Calculation of compensation for salary delays in “1C: Salary and Personnel Management 8”

In October 2021, Federal Law No. 272-FZ of July 3, 2016 on encouraging employers to pay employees wages on time comes into force. Among other things, the law increases the amount of compensation for delayed salaries from 1/300 to 1/150 of the key rate of the Central Bank of the Russian Federation.

For more information about how employers will be punished and what changes the new law makes to the Labor Code of the Russian Federation, read the article by tax expert Igor Karmazin “Tightening the requirements of the Labor Code of the Russian Federation: how employers will be punished for delaying wages”

.

In this material, 1C experts will show how to calculate compensation for delayed salaries in the 1C: Salary and HR Management 8 program.

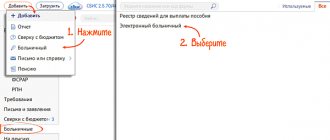

In the program "1C: Salaries and Personnel Management 8" edition 3 Salary payment date

, approved in the organization, is indicated in the

Settings

-

Organization details

on

the Accounting policies and other settings

using the link

Accounting and salary payment

.

For example, in accordance with the collective agreement, the salary payment date

set on the fifth day of the month following the calculated one (Fig. 1).

Fig.1.

Setting up accounting policies for salary payments

If the organization has delayed payment of wages, then it is necessary to calculate and pay monetary compensation to employees. It is calculated for each day of delay, taking into account the current key rate of the Central Bank of the Russian Federation.

In the program, the Central Bank rate is stored in the information register of the same name. Compensation calculated based on the Central Bank key rate corresponds to the minimum amount established by law. But the organization may provide for greater significance. This value should be indicated in the information register Rate of compensation for delayed wages

.

The rate here is indicated as a percentage of the unpaid amount per day of delay. If the value of the Compensation rate for delayed wages is filled in,

then this value is used for calculation.

Therefore, users must be careful not to indicate the Compensation Rate for delayed wages

is less than the key rate of the Central Bank, so as not to break the law.

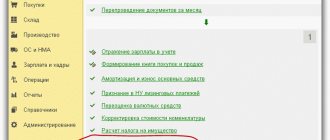

Compensation for delayed payment of wages to calculate compensation.

(menu

Payments - Compensation for delayed wages)

. Compensation should be calculated (i.e., this document should be registered) before filling out the form for payment of delayed wages.

Example.

The salary for June was not paid on the day prescribed by the established procedure in the organization - July 5. The next day there was an opportunity to pay the salary. Before generating a payroll, you need to generate and fill out the document Compensation for delayed payment of wages. In the Document Date field, you should indicate the day when the salary will be paid – 07/06. (Fig. 2) and click on the Fill button. Since the salary is delayed by 1 day, the monetary compensation is calculated for the period from 07/05 (the date of salary payment in accordance with the accounting policy) to 07/06 (the date of the document), i.e. for 1 day.

Fig. 2 Document

Compensation for delayed payment of wages

In the document Compensation for delayed payment of wages

in the

Payment

you need to indicate the method of payment of compensation (Fig. 2

): With advance payment, During the interpayment period, With salary.

To pay compensation separately from wages, you need to select the payment method During the interpayment period

and generate a payroll for compensation (Fig. 3) before generating a payroll for wages.

Fig. 3 Statement for payment of compensation for delayed wages.

In this case, in the Pay

you need to select the type of payment

of Compensation for delayed wages

and indicate the document that calculated this compensation.

If you do not generate such a statement, then regardless of the chosen payment method when generating salary payments, all due amounts will be filled in,

and compensation will be included in the payroll.

Taxation of compensation for delayed wages

Compensation for delayed payment of wages to employees is not subject to personal income tax in accordance with paragraph 3 of Article 217 of the Tax Code of the Russian Federation, because is compensation provided for in Article 236 of the Labor Code of the Russian Federation. This is confirmed in letters of the Ministry of Finance of Russia No. 03-04-05/4-54 dated 01/23/2013 and No. 03-04-05/9-526 dated 04/18/2012.

If compensation exceeds the minimum amount established by law and is provided for in a collective or employment contract, then the excess amount will also not be subject to personal income tax in accordance with letters of the Ministry of Finance of Russia No. 03-04-05/4-54 dated November 28, 2008 and No. 03-04- 05-01/247 dated 07/26/2007.

If an increased amount of compensation is not provided for in these documents, then the employer must pay personal income tax on the amount exceeding the minimum amount according to the law. This is evidenced by letters from the Ministry of Finance of Russia No. 03-04-05-01/450 dated November 28, 2008 and No. 03-04-05-01/247 dated July 26, 2007.

