What the law says

An employee who has fulfilled the full scope of his duties for the required working hours per month should not receive payment for work less than the minimum level established in the state. But what does the minimum wage consist of? Is the bonus included in the minimum wage in 2021? The basis of the minimum level of payment is salary with possible bonuses and additional payments “for hazardous production”. In each case, the fact of whether the minimum wage can eat up the bonus or whether it is accrued above it depends on the frequency of bonus payments. Their frequency is determined in the regulatory documents of the organization (under Article 135 of the Labor Code of the Russian Federation):

- employment contract;

- collective agreement;

- regulations on bonuses for employees, etc.

Payment of one-time and periodic incentives occurs on the basis of an order signed by the head of the organization.

Legislative amendments

The Ministry of Labor explained its position on this issue in a letter dated June 5, 2018 No. 14-0/10/B-4085 and comments dated July 24, 2018 on its own portal. Is the bonus included in the minimum wage in 2021 in Russia: the latest news is of interest to both employers and citizens. The Ministry of Labor has prepared legislative amendments, where it is planned not to include bonuses and incentive allowances in the minimum amount.

At the moment, legal norms remain the same. Therefore, it is necessary to compare the result payable with the “minimum wage”, excluding regional coefficients and allowances for work in special conditions from earnings, and this rule applies to both northern and non-northern regions.

One-time bonus

In accordance with Article 129 of the Labor Code of the Russian Federation, there is a clear answer to the question: is a one-time bonus included in the minimum wage? A one-time bonus is a one-time additional incentive payment. The size of this payment, due to its randomness, is not reflected in the employment contract, which must stipulate the amount of wages not less than the legally established minimum wage. A one-time bonus is accrued and paid in a separate amount above earnings.

Minimum wage and minimum wage: what is the difference

Note! The minimum wage has a federal scope, that is, absolutely all employers are required to adhere to it, regardless of industry and region of residence.

To receive the minimum wage:

- a salaried employee must complete full working hours for the month;

- an employee on a tariff or piecework basis - to fulfill the work standard established for him.

At the same time, a regional agreement (regional authorities, employers, trade union representatives) can establish a minimum wage level (MW), which cannot be lower than the minimum wage (Article 133.1 of the Labor Code of the Russian Federation).

Important! It is binding on employers only in a given region, unless the employer refuses to accede to the agreement.

You can read more about the size of the minimum wage in the review prepared by ConsultantPlus. You can obtain access to the ConsultantPlus system for free.

Risks! Neglect of the established values of the minimum wage and minimum wage entails a negative consequence for employers in the form of administrative, criminal and financial liability (Parts 6, 7, Article 5.27 of the Code of Administrative Offenses of the Russian Federation, Article 142 of the Labor Code of the Russian Federation).

Monthly bonus

Monthly incentive payments are not a guaranteed type of income, but are prescribed in the employment contract. According to Article 129 of the Labor Code of the Russian Federation, such periodic incentives are included in wages. Considering that the employee’s payment should not fall below the minimum established by the state, when asked whether the bonus is included in the minimum wage if it is paid every month, we answer that in this case the incentive additional payment is allowed to be counted as part of the minimum wage.

What does the minimum wage consist of according to the Labor Code of the Russian Federation?

In Art. 129 of the Labor Code of the Russian Federation defines wages and indicates that it includes:

- salary;

- incentive payments;

- compensation payments.

Incentive payments are understood as material incentives for certain results or achievements of an employee.

The most typical payment of this nature is a bonus. This category also includes bonuses for length of service, academic degree, qualifications, etc. The Labor Code of the Russian Federation does not contain an exhaustive list of incentive payments. The employer has the right to provide for any incentive bonuses in local regulations, as well as to develop the procedure and conditions for their accrual.

Compensation payments are compensation for any negative or difficult circumstances under which the employee is forced to work.

These include allowances:

- for harmfulness;

- unfavorable working conditions;

- secrecy, etc.

Important! Such payments should be distinguished from one-time compensation payments, which are not included in wages and are assigned solely to compensate for the costs incurred by the worker.

What does the minimum wage consist of? The salary is always included in the minimum wage and may well be less than it. The total amount that the employee will receive based on the results of the month worked, taking into account all additional payments, must be no less than this amount. If, according to calculations, it turns out to be less, then the employer is obliged to pay the employee up to the minimum wage. A sample order for additional payment up to the minimum wage can be found in the ConsultantPlus materials. If you do not yet have access to the ConsultantPlus system, you can get it for free right now.

In practice, many questions arise about which payments are included in the minimum wage and which are not.

Is the bonus included in the minimum wage?

