Filling out a sick leave certificate is not so easy, and many different rules are to blame for this

of a sick leave certificate for a citizen who is temporarily unable to work depends not only on whether he will be able to regain his health at home, but also on whether the employer will make subsequent insurance payments to this person. Therefore, there are strict rules according to which this procedure must be carried out. Let's look at them in this material.

New rules for processing sick leave from autumn 2021

The Ministry of Health issued order No. 925n dated September 1, 2020 “On approval of the procedure for issuing and processing certificates of incapacity for work, including the procedure for generating certificates of incapacity for work in the form of an electronic document.”

Document No. 59812 was registered with the Ministry of Justice on September 14, 2020 and officially published. It will come into force on December 14, 2020. The changes are aimed at simplifying the issuance of sick leave in the face of the threat of the spread of dangerous diseases, in particular the second wave of coronavirus infection, which is expected in Russia in the fall. The main changes are:

- In a remote request to issue a sick leave certificate to a therapist via chat or video call, that is, using telemedicine technologies.

- Issuing long-term temporary disability certificates for pregnancy and childbirth remotely.

In most cases, the certificate of incapacity for work will be issued in the form of an electronic file and only if necessary, duplicated on paper. In the future, the Ministry of Labor plans to completely abandon paper sick leave. For now, as an exception, they will be issued:

- pregnant women who were dismissed due to the liquidation of an enterprise, who lost their individual entrepreneur status or resigned as a notary (lawyer);

- unemployed citizens who need to confirm that they did not come to the employment service on the appointed day for a good reason.

Parents of preschool children attending kindergarten will be issued sick leave immediately for the entire quarantine period if it is declared in kindergarten.

Use the updated instructions for filling out sick leave from ConsultantPlus

Get free access and go to ConsultantPlus

Cancellation of paper sick leave

The Ministry of Labor published on a single portal for posting draft regulatory legal acts a bill amending Federal Law No. 323-FZ of November 21, 2011. Officials propose to completely abolish the issuance of paper certificates of temporary disability starting from 01/01/2021. Medical organizations will issue sick leave certificates only electronically. The changes will affect all types of sick leave issued both for temporary disability and for pregnancy and childbirth.

The conditions for generating and processing electronic sick leave will not change. As now, all interested parties will have access to them, and the calculation of temporary disability benefits will be carried out by employers. At the same time, their lack of technical ability to process an electronic document will no longer be taken into account. The period for posting the information necessary for the assignment and payment of these benefits in the FSS information system was only 3 working days.

The changes will come into force if they are supported by parliament and signed by the president.

When and why is it issued?

If a citizen has lost his ability to work due to illness (injury) or illness of a family member, he has the right to count on benefits. To receive benefits and confirm a valid reason for absence, the employee provides the employer with sick leave issued by a doctor. The employer’s task is to fill out his part of the document, which is divided by a transverse line. The first part is filled out by the doctor.

Below is the current official form of the certificate of incapacity for work in 2021. The form has not changed since 2011. But from July 1, 2021, medical institutions began issuing similar documents to citizens in electronic format. Now the employee has the right to choose in what form to receive the sheet: in the usual paper form or in the new electronic form.

The color of the paper form is blue. The fields to fill out consist of light yellow cells, each for one letter or number. There is a watermark on the paper to protect against counterfeiting. The reverse side of the certificate of incapacity for work is reserved for information: how to fill out the form correctly, what is the procedure for entering data. It bears a large logo of the FSS of the Russian Federation - this is a protective watermark. For greater protection against fraudsters, numbers are assigned to sheets in random order. They are located in the upper right corner, have a unique 12-digit combination and a barcode.

Filling rules

First, let's look at how an employer should fill out sick leave in 2021; the general rules are as follows:

- letters are located within the cell without going beyond its edges or touching the edge;

- words are entered using a printing device or written by hand in capital letters;

- When filling out manually, black ink is used;

- the doctor must not make a mistake when filling out the form; if a mistake is made or the form is lost before being sent to work, the patient is given a duplicate;

- a copy is filled out on the same form, but marked “Duplicate”;

- the employer, unlike the doctor, corrects the error without replacing the form; this is done by simply crossing out; the correct data is written on the back of the document, certified by a signature, seal and the entry “Believe the corrected one.”

How to enter coronavirus quarantine data into sick leave

In this paragraph, we will figure out how to correctly fill out a sick leave certificate for an employer for an employee who is in quarantine after arriving from countries with an unfavorable epidemic situation. The rules also apply to persons who live and have contact with the arrival. That is, the form is issued to already sick and potentially infected citizens.

