Form SZV-STAZH - is a report on work experience, which must be submitted annually to the Pension Fund ( for 2020, the report must be submitted before March 1, 2021 ).

The SZV-STAZH form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2021 No. 507P “On approval of the form SZV-STAZH, ODV-1, SZV-KORR, SZV-ISKH of the procedure for filling them out and the format of information and on the recognition as invalid by the Resolution of the Board of the Pension Fund of the Russian Federation dated 01/11/2017 No. 3P.”

We bring to your attention the basic information on the form that PFR specialists give at seminars.

SZV-STAZH - what kind of reporting is this?

The SZV-STAZH report should be considered as a form that each business entity with employees must send to the Pension Fund of Russia in order to provide the fund with data on seniority. It replaced the previously used RSV-1 report, but only with regard to information about persons working in the organization, as well as those involved under contract agreements.

At first glance, this form resembles another new report for the Pension Fund - SZV-M. It was also introduced not long ago to transfer information about pensioners who are still performing work duties to the Pension Fund.

However, upon closer examination, it becomes clear that SZV-STAZH is a more extensive source of data than SZV-M. It contains not only personal information about the employee and his SNILS number, but also the dates of the beginning and end of work in the business entity.

This report also shows periods during which the employee’s job was retained, but during this time he did not actually work. Such periods include sick periods, unpaid leaves, periods of childcare, etc.

The law established the obligation of a business entity to issue a copy of this report to an employee upon dismissal of the latter.

In such a situation, the form must be filled out for him alone, printed and submitted along with other mandatory documents on the final day of work. Attention: when submitting a report, an attachment to it is the EDV-1 form, which includes data on contributions accrued and sent to the Federal Tax Service for a given period.

The need to provide such data arises from the fact that reports on contributions in total terms during the year are provided only to the tax authority. If an employee of an organization retires, the business entity must fill out and submit to the fund the SZV-STAZH form for the correct calculation of pension payments.

How to fill out the form

The latest edition (dated September 2, 2020) of Resolution No. 507 will tell you how to fill out the SZV-STAZH for 2021. There are only a few features that you should pay attention to.

When filling out the field “Registration number in the Pension Fund of Russia”, indicate the registration number of the policyholder of 12 characters, and in the field “TIN” - the individual number of the organization or individual entrepreneur, which consists of 10 or 12 characters. If there are fewer characters than cells, dashes should be placed in the last two. In the “Type of information” column, indicate the type of report using the “X” sign. There are three types in total:

- original;

- complementary;

- assignment of pension.

If the latter type is indicated, then the form is submitted without taking into account reporting deadlines only for those persons who need to take into account the length of service for the current calendar year to establish a pension. A supplementary report to the Pension Fund is expected for insured persons who were not included in the main report for one reason or another.

When filling out section 3, please note that it provides for continuous numbering. This means that a serial number must be assigned to records for each insured person. Even if several lines must be filled in about the work period, the number is assigned only to the first of them. It is important to remember that all numbers are entered in ascending order without omissions or repetitions.

In the “Operation period” column, dates are indicated only within the reporting period, which is indicated in section 2 of the report. In case of a break in work, start a new line without duplicating the employee’s data and SNILS.

IMPORTANT!

Often, when filling out SZV-STAZH, the question arises: whether or not to fill out paragraph 4 in SZV-STAZH, when the same information duplicates the data of the “Unified Settlement”, which policyholders must submit to the Federal Tax Service. Based on the approved procedure for filling out SZV-STAZH, it is necessary to enter data on accrued and paid insurance contributions in this section only if you are submitting a form with the type of information “appointment of pension”.

After filling out the form, the responsible person indicates the name of the manager’s position, and the report itself is certified by his signature. A stamp is placed if available.

Here is an example of filling out SZV-STAZH in 2021 according to all the rules:

Who must submit the SZV-STAZH form?

The law directly states which business entities are required to submit the specified form.

This list includes:

- Companies and institutions of any form of ownership that have formalized labor agreements with employees and contract agreements. They may also have branches and representative offices that are registered in the prescribed manner;

- Individuals who operate in the individual entrepreneur format, as well as lawyers, notaries and similar persons who engage personnel under contracts.

Attention: it follows that the main criterion is the hiring of workers, to whom remuneration is calculated and insurance premiums are paid. If there are any, then the business entity submits the form unconditionally.

Deadlines for passing SZV-STAZH in 2021

It has been established that SZV-STAZH is an annual report. This means that you only need to fill it out and send it to the pension authority once a year. According to the law, this must be completed before March 1 of the reporting year. If the specified date coincides with a weekend or holiday, then the deadline for sending must be moved to the next working day.

In 2021, you must report in the SZV-STAZh format by March 1, 2019 for the past 2021. Since March 1 is Friday, this day cannot be transferred.