The procedure for paying bonuses is determined in the collective agreement or local regulations of the employer (for example, regulations on bonuses). They can be paid monthly, quarterly or annually, as well as on holidays. Bonus payments are a right, not an obligation of the employer.

Note! Monthly bonuses paid based on the results of work for the month are always included in the minimum wage.

In practice, the most difficult question is whether a one-time bonus is included in the minimum wage, and whether an annual bonus is included in the minimum wage. Labor legislation does not contain an answer to this.

The Supreme Court of the Republic of Karelia, analyzing whether a one-time holiday bonus paid to an employee for the New Year in accordance with the bonus regulations can be included in the minimum wage, came to the conclusion that such a payment should be included in the minimum wage (appeal ruling dated 06/05/2018 No. 33 -2448/2018).

Conclusion! Bonuses, ready-made or one-time, are included in the minimum wage.

Does the minimum wage include payment for holidays and weekends, as well as night hours?

Let's find out whether the minimum wage includes payment for holidays and weekends, as well as night hours.

Work at night, on weekends and holidays, in accordance with the Labor Code of the Russian Federation, is paid at an increased rate (Articles 153, 154). This is a kind of compensation to the employee for the lack of normal rest during periods intended for recuperation.

The question of whether payments for holidays and weekends are included in the minimum wage or whether they should be accrued above it is resolved in judicial practice in different ways.

Note! Most courts take the position that additional payment for night hours, holidays and weekends should be added to the salary and, in total, should not be less than the minimum wage.

This opinion is due to the fact that these payments relate to compensation (Part 1 of Article 129 of the Labor Code of the Russian Federation) and are included in the salary, and, accordingly, in its minimum amount. Such conclusions are contained in the ruling of the Supreme Court of the Russian Federation dated August 30, 2013 No. 93-KGPR13-2, the resolution of the Presidium of the Altai Regional Court dated February 10, 2015 in case No. 44G-6/2015, etc.

At the same time, there are also opposing positions. For example, as set out in the ruling of the Perm Regional Court dated September 14, 2010 No. 33-8001.

The Ministry of Labor of the Russian Federation (letter dated September 4, 2018 No. 14-1/OOG-7353) and the Constitutional Court of the Russian Federation also expressed their position on the issue of whether night and holiday work is included in the minimum wage. According to the Ministry of Labor, the inclusion of the above payments in the minimum wage depends on how the employee performed work at night or on weekends (holidays) - within the limits of working hours or beyond them.

The Constitutional Court of the Russian Federation insists that working at night, on weekends or holidays is a priori work above the norm, which means payment for such work should not be taken into account in the salary when compared with the minimum wage (Resolution of the Constitutional Court of the Russian Federation dated April 11, 2019 No. 17-P ).

Conclusion! If the standard working time is exceeded due to work at night or on holidays, then additional payments should be accrued above the minimum wage.

Are additional payments for hazardous work and overtime included in the minimum wage?

Workers are often concerned about whether additional payments for hazardous work and overtime work are included in the minimum wage.

Additional payment for overtime work has been repeatedly analyzed by the courts from the point of view of the legality of its inclusion in the minimum wage. The courts were divided on this issue. One of the positions was that the salary can only include payment for fulfilling the labor standard, and everything worked by the employee outside the working time standard should be accrued from above (for example, the appeal ruling of the Perm Regional Court dated February 14, 2018 in case No. 33-1632/2018). However, there was also an opposite opinion (for example, the appeal ruling of the Tyumen Regional Court dated June 4, 2018 in case No. 33-2844/2018).

The Constitutional Court of the Russian Federation put an end to this issue in paragraphs. 4, 5 Resolution No. 17-P dated April 11, 2019: payments for overtime work and work in hazardous conditions are payments in excess of the minimum wage.

A similar question arises when, in addition to the main job, the worker performs some part-time job function for the same employer. Decisions have been repeatedly made according to which the additional payment for part-time work should be included in the minimum wage as part of the salary (for example, the appeal ruling of the Trans-Baikal Regional Court dated 06/05/2018 in case No. 33-2256/2018). At the same time, there is another point of view (appeal ruling of the Smolensk Regional Court dated April 10, 2012 in case No. 33-894).

Conclusion! The Ministry of Labor expressed its judgment in the above-mentioned letter No. 14-1/OOG-7353, according to which any payments for work outside the established working hours should be calculated in excess of the minimum wage.

Is the regional coefficient included in the minimum wage?

Art. 129 of the Labor Code of the Russian Federation, where the concept of wages is formulated, does not give a direct answer to the question of whether regional coefficients and northern bonuses are included in the minimum wage or should be calculated above it. In judicial practice, various opinions have been expressed in this regard. The Constitutional Court put an end to the discussion in its decision No. 38-P dated December 7, 2017, establishing that these payments must be made by the employer in addition to the established minimum wage.

