As you know, from January 1, 2021, the powers of the Federal Tax Service have expanded, and now it administers insurance premiums. In this regard, many details in the contribution payment have changed - KBK, recipient, etc. For the most part, incorrectly filling out a document does not result in any sanctions for the paying company. Well, one more thing - the Federal Tax Service will distribute the funds correctly, because... The automatic accounting system itself will forward erroneous columns. So why should an accountant suffer and learn new filling rules?

Answer. The fact is that not everyone uses automated programs; some send a payment order manually. And the payer’s banks may reject such a document due to the fact that the fields are filled in incorrectly. Basically, the standardization of bank software is carried out on the initiative of the Central Bank. And he implements the instructions of the Ministry of Finance.

The introduction of new blocks into the system is slow. Accordingly, in order to avoid getting into trouble and make the payment on time, you need to know exactly how the Ministry of Finance recommends filling out the fields of the payment order for social contributions.

Many fields have not changed, but we will look at them all so that you do not have to look for information about filling out payment orders for social contributions in 2021 somewhere else.

By tradition, we first suggest downloading the sample of filling out a payment order for insurance premiums for 2021:

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

It is necessary to check payment orders in 2021

It is necessary to indicate new details of the Federal Treasury. Although I didn't notice any changes in the details.

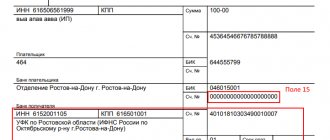

You need to fill out detail “15” of the payment order - the account number of the recipient’s bank, which is part of the single treasury account (STA).

The details can be checked using the service of the Federal Tax Service website.

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Even contributions for December must be transferred according to the new BCC to the Federal Tax Service (except for contributions to the Social Insurance Fund for injuries). Here you can find out the details of your Federal Tax Service.

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

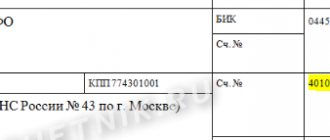

From February 6, 2021, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .everything is below)

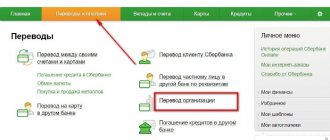

A payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs because... it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote. Payments can also be generated using online accounting.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2019-2020, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

What to do if there is an error in the KBK penalty

1.If you have received a decision in your taxpayer’s personal account to pay a penalty from the tax inspectorate, you must pay it off within the prescribed period

2. In the event of an error in the KBK regarding the penalty, the payment will go to the wrong place and the tax office may issue a decision to block the account, and the bank will be required to write off a penalty from you, and until the money reaches the Federal Tax Service, the account will work or be partially or completely frozen

3.And you will have to go to the inspectorate and find out where your penalty went, write an application to clarify the payment

4. After which, whose penalty will arrive faster, then the decision to block accounts will be canceled

As a rule, failure to pay penalties does not entail complete blocking of the current account. The client has worked and can continue to work. The bank blocks only the amount that it needs to use to pay off the penalty. A complete blocking occurs when the client owes a large amount of money.

Pension Fund FFOMS and FSS (except NSiPZ)

Purpose of payment: Insurance contributions to the Pension Fund for compulsory pension insurance for March 2021 Reg. No. 071-058-000000

Purpose of payment: Insurance premiums for compulsory health insurance, credited to the FFOMS budget March 2021 Reg. No. 071-058-000000

Purpose of payment: Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity to the budget of the Social Insurance Fund of the Russian Federation for March 2021 Reg. No. 6100000000

Purpose of payment: Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases to the budget of the Federal Social Insurance Fund of the Russian Federation for March 2021. Registration number - 7712355456

Payer status: 01 - for organizations / 09 - for individual entrepreneurs (If payment of insurance premiums for employees) (letter of the Federal Tax Service dated 02/03/2017 No. ZN-4-1 / [email protected] ) (Order of the Ministry of Finance dated April 5, 2021 No. 58n) .

TIN, KPP and OKTMO should not start from scratch. OKTMO must be 8-digit.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

Also, starting from 2021, it is necessary to indicate the period for which contributions are paid - for example MS.12.2018.

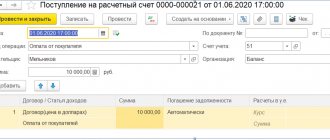

Rice. .

Fig. Sample of filling out a payment order (PFR, Social Insurance Fund contributions for employees) in Business Pack.

Sample payment slip

From 2021, tax contributions can be clarified if the bank name and the recipient's account are correct. The remaining contributions must be returned and paid again (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

Any insurance premiums, unlike taxes, are never rounded.

Let us remind you that since 2015, to pay an additional 1%, a different BCC has been used that is different from the fixed insurance premium. And for 2017-2018 they are completely different - see them below.

Fixed Pension Fund

You can calculate this fixed payment for any period (even an incomplete year or month) using our calculator here.

Purpose of payment: Insurance contributions for compulsory pension insurance in a fixed amount from income up to 300 rubles. for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status: Payer status: 24 - for individual entrepreneurs for themselves (since 2017, you need to indicate 09, because we pay contributions to the Federal Tax Service Order of the Ministry of Finance dated April 5, 2021 No. 58n).

TIN, KPP and OKTMO should not start from scratch. OKTMO must be 8-digit.

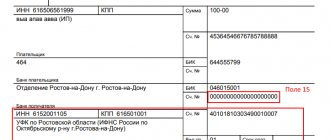

Rice. .

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

Fig. Sample of filling out a payment order (insurance fixed contribution of an individual entrepreneur) in the Business Pack.

Pension Fund over 300 tr.

You can see how to calculate additional interest on the simplified tax system, UTII, PSN, OSNO, and Unified Agricultural Tax systems using our calculator here.

