There are often situations when conflicts arise between an employer and an employee. Disputes especially often concern the provision of vacations and their payment. It is beneficial for employers that an employee is always at work and works seven days a week.

Some subordinates themselves refuse annual paid rest. It is important for company managers to understand the legal liability for failure to provide leave to an employee and to try not to violate the rights of employees.

Grounds for granting leave

The vacation schedule drawn up at each enterprise is the basis for granting vacation to an employee. Annual leave while maintaining the average salary and workplace should be 28 days per year (according to the Labor Code of the Russian Federation), while additional leave may be granted depending on the type of activity, regulated by the Labor Code of the Russian Federation and local acts of the organization.

The vacation schedule in the form developed by Goskomstat may not be used by commercial organizations from 01/01/2013, but must be and approved 1 month before the start of the year. The organization can take its own form at the local level. The vacation schedule regulates the procedure for providing employees with rest time for the purpose of avoiding vacation overlaps. All employees and their time on vacation must be reflected.

The main requirements for going on vacation are:

- submitting a leave application from the employee no later than 2 weeks in advance

- payment of vacation amounts 3 days before the start of vacation

When the schedule changes

All employed people have the right to rest, regardless of how they are registered - under a permanent or fixed-term contract. The vacation of employees hired under fixed-term contracts rolling over to the next calendar year is planned in accordance with the general procedure (Article 123 of the Labor Code). The employer includes in the schedule those employees with whom the employment relationship continues in the next calendar year. Part-time workers (internal and external) are also included in the annual plan.

All legislative norms and scheduling restrictions are taken into account by the personnel service when planning the work and rest schedule and are compiled into the T7 form (by Decree of the State Statistics Committee No. 1 of 01/05/2004). For example, employees raising 3 or more children under the age of 12 have an advantage in choosing the time of a break from work (Article 262.2 of the Labor Code, introduced by Federal Law-360 of October 11, 2018). Compliance with the schedule is mandatory for both parties to the labor process (Part 2 of Article 123). It allows:

- plan and regulate the sequence of vacation periods;

- guarantee timely execution and payment.

The employer does not have the right to independently amend the approved schedule, but there are exceptions.

Here are the legally justified reasons for the transfer, when the penalty for unplanned leave is not applied (the grounds are regulated by Article 124 of the Labor Code and are documented):

| Reason for the amendments | Condition |

| Providing rest in the current working year will adversely affect the normal course of work of the organization | Written agreement |

| Temporary disability | Written statement Sheet of temporary incapacity for work |

| Performance by an employee of state duties during regular rest | Written statement Document on involvement in the performance of state duties |

| Other cases provided for by labor legislation and local regulations | Written consent or statement Supporting documents |

Time and terms of vacation

An employee has the right to be granted leave in parts, but one of the leaves must be at least 14 days, regardless of the duration of the leave (the minimum leave is 28 days and days of additional leave are added to it in accordance with the law).

But there are situations when an employee did not write a leave application in a timely manner (which should be monitored by the HR department), recall from leave due to production needs, employee illness, etc. In this regard, the employer is obliged to provide other days for rest. If vacation was not completed during the calendar year, then these days must be transferred to the next year, that is, the vacation of the next year is increased. The vacation schedule for the next year is drawn up taking these days into account.

Art. 124 of the Labor Code of the Russian Federation prohibits not providing vacation for 2 years in a row, which means that the employee must have vacation. Replacing the main vacation with a cash payment is prohibited, but in accordance with Art. 126 of the Labor Code of the Russian Federation, such compensation can be replaced by additional compensation - at the request of the employee (with the exception of minors, pregnant workers and those working in harmful (dangerous) working conditions).

Results

The right to rest in the form of vacation is one of the basic rights of an employee guaranteed to him by the Labor Code of the Russian Federation.

The parties to the labor relationship must agree on the vacation schedule in the vacation schedule and strictly observe it. Deviation from the schedule is possible by mutual agreement of the parties and must be documented. Not providing leave to an employee is risky; in the event of an audit, fines are likely to be imposed. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Responsibility for failure to provide leave to employees

Labor legislation prohibits failure to provide vacation for 2 years in a row and the remaining vacation for previous periods. Therefore, regardless of the reasons, the employer may be held administratively liable on the basis of Article 5.27 of the Labor Code of the Russian Federation.