This is due to the fact that workers in special climatic conditions must be guaranteed to receive a higher payment for their work than workers for a similar labor function in regions without climatic conditions.

Important! In its resolution, the Constitutional Court of the Russian Federation focuses on the fact that this guarantee applies not only to the minimum wage, but also to the minimum wage. That is, if a minimum wage is established in the region that exceeds the minimum wage, the employer must charge northern bonuses based on the minimum wage. However, if the minimum wage established by a regional agreement already includes a regional coefficient, the employer is not obliged to do this.

The resolution of the Constitutional Court of the Russian Federation applies from the date of its adoption, that is, from December 7, 2017, and does not have retroactive effect.

Thus, employees whose wages were calculated with the inclusion of the regional coefficient in the minimum wage do not have the right to demand a recalculation of previously received payments.

If, at the time of adoption of this resolution, decisions in similar cases were adopted, but did not enter into legal force and/or were not executed, the courts of appeal and cassation instances are obliged to apply the provisions of this resolution (see the definition of the Constitutional Court of the Russian Federation dated February 27, 2018 No. 252-O -R).

It is noteworthy that, despite the clarifications of the Constitutional Court of the Russian Federation set out in Determination No. 252-O-R, some courts are guided by their own opinion and believe that recalculation of the amount of wages is possible only within the limitation period, which in cases of wage collection is 1 year ( for example, the appeal ruling of the Supreme Court of the Altai Republic dated June 20, 2018 in case No. 33-401/2018).

Quarterly and annual bonuses

Payments of periodic quarterly remuneration return to the question of whether a one-time bonus is included in the minimum wage or not. This remuneration is accrued once every three months, while the minimum wage must be paid to the employee every month. It is prohibited to distribute quarterly payments over several months, thus leveling the level of earnings.

The same applies to annual bonuses. It is not possible to compensate 11 months' salary up to the minimum level through a one-time bonus payment.

Payment for holidays and weekends, as well as night hours

Work at night, on weekends and holidays, in accordance with the Labor Code of the Russian Federation, is paid at an increased rate (Articles 153, 154). This is a kind of compensation to the employee for the lack of normal rest during periods intended for recuperation.

The question of whether payments for holidays and weekends are included in the minimum wage or whether they should be accrued above it is resolved in judicial practice in different ways.

Note! Most courts take the position that additional payment for night hours, holidays and weekends should be added to the salary and, in total, should not be less than the minimum wage.

This opinion is due to the fact that these payments relate to compensation (Part 1 of Article 129 of the Labor Code of the Russian Federation) and are included in the salary, and, accordingly, in its minimum amount. Such conclusions are contained in the ruling of the Supreme Court of the Russian Federation dated August 30, 2013 No. 93-KGPR13-2, the resolution of the Presidium of the Altai Regional Court dated February 10, 2015 in case No. 44G-6/2015, etc.

Read more: Unilateral netting act sample

At the same time, there are also opposing positions. For example, as set out in the ruling of the Perm Regional Court dated September 14, 2010 No. 33-8001.

The Ministry of Labor of the Russian Federation (letter dated September 4, 2018 No. 14-1/OOG-7353) and the Constitutional Court of the Russian Federation also expressed their position on the issue of whether night and holiday work is included in the minimum wage. According to the Ministry of Labor, the inclusion of the above payments in the minimum wage depends on how the employee performed work at night or on weekends (holidays) - within the limits of working hours or beyond them. The Constitutional Court of the Russian Federation insists that working at night, on weekends or holidays is a priori work beyond the norm, which means payment for such work should not be taken into account in the salary when compared with the minimum wage.

Conclusion! If the standard working time is exceeded due to work at night or on holidays, then additional payments should be accrued above the minimum wage.

Additional payment on the occasion of a holiday

When deciding whether a holiday bonus is included in the minimum wage, you should remember that it is legal to include in it only the bonus paid for the current month, without transferring it to other periods. Therefore, if incentive bonuses for the occasion are not planned in the statutory documents for each calendar month, then they are not counted towards the minimum salary level.

Let us summarize how the additional payment to the minimum wage and the bonus relate to the accounting department of an enterprise. If the regulatory documents state that a bonus for work performed is paid monthly, only in this case is it or part of it used to achieve the required minimum salary. A one-time bonus is not taken into account in the minimum wage.

The concept of minimum wage

The minimum wage is the lower limit of monthly remuneration for work, which is provided to an employee by the employer, subject to the performance of his official duties. That is, the worker must fulfill monthly standards in terms of time and volume of work. An employee may be entitled to incentive and bonus payments, then a separate topic arises: minimum wage and bonuses, whether remuneration is taken into account in all cases and what types of bonuses included in the minimum wage are not considered in the final salary.

