In 2021, all employers are faced with major changes to their current reporting practices.

If until this moment they reported on pension contributions to the Pension Fund, on contributions in case of temporary disability and injuries - to the Social Insurance Fund, and on accrued and paid taxes - to the Federal Tax Service, now all powers to administer contributions have been transferred to the Tax Inspectorate (except for contributions "for injuries"). In connection with this, Order No. ММВ-7-11/551 of the Federal Tax Service of 2016 approved a unified reporting form RSV-1. Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

8 (800) 350-31-84

According to the new rules, all employers, regardless of their form of ownership, rent it out: these can be either individual entrepreneurs with employees or legal entities.

Conditions for filling out reports

RSV-1 reporting is required to be submitted to the Tax Inspectorate by all legal entities and individuals who use hired labor in their work and are payers of insurance premiums. The form and reporting procedure for RSV-1 were approved by Order of the Federal Tax Service of 2021 No. ММВ-7-11/ [email protected]

Part of the benefits for temporary disability on sick leave is paid by the employer from his own funds, the other part is compensated by the Social Insurance Fund.

If the amount of accrued benefits turns out to be less than the amount of benefits paid, then the employer has the right to receive compensation to his current account. In this case, the receipt of such compensation must be reflected in the RSV-1 reporting form.

Thus, the conditions for filling out RSV-1 reporting are as follows: the employer has the status of a legal entity or individual entrepreneur, he employs employees under an employment contract, or he engages persons for certain operations under a civil contract, he is a payer of insurance premiums.

Conclusion of the Federal Tax Service

According to tax authorities, the amount of additionally paid benefits in the form of expenses for the payment of insurance coverage should be reflected in the calculation for the reporting period of 2019 - in which these expenses for the payment of insurance coverage were incurred .

That is, the employer does not need to submit updated calculations for the previous reporting (settlement) period (in this situation - for 2018).

Read also

28.03.2018

How to fill out the RSV form correctly

The RSV-1 calculation contains information that is the basis for the calculation and payment of insurance premiums from the 1st quarter of 2017. One of the sections of the report is devoted to insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity.

It consists of a title page and three sections indicating contributions for pension, medical and social insurance of employees, as well as personalized information.

In the RSV-1 form, it is necessary to fill out only those sections in which the employer has something to transfer. For example, if an employer does not have contributions with additional tariffs, then he does not fill it out and submit it to the inspectorate.

After the employer submits a report on contributions to the Federal Tax Service, the inspectorate transmits it to the territorial division of the Social Insurance Fund (Appendix 2-4 to Section 1 with information on accrued contributions and benefits). Therefore, the employer should take into account that the figures calculated for contributions and those transferred to the Social Insurance Fund to receive compensation must be the same.

Vrnetrud in SV-experience: code, decoding and example

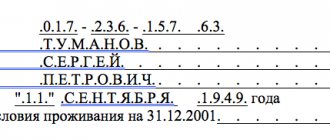

One of the most common additional information codes when calculating insurance experience is DLOTPUSK Territorial conditions (code) Column 8 of the SZV-STAZH form is filled out in accordance with the “Classifier of parameters used when filling out information for maintaining individual (personalized) records.” The code in column 8 is indicated if the employee has the right to early retirement due to territorial conditions, for example: Code Full name RKS Region of the Far North MKS Area equivalent to the regions of the Far North VILLAGE Work in agriculture Special working conditions (code) According to the column 9 of the SZV-STAZH form indicates the code of working conditions that give the right to early assignment of a pension.

And if the first version of the decoding does not even meaningfully relate to the SZV-M form (it does not contain information about employee remuneration), then the second does not seem to be erroneous, since it carries the semantic load of the report and coincides with the name of the form indicated in the document that approved it. But, in fact, it is not an abbreviation, but only a symbol, i.e. unified and approved by documents

ImportantPFR code. Evidence of this will be discussed below. For information on the required details in the report file name, see the article “PFR territorial body code for SZV-M”. The SZV-M form was approved by the resolution of the Pension Fund of the Russian Federation “On approval of the form “Information about insured persons”” dated 01.02.2016 No. 83p). For other accounting documents, not only legally approved forms are provided, but also instructions for filling them out (Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 2p).

How to reflect sick leave in RSV-1

According to the procedure for filling out the reporting form RSV-1, the amounts of insurance premiums for insurance in connection with temporary disability and maternity are prescribed in Appendix 2 to Section 1.

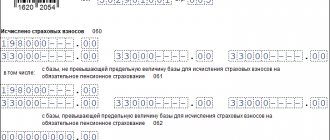

Line 060 displays accrued contributions from the beginning of the year on an accrual basis , including for the reporting period (quarter) with a monthly breakdown. Line 070 records benefits that have been accrued since the beginning of the year on an accrual basis, including for the reporting period (quarter) with a monthly breakdown.

According to clause 11.14 of the Procedure, line 080 indicates the amount of compensation from the Social Insurance Fund in the column that corresponds to the month of receipt of the actual compensation. For example, if expenses are compensated by the fund in April, then this is displayed in the column for the first month of the 2nd quarter.

Line 090 of Appendix No. 2 indicates the amount calculated using the following formula : accrued contributions minus expenses for the payment of temporary disability benefits plus the amount of compensation received from the Social Insurance Fund for the reporting period.

