Home / Taxes / What is VAT and when does it increase to 20 percent? / Book of purchases and sales

Back

Published: December 28, 2017

Reading time: 9 min

0

287

A tax document containing all the data on invoices on which VAT payers calculate tax for a certain quarter is called a purchase book.

- Shopping book - what is it?

- What information is required?

- What is not included in the document?

- What is reflected in the document?

- Purchase book according to resolution 1137

- Important Features

- Conclusion

Shopping book - what is it?

The purchase book is compiled according to the model of Appendix 4 of the Decree of the Government of the Russian Federation of December 26, 2011, No. 1137 (hereinafter referred to as Decree No. 1137).

Since October 1, 2017, a revised sample of this document has been used (the resolution was edited by the Government of the Russian Federation dated August 19, 2017, No. 981).

Taking into account the information contained in the purchase book, the amount intended for payment of VAT is subsequently recorded in the tax return.

The information obtained from the book is one by one written directly into the declaration. For these purposes, its sample (which was approved by the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ) contains section 8 . The number of sections is equal to the number of entries that are entered in the purchase book for the quarter.

Accounting for purchases is a mandatory requirement for all citizens and enterprises making VAT payments (clause 3 of Article 169 of the Tax Code of the Russian Federation).

Only they are authorized to deduct VAT using purchase ledger data. Calculations for deducted tax in accounting are noted using the entry Dt 68 Kt 19.

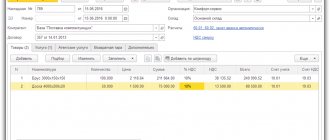

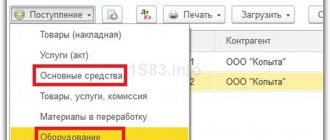

Extract from the sales book (sample)

]]>]]>

When checking the activities of taxpayers, the tax inspector may conduct cross-checks with counterparties. In this situation, you may need the data contained in the sales ledger - an extract from the ledger is sent to the tax office upon request.

Extracts on transactions carried out by the parties can be requested by tax authorities from the sales book and from the purchase book. This is necessary in order to verify the accuracy of VAT charges reflected by the taxpayer and the validity of the application for deduction of input tax amounts.

An extract may also be required if the fiscal authorities are considering the possibility of exempting a business entity from obligations to accrue and pay VAT. To do this, in accordance with clause 6 of Art.

145 of the Tax Code of the Russian Federation, the taxpayer is obliged to submit an extract compiled on the basis of data from the sales book.

Additionally, entrepreneurs will need to generate an extract from the book of income and expenses, and legal entities will need an extract from the balance sheet.

What information is required?

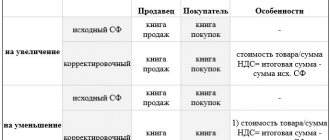

According to paragraph 2, ordinary, adjustment and corrected invoices are entered in the book.

They can be on paper forms or in electronic form. Entries in them are usually made on a computer. Some information may be entered manually.

The purchase ledger contains the following invoices:

- issued by persons selling products or services (rule 2 of the Rules for maintaining a purchase ledger);

- compiled when providing goods, works, services (GWS) (clause 22 of the Rules of Practice);

- adjusted when the price initially specified by the seller decreases and the buyer increases it (clauses 9 and 12 of the Rules of Practice);

- necessary when carrying out construction and installation works for personal use (clause 20 of the Rules of Practice);

In addition, the sales book also includes documentation that can be considered sufficient grounds for deducting VAT:

- papers (it is acceptable to include copies of them) that contain information about expenses for work trips (clause 18 of the Rules of Practice);

- documents that confirm the fact of payment of tax when importing (clause 6 of the Rules);

- statements on the import of goods and payment of indirect taxes - when importing goods from countries included in the EAEU (clause 6 of the Rules of Practice).

Fill out column 7

According to the Rules, in column 7 “Number and date of the document confirming payment of tax” the following is indicated:

- when importing goods into the territory of the Russian Federation - details of documents confirming the actual payment of VAT to the customs authority;

- when importing goods into the territory of the Russian Federation from the territory of a member state of the Customs Union - details of documents confirming payment of VAT to the tax authority.

For reference. Collection of indirect taxes on goods imported into the territory of one EAEU member state from the territory of another EAEU member state is carried out by the tax authority of the member state into whose territory the goods were imported, at the place of registration of taxpayers - owners of goods (clause 13 of Appendix 18 to the Treaty on the Eurasian Economic Union).

Since the Rules do not contain special provisions on the details of which documents should be given in column 7 when importing goods from states included in the EAEU, but taking into account the fact that the tax is paid to the tax authority, this column should reflect the details of documents confirming payment of VAT to the tax authority. That is, in this column you should indicate:

- or the number of the payment slip by which the tax is transferred to the budget;

- or details of the decision on offset of VAT amounts - if the obligation to pay tax is fulfilled by the taxpayer by carrying out an offset of VAT amounts by the tax authority (if the taxpayer has overpaid (collected) amounts of taxes).

What is not included in the document?

Invoices that do not comply are not entered into the purchase ledger (according to paragraph 3 of the Rules for maintaining the purchase ledger):

- the provisions of Article 169 of the Tax Code of the Russian Federation;

- established samples (Appendices 1 and 2 of Decree No. 1137).

Also, invoices drawn up (clause 19 of the Rules of Maintenance) are not entered:

- when provided free of charge, technical specifications containing tangible and intangible assets;

- commission agent (agent) from the principal (principal) for goods and services intended for sale, property rights, as well as advances issued on account of this sale;

- commission agent (agent) from the supplier of goods and services or property rights received for the principal (principal), counting allocated advances;

- on the amount of advance payment for goods and services received in actions that do not require VAT payments;

- advance invoices issued after the supplier receives shipping invoices.