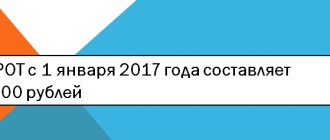

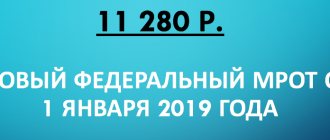

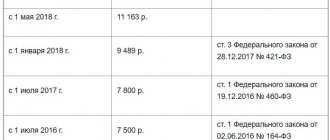

Regional authorities have the right to independently establish the amount of the “minimum wage” in force in a particular subject. It should not be lower than the level regulated by Law No. 82-FZ of June 19, 2000: from January 1, 2021 it is 11,280 rubles. If the size is not established separately in the region, then the federal value according to the specified law is applied.

Regardless of the location of the organization, it has to face the question of whether the bonus is included in the minimum wage or not. On the application of the regional coefficient, the Constitutional Court, in its Resolution No. 38-P of December 7, 2021, made its determination that the “minimum wage” as a general guarantee is given regardless of the location of the work and for the constituent entities of the Russian Federation it includes regional and percentage allowances for work in special climate are not included.

Additional pay for harmful work, overtime and combined work

Workers are often concerned about whether additional payments for hazardous work and overtime work are included in the minimum wage.

Additional payment for overtime work has been repeatedly analyzed by the courts from the point of view of the legality of its inclusion in the minimum wage. The courts were divided on this issue. One of the positions was that the salary can only include payment for fulfilling the labor standard, and everything worked by the employee outside the working time standard should be accrued from above (for example, the appeal ruling of the Perm Regional Court dated February 14, 2018 in case No. 33-1632/2018). However, there was also an opposite opinion (for example, the appeal ruling of the Tyumen Regional Court dated June 4, 2018 in case No. 33-2844/2018).

The Constitutional Court of the Russian Federation put an end to this issue in paragraphs. 4, 5 Resolution No. 17-P dated April 11, 2019: payments for overtime work and work in hazardous conditions are payments in excess of the minimum wage.

A similar question arises when, in addition to the main job, the worker performs some part-time job function for the same employer. Decisions have been repeatedly made according to which the additional payment for part-time work should be included in the minimum wage as part of the salary (for example, the appeal ruling of the Trans-Baikal Regional Court dated 06/05/2018 in case No. 33-2256/2018). At the same time, there is another point of view (appeal ruling of the Smolensk Regional Court dated April 10, 2012 in case No. 33-894).

Conclusion! The Ministry of Labor expressed its judgment in the above-mentioned letter No. 14-1/OOG-7353, according to which any payments for work outside the established working hours should be calculated in excess of the minimum wage.

Does the resolution of the Constitutional Court of the Russian Federation No. 38-P have retroactive force?

The resolution of the Constitutional Court of the Russian Federation applies from the date of its adoption, that is, from December 7, 2017, and does not have retroactive effect. Thus, employees whose wages were calculated with the inclusion of the regional coefficient in the minimum wage do not have the right to demand a recalculation of previously received payments.

However, if at the time of adoption of this resolution decisions on similar cases were adopted, but did not enter into legal force and/or were not executed, the courts of appeal and cassation instances are obliged to apply the provisions of this resolution (see the definition of the Constitutional Court of the Russian Federation dated February 27, 2018 No. 252- O-R).

It is noteworthy that, despite the clarifications of the Constitutional Court of the Russian Federation set out in Determination No. 252-O-R, some courts are guided by their own opinion and believe that recalculation of the amount of wages is possible only within the limitation period, which in cases of wage collection is 1 year ( for example, the appeal ruling of the Supreme Court of the Altai Republic dated June 20, 2018 in case No. 33-401/2018).

Regional coefficient

Art. 129 of the Labor Code of the Russian Federation, where the concept of wages is formulated, does not give a direct answer to the question of whether regional coefficients and northern bonuses are included in the minimum wage or should be calculated above it. In judicial practice, various opinions have been expressed in this regard. The Constitutional Court put an end to the discussion in its decision No. 38-P dated December 7, 2017, establishing that these payments must be made by the employer in addition to the established minimum wage.

This is due to the fact that workers in special climatic conditions must be guaranteed to receive a higher payment for their work than workers for a similar labor function in regions without climatic conditions.

Important! In its resolution, the Constitutional Court of the Russian Federation focuses on the fact that this guarantee applies not only to the minimum wage, but also to the minimum wage. That is, if a minimum wage is established in the region that exceeds the minimum wage, the employer must charge northern bonuses based on the minimum wage. However, if the minimum wage established by a regional agreement already includes a regional coefficient, the employer is not obliged to do this.