According to the above calculations, either a negative or a positive value can be obtained. The employer should take into account that if the difference is negative, then he does not need to put a minus in front of the number.

The sign of the resulting difference is indicated using the numbers 1 or 2. If the value is set to “1”, this indicates that the contributions are more than the costs of insurance compensation for workers, “2” - the employer’s costs are more than the accrued contributions. Accordingly, if the value according to the formula for line 090 is negative, then the number “2” is entered.

If the amount is positive, this means that the employer must make an additional payment to the budget; if it is negative, then he will be reimbursed from the budget.

If the employer remains in debt, then he fills out one of the lines: 110, 111, 112, 113. When he has an overpayment, then fill out lines 120, 121, 122, 128. At the same time, these lines are not filled in: that is, the employer can or must budget, or overpay into it.

If there is a discrepancy between the data from the DAM report and the financial statements, accountants often have questions about whether the form has been filled out correctly. Typically, a discrepancy arises between the actual state of affairs and the figure indicated in column “090”.

For example, if the Fund has already reimbursed the employer for expenses, and when filling out the reporting form it turned out that the company owes the Social Insurance Fund a larger amount than in reality (after all, reimbursed expenses are added to accrued contributions), then there is no error in this. The employer will have to pay only accrued contributions to the budget , and not the amount from the final line 110 or 90 of the DAM report.

If the costs of temporary disability benefits were taken into account by the employer last year, and the employer received compensation in the current year, then the report is also filled out in the standard manner.

In the above formula, it does not matter for what period the employer received compensation; it is taken into account in the month of actual receipt. This position is confirmed by the explanatory letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 2021. A similar conclusion can be drawn based on the analysis of Art. 34 of the Tax Code, which provides for the offset of expenses for temporary disability and maternity benefits against upcoming payments.

Most accounting programs today are configured to automatically check all ratios and prevent you from filling out lines incorrectly. But if the employer fills out the reports independently, then the control ratio is given in the Federal Tax Service Letter of 2021 No. GD-4-11 / [email protected]

Sample document: an example of filling out the RSV with sick leave can be found here.

Also, the employer can always find out whether taxes have been paid correctly by ordering a reconciliation of calculations from the Federal Tax Service. If the accounting data matches the reconciliation results, then there is nothing to worry about.

Types of service periods for reporting to the Pension Fund and their reflection in 1C

Published 11/13/2014 11:39

Lately I have been asked a lot of questions about the types of experience used in reporting to the Pension Fund. What is “DISTRIBUTION” and when should it be indicated? How does the “CHILDREN” type differ from the “DLCHILDREN” type? In this article I will tell you in what cases the most popular types of seniority are used and how to reflect events corresponding to the listed codes in 1C programs that support complex payroll calculations.

We will start with employees on maternity leave. So, what types of internships are used during this period:

1) DECREE - maternity leave. In 1C programs, it is registered as payment for sick leave (document “Accrual for sick leave”), which the employee provides after 30 weeks of pregnancy. If after childbirth the sick leave is extended for 16 days, then the code “DECREE” for this period is also indicated, for which a continuation of the sick leave is entered.

2) “CHILDREN” – parental leave for up to 1.5 years. During this period, in 1C programs, child care benefits are calculated at the expense of the Social Security Fund. The purpose of the benefit is recorded in the “Parental Leave” document.

3) “CHILDREN” - parental leave for a child from 1.5 to 3 years. During this period, only a benefit in the amount of 50 rubles is accrued; it is reflected in 1C in the same way as the previous type.

For other types of leave, the following codes are used:

1) “DLOTPUSK” - annual paid leave. Starting from January 1, 2014, it is necessary to allocate periods of stay on paid leave using this code. In 1C programs it is registered with the document “Accrual of vacation to employees of organizations.”

2) “SCHOOL LEAVE” - this code indicates that an employee is on study leave. Such additional leaves are provided to employees who combine work and study. In 1C programs they are also registered with the document “Accrual of vacation to employees of organizations.” It is necessary to check the “Additional leave” checkbox and indicate the type of leave – “study”.

3) “ADMINISTER” - leave without pay. In 1C it is registered with the document “Absenteeism”, located on the “Payroll” tab.

4) “Chernobyl Nuclear Power Plant” - additional leave for citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant. It is registered in the document “Accrual of leave for employees of organizations” as additional leave. However, it is necessary to add a new type of calculation and configure it by indicating the appropriate type of experience.

If an employee was absent due to illness and provided sick leave (with the exception of sick leave for pregnancy and childbirth), then this period is reflected with the code “OUTSIDE WORK”. Registered in the program with the document “Accrual on sick leave”.

The code "NEOPL" is used in a large number of cases and denotes unpaid periods. But most often it is used for absenteeism and downtime due to the fault of the employee. To reflect them in the program, you must use the “Absenteeism” document or register one-time accruals, having previously configured the reflection of length of service in the accrual.

“DOWNTIME” is downtime due to the fault of the employer. The program is reflected in the document “Registration of one-time charges”, in which you must select the appropriate type of calculation and indicate the dates.

There are also various types of codes that are used much less frequently than those listed. But if you have questions about some type of experience that I did not mention in this article, then you can ask your question in the comments. Also ask if something cannot be configured for the listed codes for reflection in 1C programs.