The concept of a universal transfer document (UDD) came to us in 2013 with the submission of the Federal Tax Service of Russia in agreement with the Ministry of Finance. This form of document combines a primary accounting document and an invoice, which is generated on its basis for tax accounting purposes.

The emergence of UPD became possible thanks to Law No. 402-FZ of the Russian Federation “On Accounting”, which came into force two years earlier, which made it possible to abandon the unified formats of the primary report, fixing only the filling out of the required details. Along with this, at the legislative level, permission has appeared to include additional information in invoices, for example, mandatory details for primary accounting that are usually not included there. All this created the opportunity for the emergence of UPD.

Since primary documents are used for both accounting and tax accounting (VAT deduction is possible only if there is an appropriate primary document), this ensured the legality of the use of UTD for both types of accounting, avoiding duplication of data, most of which are repeated in the primary and SF. We'll talk about the benefits of this below.

When switching to EDF, the seller and buyer must agree in advance which documents to exchange - UPD or separately the SF and primary documents

Changes to the UPD from July 1, 2021

The UPD sample has changed since July 1, 2021, following the invoice. Now these documents should have a line to indicate information about the government contract - its number 8. If you don’t know what to write in it, then most likely you won’t have to fill it out. But the line “Identifier of the state contract, agreement (agreement)” itself should be in the UPD in any case.

Read more about filling out line 8 here >>

Changes to the UPD came into force on July 1, 2021. That is, all documents dated this or a later date must contain new details.

How it works in practice

A budget organization sells services to a third-party company under a contract. At the time of provision of services, the parties are required to sign a certificate of services rendered. Only after the customer accepts the completed actions does the budget organization have the right to make payment demands. That is, generate an invoice.

General document flow is not always convenient. For example, if the customer and the contractor are located in different localities or even regions. These are additional costs for organizations.

A simplified method of document flow will allow you to reduce costs: the budgetary institution will generate a UPD, which replaces both the act and the invoice at the same time. The customer, having checked the quality and volume of services provided, will sign the form and immediately submit it for payment. This will significantly reduce the time of settlements between the parties.

Changes in the UPD form from October 1, 2021

Attention!

From October 1, 2021, invoice and UPD forms approved by Government Decree No. 981 dated 08/19/17 are in effect. Here is a list of changes that need to be made to the form:

- column 1a “Product type code”. Here the code of the type of product is indicated according to the unified Commodity Nomenclature of Foreign Economic Activity of the EAEU. Mandatory for goods exported from Russia to the EAEU states: Belarus, Kazakhstan, Armenia, Kyrgyzstan. The code must be selected from the reference book of HS codes (approved by decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54). If you do not have data for this column, put a dash. Applies to invoices, adjustment invoices and UPD.

- field for additional signature. Here the signature of an authorized person is placed, who signs the invoice instead of the entrepreneur. Previously, the form only had fields for the signature of the manager, chief accountant and individual entrepreneur or their representatives.

- name of line 8. Here, from October 1, 2021, it is indicated that the line is filled in only if data is available.

- the name of column 11. From October 1, it is called “Registration number of the customs declaration”. Filled out for goods not made in Russia. We fill it out if the product is not made in Russia.

Download a new sample UPD from 10/01/2017 here >>

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Advantages

This type of documentation significantly reduces the cost of time, consumables and even storage space for the archive. With its help, you can speed up and simplify document flow, and in addition, the document has other advantages:

- the design style becomes uniform for all types of sales;

- the possibility of error is eliminated, since most of the fields are pre-filled by the program;

- may be used for tax and accounting purposes;

- does not create problems for suppliers and other counterparties.

Does everyone need to indicate a government contract ID in the UPD in 2021?

The state contract identifier in invoices and UPD is needed to make it easier for the tax authorities to control the shipment of goods (work, services) against advance funds received from the federal budget.

If you don't know what to write on the new line, then most likely you won't need to fill it in. Line 8 is filled in only if you are working with a government contract that has been assigned a unique identifier.

If your contract does not have such details, then you do not need to indicate the government contract identifier in the UPD: a dash is placed in the field.

Unique identifiers are assigned to government contracts for defense orders (Article 6.1 of the Federal Law of December 29, 2012 No. 275-FZ “On State Defense Order”), as well as contracts that are financed from budget sources (Article 5 of the Law “On the Federal Budget for 2021”) g and for the planning period 2021 and 2021, Decree of the Government of the Russian Federation dated December 30, 2016 No. 1552).

