General approach

It is advisable to complete the certificate in question in one of 2 ways:

- On company letterhead.

- Place a corner stamp of the company indicating the legal address.

Here is the most important thing that needs to be reflected in the certificate of average earnings for the employment center in 2021:

- TIN and OKVED of the employer;

- FULL NAME. a former employee who requested a certificate;

- legal name of the enterprise;

- the entire period of work of the former employee;

- the amount of calculated average earnings for the last 3 months (in numbers and in words);

- number of calendar weeks of paid work 12 months before dismissal;

- the number of working hours per day and working days per week on a full-time basis, indicating dates;

- the number of working hours per day and working days per week on a part-time basis, indicating dates;

- article of the Labor Code of the Russian Federation, on the basis of which part-time work is established;

- periods excluded from the calculation (dates and reasons for exclusion);

- the basis for issuing the certificate (indicate the employee’s personal account, pay slips, etc.);

- FULL NAME. and signatures of the head of the organization and the chief accountant;

- date of issue of the certificate;

- phone number to contact the company.

Also see “How to fill out a certificate of average earnings for the employment center.”

When needed

As a rule, citizens need a document on average earnings in the following cases:

- registration with the Employment Center;

- processing loans and other loans;

- obtaining a visa to travel abroad;

- registration of benefits and pensions;

- registration of subsidies;

- litigation.

Any employee has the right to receive this document. To do this, it is enough to contact the employer with a corresponding application. In accordance with Article 62 of the Labor Code of the Russian Federation, it is prepared and issued within three days from the date of application. When registering as unemployed, a worker will need a certificate of average earnings for the last 3 months for the employment center - this document is used to calculate the amount of unemployment benefits. This is stated in paragraph 2 of Article 3 of the Federal Law of April 19, 1991 No. 1032-1. The form of paper on average earnings suitable for this case is given in the letter of the Ministry of Labor dated January 10, 2019 No. 16-5/B-5. As in the letter of the Ministry of Labor dated August 15, 2016 No. 16-5/B-421, officials emphasize that if the document on average earnings contains all the necessary information to determine the amount of benefits, but is drawn up in any form, then it is also valid. As for the procedure for calculating the amount of benefits, it is determined by Resolution of the Ministry of Labor dated August 12, 2003 No. 62.

Sample of filling out a certificate of average earnings for the last three months

On the form of the Ministry of Labor

To begin with, we will give an example of a certificate of average earnings, the form of which was developed and recommended by the Ministry of Labor of the Russian Federation in letter dated August 15, 2021 No. 16-5/B-421. You can download it from our website using the following direct link .

EXAMPLE

Shirokova Elena Alekseevna worked at Guru LLC from October 1, 2009 to November 25, 2021. The main activity of the company is non-specialized wholesale trade. According to OKVED it has code 46.90.

Address of Guru LLC: 111456, Moscow, st. Tkatskaya, 17, building 6. Contact phone number. TIN 7719123456.

Throughout the entire period of her work at Guru LLC, Shirokova had a standard working week – an eight-hour, five-day week.

During the 12 months before the day of dismissal, Shirokova was on sick leave from 09/06/2016 to 09/14/2016 (period excluded from the calculation).

Shirokova’s average earnings over the last 3 months before leaving the company were 45,000 rubles 10 kopecks.

Based on these data, the accountant of Guru LLC needs to prepare and issue to her a completed certificate of average earnings for the employment center within 3 working days from the date of receipt of Shirokova’s application (Article 62 of the Labor Code of the Russian Federation).

Below is a sample certificate of average earnings in 2021 on the form of the Ministry of Labor.

Since the rules for filling out this certificate are not approved by law, it is not entirely clear, it is necessary to provide specific details of the employee’s personal account and payment documents on the basis of which he received earnings and the company made the corresponding calculations.

Also see “Form for a certificate of average earnings for the employment center.”

Note-calculation when calculating average earnings

“Payment in a state (municipal) institution: accounting and taxation”, 2021, N 1

At the beginning of the year, we will remind you of the document that must be filled out when calculating the average salary of an employee. This is a note-calculation on the calculation of average earnings when granting leave, dismissal and other cases. In the article we will highlight the features of filling out this document, and also tell you in which cases its execution is mandatory.

