What is included in the calculation of vacation pay?

The amount of vacation pay that an employee will receive is influenced by 2 indicators:

- Special coefficient.

- The number of periods worked by the employee.

The first indicator changes annually, but it is the same for everyone and depends on the number of holidays occurring in the current year.

The second figure is individual in nature and depends on the amount of time worked by a certain employee and the average salary.

Questions from our readers

? Question from Olga: the employer does not want to take into account the regional coefficient when calculating vacation pay (I work in Novosibirsk), is he right »»»

? Question from Semyon: the employee worked for six months and went on vacation for 28 days, when he left, he immediately submitted a letter of resignation, how to withhold the overpayment from him »»»

Ask your question in the comments below and get a free answer!

Days worked in February 2019 (28 - 14) * 29.3 / 28 = 14.65 Days worked in the billing period Average daily earnings 322000 / 336.95 = 955.63 Vacation payThe article describes typical situations. To solve your problem , write to our consultant or call for free:

What is not included in the calculation of vacation pay?

It was mentioned above that the amount of vacation payments depends half on the total amount of money earned by the employee for a certain period of time.

However, for the calculations to be carried out correctly, some payments must be subtracted from the final figure (if they took place in a certain period of time), these include:

- Vacation pay amount.

- Various types of financial assistance.

- Payment of sick leave.

- Additional incentive bonuses.

Thus, the basis for calculating vacation pay is exclusively the employee’s salary.

How is the payment calculated?

After working for a full calendar year, you will need to calculate your average daily earnings in order to subsequently use this figure to determine the final amount. The result of the calculations must include the income received by the citizen over the last 12 months, divided first by the number of months in the billing period, and then by 29.4 (the average duration of one month). It is noteworthy that the latter indicator is calculated annually and is used as amendments to the Labor Code of the Russian Federation.

In practice, in most cases it turns out that the employee cannot work out the calendar year. This period usually includes sick leave, financial aid payments and bonuses. If we take all of the above amounts into the calculation of the average, they will significantly increase the final figure.

As a result, when asked whether various additional payments are included in the basic amount for calculating vacation pay, the answer is no. When deducting such amounts, the period that is taken as the main one for the calculation also decreases. To give an idea of the procedure for calculating vacation pay, we will give a practical example.

Right to annual leave

Every person, even those who are especially sensitive to their work responsibilities, needs rest, since strength needs to be restored, and personal issues also need to be resolved, all of which naturally takes time.

For these purposes and tasks, the legislator provides for annual paid leave. The key word in this phrase is “annual”, especially this time period is important for those who got a job not so long ago, as it will be when they can take a break from routine everyday life.

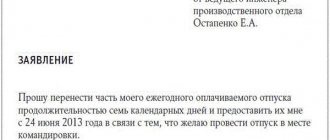

According to the current legislation in our country, the minimum period after which an employee can go on another vacation is 6 months. But what should you do if a person has not worked for a new employer for six months, and you need a vacation now?

Meanwhile, official documents also take into account this scenario, because there is a clarification that leave can be issued earlier with the agreement of the parties, that is, the employee and the employer.

Regardless of what time period has passed since the conclusion of the employment contract, if necessary, you should try to negotiate a vacation with management, but you need to take into account one important aspect: if the cherished 6 months have not yet expired, then the vacation can only be administrative, that is, unpaid.

What amounts are taken into account?

When calculating average earnings, all payments provided by the wage system must be taken into account. This is stated in paragraph 2 of Government Decree No. 922 of 2007.

When determining average earnings, the employee's monthly salary is taken into account. According to paragraphs. “a” - “c” clause 2 of the Regulations of the Government Decree of 2007 No. 922, such employee income includes:

- Salary for hours worked , according to tariffs and salaries.

- Earnings for work performed at piece rates.

- Earnings for work performed as a percentage of revenue from the sale of any product or as a commission (agency) remuneration.

- Salary received in non-monetary form.