By whom and when is it used?

The UPD form was developed by the Federal Tax Service of the Russian Federation on the basis of an invoice at the end of 2011. When creating the new form, the obligatory consignment note, TORG-12 and other papers that confirm the transfer of inventory items were taken into account.

Thus, the UPD document is an invoice expanded by introducing additional details. Including information from other primary accounting documentation:

- TN;

- TTN;

- document confirming shipment;

- act of acceptance and transfer of goods and services.

When understanding how to fill out the UPD according to all the rules, you should remember that any trade organizations and private entrepreneurs can use it. The tax system applied to them does not matter. Thus, companies and individual entrepreneurs operating under special tax regimes also have the right to use the UTD form in their work. In addition, taxpayers who work without charging VAT can also adopt this type of paper. For them, the form is a sample of primary documentation.

UPD with status 1

Subsection with invoice

Line 1 Document number (in chronological order) and date of its preparation. The maximum period for issuing an invoice is five calendar days from the date of shipment of goods, provision of services, performance of work, transfer of property rights.

Lines 2, 2a and 2b Information about the seller: name, address, tax identification number and checkpoint.

Lines 3 and 4 Information about the shipper and consignee. The lines are filled in only when goods are sold. If the invoice is issued for services or work, a dash is added. If the organization is both a seller and a shipper, then write “aka” in line 3. If the consignee and the buyer are the same person, then indicate the name and address of the consignee (you cannot write “he”).

Line 5 Information about the payment order number. Filled out if there was an advance payment, i.e. in the invoice for the advance payment. If there was no prepayment or it was transferred on the day of shipment, a dash is added.

Lines 6, 6a and 6b Information about the seller. Fill in the same way as information about the buyer.

Line 7 Name and code of currency. An invoice is issued in foreign currency only if prices and calculations under the contract are expressed in it (Clause 7, Article 169 of the Tax Code of the Russian Federation).

Line 8 Government contract ID. Line 8 in the UPD is filled in only if you have the data. If not (that is, if you are not working with a contract, or your contract does not have an identifier), a dash is placed in the line.

Tabular part

A Table row number. You don't have to fill it out.

B Code of goods, works, services. For goods - article number, for work - code according to OKVED, for services - code according to OKUN. The code of goods, works, services in the UPD is given if you need to indicate tax benefits or other special conditions.

Columns 1, 1a and 2 Name of goods or description and units of measurement of work performed, services provided, property rights transferred. Column 1a contains the code of the type of goods according to the unified HS of the EAEU; from October 1, 2021, its completion is mandatory for goods exported from Russia to the EAEU states - to Belarus, Kazakhstan, Armenia or Kyrgyzstan (otherwise a dash is added). The product code is taken from the reference book of HS codes (approved by decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54).

Column 3 Quantitative parameters of goods, works, services. If it is impossible to determine them, a dash is added.

Column 4 Price per unit of measurement (if it is possible to indicate it) without VAT.

Column 5 Cost of the total quantity of goods, work, services, transferred rights without VAT.

Column 6 Excise tax amount. To be completed only when selling excisable goods. Otherwise it is written “Without excise duty”.

Column 7 VAT rate. If the company is exempt under Article 145 of the Tax Code of the Russian Federation or in the case of issuing an invoice by companies that do not work with VAT, it is written “Without VAT”.

Column 8 VAT amount in rubles and kopecks without rounding. In the cases indicated above, it is written “Without VAT”.

Column 9 Cost of the entire quantity of goods (work, services, transferred rights) including VAT.

Columns 10, 10a, 11 Name of the country of origin and its OKSN code, customs declaration number. Filled out for imported goods. Attention! From October 1, 2021, the name of column 11 has changed. It is now called “Registration number of the customs declaration.”

Who signs the UPD? Find out by following the link >>

Conclusion

For many who are just beginning to understand the nuances of designing a universal form, this task seems too difficult.

And since the document is not mandatory, not everyone uses it - and in vain. In fact, studying the intricacies of creating documentation, figuring out how to fill out column B in the UPD, finding out what the content of the operation is is much easier than it seems at first glance. But it is the UPD form that allows you to significantly reduce the volume of document flow and thereby facilitate the work of an organization or individual entrepreneur. Number of impressions: 615

When registering for UPD, what is the difference between status 1 and 2?