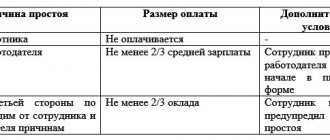

| Type of administrative responsibility | Responsibility for: | |

| Officials | Organizations | |

| For failure to provide vacations | fine from 1000 to 5000 rubles. | fine from 30,000 to 50,000 rubles. |

| For repeated violation | – fine from 10,000 to 20,000 rubles. – disqualification from 1 year to 3 years | fine from 50,000 to 70,000 rubles. |

Due to the fact that employees accumulate vacations, and administrative penalties may be applied, it is recommended that the accumulated vacations be released.

Labor inspectors can learn about a violation during an inspection of an organization or from an employee complaint.

Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare of the Ministry of Health of Russia Nina Kovyazina

We respond to the complaint

Reviews ConsultantPlus

The Supreme Court published a review on coronavirus No. 1 and No. 2

A response to a buyer’s complaint is a document sent by the seller to the applicant in order to resolve a dispute regarding the quality of the purchased product or service. It is used as a tool for pre-trial resolution of disagreements between the parties.

- agreement with the presented requirements and their consequences - for example, with the suspension of work or shipment of goods under the contract;

- disagreement of the recipient of the complaint with the requirements set out in it and, accordingly, refusal to fulfill them.

Example of providing accrued vacations

Although the employer is responsible for providing leave, some employees do not take leave. To avoid liability, the employer can use the following methods:

- termination of the employment contract (by mutual agreement) - in this case, upon dismissal, compensation is paid, and the next day the employment contract is signed again

- short-term vacations are provided, taking into account weekends - in this situation, over time, non-vacation days of vacation will be used and vacation pay will be accrued for vacations on weekends

Requirements for compensation for moral and material damage in a claim

Hello! On 05/16/18, a client at the hairdresser received a hair coloring service. 05/21/18 she complained about unevenly colored hair and inflammation of the scalp. He demands a full refund for the service - 1280 rubles, reimbursement of treatment costs - 800 rubles. and compensation for moral damage in the amount of 3,000 rubles. Total 5080 rubles. At the same time, only a copy of a sheet without seals and stamps was attached to the claim, with the name of the drugs (suprastin (tavegil), calcium gluconate and Friederm shampoo). Neither a receipt for payment for the drugs, nor a doctor’s report, nor the results of a medical study were attached. Visually on the head on 05/21/18, there are no signs of an allergic reaction to the dye (the head and hair look healthy). There were also no complaints of discomfort during dyeing. Since within 7 days (painting guarantee) the client has the right to a free correction, but demands a refund, we agree to pay 1280 rubles. Does the client have the right to demand reimbursement of treatment costs and compensation for moral damage, in this case? What is meant by moral damage in our situation?

- return the money

- Share

Answers from lawyers (3)

- 8.9 rating

- 795 reviews

Elena, good afternoon! It’s worth returning the money for the services, but for everything else, I think it’s not necessary in this situation, but it’s definitely worth giving a response to the claim, in which you indicate that the damage and expenses for it are not documented. Therefore, there are no grounds for compensation. Especially moral damage.

According to Article 1100 of the Civil Code of the Russian Federation, compensation for moral damage is carried out regardless of the guilt of the harm-doer in cases where: harm is caused to the life or health of a citizen by a source of increased danger; harm was caused to a citizen as a result of his illegal conviction, illegal prosecution, illegal use of detention or recognizance as a preventive measure, illegal imposition of an administrative penalty in the form of arrest or correctional labor; harm was caused by the dissemination of information discrediting honor, dignity and business reputation; in other cases provided by law. In accordance with paragraph 1 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 10 “Some issues of application of legislation on compensation for moral damage” dated December 20, 1994, the court should also establish what confirms the fact of causing moral or physical suffering to the victim, under what circumstances and by what actions (inaction ) they were inflicted, the degree of guilt of the perpetrator, what moral or physical suffering the victim suffered, in what amount he estimates their compensation and other circumstances relevant to the resolution of a particular dispute.