Currently, the form and procedure for filling out the calculation note are approved by Order of the Ministry of Finance of Russia dated March 30, 2015 N 52n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds , state (municipal) institutions, and Guidelines for their application" (hereinafter referred to as the Guidelines). This form has code 0504425. The Methodological Instructions approved by this Order state that primary accounting documents and accounting registers are compiled in the form of an electronic document signed with a qualified electronic signature, and (or) on paper in the absence of the possibility of their formation and storage in in the form of electronic documents and (or) in the event that federal laws or regulations adopted in accordance with them establish a requirement for the need to draw up (storage) a document exclusively on paper.

Note! To reflect analytical indicators formed in accordance with the accounting policy, the institution has the right to enter additional details and indicators into the accounting registers. However, deleting individual details from the forms of primary accounting documents and accounting registers approved by Order of the Ministry of Finance of Russia N 52n is not allowed.

On a regional form

It should be noted that your sample certificate of average earnings for an employment center can be approved at the level of a constituent entity of the Russian Federation by the body responsible for labor relations in the region.

For example, in Moscow - this is Appendix 1 to the order of the Department of Social Protection of the City of Moscow dated December 24, 2021 No. 1721. Appendix No. 1 approves the form of the Moscow certificate. You can download it from the official website using the link. Here is her form.

The following is an example of filling out a certificate of average earnings, which can be used by employers registered in Moscow if they wish. Let's take the same conditions as a basis. And we additionally point out that from February 8 to July 15, 2016, Shirokova, on the basis of Part 1 of Article 93 of the Labor Code of the Russian Federation, worked part-time.

In our opinion, the second (Moscow) sample for filling out a certificate of average earnings in 2021 is even easier to complete than the one developed by the Ministry of Labor, since it includes a smaller number of mandatory details related to calculating the average earnings of a resigned (dismissed) employee for the last 3 months.

Also see “Average earnings for 3 months: how to calculate.”

It is important to say that each regional employment center develops its own form. Therefore, before filling out the certificate, contact the territorial office of the employment service for the form. Submission of a certificate not in the form approved by the regional employment center may be the reason for refusal to assign unemployment benefits (letter of Rostrud dated November 8, 2010 No. 3281-6-2).

Read also

26.04.2017

What is a form for calculating vacation pay, how to store it and where to download it

The Resolution of the State Statistics Committee of the Russian Federation “On approval of unified forms of documentation for labor accounting...” dated 01/05/2004 No. 1 (hereinafter referred to as the Resolution) approved the note for calculating vacation pay in the T-60 form.

And although since 2013 there is no legally regulated need to fill out the T-60 form, it continues to be used: it is quite convenient and informative, since it gives a clear idea of all the nuances of calculating vacation pay. At the same time, if for some reason the unified form does not suit you, you can develop your own form.

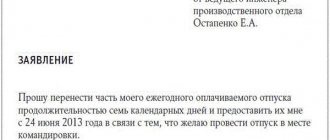

Find out how to correctly write a vacation application from the article “Application for another vacation - sample and form (2020).”

The form of the unified calculation note is presented below. Next, let's look at how it is designed.

Experts from ConsultantPlus explained how to properly process the granting of an imprint. Get trial access to the system and move on to the Typical Situation for free.

At what point should a certificate be issued?

A certificate of average earnings for determining unemployment benefits is not part of the mandatory documents that the administration must draw up at the time of termination of an employment contract with an employee.

It is drawn up when a fired or resigning person receives a request for the head of the company. According to the law, the accounting department is obliged to draw up this document within three days from the date of submission of the application for the generation of this form.

Except for the case when he asked to give it away while still an employee of the company. In this case, it is drawn up and transferred to the person being dismissed on the last day of work of this person.

Attention! An employee who quits can request it immediately at the time of dismissal or apply a little later. The employer does not have the right to refuse this request, even if a year or more has passed since the termination of the contract with this person.

For what period should information be provided (for how many months)

The Employment Law regulates that a certificate of average earnings for an employment center must be drawn up for three full months preceding the date of dismissal of the employee.

This norm distinguishes this process of determining average earnings from calculations according to the general rule. For example, if you quit on September 18, the payroll period is taken from June 1 to September 1.