The deadlines for submission in 2021 on paper do not differ from submission via the Internet.

However, there are situations in which the report submission dates change:

- If an employee resigns, then it is necessary to draw up and hand over completed reports to him on his final working day;

- If an employee applies for a pension for the first time, then after receiving a request from the fund, the business entity must draw up and submit a report on it within three days.

Who submits and when?

Federal Law No. 27 of April 1, 1996 “On individual (personalized) accounting in the compulsory pension insurance system” states that the report is submitted once a year, no later than March 1.

There is no need to wait until the first of March in case of reorganization or liquidation of an organization (IP): a report on the length of service of employees must be submitted before information about the termination of the company or individual entrepreneur is entered into the Unified State Register of Legal Entities (USRIP). The data must be received by the Pension Fund within one month from the date of approval of the interim liquidation balance sheet (making a decision to terminate activities as an individual entrepreneur). If bankruptcy proceedings are applied, the report is provided before the bankruptcy trustee’s report on the results of bankruptcy proceedings is sent to the arbitration court in accordance with the Federal Law “On Insolvency (Bankruptcy)”.

A similar procedure is provided if an individual entrepreneur or company carries out a reorganization.

The list of persons who take the SZV-STAZH is indicated in Art. 1 27-FZ: these are all insurers, that is, organizations and individual entrepreneurs, including foreign ones, who employ citizens under an employment contract or a civil process agreement and pay insurance premiums for them.

Delivery methods

It has been established that the SZV-STAZH form can be transferred to the Pension Fund in several ways:

- You can fill out the report on a computer, print it out and give it to the inspector personally. In this case, you must have two copies of it - the second one must be marked upon receipt of the form. Sometimes, at the time of submission on paper, you need to provide an electronic file on a medium (disk, flash drive, etc.). This method of submitting a report is available only to those business entities whose number of hired personnel does not exceed 25 people.

- You can send the report electronically using the EDI system. To do this, the subject must have an electronic signature and conclude an agreement with a specialized service. This method is mandatory for those employers who have more than 25 employees. Up to this amount, you can submit electronically if you wish.

Seeing you off to retirement

When applying for a pension, an employee must submit information to the Pension Fund using the SZV-STAZH form. The filing deadline is within three days from the date of receipt of a written application from the employee. Consequently, the future pensioner is required to submit an application to the employer. There is no unified application format; draw up the document in any form. For example, it looks like this:

An example of filling out a report when registering an employee for retirement:

Report submission form

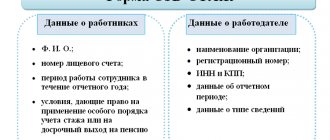

The form contains information both about the business entity itself and about its employees, for whom the company accrued and paid contributions.

Attention: together with the SZV-STAZH form, you must also send the EDV-1 inventory.

This document must indicate information about the business entity, as well as the amount of the balance of contributions at the beginning of the period, accrued and paid during the period. Additionally, here you must indicate the number of employees with whom the company has signed employment agreements.

Sample of filling out SZV-STAZH in 2019

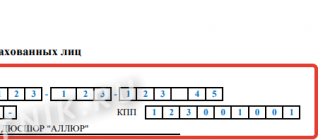

Section No. 1 – Information about the policyholder

At the very top is the registration number assigned to the business entity in the Pension Fund.

Then the TIN and checkpoint codes are indicated. The company’s TIN code includes 10 characters, and the two cells that turn out to be empty after filling will need to be crossed out. The entrepreneur, in turn, has a TIN code that includes 12 characters, but is not assigned a checkpoint code.

Next, you need to write down the short name of the company or full name in the report. entrepreneur. This information must be taken from the registration documents.

The “Information type” column can take the following values:

| Code | Description |

| Original | This report is transmitted for the first time in the specified period |

| Additional | The report has already been submitted to the Pension Fund in this period, but it needs to be supplemented with new information |

| Assignment of pension | This code is only used if the report is for a retiring employee. |

Section No. 2 - Reporting period

In this section you must enter the number of the year for which the report is being sent.

Section No. 3 – Information about the period of work of the insured persons

This section looks like a table where you need to enter information about all employees with whom employment contracts or contract contracts were concluded during the reporting year.

In the columns “Last name”, “First name” and “Patronymic” the specified personal information for each employee is entered.

In the next column of SNILS, you must indicate the number assigned to each employee in the Pension Fund of Russia.

The column “Operation period” is divided into two parts. On the left you need to write down the date from which the employee began performing work duties in the company. The day on which he quit is recorded on the right. If an employee has worked for the organization for the entire year, then the beginning and end days of the calendar year are recorded in these columns.

A situation may arise in which one employee will have several periods of work at once. This can happen if, for example, he quit and then returned to this institution again in the same year.