We are ready to return the money for the service, since we would not risk doing the correction ourselves if she really had an allergic reaction (although there are a lot of doubts about this). The service was performed by a master with 25 years of experience and this is the first time in our 20 years of work. The client's behavior was suspicious from the very beginning. All this is very similar to blackmail. How to competently respond to a claim, what articles of the law can be used as a guide?

For example, this one refers to the fact that the client has not documented any harm to health. The only thing you should know is that in the event of filing a claim, conducting an examination and admitting guilt, you will have to compensate for all expenses, so I recommend writing it in a streamlined manner, i.e. if they provide documents, then the issue will be resolved separately. I am ready to help you separately with the preparation.

Article 14. Property liability for damage caused due to defects in goods (work, services) Law of the Russian Federation dated 02/07/1992 N 2300-1 (as amended on 04/18/2018) “On the protection of consumer rights” Article 14. Property liability for harm caused due to defects in the product (work, service)

4. The manufacturer (performer) is responsible for damage caused to the life, health or property of the consumer in connection with the use of materials, equipment, tools and other means necessary for the production of goods (performance of work, provision of services), regardless of whether the level of scientific knowledge allowed and technical knowledge to reveal their special properties or not.

Your task now is to enter into correspondence with the client, because... Most likely, she will write a second claim and send documents, and then you can see how they are prepared and when and whether they can serve as evidence.

Payments of vacation pay to employees

An employee's vacation is related to payments. Payments are calculated based on average annual earnings (excluding social payments). It is also necessary to take into account that an important condition for an employee to go on vacation is the payment of vacation pay 3 days before the vacation , and for the delay of vacation pay, the employer may be subject to financial liability provided for by the Labor Code of the Russian Federation and expressed in compensation (not subject to personal income tax) for each day of delay in payments . And compensation is calculated based on 1/150 of the key rate of the Central Bank, which is currently 7.25%, but if local acts provide for an increased payment, then compensation in excess of the statutory share is subject to personal income tax.

Administrative liability is also provided for late payment of vacation pay, so the employer needs to calculate all payments for the delay, if any, without waiting for State Tax Inspectorate checks.

Which employees have priority when taking leave?

What to do if an employee refuses to go on vacation? According to the vacation schedule at ABC LLC, accountant Kopeikin K.K. a vacation is planned for the period 04/15/2020-04/30/2020, but it is during this period that an unscheduled on-site audit by the tax authorities should be carried out. Kopeikin K.K. It is mandatory to attend this event; in addition, you need to carefully prepare for the inspection. In this case, the employee will be asked to postpone the vacation to another time convenient for him.

I work officially. Now on maternity leave for up to 1.5 years. The maternity leave was supposed to arrive on the 15th, today I wrote to the accountant. She said they would come today, but they never came. How long can an employer delay maternity leave?

Calculation of vacation amounts and reflection in accounting

The procedure for calculating vacation pay is regulated by Art. 139 of the Labor Code of the Russian Federation and the Regulations on average wages, which determines:

- the amount of payments to the employee for the year preceding the vacation

- number of calendar days to calculate average daily earnings

- Average daily earnings and vacation pay

Important! The amount of vacation pay is calculated within the framework of the employment relationship and is subject to personal income tax (minus standard tax deductions) and insurance contributions.

At the same time, the employer, at its discretion, can create a reserve fund for vacation amounts or not.

If there is a vacation pay fund, then vacation pay is reflected: D 96 K 70

If there is no fund, then: D 20 (23, 26, 44, etc.) K 70

Personal income tax on vacation pay: D 70 K 68

Article 121. Calculation of length of service giving the right to annual paid leave

- for the employer, these are fines for violation of labor and tax laws, incl. criminal liability.

Example

evasion of registration or improper legal registration, or conclusion of a civil contract that actually regulates labor relations between the employee and the employer -

- for officials in the amount of 10,000 (ten thousand) to 20,000 (twenty thousand) rubles;

- for persons carrying out entrepreneurial activities without forming a legal entity - from 5,000 (five thousand) to 10,000 (ten thousand) rubles;

- for legal entities - from 5,000 (fifty thousand) to 100,000 (one hundred thousand) rubles;

- for the employee, in the form of the absence of pension and social contributions, the right to vacation and vacation pay, and there are also common cases of non-payment of the promised salary and the difficulty of proving in the event of subsequent legal recovery.