The issue is regulated by government decree No. 294 of March 18, 2020. Certificates of incapacity for work under the new scheme are issued from March 20 to July 1 of the current year.

The document is valid for 14 days, since this period is officially accepted as the incubation period. The sheet is issued on the basis of an application submitted through your personal account on the FSS website and other necessary documents. To log in, you will need an account on the State Services portal. The application is filled out by the patient himself or another person (if the patient is not registered in the Unified Automated Identification of Authorities). After filling out, the electronic document number is sent to the employer.

In addition, it remains possible to apply for sick leave through a medical professional.

How does the employer act:

- Checks information from the medical facility.

- Enter the required code in the “Reason of disability” field. For example, if an employee or his child is sick, you will need code 03. For special cases (isolation), enter 10.

- Calculates the payout amount. The financial issue is completely dealt with by the FSS. The fund pays the amount to the employee in installments: benefits for the first seven days are transferred the next day after the employer transmits information about the employee. Compensation for the remaining seven days is due within the next day after the end of quarantine.

Calling a "friend"

And yet, if possible, it is better to do without unnecessary fuss and resolve the issue peacefully. An accountant who discovers a fake sick leave should call the “offending” employee into the office and ask him to write a statement of his own free will. The HR employee has the right to dismiss such an employee in one day.

If the employee begins to “resist” and prove his innocence, the accountant can call the medical institution where the sick leave was issued. The question of who is right and who is wrong will be resolved within a few minutes.

Ekaterina Petrova

, for the magazine “Moscow Accountant”

Work with personnel at the enterprise

Correctly drawn up documents will protect you from penalties from inspectors and will get you out of a conflict situation with employees. With the e-book “Working with Personnel in an Enterprise,” you will have all your documentation in perfect order. Find out more >>

If you have a question, ask it here >>

How to fill it out at work and in a medical facility

The medical institution entrusts the filling out of the document to the attending physician - he fills out the first section. We will give only a general description and description of the procedure for filling out the first part and will dwell in more detail on how to fill out a sick leave certificate for an employer; the sample shows the rules for filling out the section in which data is entered at the work of the sick person.

In a medical institution, before handing the form to the patient, you must:

- put a mark indicating which form is being issued (primary or duplicate);

- enter the short name of the clinic (hospital), address and OGRN;

- enter information in the “Date of issue” field;

- indicate the patient’s full name and date of birth;

- according to the patient, enter the name of the work organization;

- indicate for which place of work the document is issued (main or part-time);

- if the sheet is issued to care for relatives, enter their full name and degree of relationship;

- if the sheet is issued for pregnancy or a disabled employee, fill in the appropriate lines;

- enter the period of release, position, surname, initials into the table, and sign the doctor;

- indicate the date from which the patient begins work and affix the seal of the medical institution.

After receiving a certificate of incapacity for work at a clinic or hospital, the employee transfers it to the employer. The latter’s task is to fill out the bottom section of the form. A step-by-step guide will help the employer's representative, who is responsible for filling out the documentation, not to make mistakes when entering data. Let's look at a sample of filling out sick leave by an employer in 2021 in the form of step-by-step instructions.

Step 1. Place of work

The name of the company is entered in this field. The FSS recommends providing the short name of the organization, if any. When there is no abbreviated name, and the full name does not fit on the line, the name is interrupted mid-sentence. You should not go beyond the cells. One cell is skipped between words.

Step 2. Employment status

You need to put a mark that will indicate the status of the place of work: main or part-time. An employee who works part-time has the right to submit a certificate of incapacity for work to two organizations. To do this, he requests two forms from the doctor.

Step 3. Registration number of the company in the Social Insurance Fund

The number assigned to the organization when registering with the Social Insurance Fund is entered in this field, as shown in the example of filling out a sick leave certificate in 2021 by an employer. The FSS assigns the number independently after receiving information from the tax service about the registration of the enterprise. A notification of registration with a registration number is sent to the legal address of the company by mail. If the notification is lost during transmission, you must apply for notification again. In addition, there are monitoring systems that help find out the registration number in the Social Insurance Fund using the organization’s TIN. The number is assigned once and does not change.

Step 4. Subordination code

The subordination code indicates the territorial number of the Social Insurance Fund to which the organization is attached. It consists of 4 digits if the FSS does not have a branch. The regional branch of the fund has a 5-digit code.

Step 5. Employee Taxpayer Identification Number

The employee's TIN is indicated only if it is available.

Step 6. SNILS of the employee

Insurance number of the employee's personal account in the Pension Fund.