From this time, the accountant must exclude the following periods:

- Vacation time, when his place of work was retained and vacation pay was paid;

- Periods of incapacity;

- Downtime that occurred through no fault of the employee;

- Time off;

- The time of child care provided to the employee additionally, for which payment was made;

- The period of a strike when the dismissed person did not take part in it, but because of it could not work;

- The time when the employee did not work with payment of wages in whole or in part.

- Periods when the employee used his time off.

Attention! In practice, it may turn out that this billing period will not contain either the employee’s salary or the days actually worked. Then, as the calculation period, you can take the full three months preceding this time.

When you need it

One of the mandatory documents that must be provided in order to register with the employment service is a certificate of average earnings to determine the unemployment benefit received from the previous employer.

IMPORTANT! The exception is citizens who get a job for the first time. They had no salary, so there is no information for this document. Their benefits will be set at the minimum level established by law. In 2021, this is 1,500 rubles (Resolution of the Government of the Russian Federation dated November 15, 2018 No. 1375 “On the amounts of the minimum and maximum amounts of unemployment benefits for 2020”).

In all other cases, it is necessary to take into account the average earnings for the last three months. Based on it, the employment center will determine the amount of monthly government assistance to a specific citizen. The completed certificate form for the employment center 2021 is designed to confirm these incomes.

How to fill out a document

It must be issued by the organization where the citizen recently worked before dismissal (see paragraph 1 of Article 34 of the Law of the Russian Federation of April 19, 1991 No. 1032-1). A certificate from the employment center must contain:

- name of the company and its details;

- duration of employment;

- time worked on a full-time and part-time basis (giving the number of days and hours), if it was established;

- average earnings: indicate both in numbers and in words to eliminate discrepancies (you can use an online calculator to calculate average earnings).

This is what a sample application to the employment center looks like, prepared for the period from June to August.

Let us remind you that the employer has the right to use the form recommended in the letter of the Ministry of Labor No. 16-5/B-421 dated August 15, 2016. It provides more detailed information: it adds the number of calendar weeks for which the applicant received a salary, and periods that were not included in the paid period (sick leave, maternity leave, forced absences, administrative leave, etc.). This is especially convenient when preparing a document for external part-time hourly workers. For example, an associate professor has a fixed-term employment contract with a university for the period from September 1 to August 31. But he may not work for the entire specified period: in the first semester he will lecture for two months for half a day, in the second - twice a week, and during the session his working time is calculated not by the hour, but by the students. As a result, it is possible that the assistant professor will not work 26 full weeks during the year and will be paid the minimum unemployment benefit.

Responsibility for failure to issue a certificate

Labor legislation does not define punishment as such if the employee was not given a certificate of average earnings for the employment center upon dismissal, or upon submission of a written request.

But since this document is mandatory, which the employer must draw up for the employee when submitting a written request, the latter can contact government agencies to protect his rights.

He has the right to file a complaint with:

- Labor Inspectorate;

- Prosecutor's Office;

- Judicial authorities.

The Code of Administrative Offenses establishes the following liability for violations of the Labor Code of mild severity that do not cause harm to health or life:

- For an official - a warning or a fine from 1 to 5 thousand rubles.

- For a legal entity - a fine of 30 to 50 thousand rubles.

A warning is a measure of punishment that is expressed in official written censure of the guilty person.

If the violation is repeated:

- For an official - a fine of 10 to 20 thousand rubles;

- For a legal entity - a fine of 50 to 70 thousand rubles.

Applying for loans, subsidies and visas

Credit institutions usually do not require a certificate of average earnings to determine the amount of unemployment benefits, but bankers need a document on the average salary for the last three to six months. Existing legislation does not establish a unified form for such a document and does not specify what information it includes. But banks require that it contain:

- name of company;

- Contact details;

- employee's length of service;

- job title;

- monthly data on wages.

A similar document is sometimes requested to apply for subsidies.

Certificate of average earnings for the last three months at the last place of work for subsidies

When applying to visa centers and foreign embassies to obtain a visa, you also need this document. It must be printed on company letterhead. Its form is not defined by law, but in practice it is recommended to indicate:

- name of the enterprise;

- Contact details;

- employee position;

- monthly salary for the last six months.

There must also be wording that during the trip abroad the employee retains his job and salary. Embassies of some countries, when considering a visa package of documents, give preference to the 2-NDFL form, since it is real evidence that the visa applicant is legally employed.