In this case, both periods are entered, placing the lines one below the other. The personal data of such an employee (full name and SNILS number) must be entered only once, in the first line. In the remaining rows these columns are left empty.

In a situation where an employee retires and a report is drawn up due to this event, then in the last column it is necessary to indicate the day of the expected start of the rest.

If a citizen performed work in accordance with the concluded GPC agreement, then the dates of its validity period must be entered in the columns.

In the “Territorial conditions” column, it is necessary to indicate a code that determines the employee’s performance of duties in special environmental conditions.

Example codes:

| Code | Description |

| RKS | Far North |

| VILLAGE | Work in agriculture |

| ChZ1 | Work in the Exclusion Zone |

| ChZ3 | Permanent residence in the Zone with the right to resettle |

A complete list of codes is provided in the instructions for filling out the form.

A code is entered in the “Special conditions” column when the employee performed work in conditions with harmful factors. Such work gives the right to retire at an early age. However, when indicating this period, there is a peculiarity - if there was such work, but all the necessary documents were not completed for confirmation, then this benefit cannot be used.

Example codes:

| Code | Description |

| ZP12A | Underground work |

| ZP12V | Women's work as tractor drivers and machinists in agriculture |

| ZP12E | Work in field, geological exploration and other similar parties and expeditions |

| ZP12ZH | Logging work |

A complete list of codes is also provided in the instructions for filling out the form.

Column 10 should contain a code indicating length of service. In this case, column 11 contains the duration of this period in months and days.

| Code | Description |

| CHILDREN | Child care period up to 1.5 years |

| NEOPL | Vacation without pay, simply because of the employee |

| VRNETRUD | Being on sick leave |

| QUALIFY | Being in advanced training |

| SIMPLE | Downtime due to employer |

A complete list of possible codes is in the instructions for the form.

The column “Information about the dismissal of the insured person” should include a checkbox only if the day of dismissal of the employee is December 31.

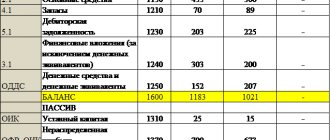

Section No. 4 – Information on accrued (paid) insurance contributions for compulsory pension insurance

Information is entered into this section only if the employee for whom the report is being prepared retires. There are two columns here in the form of questions that need to be answered by checking the boxes.

Section No. 5 – Information on paid pension contributions in accordance with pension agreements for early non-state pension provision

This section should also only be completed when the employee is about to retire. In the section it is necessary to note the periods for which contributions were calculated, and also indicate whether they were paid.

Regulations

Regulatory acts governing personalized reporting to the Pension Fund:

- Federal Law No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system” (as amended by Federal Law No. 250-FZ of July 3, 2016), hereinafter referred to as Federal Law No. 27-FZ

- Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n “On approval of the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons”

- Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507P “On approval of the form “Information on the insurance experience of insured persons (sv-experience)”, the form “Information on the policyholder transferred to the Pension Fund of the Russian Federation for maintaining individual (personalized) records (EFV-1)” , forms “Data on the adjustment of information recorded on the individual personal account of the insured person (sv-corr)”, forms “Information on earnings (remuneration), income, amount of payments and other remunerations, accrued and paid insurance premiums, periods of employment and other activities counted in the insurance period of the insured person (sv-iskh)", the procedure for filling them out and the format of information and on the recognition as invalid of the resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2021 N 3P"

Inventory EDV-1

Along with completing the SZV-STAZH report, the responsible person must also fill out and submit an inventory in the EDV-1 form. It summarizes all the data that was included in the report.

The inventory can be compiled in one of three acceptable formats: “Initial”, “Correcting”, as well as “Cancelling”. The format is selected by marking o in the appropriate window.

Section 1 provides information about the organization. Filling out this information is carried out by analogy with section 1 of the SZV-STAZH form.

In section 2, the “Reporting period” column should always include “0”. The “Year” column records the number of the year for which the report and inventory were prepared.

Section 3 records the total number of employees included in the report.

Section 4 is completed only when the reports contain data in the SZV-ISH and SZV-KORR formats and marked “Special”. The data reflected here must be presented for the entire reporting period.

Section 5 contains information if the report contains data in the SZV-STAZH or SZV-ISKH format for employees who are going to retire early due to special climatic conditions or harmful factors.

Special Moments

Providing pension information in the SZV-STAZH form has a number of characteristic nuances. Here are the instructions for filling out the SZV-STAZH in 2021:

- Submit the report even if there were no accruals in favor of the insured persons during the reporting period. The regulation mainly affects companies whose staff includes a manager who is the only founder. In other situations, when there have been no accruals for a long time, you will have to submit information in any case.

- If during the reporting period your organization has already submitted data to the Pension Fund of the Russian Federation on an employee (for example, the employee retired in May), then still include it in the annual report. Otherwise, discrepancies will arise in the database of the controlling fund, and the lack of information will entail the imposition of an administrative penalty on the company.