You can read about these and other emerging issues in this article, or use the services of our Legal Center.

When an employee is actually admitted to work, the employer is obliged to draw up an employment contract with him in writing no later than 3 (three) working days from the date of the employee’s actual admission to work, and if relations related to the use of personal labor arose on the basis of a civil law contract, but were subsequently recognized as labor relations - no later than 3 (three) working days from the date of recognition of these relations as labor relations, unless otherwise established by the court.

- receive your monthly salary on time;

- qualify for a full social package (provision of days off, overtime pay, compensation for periods of sick leave, payment for business trips and payment of severance pay in case of termination of the contract);

- obtain the insurance (pension) length of service necessary for calculating pension payments;

- receive medical and insurance coverage (the employer contributes certain amounts to the appropriate funds).

Option 1: Insist that the employer formalize the contract

Inform the employer (in writing or orally) of his obligation to draw up an employment contract upon actual admission to work with reference to Art. 67 of the Labor Code of the Russian Federation, paragraph 12 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2. Demand that you be familiarized with the order for employment and make a record of employment in your work book (Articles 66, 68 of the Labor Code of the Russian Federation) .

Option 2. Collect evidence of the existence of an employment relationship to protect your rights in the labor inspectorate or in court.

To recognize the existence of an employment relationship in the actual absence of a written employment contract, it is necessary to prove the fact of the work itself, as well as the fact of admission to it by the employer or his authorized representative (Decision of the Supreme Court dated January 24, 2014 No. 18-KG13-145).

Note!

If it is proven that the employee was allowed to work, then even in the absence of an employment contract with a fixed wage, the burden of proving in court the amount of wages and the absence of arrears in paying wages to the employee lies with the employer.

The mere fact of payment of a “gray” salary at any enterprise is not a basis for collecting it, since it follows from the norms of the Labor Code of the Russian Federation that the law attaches legal significance only to official wages (Article 136 of the Labor Code of the Russian Federation), and therefore, even if sufficient data on such payment are established, this cannot entail the collection of such amounts as remuneration for the employee.

Even if you have established the fact of an employment relationship, an important question remains the amount of wages and how to determine it. We believe that you can safely expect an amount of at least one minimum wage for each unpaid month, for example, minimum wage in Moscow or Russia.

Compensation, incentive and social payments should be established above the minimum wage, but when working without an employment contract there is no point in talking about this, the court will refuse.

- freelancers;

- student interns;

- trainees in companies.

Freelance employees can easily work without an employment contract. They most often do not formalize their employment relationships in any way, since they plan their time and choose orders themselves. They de facto have no employer.

From a legal point of view, this is completely acceptable. In some cases, these may be couriers or assistants to certain specialists.

As for student interns and interns, the law does not oblige them to enter into an employment contract, since everything depends on the will of their superiors. The employer, however, can meet them halfway and conclude an agreement, as well as pay wages.

IMPORTANT! Trainees and probationary employees are different legal categories.

By agreement, an employment contract may not be concluded with any employee. If the applicant is satisfied with such conditions, then he will work in the organization. However, problems with employment may arise in the future, so you need to think carefully about everything.

In any case, the employer is obliged to formalize its relationship with the employee as follows:

- conclude an employment contract or government contract;

- conclude a civil contract (contract, commission, agency agreement, etc.).

The law provides for situations when, instead of an employment contract, management can enter into another type of agreement - a civil contract.

A civil law contract is far from identical to an employment contract, but is concluded with an employee who, in fact, is not a full-time employee, performs strictly limited functions or works on a specific project (courier, specialist assistant, operator, etc.).

An employment contract is not always concluded immediately and immediately. According to the general rule of Art. 67 of the Labor Code of the Russian Federation, management must conclude an agreement with an employee within 3 working days. This means that an employee can initially work without a signed employment contract, but subject to certain conditions.

In this case, the legislator still believes that it has been concluded; therefore, the employer remains obliged to draw up the agreement in writing as soon as possible.