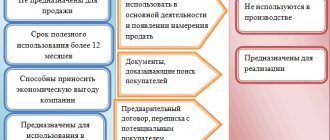

UPD statuses 1 and 2 determine the purpose of the document. UPD with status 1 can be used both as a primary document for processing business transactions and as an invoice. UPD with status 2 can only be used as a primary document for processing business transactions. Then the invoice is prepared separately.

The status when filling out the UPD is of an informational nature. The actual status of the document will be determined by the details that you specify: for example, if you assigned a document status 2, but at the same time indicated VAT in it, then such a document can be used as an invoice to justify a tax deduction, despite the status.

Results

Thus, the UPD is a universal document that allows you to reduce the company’s document flow by half. Currently, there is a sufficient number of clarifications from the Federal Tax Service of Russia on the use of UTD, and therefore the risks of controversial issues are insignificant. The material collected in the article reflects the main issues that arise in the process of using this document. We hope that it will be useful both to companies that are just thinking about switching to using UPD, and to long-time users of this form.

Firmmaker, June 2020 Elizaveta Karpuk When using the material, a link is required

Who signs the UPD?

The universal transfer document must be signed by the responsible persons on the part of the seller and the buyer. For each representative of both parties, you must indicate the position and full name.

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Signatures in the UPD on the part of the seller:

- In the subsection with the invoice: signatures of the head of the organization (or other authorized person), chief accountant (or other authorized person). If the document is filled out by an individual entrepreneur, then the signature of the individual entrepreneur and indication of the details of the certificate of state registration of the individual entrepreneur. The signature of the authorized person who signs the document instead of the entrepreneur, from October 1, 2021, is placed in the field for an additional signature.

- In the field of table 10: signature of the person who transferred the goods, works, services.

- In table 13: signature of the person responsible for the correct execution of the document. This field is called in the UPD “Responsible for the correct registration of the fact of economic life.” If this employee has already signed the document, then he does not have to sign in field 13 again: it is enough to indicate the position and full name.

Signatures in the UPD on the part of the buyer:

- In table field 15: the person who received the goods, works, services.

- In table field 18: the person responsible for the correct execution of the document. If this employee signed up in field 15, then it is enough to indicate the position and full name.

Documents replaced by the new form

Previously, the transfer documents required for registration were the consignment note, the commodity part of the consignment note and the transfer act in approved forms. Now all these forms have lost their relevance and necessity, although they can still be used by organizations if desired. Each company must set out information about which documents to use in its work in its accounting policies on an individual basis.

Is it possible to indicate services and goods simultaneously in the UPD in 2021?

Can. Tax legislation of the Russian Federation does not require issuing a separate invoice for each type of product (service). In one invoice (or, accordingly, in one UPD) it is possible to reflect simultaneously the entire shipment (goods, work, services) to one buyer. In this case, you draw up one UPD - instead of a certificate of completion and a delivery note at the same time. It is important to comply with the deadline for issuing invoices - 5 calendar days from the date of shipment).

For issuing one invoice for the entire shipment, see letter of the Federal Tax Service No. ED-4-15/17910 dated September 23, 2016.

The more convenient to use

Each company will decide this issue for itself. The main thing is to know that if you use a universal transfer form, then all the fields required for the invoice must be filled out.

If we take into account the advantages, versatility and multifunctionality, then UPD goes far ahead. It is easy to complete electronically, reduces the volume of recurring transactions, significantly reduces costs, and does not cause forms to be lost. The package is always at hand, there is no need to look for anything or reprint it.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

What must be indicated

There is a list of fields that must be filled in by the selling party when using this form. The standard list of details includes:

- name of the form;

- date when they started compiling;

- names of participating organizations or full names. IP;

- what is the operation;

- the result of the commission in kind or monetary terms, indicating units of measurement;

- Name and position of the person who is responsible for the operation.

Since it can replace a whole set of documents and act as independent primary documentation, it contains one more permanent requisite - status. There are only 2 of them:

- Used as SF.

- As a primary source for reporting.

In the second case, it is allowed not to enter information about the rate, as well as the “country code and its name.” You can apply for a deduction when “1” is indicated, or in the case when all the necessary lines were written down, but “2” was written by accident or mistake. It is worth noting that it is not allowed to be filled out only as a SF, in particular because for these purposes a separate status is required, but there is none. Therefore, it should be considered more broadly.