The balance sheet is not only one of the main forms of financial reporting, but also contains important methodological prerequisites that determine the accounting methodology.

The balance sheet as a reporting form characterizes the state of economic assets in terms of their composition and sources of formation in cash as of a certain date.

The funds represented in the asset undergo a continuous circulation, consisting of a countless number of various technological and organizational business operations that form the processes of acquisition and procurement of material resources, their processing, production and sale of finished products. The more actively the funds pulsate in the circulation, the faster they turn around, the more rationally they are used and the more economically efficient the enterprise operates, since each turn in the circulation not only reimburses the funds spent, but also makes a profit.

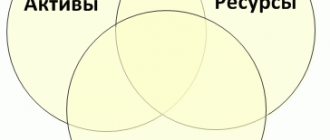

Balance sheet assets

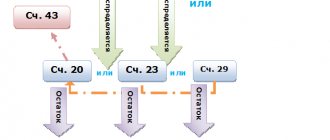

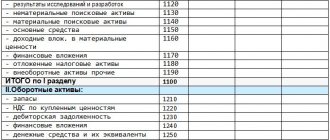

Due to the different nature of participation in the circulation, economic assets are divided into current and non-current assets. The difference between them is not that some of them participate in the turnover and others do not, but in how they participate in it. Working capital, as it is consumed, enters circulation in its entirety, changing its form, transforming from one type to another - from cash into reserves of raw materials, from raw materials as they are processed into parts, semi-finished products and finished products, finished products for sale - in cash, etc.

Non-current assets , in the form of buildings, structures, machinery, equipment and other tangible objects of fixed assets or intangible assets, as well as other long-term investments, serve for a long time, wear out gradually and, as parts wear out, gradually enter into circulation. Their turnover becomes slow and takes a long time, so they are allocated in the balance sheet in a special section called “Non-current assets”

Since the funds in the balance sheet assets are grouped in order of accelerating turnover or increasing the level of liquidity - from fixed assets to inventories and cash, the second section of the balance sheet assets is “Current assets”.

Conclusion

Margin trading in Forex, CFDs and shares has some associated risks and is not suitable for everyone.

Before choosing a broker, evaluate your experience and risk appetite. Since there is always a chance that something will go wrong, take advantage of a negative balance protection policy.

Unfortunately, many brokers do not offer negative balance protection. Remember that in the event of an extreme market situation, such a broker will not cover all your risks.

Luckily, licensed and regulated brokers offer you the option of working with negative balance protection.

Always check brokers' terms and conditions before signing up. Negative balance protection is an important selling point because it removes you from a dangerous streak.

Balance Liabilities

Sources in the liability are divided into own and attracted . Own sources belong to the enterprise itself and are presented in the first section of the liability in the form of capital and reserves, and attracted, that is, borrowed or arising during settlement relations in the form of credit debt, in the next two sections. Those attracted , depending on their repayment period, are divided into long-term and short-term liabilities. This determines the structure of the balance sheet liability and the sequence of placement of sources of economic funds in it.

This construction of a balance sheet makes it possible to create a clear idea of the volume, structure and state of the enterprise’s funds, the availability of their own and attracted sources to cover them, as well as the financial results and their use. This information is extremely important for investors, creditors, suppliers, buyers, government financial and tax authorities and all other users of financial statements, as it allows assessing the profitability of the enterprise, its solvency, the condition and efficiency of the use of resources, credit and settlement relationships, viability and business efficiency.

Factors to consider when choosing an NBP broker

Choosing the best broker for negative balance protection can be a little difficult since the broker must satisfy all your needs at the same time.

However, by exploring a few options, you can create a safety net of sorts. Below we list some factors to consider.

Regulation and licenses

Make sure that your preferred broker is actually licensed and regulated by a regulatory body or commission.

Check where the firm is located as different jurisdictions have different financial registration requirements.