In addition, to calculate average earnings you need to take into account:

- Allowances and additional payments to wage rates and salaries (for length of service, combination of professions, team management, etc.).

- Payments that are related to working conditions (for example, increased rates for night work, hard work, etc.).

- Bonuses and rewards , according to the remuneration system.

In this case, the source of these payments does not matter.

The calculation of average earnings has certain features if during this period the company increased official salaries or paid any bonuses to the employee.

The average employee’s earnings should increase if the organization as a whole has increased its tariffs or remuneration. To do this, the indexation coefficient is determined by determining the ratio of the salary after the last increase to the salary for each month of the billing period.

In practice, a situation may arise when an employee did not work during the entire billing period and his salary was not accrued. A typical example: a woman was initially on vacation, then on maternity leave for up to 1.5 years, and then took annual paid leave. In such a situation, vacation pay will be calculated taking into account earnings for the last 12 months during which earnings were paid. After that, vacation pay is calculated in the standard manner.

In the case where there was no earnings either in the calculation period or in the period preceding it, vacation pay is accrued on the basis of income in the month of going on vacation . If at the time of going on vacation the employee has not worked even one day, then vacation pay is calculated based on the accrued salary.

When an employee is employed on a part-time basis, vacation pay is paid to him in the standard manner, taking into account income from such activities . Only actual payments that were accrued in favor of the employee need to be taken into account. The main thing is that the employee works all the days of his part-time working week: this will be equivalent to the fact that he worked a full month.

It is worth noting that the explanatory letter of the Ministry of Finance No. 03-03-06/2/2557 indicates the employer’s right to provide in a collective agreement or local regulatory act other approaches and algorithms for calculating average earnings. But at the same time, the situation of workers should not worsen in comparison with the Labor Code.

According to the explanations, the accountant will have to count vacation pay twice: first according to the norms of the Labor Code and Regulation No. 922, and then according to the rules of the collective agreement. As a result, the employee must be paid a larger amount.

The procedure for calculating vacation pay in 2021

It was mentioned above that vacation directly depends on the special coefficient in force in the current year and on the average salary of the individually considered employee for a certain period of time. In order to consider the calculations in more detail, let’s consider them using a separate example.

In 2021, when calculating vacation pay, accountants use a new scheme adopted this year. The main reason for this innovation is a different number of holidays (weekends), of which there are much more during the twelve months under consideration.

The special coefficient that accountants use this year when calculating vacation pay is 29.3. It is this figure that is equivalent to the average days worked by workers.

The next figure that directly affects the amount of vacation pay is the average salary of an individual employee.

Thus, today, in order to calculate vacation pay, you first need to calculate the wages that were paid to the employee over the last year; in order to find out this unknown number, you need to use the following formula:

- Average salary/12/29.3;

After the required has been calculated, you need to multiply this number by the number of vacation days, as a rule, in most Russian organizations it is 28. The result of these simple arithmetic problems will be equal to the vacation pay that the employee will receive.

Let’s assume that an employee must go on vacation in August of this year, 2016. In March, from the 10th to the 17th, the employee in question was on sick leave.

The salary that the employee received during the period of time under consideration is equal to 350,000 rubles:

- OD=30-8=22

- KNM=29.3/30*22=21.48 days.

- SDZ=350000/(11*29.3+21.48)=

- TOTAL vacation pay = 28 * 1018.093 = 28.506 rubles.

Thus, the vacation pay that this employee will receive will be equal to the amount: 28,506 rubles.

Which payments are included in the calculation base and which are not?

Certain provisions of the labor code clearly indicate which days and payments are used when calculating vacation pay and which are not. In this regard, we will create a small table:

- employee salary;

- percentage of revenue;

- payment in kind;

- monetary allowances for employees of government agencies and municipalities;

- fees from media and cultural organizations;

- allowances and surcharges.

| Payments that are excluded from the base | Amounts to be taken into account |

|

Sometimes employees are paid bonuses that are permanent and secured by internal regulations. These payments are also subject to accounting when calculating vacation benefits.

