In this article we will tell you who is issued a 2nd personal income tax certificate during maternity leave and why, and what data it contains. Let's look at the wording first.

Maternity leave, maternity leave - for simplicity, this is the name for the time when an employee is:

- on maternity leave

- on maternity leave for up to one and a half years

During such periods, the employee, as a rule, does not work, but receives benefits in accordance with Federal Law No. 255-FZ of December 29, 2006.

Income in the form of maternity benefits and child care benefits up to one and a half years old

These types of income are not subject to personal income tax. This is directly established by paragraph 1 of Article 217 of the Tax Code of the Russian Federation. In what cases can an employee on maternity leave be issued a 2-NDFL certificate:

- If the employee is on maternity leave for up to one and a half years and, in accordance with Article 256 of the Labor Code of the Russian Federation, has written a statement of desire to work during this leave on a part-time basis. The benefit is retained.

- If it is not the woman herself who is on maternity leave for a child under one and a half years old, but her husband, one of the parents, other relatives or a guardian, such persons can also go to work on a part-time basis in compliance with all the requirements of Article 256 of the Labor Code .

- If an employee on vacation was paid, for example, a bonus for the previous year or financial assistance. Both the bonus and financial assistance must relate to payments subject to personal income tax.

- If, for example, a lease agreement is concluded with an employee for a car that she owns, and she receives rent while on maternity leave.

- In all other cases of receiving other income subject to personal income tax.

| ★ Manual “How to calculate maternity benefits in a new way in 2021” (practical examples, complex cases, step-by-step instructions) purchased > 2600 |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Free legal assistance

Hello! Please tell me! I am applying for a child benefit from social security. They require proof of income for both parents. It’s clear that they will give my husband 2NDFL. And I’m on maternity leave and only receive benefits for caring for a child up to 1.5 years old (the child is 9 months old, maternity leave is not included in the previous 3 months).

- sick leave issued for the entire period of incapacity for work of 140, 156 or 194 days;

- certificate of registration at the antenatal clinic in the early stages of pregnancy - up to 12 weeks (if available);

- application addressed to the employer;

- identification documents;

- certificate of income for the last year of work;

- number of the bank account or card where the benefit will be transferred.

- For leave and child care benefits:

- identification documents;

- a copy of the child(ren)’s birth certificate and the original(s) for verification;

- bank account or card number;

- statement.

Answers to common questions

Question No. 1. An employee who is on maternity leave asks for a 2-NDFL certificate to receive a subsidy. The employee did not have any income this year, what should I do?

Benefits are paid directly by the territorial body of the Social Insurance Fund. This means that you do not have the right to issue even a certificate in any form to such an employee.

In everyday life, maternity leave is a leave that is taken out in connection with childbirth, as well as for caring for a baby until he reaches 1.5 years of age. According to the law, benefits are issued during this period. A woman who is on maternity leave can contact the bank to open a credit line or apply for a visa to the consulate. In such cases, she will need a declaration, but how to issue a certificate in Form 2 of personal income tax for a maternity leave, if the type of income is not subject to income tax. Let's consider all the features of filling out documents in this case.

Topic: Certificate for social security for maternity leave

Good afternoon, perhaps someone has already encountered such a situation. The maternity leaver asked for a certificate from social security to receive something there for the last 3 months. In these last 3 months, she just began to receive child care benefits for up to 1.5 years. They turned her over to social security and told her to bring a certificate stating that she received maternity and maternity benefits. She received maternity benefits in February, and benefits for the birth of a child in May. I gave the employee a certificate for the entire year: January-September, so that the amounts received could be clearly seen (indicated that the payments were from the Social Insurance Fund and the names of the benefits). In social security, the worker was again presented with a certificate and told to spread the amounts received by month. those. Divide maternity and birth by month so that there are no “empty” months on the certificate.

I’ll be honest, this is the first time I’ve encountered such a wish. Are social security claims legitimate? “spread out” these benefits over months? Maybe something new has appeared in the legislation? in social security she screams on the phone like a victim. “If there is no such certificate, the woman will not receive some kind of benefit.” Do I have the right to make such a certificate? Tell me please.

When is the 2nd personal income tax declaration completed?

A business entity can issue an employee a personal income tax certificate 2 only if income that is subject to income tax was transferred in her favor.

These include:

- Salary and equivalent payments, bonuses and allowances;

- financial assistance, the amount of which exceeded the minimum threshold for calculating personal income tax of 4,000 rubles. in year;

- amounts accrued for sick leave, including child care;

- other income, for example from the rental of real estate, is subject to personal income tax.

Procedure for payment of amounts

The following categories of women have the right to maternity benefits:

- Working;

- registered with the central control center;

- full-time students;

- military.

The amount of payments depends on the amount of accrued income. It should be separately noted that the state also took care of those women who took in children from the orphanage.