What is reflected in the document?

The purchase book contains:

- The header contains information about the taxpayer-buyer, that is, its full or abbreviated name according to the statutory documents (or full name of the individual entrepreneur, INN and KPP). Data on tax cycles (with start and end dates).

- The tabular section contains information about the documents used to calculate VAT and its value.

If GWS are provided for actions subject to taxation at rates of 18, 10 and 0%, then the invoice is noted at the parts corresponding to these rates (clause 6 of the Rules for maintaining a purchase book, letter of the Ministry of Finance of Russia dated March 17, 2015 No. 03-07-11/14238 and 03/02/2015 No. 03-07-09/10695).

If the supply is intended for taxable and non-taxable actions, then the document is drawn up for the amount of the deduction after determining the size of the accounted share (clause 6 of the Rules of Practice).

Purchase book according to resolution 1137

According to the provisions of resolution 1137, the purchase book is compiled as follows (clause 6 of the Rules for maintaining the purchase book):

- Column 1. The serial number of the invoice mark (including the adjustment number) is assigned.

- Column 2. The transaction type code is entered (until July 2021, it was allowed to use codes from the order of the Federal Tax Service of Russia dated February 14, 2012 No. ММВ-7-3/ [email protected] and from the letter of the Federal Tax Service of Russia dated January 22, 2015 No. ГД-4-3/ [ email protected] , but, starting from July 2021, in the code section they use exclusively the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected] ).

- Column 3. Usually the serial number and time of drawing up the supplier's invoice are recorded. If the tax deduction is certified using other documentation (customs certificate, applications for import of products, etc.), then the details of these papers are entered.

According to the edited resolution No. 1137, in column 3 the following should be taken into account:

| Information necessary to correctly fill out column 3 | Under what circumstances are they necessary? |

| Number and time of filing an application for the import of products and payment of indirect taxes with marks from tax structures indicating payment of VAT | When importing products into the Russian Federation from EAEU countries |

| Number of the customs declaration drawn up during the customs procedure for registering the release of products for internal use at the end of the customs operation of the free customs zone on the territory of the SEZ in the Kaliningrad region | When marking VAT in the purchase book, calculated in accordance with paragraph 14 of Article 171 of the Tax Code of the Russian Federation |

| The number and time of execution of a payment and settlement document or other paper containing generalized information noted by the supplier in the sales book. | When determining VAT on prepayment paid towards the provision of GWS and subject to accounting from the date of provision of GWS. |

- Columns 4–6. Contains serial numbers and dates of corrected and/or adjusting invoices.

- Column 7. Enter the number and time of drawing up the document certifying the fact of payment of VAT. Details of the payment order are noted in column 7 in the case where the tax is calculated only after it has been paid. This happens, for example, when importing products into the Russian Federation (see letter from the Ministry of Finance of Russia dated November 26, 2014 No. 03-07-11/60221) or when returning an advance to the person making the purchase in cases of cancellation or correction of the agreement (letter from the Ministry of Finance of Russia dated March 24 .2015 No. 03-07-11/16044 and 03/23/2015 No. 03-07-11/15889).

- Column 8. Enter the exact date of receipt of products (production of work or services), as well as the acceptance of rights to property.

- Columns 9 and 10. Contain the names, TIN or KPP of the person selling services or products.

- Columns 11 and 12. Are drawn up by the buyer-committent (principal). Here you enter the name, tax identification number and checkpoint of the intermediary commission agent (agent) who receives products or services.

- Column 13. Enter the registration number of the customs declaration when selling products imported into the Russian Federation, if customs registration is determined by the legislative acts of the Customs Union. Making a column is not required when recording information on an adjustment (or corrected adjustment) invoice in the purchase book.

- Column 14. Contains the name and code of the currency (only when receiving products and services and rights to property for the currency of other countries).

- Column 15. The price of products or services, transfer of rights to property or the amount of advance payment including VAT is indicated.

- Column 16. Contains the amounts of VAT that are subject to deduction.

Marriage registration during pregnancy can be done on the day of filing the application. An application for marriage registration can be submitted online. You can find out how and where to do this in our article.

As a result of declaring a marriage invalid, legal consequences arise. Read more about them here.

New procedure for filling out a customs declaration

Order of the Federal Customs Service dated August 24, 2018 N 1329, new rules with 13.09.2018

:

- for whom?

— participants in foreign trade activities who have opened a single personal account (USA) at the level of the Federal Customs Service (resource

Personal Accounts - SPA

); - the list of customs authorities administering the unified tax system is changing;

- in column “B” of the DT, the details of payment documents and the method of payment of customs duties, other payments the collection of which is entrusted to the customs authorities are not filled in

(elements 4 – 6 of column “B” of the DT).

Column “B” of the goods declaration – WAS:

Column “B” of the goods declaration – BECAME:

Important Features

The following rules must be kept in mind:

- The purchase book can be kept on paper or in electronic format.

- Price parameters must be indicated in rubles. There is only one exception in the form of column 15, which is issued when receiving goods, services or rights to property for the currencies of other states).

- In order not to violate the rules and correctly correct the erroneous mark, the taxpayer must record the invoice on an additional sheet for the same tax quarter when the first invoice was issued. You can cancel the document in the same way.

- A paper purchase book at the end of the next quarter (no later than the 25th day of the month following the end of the quarter) must be signed by the boss (or responsible employee), all pages numbered and laced, sealed.

- Purchase books must be kept for 4 years from the date of the last entry.