This is important to know: How is maternity leave paid for a working woman?

Features of bonus calculation

As an additional incentive for employees to achieve greater success at work, employers very often use, in addition to paying monthly wages, bonuses, which can be:

- monthly;

- quarterly;

- annual;

Incentives are local in nature, that is, they are paid individually in each individual enterprise, and therefore the terms of their payments are stipulated in a separate clause in the agreement concluded between the employee and the employer.

In most cases, the criterion for paying a bonus is the achievement of certain results by the employee in his professional activities.

Monthly

If the employee fulfills the condition of working the entire pay period preceding the vacation, when calculating the amount of vacation pay, the accountant must also take into account the amount of bonuses paid.

So, if an employee received 13 monthly bonuses during the reporting period, then when determining the amount of vacation pay, the accounting employee has the right to take into account only 12 of them, since according to the current financial documents, it is allowed to take into account no more than 1 bonus per month that were paid during the billing period in question.

Quarterly

If an employee going on vacation has fully worked the pay period, then bonuses paid during this period of time should also be fully included in the calculation of vacation pay. The key point here is that the premiums must be paid within this billing period.

If bonuses were paid for the period of time in question, but their payment was made outside the billing period in question, then in this case they should not be included in the calculation of vacation pay.

Annual

When calculating the employee's vacation pay, the annual bonuses he receives are also taken into account, but only in the following cases:

- Such a measure of material incentives is provided in the organization.

- If it was assigned to the employee for his labor success.

The bonus paid once a year is taken into account when calculating vacation pay (if any), regardless of the month in which the employee goes on vacation.

That is, if an employee received an annual bonus in the past 2015, then regardless of whether the employee goes on vacation in February or August 2016, the previously received bonus must in any case be taken into account.

What indicators can affect the amount of vacation pay?

Many Russians are interested in the question of whether vacation funds paid to a citizen not for hours worked at the workplace are taken into account, and what factors in general may influence the amount of accrued vacation funds.

By law, the management of companies operating in the Russian Federation is obliged to comply with the general rules defined by the Labor Code of the Russian Federation. This document details the methodology for calculating employee earnings, as well as the algorithm for calculating vacation pay. The accountant of the enterprise must be guided by these points and provisions when calculating benefits.

Articles on the topic (click to view)

- Fine for late payment of vacation pay

- What to do with unused vacation

- What to do if your employer does not pay vacation pay

- How long after employment is vacation allowed?

- Is maternity leave taken into account when calculating pensions?

- Accounting for compensation for unused vacation

- Dismissal while on maternity leave

For calculating vacation pay, the calculation period is considered to be a calendar year; however, it is not enough to simply take the amounts paid to the citizen during this time. The following indicators will also need to be taken into account:

- citizen's work experience;

- the total number of days on sick leave for the year;

- whether the employee was on maternity leave or took rest days at his own expense;

- how much the next vacation is used;

- amount of additional payments and bonuses.

All of the above indicators must be taken into account, as they can affect the final amount. We’ll talk further about whether vacation pay paid in the previous period is included in the calculation.

To walk or not? Can an employee not go on vacation?

Going on vacation is a guaranteed human right, but not an obligation. From which it follows that, in principle, he can avoid taking long weekends. However, for the second participant in the employer’s labor relations, such a scheme is not so harmless.

Since the law establishes a fine for an employee’s failure to go on vacation for 2 years. That is why, towards the end of the year, enterprises begin internal accounting of employees who have not left their jobs for the cherished 28 days during the year.

Average earnings in case of business trips

Often employers agree to pay something like moral compensation for the inconvenience caused by the business trips themselves. In addition, the days themselves spent on such travel are considered irregular. This means that it is impossible to accurately calculate the number of hours.

There are situations when a citizen is assigned to an area for which increased coefficients are applied.