Step 7. Accrual conditions

The line contains coded data about special conditions for the calculation and payment of benefits. The codes are given on the back of the form. The benefit is calculated differently for patients:

- affected by radiation (code 43);

- workers of the North (code 44);

- disabled people (code 45);

- citizens working for less than 6 months (code 46);

- citizens who fell ill within 30 days after dismissal (code 47);

- persons who violated the regime for a good reason (code 48);

- disabled people who have been ill for more than 4 months in a row (code 49);

- disabled people who are sick for more than 5 months a year (code 50);

- citizens working part-time (code 51).

Two-digit codes are entered only if the appropriate conditions exist. In other cases, the line remains empty. When combining conditions, several codes are set.

Step 8. Act form N-1

The line is filled in only if the injury for which a certificate of incapacity was issued was received at work. Then the date of drawing up the act that records the incident is recorded in these cells. In other cases, the field remains empty; the rules for filling out sick leave by an employer in 2021 in this part have not changed.

Step 9. Start date

The column is filled in only when canceling a contract with an employee. Management has the right to cancel an employment contract if the employee does not show up for work on time. He is entitled to sickness benefits. Enter the start date of work under the employment contract in the field.

Step 10. Insurance experience

The citizen’s total insurance experience is entered in the column - the time during which he is insured and makes contributions to the Social Insurance Fund. This is usually the time spent working under employment contracts. Periods of military, civil service or service in the police department are also included in the insurance period.

If the length of service is equal to the full number of years, the fields are filled in as follows:

If the number is incomplete, indicate years and months:

Step 11. Non-insurance periods

Non-insurance periods - time of military service starting from January 1, 2007. If the service began earlier than this date and ended later, only the period from January 1, 2007 until its actual end is included in the column. The number of complete years and months of military service is indicated. Non-insurance periods are included in the total insurance period.

Step 12. Benefit accrual period

The line contains the calendar period of absence of the sick employee - the opening and closing dates of the sick leave.

Step 13. Average earnings

To calculate the average salary of an employee, the easiest way is to use an online sick leave calculator. Average earnings for calculating benefits are calculated for the two previous calendar years.

Step 14. Average earnings per day

Since benefits are calculated on calendar days, to calculate daily earnings, the total amount earned over 2 years is divided by the number of calendar days in two years (730). The result is the employee’s average daily earnings.

Step 15. Benefit amount from the employer's funds

According to the law, if an employee becomes ill or injured, the employer pays for the first three days of sick leave from his own funds. The rest of the benefit is transferred by the FSS. When a certificate of incapacity for work is issued for other reasons, the entire amount of the benefit is paid by the Social Insurance Fund - this is the procedure prescribed by law.

Step 16. Benefit amount from the Social Insurance Fund

The Social Insurance Fund transfers benefits to citizens from its own funds for all days of illness, except for the first three. If sick leave is issued for patient care, prosthetics, treatment in a sanatorium or due to quarantine, then the entire amount comes from the Fund.

Step 17. Total amount

The final amount of the benefit will be calculated by an online calculator. This can be easily done manually by multiplying the number of sick days by the employee’s average daily earnings and percentages depending on length of service.

Step 18. Name of the head of the organization

The surname and initials of the head of the company are entered in the column without dots. A signature is placed opposite them.

Step 19. Name of the chief accountant

The final line contains the surname, initials and signature of the chief accountant. If the company does not have the position of chief accountant and his duties are performed by a manager, then the name and signature of the manager are duplicated.

Step 20. Employer's stamp

The completed sick leave form is certified with the round seal of the organization. It is important that the seal impression does not fall on the filled cells, blocking the information, otherwise the scanner will not be able to read it.

Serious punishment

If the accountant continues to doubt whether the sick leave is fake, we advise you to contact the authorities of the Social Insurance Fund of the Russian Federation with a request for verification. “All forms have unique numbers. An employer can always call our hotline and dictate the sick leave number that has raised suspicions. Within a few minutes, the authenticity of the sick leave can be established,” Irina Bukina commented on the situation.

In addition, the employer can contact the police. Law enforcement officers, within the framework of their powers, will have to check by whom, when and under what circumstances the fake certificate of incapacity for work was issued.

On a note

Forgery of documents carries a fine of up to 180 thousand rubles, or correctional labor for up to two years, or restriction of freedom for up to four years.

Forgery of documents, by the way, provides for criminal liability (Article 327 of the Criminal Code of the Russian Federation “Forgery, production or sale of counterfeit documents, state awards, stamps, seals, forms”). This act provides for a fine of up to 180 thousand rubles, or correctional labor for up to two years, or restriction of freedom for up to four years.

In addition, Article 159.2 of the Criminal Code of the Russian Federation “Fraud in receiving payments” also provides for criminal liability. Thus, for the theft of funds or other property when receiving benefits, compensation, subsidies and other social payments by providing knowingly false and (or) unreliable information, as well as by keeping silent about facts leading to the termination of these payments, a fine of up to 1 million rubles is imposed, correctional labor for up to five years, imprisonment for up to four years.