The program does not provide for taxation of increased compensation. We recommend stipulating the use of an increased rate in a collective or employment agreement.

Since compensation for delayed wages is not mentioned in Article 9 of Federal Law No. 212-FZ, there is an opinion that it is subject to insurance contributions in the generally established manner. However, there are judicial acts according to which compensation for late payment of wages should be classified as compensation payments related to the performance by an individual of his work duties.

Thus, it is not subject to insurance premiums on the basis of clause 2 of part 1 of Article 9 of Federal Law No. 212-FZ (for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 11031/13 dated December 10, 2013 and Resolution of the Supreme Arbitration Court of the Russian Federation dated No. VAS-608/13 25.03. 2013).

In the program, compensation for delayed wages is not subject to insurance premiums. There are two points of view regarding the possibility of including compensation for delayed salaries of employees as expenses for tax purposes.

According to the official point of view (letters of the Ministry of Finance of Russia No. 03-03-06/2/164 dated October 31, 2011 and No. 03-03-06/2/232 dated December 9, 2009), this compensation payment is not recognized as an income tax expense. But judicial practice shows that compensation paid on the basis of Article 236 of the Labor Code of the Russian Federation is considered a sanction for violation of contractual obligations (for example, resolution of the Federal Antimonopoly Service of the Volga Region No. A55-35672/2009 dated 08/30/2010 and No. A49-6366/2006 dated 06/08/2007 ) and can be accounted for as a non-operating expense.

The envisaged increase in compensation from 1/300 to 1/150 of the current key rate of the Central Bank of the Russian Federation from the first day of late wages will be taken into account automatically when updating the program in a timely manner.

What are the consequences of late payment of wages?

Payment to employees for their work must be made at least twice a month.

The periods for advance payment (from the 15th day of the month until its end) and final payment (from the 1st to the 15th day of the month) are regulated by the Labor Code. More precise terms for salary payment are established depending on the capabilities and desires of the employer. If the salary is not paid on time, the employer is obliged to pay the employee interest for the delay (Article 236 of the Labor Code of the Russian Federation). In fact, these percentages, calculated as at least one hundred and fiftieth of the key rate of the Central Bank, will be compensation for late paid wages.

In general, the smallest amount of compensation can be calculated using the formula:

Kmin = Unpaid wages on time × Key rate / 150 × Number of days overdue

NOTE! A larger amount of compensation may be stipulated in the wage regulations, employment contract or other local regulatory act.

An example of calculating compensation for delayed payment of wages from ConsultantPlus In the organization, wages for the second half of January 2021 (final payment) should have been paid on February 6, 2021. It was paid on February 11, 2021. The delay in payment was 5 days (from 02/07/2020 to 02/11/2020). The amount of wages not paid to the employee on time is 60,000 rubles, the amount of personal income tax withheld upon payment is 13,000 rubles. See the full example in K+.

Reversal of payments in Zup 1s 8 3

Reversal of payments in Zup 1s 8 3

A correction document was entered on this date.

Accordingly, payment of the additional accrued part of the vacation can be made on the next payment of something after 10/28, in this case it is the salary payment for October - 11/08. We will set this payment date in the correction document.

Since the recalculation resulted in a positive base (an additional accrual occurred, not a reversal), this income and the personal income tax on it will have a “date of receipt of income” equal to the date of payment, and not the original date from the source document.

Now let's see how this situation will be reflected in 6-NDFL.

When registering this document, the user specifies the type and selects the specific document to be reversed (Fig. 1). When carrying out a reversal document, the same data is recorded in the registers as made by the document being reversed, but with a minus sign and in a different period.

Important

After the correction document is written, the original document is locked. In the tabular parts of the source document, rows with corrected employees are highlighted in gray and become unavailable for re-correction.

A connection is established between the corrected document and the correction documents. Using links in documents, you can open related documents (correction documents or corrected document, respectively).

Attention

Let us also examine this issue using the example of accrual of vacation pay.

So, at the end of September (September 27), the employee is calculated vacation, the period of which is 03.10 - 09.10

This means that when calculating the average, the calculation period should include the hours worked and accruals for September. But at the time of calculating vacation pay, it is not possible to perform the main calculation , since there is no data necessary for accrual for September (for an employee, the calculation depends on the total revenue for June, and this information is not yet available).

Therefore, vacation is accrued and calculated without data for September.