IMPORTANT! An employment contract is concluded if the employee actually carries out labor activities with the consent or on behalf of management and other responsible persons in accordance with Art. 67 Labor Code of the Russian Federation.

Often in practice it turns out that the employer deliberately hesitates and postpones the conclusion of the contract, citing a probationary period, employee audit, non-payment of taxes or other reasons.

First of all, this is illegal, since an employment contract must be concluded even if the organization has a probationary period and any other cases. If this is just a paid short-term internship, then such an approach on the part of management is acceptable.

To solve this problem, you can contact the following authorities:

- Labour Inspectorate;

- court.

Labor inspection is the initial stage of an employee’s application to protect their labor rights. This organization exists in every city, which is authorized to initiate administrative proceedings against the employer in case of violations of the Labor Code of the Russian Federation.

You can contact this institution either in person or through an electronic application on the official website https://onlineinspektsiya.rf. However, before this you need to register on the government services website. Within 30 days, the request will be reviewed by competent persons and a response will be given.

If the labor inspectorate does not help in solving the problem, then all that remains is to go to court. Moreover, labor disputes are considered only by the district court. To do this, you need to contact a judicial institution of your choice: both at the employee’s place of residence and at the location of the employer.

In connection with changes to the Code of Civil Procedure of the Russian Federation dated December 3, 2016, such workers can now apply to their local district courts to resolve labor disputes. This makes the task much easier. Then you need to draw up a regular claim in writing, which must meet the requirements of Art. 131 Code of Civil Procedure of the Russian Federation.

All documents are attached to the claim. Next, the court considers the case and can make a decision in favor of both the employee and the employer. It all depends on the evidence presented.

REFERENCE! There is a special limitation period for labor disputes. The employee must go to court within 3 months from the day he became aware of a violation of his rights in accordance with Art. 392 Labor Code of the Russian Federation.

(as amended by Federal Law No. 90-FZ of June 30, 2006)

The minimum duration of annual additional paid leave for employees engaged in work with harmful and (or) dangerous working conditions, and the conditions for its provision, are established in the manner determined by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations.

(Part two as amended by Federal Law No. 90-FZ of June 30, 2006)

The list of categories of employees for whom annual additional paid leave is established for the special nature of the work, as well as the minimum duration of this leave and the conditions for its provision are determined by the Government of the Russian Federation.

actual work time;

the time when the employee did not actually work, but in accordance with labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations, an employment contract, he retained his place of work (position), including the time of the annual paid leave, non-working holidays, days off and other rest days provided to the employee;

time of forced absence due to illegal dismissal or suspension from work and subsequent reinstatement to the previous job;

the period of suspension from work of an employee who has not undergone a mandatory medical examination (examination) through no fault of his own;

the time of unpaid leave provided at the request of the employee, not exceeding 14 calendar days during the working year.

(paragraph introduced by Federal Law dated July 22, 2008 N 157-FZ)

(Part one as amended by Federal Law No. 90-FZ dated June 30, 2006)

Answers to common questions

Question No. 1 : The employee wrote an application for early exit from maternity leave for up to three years and from the date of exit - an application for leave that was not previously used. Can an employer issue such leave?

Answer : Parental leave can be used at the employee’s discretion (Part 2 of Article 256 of the Labor Code of the Russian Federation), that is, he can go to work and go on parental leave at any time. When returning from maternity leave, the employer, at the request of the employee, is obliged to provide another leave.

Question No. 2 : Should an employer provide a part-time employee who is on maternity leave with up to 1.5 years?

Answer : An employee does not have the right to be on two vacations at the same time and receive two amounts of vacation pay. Therefore, in order to use the main leave, you need to receive an application for leave from parental leave and an application for the main leave, and after the main leave you can again write an application for leave to care for a child up to 1.5 years. In this case, child care benefits will not be paid, but only vacation pay will be received.

If the employee himself does not want to rest

In this case, he should be forcibly sent on long rest and familiarized with the instructions and orders. Even if the employee does not want to exercise his right, this will not become a mitigating circumstance when imposing a fine. Be sure to record going to work on rest days and, if possible, stop work activity, even threatening disciplinary action. Violation of the schedule for taking time off is a disciplinary violation, since it contradicts the approved Labor Regulations and other local regulations of the enterprise.