For such periods, the accountant carries out calculations using the following scheme:

- The daily earnings for a subordinate are multiplied with a bonus coefficient. It depends on the rules established specifically for a particular organization.

- If a business trip involves an increased locality coefficient, the result is multiplied by this coefficient.

- The result is multiplied with the exact number of days spent on a business trip. The indicator can be easily found out by studying the detailed report provided by the employee. Arrival and departure notes are carefully studied. Weekends and holidays that fall within this period are also subject to accounting.

- The last step involves deducting the amount of taxes levied on such payments.

Calculation of vacation pay if the company has a part-time working day

Nowadays, enterprises have a common practice of shortened working hours for many categories of workers. Instead of an 8-hour working day, a 6, 7, 4, etc. day can be established. hourly working days.

For employees who work with reduced working hours, vacation pay is calculated in the same way as for all employees.

You need to take the amount of payments for the 12 months preceding the vacation, add all allowances, bonuses and rewards, divide the total amount by 12 and divide by 29.3 rubles.

Calculation algorithm using examples

Let's look at a few more examples for different life situations.

The employee has been working for the company for several years

The employee has been working for the company for 5 years. Starting July 6, he goes on vacation for 14 calendar days. Over the previous year, I already took 14 days off once in April, was on sick leave for 5 days in February, and went on a business trip for 3 days in June. Income minus sick leave, vacation pay and travel allowances amounted to 350,000 rubles.

We will calculate vacation pay according to the scheme.

Step 1. Calculation period - from July 2021 to June 2021.

Step 2. Number of fully worked months – 9.

Step 3. Number of days in months not fully worked:

- February: 24 / 29 * 29.3 = 24.25;

- April: 16 / 30 * 29.3 = 15.63;

- June: 27 / 30 * 29.3 = 26.37.

Step 4. Number of days of work = 29.3 * 9 + 24.25 + 15.63 + 26.37 = 329.95 days.

Step 5. Average daily earnings = 350,000 / 329.95 = 1,060.77 rubles.

Step 6 . Vacation pay = 1,060.77 * 14 = 14,850.78 rubles.

Employee has been working for less than a year

The employee joined the company on October 1, 2021. In July 2021, he will go on vacation for 28 calendar days. From the moment of employment, I worked at my workplace every day. Received an income of 270,000 rubles.

Vacation payment will be made on the basis of not the previous 12 months, but only 9. The billing period is from October 2, 2021 to June 30, 2021.

- Number of fully worked months – 9.

- Number of days of work = 29.3 * 9 = 263.7 days.

- Average daily earnings = 270,000 / 263.7 = 1,023.89 rubles.

- Vacation pay = 1,023.89 * 28 = 28,668.92 rubles.

Vacation during the holidays

If official holidays fall during your vacation, then such days are not included in vacation days and are not paid.

For example, an employee goes on vacation from June 1 for 28 days. June 12 is an official holiday in the country in honor of the holiday. The employee returns to work after rest on June 30, not 29.

The same will apply to New Year's weekends, February 23, March 8, May holidays and November 4.

Vacation pay upon dismissal

Upon dismissal, an employee has the right to compensation for unused vacation. The payout calculation is similar to the previous examples. To determine the amount of compensation, the average daily earnings must be multiplied by the number of days of unused vacation.

How is study leave calculated?

Designation in the time sheet for which average earnings are calculated

The average salary is paid for the time the citizen was released from duties. The indicator must be present in the form T12 or T-13.

Special codes help to understand the situation:

- BUT – removal from work for reasons specified in the text of the current legislation. Payment has been saved.

- RP or NP. Downtime for which the employer is to blame. Or when reasons appeared beyond the control of the parties.

- OV - Additional days off if the salary was retained for them.

- D – Public, government responsibilities that led to absence from work.

- U – designation of study leaves.

- OT, OD – annual leave. Main or additional.

- PC OR PM - advanced training, which requires a break from production.

- K - for business trips.