Sick leave for pregnancy and childbirth

It is drawn up by the medical institution as shown in the example of filling out sick leave for pregnancy and childbirth in 2021: it contains the reason for issuing a certificate of incapacity for work.

Filling out the form by the employer in this case differs from the above in only one way: the line “Benefit amount: at the expense of the employer” is left blank, because payment is made at the expense of the Social Insurance Fund.

Which pen should I use to fill it out?

Black ink is used. Order No. 624n of the Ministry of Health and Social Development allows filling out a certificate of incapacity for work only with a gel, capillary or fountain pen. The Supreme Court of the Russian Federation in 2015 came to the conclusion that the use of a ballpoint pen when filling out is only a technical defect that does not affect the payment of benefits. The main thing is that using a ballpoint pen does not lead to illegibility of the writing. The RF Armed Forces ordered the Social Insurance Fund to accept for payment the sick leave, which the doctor filled out with a ballpoint pen. In this case, the employer, noticing the error, contacted the medical institution for a duplicate. Despite the court's approval, in order to avoid disputes with the FSS, it is advisable not to use a ballpoint pen to fill out forms.

Sample of filling out a certificate of incapacity for work by an employer in 2020

general information

Filling out a certificate of incapacity for work is regulated by order of the Ministry of Health of the Russian Federation No. 624n, issued on June 29, 2011 (the document was last revised on June 10, 2019). According to the provisions of this order, LN is issued to all citizens of the Russian Federation insured by the Social Insurance Fund after their examination by a medical professional, provided that the citizen’s condition requires exemption from work.

The medical organization where the citizen is undergoing treatment is responsible for filling out the LN form. An employee of the employer's HR department enters information into a series of columns. The patient himself does not enter any data into this document.

Who fills it out: accountant or personnel officer

Those responsible for filling out sick leave are the head and chief accountant of the organization. They sign the completed form. Filling out a document or checking its correctness is the task of those officials whose signature certifies the completed form. In some cases, entering certain data is the responsibility of the personnel officer; he indicates, for example, the name of the company, insurance experience and other non-accounting information. The job description of the personnel officer must provide for these powers, otherwise it is unlawful to require him to fill out a sick leave form.

Correcting errors

Let us list the features of correcting errors in the finished document.

Recommendations for an accountant on how to correctly fill out corrections on a sick leave certificate or make adjustments to calculations:

- Corrective agents cannot be used.

- Carefully cross out the error with one thin line.

- Fill in the correct information on the back of the form.

- Certify the corrections by putting your full name, position and signature of the head of the organization.

- Place a round seal of the organization (if available) next to it.

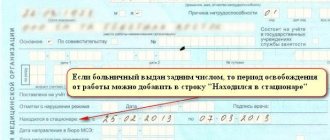

An example of a record of correction of errors on sick leave made by the employer

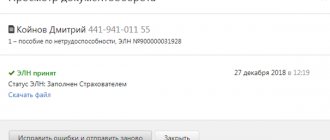

Features of the electronic certificate of temporary incapacity for work

Federal Law No. 86-FZ of May 1, 2017 provides for the issuance of sick leave in electronic form. To ensure that any interested person has the opportunity to quickly obtain information about sick leave issued to a citizen, a special automated system has been created, the operator of which is the Federal Social Insurance Fund of Russia. By issuing a certificate of incapacity for work to a patient in electronic form, the doctor and medical institution certify it with enhanced qualified electronic signatures. The database is available to the Social Insurance Fund, medical institutions and all employers. The latter have the right to receive in their personal account information only about those citizens who are currently employed by them.

To process electronic documents, organizations and individual entrepreneurs need special software and the technical capability of electronic document management with the Social Insurance Fund. If the employer does not have such an opportunity, he refuses the electronic document and requests a paper version. Otherwise, payments are processed according to the same scheme.

Is the form always stamped?

The fact is that not all employing organizations have stamps in their use, so this point is insignificant, which is confirmed by Federal legislation:

- Federal Law, Law No. 208, Article No. 2, paragraph 7.

- Federal Law, Law No. 14, Article No. 2, paragraph 5.

As for the seals and stamps of a medical organization, they are mandatory. But due to the observance of medical confidentiality, there are seals that do not indicate the profile of the medical institution:

- psychiatric;

- drug treatment;

- Center for Prevention and Control of AIDS.

But this absence of a medical institution’s profile on the seal, as indicated in the relevant documentation, is an exception to the generally accepted rules.