not be there. In this case, fix the error as quickly as possible.

Example. I first submitted the cancellation form, and then after the due date I corrected the error by sending a report with the type “Ex”. The Pension Fund of Russia began to consider the information as nullified and demanded that a supplementary form be submitted. Since the policyholder provided it after the delivery deadline, he was fined. He was able to lift the sanctions only in court.

Attach a cover letter to the clarification, indicating that you are correcting the error.

An extra employee in the report, for example, a fired employee

In this situation, you need to make a cancellation report, indicate the code “Cancel” in block 3, and indicate the data of the extra employee in the fourth block.

Do not list all employees, otherwise the data on them will be reset.

Forgotten worker

The SZV-M form must include all company employees with whom GPC agreements or employment contracts were in force during the reporting month. The report must include even those employees who were hired on the last day of the reporting month or fired on the 1st.

To eliminate this error, submit SZV-M with the “Additional” type. To do this, generate a new report in the program; in block 3, enter the code “Additional”. In block 4, enter the missing employee, his INN, SNILS.

SZV-M

Self-employed in the report

There is no need to submit an SZV-M for the self-employed. Submit a cancellation form if you included it in error.

An employee not included in the report who has lost his self-employed status

To correct this error, submit the supplemental form on time.

Incorrect company TIN

In this case, the fund will send a protocol with error code 50. This means that the report has not been accepted. To correct the error, resubmit the SZV-M with the “original” form type by the 15th.

Incorrect employee information

Example. The company incorrectly indicated the employee's TIN or made a mistake in the full name or SNILS of the insured person.

In the program, generate a report again, indicate the code “Cancel” in block 3. In block 4, add employees with incorrect data. Then generate another report. In block 3, indicate the code “Additional”; in block 4, list the same employees with corrected data.

If an employment contract has not been concluded with the sole founder, you still need to submit the SZV-M before the 15th, otherwise the company will be fined 500 rubles. (Letter of the Ministry of Labor dated July 7, 2016 No. 21-3/10/B-4587).

Penalty for an error in SZV-M

The pension fund may fine the company for late submission of the report and errors.

If an organization with 25 or more employees submits a paper report, it will be fined 1,000 rubles.

If not all employees are included in the report, then the Pension Fund considers that the company did not provide information on the insured person on time. According to clause 4 of Article 17 of Federal Law No. 27 of 04/01/1996, the fine will be 500 rubles. for one person.

Example. The company employs 40 people. They forgot to add 10 people to the report. The organization will pay a fine of 500 10 = 5000 rubles*

To avoid a fine, submit reports not on the last day, but several days earlier than the due date. Then you will have time to complete the report without penalty.

There is also a penalty for an error in SZV-M. It is 500 rubles for each employee for whom there was an inaccuracy. During report processing, all errors are summarized for each employee.

Even if you made more than 3 mistakes for one employee, the fine amount will still remain 500 rubles per person.

Is the exact form required?

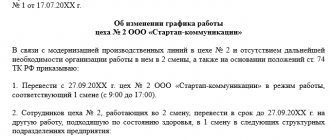

There is no approved form for this order. The law provides only requirements for the paper that will be published on this occasion. And the most important of them is the content of the details of those primary documents that served as the basis. This is directly stated in the ninth article of Law No. 402-FZ of December 6, 2011.

Thus, an order can have any form. The main thing is that it expresses the meaning of the order and has documentary grounds. In this case, you need to be guided by GOST R 6.30-2003. Organizational letterhead is ideal for printing this document.

General principle for correcting errors in SZV-M and deadlines for submitting corrections

If you find an error in the submitted report, you need to submit a correction. It comes in two types: complementary (type “extra”) and o).

The general principle for correcting errors in SZV-M:

- If the report is not accepted, it must be retaken. This happens, for example, if the policyholder incorrectly wrote the registration number in the Pension Fund.

- If the report is partially accepted (for example, you did not report on all employees, you wrote the last name, first name, patronymic, and SNILS number of the employee incorrectly), send a supplementary report. Include in it only those employees whose data is not indicated in the initial report or is indicated in error.

- In the original “ISH” form, all employees are indicated again; in the supplementary “ADP”, those who need to be added or excluded from the initial version of the report are indicated.

From October 1, 2021, new rules are in effect: it is possible to correct an error in an accepted report without a fine (clause 39 of Instruction No. 766 of December 21, 2016).

For example, the company made a mistake in the employee’s full name or SNILS number. The organization will be notified of errors. An error in the SZV-M in the last name, first name, patronymic of an employee is corrected in the usual manner: a canceling form is submitted to the Pension Fund of Russia, and then a supplementary one.

According to paragraph 39 of Instruction No. 766, defects must be corrected within 5 days from the date of receipt of the notification.