Licensing and regulation provide essential insurance against financial problems and internal fraud that a broker may encounter.

Regulatory requirements require brokers to hold clients' funds and their funds in separate accounts.

Broker reputation

An important factor that cannot be ignored when looking for a negative balance protection broker is their reputation and work history.

Choose a broker with a good financial history. Do enough online research to find out about other users' past experiences with this broker.

When reading independent reviews, you may come across information about sanctions, violations or ongoing litigation. two years of experience .

Withdrawal time

Check what financing methods the broker offers and whether there are minimum deposit and withdrawal conditions.

While most brokers allow traders to fund their accounts via bank transfer, credit cards and cashier's checks, we recommend that you ensure that the broker you are considering has deposit/withdrawal options that are convenient for you.

Look for a broker that offers smooth, fast and hassle-free deposit and withdrawal processes.

Rules for evaluating financial statements items

PBU 4/99 “Accounting statements of an organization” establishes rules for evaluating items of financial statements that are taken into account when preparing the balance sheet.

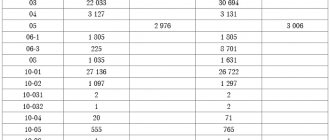

1. The balance sheet data at the beginning of the reporting period must be comparable with the balance sheet data for the period preceding the reporting period, taking into account the reorganization carried out, as well as changes associated with the application of PBU 1/08 “Accounting Policies”.

2. In the financial statements, offsetting between items of assets and liabilities, profits and losses is not allowed, except in cases where such offsetting is provided for by the relevant accounting provisions.

3. The balance sheet must include numerical indicators in net estimates, i.e. minus regulatory values, which must be disclosed in the notes to the balance sheet and profit and loss account. PBU 21/2008 Accounting Regulations “Changes in Estimated Indicators”, Appendix No. 2 to Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106 introduced the concept of “change in estimated values.”

4. The rules for evaluating individual items of financial statements are established in the relevant accounting provisions:

— Regulations on accounting and financial reporting in the Russian Federation”, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n (as amended on December 30, 1999, March 24, 2000, September 18, 2006, March 26 2007);

— PBU 1/2008 Accounting Regulations “Accounting Policy of the Organization”, Appendix No. 1 to the Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n.

5. Items in the financial statements prepared for the reporting year must be supported by the results of the inventory of assets and liabilities.

6. Assets and liabilities are reflected in the Balance Sheet depending on the timing of their circulation (repayment), divided into long-term and short-term.

Rules for evaluating balance sheet items

The organization's funds are reflected in the balance sheet as follows:

• fixed assets - at residual value, i.e. at the actual costs of their acquisition, construction and production minus accrued depreciation; • intangible assets - at residual value, i.e. at actual acquisition costs, including costs of bringing them to a state in which they are suitable for use for the intended purposes, minus accrued depreciation; • unfinished capital investments—at actual costs for the developer (investor); • equipment—at the actual cost of acquisition; • financial investments (investments in securities, in the authorized capital of other enterprises, bonds, loans provided, etc.) - at actual costs for the investor; • material assets (materials, fuel, spare parts, containers and other material resources) - at their actual cost; • work in progress - at actual production cost (in mass and serial production - at standard (planned) cost or at direct costs, or at the cost of raw materials, materials and semi-finished products); • distribution costs - in the amount of costs attributable to the balance of unsold goods in trade and public catering organizations; • deferred expenses - in the amount actually incurred in the reporting period, but relating to the following reporting periods; • finished products - at actual or standard (planned) production cost; • goods - at the cost of their acquisition; • goods shipped, work delivered and services provided - at full actual or standard (planned) cost; • accounts receivable—in the amount recognized by debtors; • balances on foreign currency accounts, other funds (including monetary documents), securities, receivables and payables in foreign currencies—in rubles, determined by converting foreign currencies at the exchange rate of the Central Bank of the Russian Federation effective on the last day of the reporting period. The organization's sources of funds are reflected in the balance sheet: • authorized capital - in the amount determined by the constituent documents; • reserve capital—in the amount of unused funds of this capital; • reserves for doubtful debts - in the amount of reserves created at the end of the reporting year to cover the organization's receivables; • reserves to cover future expenses - in the amount of unused reserves during the year and in the amount of reserves carried over to the next year - in the balance sheet at the end of the reporting year; • deferred income - in the amount received in the reporting period, but relating to the following reporting periods; • financial result of the reporting period—as retained earnings (uncovered loss), i.e., the final financial result identified for the reporting period, minus taxes and other similar payments due from profits, including sanctions for non-compliance with tax rules; • accounts payable - in the amounts of actual debts to creditors.