If an employee on maternity leave refuses subsidies and continues to work, she is not entitled to transfer benefits, since she receives her basic income, which is subject to personal income tax. At any time she can go on maternity leave, in which case the payment of remuneration will be stopped and the benefit will replace it.

The subsidy is transferred to the woman at her place of employment. If the company was liquidated during maternity leave, payments continue to be made to the social insurance at the place of residence.

The subsidy is calculated based on the amount of earnings, for students - from a scholarship, for military personnel - from salary allowance. For dismissed employees due to the liquidation of the organization, 300 rubles are paid.

The amount of maternity leave is calculated based on average earnings for the last 2 years. If a woman was on maternity leave during a given period of time, it can be replaced by previous months. It is important to exclude periods of sick leave from the calculation.

When you can and cannot replace years to calculate maternity payments

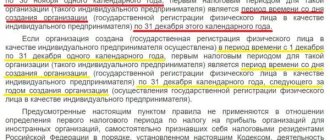

The legislation allows in some cases to replace the billing periods for calculating subsidies:

- To calculate maternity and child care benefits;

- if during the billing period the woman was on maternity leave;

- if the average salary increases with such a replacement, the amount of the benefit will increase accordingly;

- you can replace both the first and second years of accrual, and it does not matter which of them was the time after maternity leave;

- can be replaced by earlier periods;

- it is important to take into account the number of days in the period being replaced, taking into account leap years;

- The average daily earnings of the year being replaced should not exceed the maximum permissible average value for the given period.

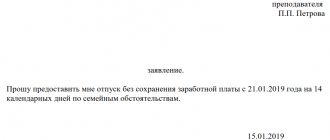

Sample application for transferring years to calculate benefits:

Calculation of maternity benefits for a part-time worker

Maternity benefits for the expectant mother are calculated for each place of employment, and it does not matter whether it is the main place or a combination. She must provide the original certificate of incapacity for work to all employers, apply for leave and receive the benefit amount.

In this case, the benefit will be accrued for the last two years. If employment during this period was in several places, each earnings must be calculated separately. It is important to take exactly those incomes where contributions to the Social Insurance Fund were made. If there were rewards and contributions were not accrued, such amounts are not taken into account.

For 2021, the maximum amount of earnings has been determined to be 815 thousand rubles. In case of combination, this limit is considered for each enterprise.

Example calculation calculator:

- The woman’s earnings at one company amounted to 600,000 rubles;

- for the second – 100,000 rubles;

- on the third – 300,000 rubles;

- the total amount of income is 1,000,000 rubles.

The minimum amount of benefits in case of combination cannot be lower than the calculated value of 43,675.40 rubles.

The maximum calculation of maternity leave for 2 years for part-time workers is:

- (755000+718000)/730*140 = 282493.15 rubles.

The size of the maximum payment amounts by year:

Benefit amount

Accounting needs to take into account the size of the maximum base for Social Insurance contributions for the selected years. In 2021 it is 865,000.00 rubles, in 2018 it is 815,000.00 rubles. This affects the maximum benefit amount. In 2021, for each day of maternity leave, an employee can receive no more than 2,301.37 rubles.

The minimum benefit is tied to the minimum wage - in 2021 its amount cannot be lower than 398.79 rubles. per day (provided that the employee is employed full time, otherwise payment is made in proportion to working hours). If the accounting department makes calculations based on the “minimum wage”, this must be indicated in the calculation certificate.

If the employee has a total work experience of less than six months, then the monthly benefit should not exceed the minimum wage level (in 2021 - 12,130 rubles).

A calculation certificate is drawn up on a separate sheet attached to the sick leave. It is not necessary to put a stamp on the calculation. If the next sick leave was issued, extending the leave, for example, for complicated childbirth, then the certificate must indicate not only the number of the second certificate of incapacity for work, but also the primary document.

Below is an example of a completed certificate of calculation for the standard duration of leave under the BiR of 140 days.

Certificate 2-NDFL during maternity leave

In this article we will tell you who is issued a 2nd personal income tax certificate during maternity leave and why, and what data it contains. Let's look at the wording first. Maternity leave, maternity leave - for simplicity, this is the name for the time when an employee is:

- on maternity leave

- on maternity leave for up to one and a half years

During such periods, the employee, as a rule, does not work, but receives benefits in accordance with Federal Law No. 255-FZ of December 29, 2006. When a certificate in form 2-NDFL is issued A certificate in form 2-NDFL is issued only if there have been income payments to the employee.

- Salary and bonuses

- Over 4 thousand in financial assistance.

rub.

Procedure for issuance at the place of work

You need to submit a statement to the manager or his authorized representative. A copy of the document, according to the Labor Code of the Russian Federation - Art. 62, is provided to the employee free of charge - in person or via mail.