Purpose of payment: Insurance contributions for compulsory pension insurance in a fixed amount for income over 300 tr. for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status: Payer status: 24 - for individual entrepreneurs for themselves (from 2017 you need to indicate 09, because we pay contributions to the Federal Tax Service).

TIN, KPP and OKTMO should not start from scratch.

Rice. .

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

Fig. Sample of filling out a payment order (PFR over 300 tr. Individual entrepreneur) in Business Pack.

How long should payments be kept?

Within 6 years after the end of the year in which the document was last used for calculating contributions and reporting (Clause 6 of Part 2 of Article 28 of the Federal Law dated July 24, 2009 No. 212-FZ) or 5 years (clause 459 Order of the Ministry of Culture of Russia dated August 25 .2010 N 558)

Medical insurance FFOMS

You can calculate this fixed payment to medicine for any period (even less than a year or a month) using our calculator here.

Purpose of payment: Insurance premiums for compulsory medical insurance in a fixed amount for the 1st quarter of 2021 Reg. No. 071-058-011111

Payer status: Payer status: 24 - for individual entrepreneurs for themselves (from 2017 you need to indicate 09, because we pay contributions to the Federal Tax Service).

TIN, KPP and OKTMO should not start from scratch.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

It will sound strange, but field 108 (below the “code” on the right and the “reserve field” on the left) indicates “14; SNILS IP number”. This is the requirement of the Pension Fund.

Rice. .

Fig. Sample of filling out a payment order (Medical insurance FFOMS IP) in Business Pack.

Attention! Starting from 2021, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

FSS NSiPZ

Purpose of payment: Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases to the budget of the Federal Social Insurance Fund of the Russian Federation for March 2021. Registration number - 7712355456

Payer status: 08 (only here 08, because this is the only contribution that we pay not to the Federal Tax Service).

TIN, KPP and OKTMO should not start from scratch.

Rice. Sample of filling out a payment order (FSS NSiPZ) in Excel (download).

How long should payments be kept?

Within 6 years after the end of the year in which the document was last used for calculating contributions and reporting (Clause 6 of Part 2 of Article 28 of the Federal Law dated July 24, 2009 No. 212-FZ) or 5 years (clause 459 Order of the Ministry of Culture of Russia dated August 25 .2010 N 558)

Fig. Sample of filling out a payment order (FSS NSiPZ) in Business Pack.

KBK contributions from the Pension Fund of the Russian Federation, Social Insurance Fund for employees

Current for 2019-2020.

| Payment type | BCC for contributions for December 2021 | BCC for contributions for the months of 2017-2019 |

| Contributions to compulsory pension insurance | ||

| Contributions of organizations for compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Additional pension contributions according to list 1, if the tariff does not depend on the special assessment | 182 1 0210 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Additional pension contributions according to list 1, if the tariff depends on the special assessment | 182 1 0220 160 | 182 1 0220 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Additional pension contributions according to list 2, if the tariff does not depend on the special assessment | 182 1 0210 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Additional pension contributions according to list 2, if the tariff depends on the special assessment | 182 1 0220 160 | 182 1 0220 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Individual entrepreneur contributions to compulsory pension insurance (26% of the minimum wage) | 182 1 0200 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Individual entrepreneurs' contributions to compulsory pension insurance with income over 300 thousand rubles. | 182 1 0200 160 | 182 1 0200 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Contributions for compulsory health insurance | ||

| Contributions of organizations for compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties on contributions for compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties for compulsory health insurance contributions | 182 1 0211 160 | 182 1 0213 160 |

| Individual entrepreneurs' contributions to compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties on contributions for compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties for compulsory health insurance contributions | 182 1 0211 160 | 182 1 0213 160 |

| Contributions to compulsory social insurance | ||

| Contributions for disability and maternity | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions in case of disability and maternity | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions in case of disability and maternity | 182 1 0200 160 | 182 1 0210 160 |

| Contributions in case of industrial injuries and occupational diseases | 393 1 0200 160 | 393 1 0200 160 |

| Penalties on contributions in case of industrial injuries and occupational diseases | 393 1 0200 160 | 393 1 0200 160 |

| Penalties on contributions in case of industrial injuries and occupational diseases | 393 1 0200 160 | 393 1 0200 160 |

Deadline for payment of social insurance contributions in 2020

Employee social insurance contributions (VNIM) are paid to the budget monthly - until the 15th. If the deadline for payment falls on a non-working day, it is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

So, in 2021, the deadline for paying social contributions will be postponed in February, March, August and November. More details about the specific deadlines for paying social contributions can be found in this article.

All payments

See the full list of payment orders:

- For a description of the fields and rules for payment orders, see here.

- Sample of filling out a payment order for payment of the simplified tax system in Excel and in Business Pack

- Sample of filling out a payment order (personal income tax for employees) in Excel and in Business Pack

- Sample of filling out a payment order for VAT payment in Excel and Business Pack

- Sample of filling out a payment order for payment of Property Tax in Excel and in Business Pack

- A sample of filling out a payment order for the payment of Income Tax in Excel and in Business Pack

- A sample of filling out a payment order for payment of the Fixed Contribution of Individual Entrepreneurs (PFR and FFOMS) in Excel and in Business Pack

- Sample of filling out a payment order (PFR, Social Insurance Fund contributions for employees) in Excel and in Business Pack

Key points for paying penalties on insurance premiums

Penalties are a security measure for timely payment of insurance premiums by business entities. The payment order for it has some identical characteristics as for payment of the principal amount of insurance premiums. These include the status of the payer (business entity), details of the recipient (budget revenue administrator).

For information on filling out a payment order for the transfer of the main amount of insurance premiums, see the article: “Sample payment order for insurance premiums in 2018.”