Change in estimates

PBU 21/2008 introduced a new concept of “change in estimated values”, which is understood as an adjustment to the value of an asset (liability) or a value reflecting the repayment of the value of an asset, due to the emergence of new information, which is made based on an assessment of the current state of affairs in the organization, expected future benefits and obligations and does not constitute a correction of an error in the financial statements.

In this case, the estimated value is:

the amount of reserve for doubtful debts, reserve for reduction in the value of inventories, other valuation reserves,

- useful lives of fixed assets, intangible assets and other depreciable assets,

- assessment of the expected receipt of future economic benefits from the use of depreciable assets, etc.

- A change in the way assets and liabilities are measured is not a change in accounting estimates.

If any change in accounting data cannot be clearly classified as a change in accounting policy or a change in an estimated value, then for the purposes of financial reporting it is recognized as a change in the estimated value.

A change in the estimated value is subject to recognition in accounting by including in the income or expenses of the organization (prospectively):

- the period in which the change occurred, if such a change affects the financial statements only for this reporting period;

- the period in which the change occurred, and future periods, if such a change affects the financial statements of this reporting period and the financial statements of future periods.

A change in the estimated value that directly affects the amount of the organization's capital is subject to recognition by adjusting the corresponding capital items in the financial statements for the period in which the change occurred.

In the explanatory note to the financial statements, the organization must disclose information about changes in the estimated value.

Optimal average value

Equity is important because it represents the true value of a share in the share capital. Investors who own shares in a company are usually interested in their own personal equity in the company represented by their shares.

However, such personal capital is a function of the total capital of the company itself, so a shareholder interested in his own earnings will necessarily have an interest in the company.

Owning shares in a company provides capital gains for the shareholder and potential dividends over time. It also often gives the shareholder voting rights at the founders' meeting. All these benefits further increase shareholder interest in the company.

Most often, the average value for the year is used to assess equity capital, which allows you to most accurately determine its variations over time.

The formula for calculation is as follows:

Sk = (Sk at the beginning of the year + Sk at the end of the year) / 2

The data is taken from the balance sheet for the relevant reporting periods.

Shareholders have voting rights and other privileges that come only with ownership, since capital represents a claim to a proportionate share of the company's assets and earnings. These claims are generally those of creditors, but only shareholders can truly participate in and benefit from the growth in the value of the enterprise.

Some financial instruments have the characteristics of equity, but are not actually equity. For example, convertible debt instruments are loans that convert into equity when the company (the borrower) crosses certain thresholds, thereby turning the lender into an owner in certain cases.

Stock options also act like shares in that their value changes with the value of the underlying shares, but option holders generally do not have voting rights and cannot receive dividends or other financial instruments.

It's important to understand that while equity represents a company's net worth, a company's stock is ultimately only worth what buyers are willing to pay for it.

It is highly desirable that the amount of equity capital or net assets be higher than the amount of the company's authorized capital. This criterion is important from the point of view of maintaining the investment attractiveness of the business.

A business must pay for itself and ensure an influx of new capital. Sufficient equity capital is one of the most significant indicators of the quality of a company’s business model.

What is own working capital? Details are in this article.