Correction of the surname in SZV-M is necessary when changing the surname of an employee. For example, an employee got married. Based on the marriage certificate, it is necessary to redo SNILS. To do this, contact the Pension Fund.

If an employee has changed the passport data, but has not changed the SNILS, the Pension Fund of Russia will refuse to accept the report, since the previous data is considered invalid.

If, on the deadline for generating the report, SNILS is at the Pension Fund of Russia at the registration stage, you still need to submit the report. For example, you submitted documents for changes to SNILS on the 12th, and the deadline for submitting the report is the 15th. The old data is invalid and the new data is not ready. Algorithm of actions of the policyholder:

- Submit the original form for all employees, except for the one for which SNILS is not ready.

- After receiving the SNILS, send a supplementary form for the employee with the new SNILS and a letter of explanation.

If an organization independently discovers an error, it can correct the SZV-M only after notification in the program from the Pension Fund of Russia. Submit clarification within 5 days from the date of receipt of the notification from the Pension Fund with the following indication:

- “DOP” - if the company has discovered a forgotten employee.

- “OTMN” - if you included extra employees.

- “A - if the organization made a mistake in the employee’s data.

In order not to make additional adjustments and preview the generated report, download the CheckPFR program on the Pension Fund of Russia website for free and do not forget to update it on your computer. This program is synchronized with Pension Fund data and is periodically updated.

Generate SZV-M report online

In the following blocks we will look at how to fix common types of errors.

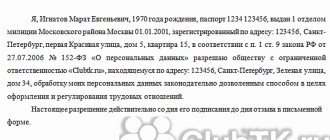

Reasons

In order for the head of an institution to issue an order to change a surname in connection with marriage, not many documents are needed. An application from the employee herself, her passport and marriage certificate will be sufficient.

All papers are attached to it when filling out the document. The marriage certificate is provided in the form of copies, and you will need two of them. One is certified and filed in the employee’s personal file, the second is attached to the order to change the surname in connection with marriage (as a basis). According to Federal Law No. 143-FZ of November 15, 1997, marriage is formalized with the appropriate documents. A record of this fact will always be in the hands of the employee who wishes to change his last name.

Please note that the formation of an order is possible only after the employee receives a passport with a new surname. Issuing an order earlier than this period will be a violation.

“SZV-M error 30”: how to fix

Result code 30 means that the report has been accepted, but inaccuracies for some employees need to be corrected.

Examples of such errors:

- Error in the patronymic, first name, last name of the employee.

- The employee's SNILS was recorded incorrectly.

- Full name does not match the insurance certificate.

- Lack of last name or first name of the employee.

The fund will also accept a report with extra spaces, periods, and hyphens.

How to correct error code 30 in SZV-M: submit a supplementary form for employees if you did not indicate the last name and first name of the employee. If there is an error in the personnel data, then you need to submit a canceling and supplementing form.

Divorce

In the case of divorce, the situation follows exactly the same pattern. The main thing is to wait until the employee of the organization receives a divorce certificate and a passport with updated data in hand.

Last name, first name or patronymic may change due to other reasons. An employee can change his full name at any time on his own initiative. Only the reasons for issuing the order will change depending on the reasons. There will be no significant changes to its content. In the cases described, it would be correct to rely on the order to change the surname in connection with marriage.

“SZV-M error 50”: how to fix

Result code 50 means that the report must be resubmitted, otherwise it will be considered failed.

Error code 50 appears if the policyholder:

- The XML document was filled out incorrectly.

- The report file does not match the XSD schema.

- The report is signed with someone else's electronic signature. This happens if the representative does not have a power of attorney.

- You provided an incorrect TIN or organization registration number.

- Submitted a supplementary form instead of the original one. This happens if the organization made a mistake in the type of form.

- The period code you specified was incorrect.

Let's take a closer look at how to fix error code 50 in SZV-M.

If there are errors in the composition or structure of the file, contact the program developer and update it. If IT specialists take too long to correct errors, and you realize that you will not be able to submit your report on time, use the programs on the Pension Fund website. Generate the report again and send it to the Pension Fund.

Rename the corrected file. If the name remains the same when you resubmit, the fund's verification program will not automatically accept it.

If the fund returned the report because of someone else’s signature, redo the document or send a power of attorney to the company’s representative at the Pension Fund. Indicate in it that he has the right to sign SZV-M with his electronic signature.

If the policyholder made a mistake in the TIN and registration number, correct these data and submit the report again.

If you specified the wrong form type, follow this algorithm: send a report with the “outcome” type and a letter explaining the error. If the policyholder submits a report for the first time a month, then the “outcome” type should always be.