You can also get a monthly statement from your statement, personal account, or work book.

Deadlines

Documentation is issued within three days from the date of application.

After submitting the application, you should make sure that it is registered in the accounting register.

You can receive a certificate upon applying to social protection of the population, along with other information necessary for calculating financial assistance.

Will they give you a 2nd personal income tax certificate while on maternity leave? what will it look like?

This is done so that the new employer can assign a decent salary to the new employee. The purpose of a certificate of income when assigning alimony is great. It does not matter in what form alimony is assigned - as a percentage of earnings or as a fixed amount. Information from the certificate will help the court determine the required amount of alimony and make the right decision. Certificates are presented to the court when assigning alimony, both for children and for parents and other needy relatives. The most common purpose of this certificate is when applying for a loan.

Banks require the provision of such a certificate, both in a unified form and in the bank’s form. It's no secret that many workers receive two salaries - official and in an envelope. The salary that is received in the envelope is not reflected in any way on the 2-NDFL certificate.

Where you may need help

A document on income for a maternity leaver is required in the following cases:

- to process lump sum payments and child benefits for three months;

- if you want to get a microloan or credit;

- when applying for a new job to calculate compensation for being on sick leave in the future.

If you are on maternity leave for one year and need to obtain a document on income, the accounting department issues a “zero certificate”, which shows that wages were not accrued during the specified period. This is provided for by current legislation.

Certificate 2-personal income tax and maternity leave

2-NDFL certificates are submitted to the inspectorate at the location of the unit. Therefore, it is necessary to attach a certificate and another document that confirms an additional source of income. Certificate 2-NDFL is an official document that has legal force in many government agencies. This is done when she is going to quit after the end of maternity leave and she needs to receive benefits through the social security authorities.

If the length of service of a woman who is going on maternity leave is not enough to calculate sick leave payments, she must bring a certificate in form 2-NDFL from her former employer. The bank requires such a certificate if not all of the salary is paid to the borrower officially - that is, not all of it is subject to income tax. 2-NDFL and maternity leave The main thing is that the employer’s stamp is on the certificate. If the latter has the right to sign, then only his signature can be on the certificate.

Download a free sample for Social Security

A citizen can obtain a certificate of income only from his employer. To do this, you need to contact the accounting department. An important condition is to indicate where exactly the document will be submitted, since the form of its execution depends on this.

Often it must be provided to the social protection authorities, where the citizen applies for benefits, subsidies or allowances. In this case, the document should be drawn up according to the general rules, and the destination should be designated “for submission to the social security department” or “at the place of request.”

Personal income tax

The salary certificate has several approved forms, among which the most common is 2-NDFL. Some organizations may have their own requirements, such as document execution on company letterhead, etc.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

2-NDFL has a more complex form than a simple certificate. The form of this form is approved by the tax service. Together with income for the last months, it lists tax deductions for this period (if any), as well as the amount of taxes and income.

The sample is issued in the quantity requested by the employee. The employer does not have the right to charge him a fee for issuing certificates, no matter how many are required.

In free form

The certificate can be issued in free form, since the legislation does not provide clear instructions regarding its type.

You can create a form in one of the following ways:

- take as a sample a document developed in the organization;

- write it yourself;

- download from the Internet.

If an employee has a debt at the place of work, this should also be indicated.

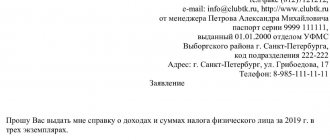

The document is drawn up according to the standard structure:

- in the upper left part you should write down the name of the organization and its details;

- a little lower - the address of the enterprise location;

- the date the document was written (if it is issued on letterhead, most of this information is already present);

- The word “Help” should be written in large letters in the center;

- the text must be written on a new line - indicate information about the employee (passport details, full name, information about work activity, position, date of conclusion of the employment agreement, its validity period);

- the second paragraph should contain data on income - they can be presented in free form (table or list);

- the exact amounts of income should be indicated;

- if you need to indicate information about deductions to extra-budgetary funds, you can create a new column in the table or create a new list.

Supervisory authorities very carefully check the documents received by them, so care should be taken to ensure the reliability of the information.

It is also not allowed to make corrections in such certificates. To make the form, you can use not only company-branded sheets of the enterprise, but also a regular sheet of A4 paper. Information can be entered in printed form or manually. The document must be signed by the head of the organization and the accountant.

Sample certificate of salary for 3 months for social security

Calculation of personal income tax for maternity leave in 2021

- Benefits for temporary disability (including for caring for a sick child)

- Other income (for example, rental of property owned by an employee).

- Other payments listed in Chapter 23 of the Tax Code of the Russian Federation.