- If in the reporting year citizens from places of deprivation of liberty were involved in work in the organization, then they should also be included in the reporting. Request the necessary information about prisoners in FSIN institutions. Periods of work will be included in the length of service on the basis of Art. 1 of Law No. 27-FZ of 04/01/1996.

- If there are no employees on the staff of an individual entrepreneur, but the functions of the head of the company are performed by the merchant himself under a contract, there is no need to submit data to the Pension Fund. This is all explained by the fact that individual entrepreneurs independently calculate and pay insurance premiums for their own benefit. Therefore, there is no need to submit information about the individual entrepreneur’s experience.

Be sure to check whether the listed exceptions occur in the activities of your organization.

Zero reporting on the SZV-STAZH form

The report establishes that it is submitted to the Pension Fund in cases where a business entity has at least one concluded employment agreement. An entrepreneur without employees, as well as a lawyer or notary who works alone, has no obligation to submit this report.

It should be noted that the format of this report implies that the tabular part must contain at least one row of data. Otherwise, it will not be able to pass the entrance control for correct filling.

There is no clear answer for companies regarding the preparation of a zero report. This is due to the fact that this business entity has at least a director named in the Articles of Association.

Therefore, the need to submit a report can be twofold:

- The company does not have a single employment agreement, including with the director. This means there is no need to submit a report. But at the same time, the director must be a hired person from outside, and not the only founder.

- The report must be submitted if an agreement has been concluded with the manager. In addition, this will also have to be done if there is no agreement, but the director is the sole owner. In this case, according to the law, he is considered to be in an employment relationship, regardless of the actual conclusion of the agreement. The report will contain a single line with this person.

Attention: the report will not be considered zero if the organization has employees, but all of them are on vacation without pay. In this situation, they are all entered on the form, indicating the period code.

Separate divisions: how to report

Check that two prerequisites are met:

- Who calculates and pays wages to employees of the department.

- Does the separate division have a separate current account?

If a separate division has opened an independent current account in any banking organization (with the Federal Treasury for public sector institutions), and the OP independently calculates wages and pays them from its current account in favor of employees, then you will have to submit a separate SZV-STAZH for the separate division .

The rule only applies if two conditions are met simultaneously. If only one of the above conditions is met, then the parent agency is required to report.

Filling out SZV-STAZH for a separate unit has several nuances:

- Information must be submitted to the territorial office of the Pension Fund at the location of the separate unit.

- The report should indicate the registration number of the policyholder that was assigned to the separate unit upon registration with the Pension Fund of Russia.

- Fill out the checkpoint and tax identification number in the same way as the registration number. Indicate the values that were assigned to the separate division, not the parent organization.

Fines for failure to submit a report or for failure to issue upon dismissal

There are several fines for failure to submit a report, the amount of which depends on the circumstances of the violation:

- The business entity submitted the report in full, but the deadline established by law was not met - 500 rubles for each employee whose information was not sent on time.

- The report was sent on time, but not all the necessary employees were included - 500 rubles for each employee whose information was not included in the report when submitted.

- The report was submitted to the authority on time and all necessary workers were identified in it. However, during the inspection, the supervisory authority found out that false data was entered into the report for some employees - 500 rubles for each person for whom incorrect data was provided.

Another fine is established in the case where a business entity was required to report only electronically, but submitted the report on paper. Its size is set at 1000 rubles.

Important: since by law the employer is obliged to hand over SZV-STAZH forms with information about him upon dismissal to his former employee, fines have been introduced for violating this obligation. Its size is set at 50,000 rubles.

The same amount of the fine will need to be paid in a situation where an employee is applying for a retirement pension, and the company did not submit information about him to the Pension Fund within the established three-day period.

Tags: ReportingReporting for employees SZV-STAZH

Delivery format

The type of reporting to the Pension Fund of the Russian Federation directly depends on the average number of employees.

If a company employs 25 people or more, the SZV-STAZH report must be filled out online on the Pension Fund website and sent electronically; a paper report will not be accepted. For non-compliance with the reporting format requirements, separate administrative measures are provided.

If the number of the company does not reach 24 people, then calmly report on paper. The company has the right to simplify and speed up document flow with regulatory authorities by switching to electronic data exchange, that is, sending reports electronically.

IMPORTANT!

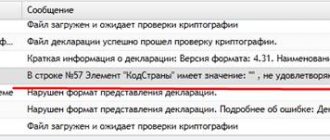

To generate electronic reporting, you will need a special enhanced digital signature. It should be issued in the name of the manager or another responsible person vested with the appropriate authority (signature authority).

An electronic signature that does not meet the current requirements for cryptographic information protection is not used to sign electronic reports. The Pension Fund of Russia will refuse to accept such a report.