To avoid errors in reports, connect to the “My Business” service. If you have any additional questions or other difficulties, our specialists are always ready to help. Subscribe to blog updates - stay up to date with the latest changes. Add to favorites Press Ctrl+D to add a page to favorites 0 likes Share:

Dating

Often the dates of this document raise questions. The personnel officer has three dates: when the marriage certificate was issued, when the employee received a passport with a changed surname, and when he submitted an application to the personnel department with a request to make changes.

Attention!

A correctly executed order must be dated the third day (no later than three working days from its submission): when the employee expressed a desire to change documents. Until this point, the organization does not have the right to make any changes to the personal file or anywhere else.

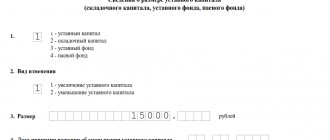

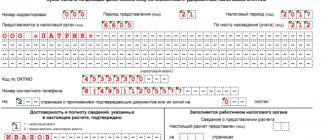

Composition and deadlines for reporting contributions

Form 4-FSS on paper had to be submitted by January 22, 2018. In electronic form, 4-FSS is accepted until January 25, 2018 inclusive.

If there are no accruals, you must submit a zero report in Form 4-FSS, which consists of a title page, table 1, table 2 and table 5.

To calculate insurance premiums (DAM), which policyholders submit to the Federal Tax Service, a single deadline has been established - you need to report before 01/30/2018 inclusive.

If there are no accruals, you must submit a zero calculation, which includes the title page, sections 1 and 3, subsections 1.1 and 1.2 of Appendix No. 1 of Section 1, Appendix No. 2 of Section 1.

The reporting forms for insurance premiums have not changed.

New control ratios in the DAM

As of January 1, 2018, a new edition of the Tax Code of the Russian Federation is in force. The changes also affected insurance premiums. In para. 2 clause 7 art. 431 of the Tax Code of the Russian Federation, cases have been added when the Federal Tax Service considers the payment of contributions to be unpaid.

Inspectors have the right to consider the DAM unrepresented if:

- personal data about individuals is unreliable;

- errors were made in calculating the amount of payments to individuals;

- the base for calculating contributions to compulsory pension insurance and (or) pension contributions (at basic and additional tariffs) is incorrectly calculated;

- the amount of pension contributions for each individual for the billing (reporting) period and (or) for each of the last three months of this period does not coincide with their amount for the organization as a whole.

Changes in the Tax Code of the Russian Federation entailed changes in the control ratios that the Federal Tax Service uses when checking the DAM. New control ratios are given in the letter of the Federal Tax Service of the Russian Federation dated December 13, 2017 No. GD-4-11/ [email protected]

Typically, accounting programs have built-in automatic checking of control ratios into each report. When filling out the RSV for 2021, make sure that your program is updated and takes into account the new verification formulas.

How to calculate the average headcount

The average headcount is indicated on the title page of the 4-FSS report. This indicator is also included in Appendix No. 5 of the DAM by policyholders who apply reduced rates.

The average headcount is calculated in accordance with Rosstat Order No. 498 dated October 26, 2015.

To calculate this indicator for the annual report, you need to take the headcount data for each month and divide by 12.

Let’s assume that the company’s average headcount (ASH) from January to November was 4 people. In December the number was 12 people.

MSS = (4 x 11 + 12) : 12 = 4.67

The result obtained is rounded to 5. This means that in the contribution reports, the value 5 should be indicated in the line for the average headcount.

You may also find the following materials useful:

Cheat sheet for calculating the average number of employees

Employment contract

How to make changes to an employment contract? There are two points of view on this matter.

One of them involves drawing up an additional agreement to the contract, where the personnel officer reflects the changes. It is based on the Labor Code of the Russian Federation, Art. 57, which states that the missing information should be included in the text of the employment contract itself, and a change of surname means changed information. Therefore, an additional agreement is necessary.

Do I need to make changes to the employment contract when the employee changes her last name?

Another position is that a change in the full name is a change in information about the employee, and not in the conditions of his work. The missing information should be included in the text of the agreement (clause 3 of the same article of the Labor Code of the Russian Federation). Additionally, supporters of this position refer to Art. 72 of the Code, which states that an additional agreement applies only when the employee’s working conditions change.

Prudent personnel officers often make changes to both the employment contract and the additional agreement drawn up to it in order to guarantee that claims from regulatory authorities are excluded. In the practice of inspections of companies by the Labor Inspectorate, sanctions for such “double” reporting of information have not yet been recorded.

At what point should data on a change of surname be reflected in the RSV?

All personal data on employees is reflected in the third section of the DAM.

If an employee changes her last name, she must change her SNILS. If at the time of compiling the DAM the new SNILS has not yet been received, the report must indicate the employee’s previous surname.

The employee’s new surname is reflected in the calculation of insurance premiums only when he receives a new SNILS.

Thus, the employee’s personal data must correspond to the current SNILS.