Income in the form of maternity benefits and child care benefits up to one and a half years old. These types of income are not subject to personal income tax. This is directly established by paragraph 1 of Article 217 of the Tax Code of the Russian Federation. In what cases can an employee on maternity leave be issued a 2-NDFL certificate:

- If the employee is on maternity leave for up to one and a half years and, in accordance with Article 256 of the Labor Code of the Russian Federation, has written a statement of desire to work during this leave on a part-time basis.

Where to get it?

The document is drawn up by the employer. If the company is liquidated, then information about payments is included in the template based on archival information.

Unemployed people receive a certificate from the Labor Center at their registration address. Data can be obtained based on information from form 2-NDFL.

If on maternity leave

You should contact the employer directly or send the application by mail. Written information is also compiled at the place of operation of the employer's branch or representative office.

The payments include amounts as benefits for a child up to 1.5, 3 years old, and other funds provided for by collective agreements.

The entrepreneur submits Form 3-NDFL to social security. It is needed even if a businessman has zero income.

Information is provided by the tax office on the basis of periodic reporting.

What is a certificate of income of an individual (form 2-NDFL)

What programs are there for filling out personal income tax certificate 2? Personal income tax is levied on all employed citizens whose wages exceed the non-taxable minimum. If the need arises, Russian citizens can request from their employers a certificate, Form 2-NDFL, which will indicate their earnings for a certain period of time. Procedure... What are the consequences of falsifying a 2-NDFL certificate (consequences) If the income is not official, the employee cannot receive a 2-NDFL certificate at all.

ContentsWhat you need to know? What are the consequences of falsifying a 2-NDFL certificate? Judicial practice (decisions and cases) Either the data in it does not correspond to his actual income - in this case, many try to forge this document. What do you need to know? ↑ Certificates... How to obtain a 2-NDFL certificate for a military personnel in 2021 Of course, income tax is also withheld from allowances. The bank certificate also indicates the amount of the taxpayer’s unofficial income. If a foreign citizen works at an enterprise and an official salary is paid to him, then the employer is also obliged to withhold income tax from him. And since there is income tax, then a certificate in form 2-NDFL exists.

If the taxpayer has the right to a deduction, then information about him must be reflected in the certificate. For example, a taxpayer can receive a property deduction both at his place of work and at the tax office. To prove to the tax authorities that he is or is not receiving a deduction, he must present to the tax authorities a certificate that either indicates the information about the deduction or not.

Information from the certificate in form 2-NDFL plays a huge role when adopting a child. Based on this data, the court makes a decision whether the future parents will be able to financially support the child or not.

How is the form compiled?

Order of the Ministry of Labor No. 182n provides a recommended template with payment data for the two-year period preceding the termination of work.

The regulatory act regulates the procedure, establishes the structure of the certificate, indicating vacation days and other periods of time when the employee maintained his average salary, but social contributions were not deducted for it.

The procedure for issuing a form indicating the amount for three months is not centrally regulated by federal legislation. The company is authorized to develop a template with text and tabular information independently.

Form of income certificate for 3 months

The document contains the following points:

- name of the enterprise (organizational and legal structure), INN, OGRN, legal address, contact details;

- name of the form, with a three-month period;

- date of submission to the social security structure;

- the fact that the form was issued to an actual employee of the company (the name of the employer is indicated);

- the position of the specialist and the period of his employment;

The sample specifies the total amount of salary transferred for a specific period. The digital form is duplicated with text.

The accounting specialist also enters the amount of income tax deducted. If the applicant pays alimony or credit obligations established by a court decision, then this is also indicated.

The form provides for calculating the average monthly income of a citizen. Information for filling it out is taken from the personal account or expense order. At the end, the signature of the manager, chief accountant is placed.

Printing is required. If it is not available, then documentation confirming the authority of the specialist issuing the certificate must be attached. The seal is placed on the left side and should not overlap the signature. Errors and blots are not permitted.

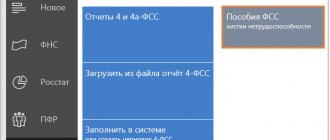

HR departments are authorized to develop the printed form independently. Often an accountant draws up a document in the 1C program.

Registration of a certificate of income in the 1C program

Sample filling

Its strict form is not provided:

- Information about the enterprise and contact information of the employer are indicated.

- Information about the specialist is indicated: his position, grounds for employment - type, contract number.

- It is recommended to enter the start and end date of the activity if the employee has already resigned.

The accountant refers to information from statements, personal accounts, and orders. The total amount of payments is entered. One-time charges that are not subject to insurance premiums are excluded from the list of mandatory data. Additionally, the legislator gives the authority to indicate periods with the same salary. The template requires the signature of the accountant and the head of the company.

A sample form is developed by the company in accordance with local regulations. Design is done with a blue or black ballpoint pen. If the form is developed in advance, it is printed on a PC.

Deciphering the signatures of authorized specialists is desirable. The form should indicate all accruals provided for by the enterprise’s wage system.