Reversal of payments in Zup 1s 8 3 1

By clicking on the document in the “Cause” column, we can view the document that caused this situation.

If there is such a need, then you can yourself register the reason for the recalculation for an employee for a specific period.

In addition, if we open “Accrual of salaries and contributions”, we will see that information has appeared, highlighted in red, which states that the document needs to be recalculated.

When you click on the “More details” hyperlink, a list of reasons for the occurrence of recalculations opens.

How to adjust overpayment of wages in 1s 8 3 zup

How to change salaries in 1s ZUP? 1C 8.3 How to change an employee’s salary in 1C 8.3 ZUP? Today, by popular demand, we will look at the process of changing salaries in the 1C: Salary and Personnel Management program (1C ZUP) version 8.3.

Reversal of payments in zup 1s 8 3 zup

The recalculation of the calculated personal income tax from vacation pay will be taken into account in section 1 of the 6-personal income tax report for the year (for the 4th quarter), since section 1 is filled in with a cumulative total and the recalculation for September will be taken into account in this cumulative total.

As for the personal income tax withheld, the fact of personal income tax withholding from the salary for October, which takes into account the reversal of personal income tax from vacation pay, also falls into the report for the year (for the 4th quarter), in section 2 of 6-NDFL .

Again, there is no point in adjusting the information in the report for the half-year, since at that moment there was no recall from vacation yet, and during the initial payment of vacation pay, exactly the amount of personal income tax that needed to be withheld was withheld.

Accounting for the recalculation of vacation pay (positive income) in 6-NDFL

Let's consider a situation where, as a result of recalculation in 1s 8.3 zup, a positive income was obtained .

Reversal of payments in Zup 1s 8 3.0

Thus, the same document “Calculation of salaries for employees of organizations” can be corrected several times as calculation errors are identified.

For documents drawn up for one employee (for example, documents recording accruals calculated based on average earnings), only complete correction is possible.

Figure 2 Correction of the “Payroll” document In “corrected” documents, it is possible to go to the correction document, view the list of such documents, and also cancel the correction. Now the program tracks when recalculation is required and displays a list with similar information.

Next, based on the original “Vacation” document, a correction document is created (the “Correct” button in the lower left corner of the source document).

It reverses the vacation accrued in the original document and accrues a new amount calculated taking into account the salary for September. It will be higher, so additional personal income tax will be calculated.

The peculiarity of this option for recalculating vacation pay in 1C ZUP 3.

1 is that the correction document is registered in the next month of accrual (in this case, it is the accrual month of October).

The use of this recalculation option is justified if, by the time the need to recalculate the vacation was discovered, the month in which the original vacation was registered had already been “closed.”

Let's assume that the need to correct vacation for September was discovered only on October 28.

The user is asked to correct the original calculation data in each new line and carry out the standard calculation procedure.

Reversal of documents and registers in 1C 8.3 (8.2) Accounting

Select the organization and the document to be reversed. First, a list of all documents that are in the program will appear.

We select the one we need from it. I propose to reverse a document for the sale of goods issued by mistake in the first quarter: After selecting the type of document, a list of all documents for the established organization will appear.

Let's choose any one. The tabular part of the reversal document will be filled in automatically: Get 267 video lessons on 1C for free:

Sincerely, !

If you liked the publication, you can save a link to it on your page on social networks. To do this, use the “” button located just below.

dtpstory.ru

The indexation coefficient of benefits and the date from which it applies are indicated in the left tabular part.

Attention In this case, the benefit amounts in the right table part are automatically calculated based on the specified coefficients.

When performing the operation “Record indexation results”, the processing “Indexation and recalculation of state benefits for citizens with children” will be called (Fig. 5).

The same processing can be called using the program menu. And this method seems to be more correct.

Source: https://advokat-martov.ru/storno-vyplaty-v-zup-1s-8-3

Attribution of compensation to settlements for other transactions

Since compensation for delayed wages does not relate to labor costs, it should be reflected in the credit of account 73.03 “Settlements for other operations”. To do this, you need to create a document Transaction entered manually in the section Transactions – Accounting – Transactions entered manually.

The document states:

- Debit - “Settlements with personnel for wages”.

- Subconto 1 - employee to whom compensation has been accrued.

- Credit - 73.03 “Settlements for other operations.”

- Subconto 1 - employee to whom compensation has been accrued.

- Amount —the amount of compensation.

- Amount NU Dt and Amount NU Kt will be filled in automatically.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge