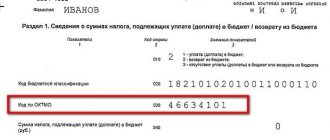

Check OKTMO - code for the classifier of municipal territories

Charges and payments must be on the same OKTMO. Accruals are what you showed in the 6-NDFL report and must pay, and payments are what you actually paid. It is important that OKTMO in the report and payments coincide.

The tax office records accruals and payments in a special card for settlements with the budget. A new OKTMO means that another card has been opened for you. If you continue to pay and report as before, one will result in an overpayment, and the other an arrears.

OKTMO can change even if you moved to the next street.

Burden of Separate Units

Domestic tax agents - legal entities can create their own third-party structures. Most of them, by law, have the legal status of separate units. Typically this is:

- branches;

- representative offices (trade, interests of the parent company, etc.);

- permanently equipped work places.

An organization has the right to choose a separate division for which it will register for tax purposes if several of its “separate divisions” are located:

- in one municipality;

- in Moscow, St. Petersburg and Sevastopol in areas reporting to different tax inspectorates.

After choosing the Federal Tax Service, you need to notify the tax authorities about this (clause 4 of Article 83 of the Tax Code of the Russian Federation).

Thus, companies with an extensive network are required by law to deduct calculated and withheld income tax (Clause 7, Article 226 of the Tax Code of the Russian Federation):

- and according to its location;

- and there, each separate division is present.

In turn, this obliges the corresponding calculation to be submitted in Form 6-NDFL to the tax office where the separate subdivision is located and registered there for tax purposes.

Moreover, in this calculation, the “isolation” should include not only the personnel under the employment contract, but performers, contractors, etc., to whom it pays fees. Of course, provided that civil agreements with these persons are signed on behalf of a separate unit.

Also see “How to open a separate division of an LLC: instructions.”

Read also

01.12.2016

After changes to the Unified State Register of Legal Entities / Unified State Register of Individual Entrepreneurs, report to the new tax office

Ideally, it should be like this: you write an application to change your legal address, you are deregistered with the old tax office and the card for settlements with the budget is transferred to the new inspectorate. From now on, you pay and report there only.

The procedure for filling out 6-NDFL states that organizations indicate the OKTMO code of the municipality where the organization or its separate division is located. Formally, the presence of separation is the only reason when you need to submit reports with different OKTMOs for one period.

But in practice it happens differently. Sometimes, due to a move, tax officials are asked to submit two sets of reports.

☎️ Call the new tax office and ask how to submit 6-NDFL and 2-NDFL for the period of moving.

If they say “submit one report with the new OKTMO”, change the details in Elba and send the reports to the new tax office. Correct payments and reports will be generated automatically. You don't need to do anything else.

⚠️If during the moving period you are asked to submit two reports with different OKTMOs, follow the instructions below.

Explanations from the Federal Tax Service

The Russian Tax Service issued a letter dated February 14, 2021 No. GD-4-11/2828, in which it explained which OKTMO to indicate in 6-NDFL if personnel migrate to separate divisions of their employer. Below in the table we have collected comments from officials about filling out the 6-NDFL when transferring an employee to another separate unit.

| № | Situation | Questions | Position of the Federal Tax Service |

| 1 | Until January 15, the employee works in a division of a company that is registered in the territory belonging to OKTMO-1; from January 16, he works in the territory of OKTMO-2. Salaries are calculated at the end of the month for the month. | Should each separate division (hereinafter - OP) separately pay personal income tax and submit reports? | Since the employee performs labor duties in the OP with OKTMO-1 until 15.01, and from 16.01 in OKTMO-2, the tax is transferred to the appropriate budgets at both locations of the OP - OKTMO-1 and OKTMO-2, taking into account the actual income received from the corresponding OP. Accordingly, the tax agent submits two 6-NDFL calculations: at the location of the OP with OKTMO-1 and OKTMO-2. |

| 2 | In January, the employee works in an OP registered on the territory of OKTMO-1. In January, he submits an application for leave from 02/01/2018 to 02/15/2018. Payment (transfer of money to a bank or issuance through a cash desk on the territory of OKTMO-1) occurs on January 31, 2018. Then, from 02/01/2018, the employee is transferred to the OP from OKTMO-2. | When filling out 6-NDFL, which OKTMO should vacation pay and tax be attributed to? | Since payment for vacation is made by the OP with OKTMO-1, this operation is reflected in the calculation submitted by the OP with OKTMO-1 |

| 3 | In January, an employee works in an OP with OKTMO-1. In January, he submits an application for leave from 02/01/2018 to 02/15/2018. Payment (transfer of money to a bank or issuance through a cash desk on the territory of OKTMO-1) occurs on 02/05/2018. But from 02/01/2018 he is transferred to the OP from OKTMO-2. | ||

| 4 | In January, an employee works in an OP with OKTMO-1. In January, he submits an application for leave from 01/25/2018 to 02/15/2018. Payment (transfer of money to the bank or issuance through the OKTMO-1 cash desk) occurs on January 31, 2018. Then, from 02/01/2018, he is transferred to the OP with OKTMO-2. | ||

| 5 | In January, an employee works in an OP with OKTMO-1. Then, from 02/01/2018, he is transferred to the OP with OKTMO-2. In February, he receives an additional salary for his work in the OP with OKTMO-1. The additional payment is made by the department with OKTMO-1. | When filling out 6-NDFL, to which OKTMO and to which month should the additional payment and the corresponding personal income tax amount be attributed? How to fill out 6-NDFL if you change the conditions of the example so that the specified additional payment is made by the OP with OKTMO-2? | If wages (or temporary disability benefits, vacation pay) accrued during work in an EP with OKTMO-1 are made by the same OP, then this operation is reflected in the calculation of 6-NDFL for the delivery of EP with OKTMO-1. If the payment of the indicated income is made by an OP with OKTMO-2, this operation is reflected in the calculation when handing over the OP with OKTMO-2. Additional accrued wages are reflected in the month for which these amounts are accrued. And sick leave benefits and vacation pay are in the month in which they are directly paid (Article 223 of the Tax Code of the Russian Federation). |

| 6 | In January, an employee works in an OP with OKTMO-1. Then, from 02/01/2018, he is transferred to the OP with OKTMO-2. In February, additional accrual is made not on salary (for example, vacation pay or sick leave payments) for the period of work of the OP with OKTMO-1 (and the vacation/sick leave was initially paid in January in the OP with OKTMO-1). The additional payment is made by the department with OKTMO-1. | When filling out form 6-NDFL, to which OKTMO and to which month should the amount of such additional payment for vacation (sick leave) and the amount of personal income tax be attributed? How to fill out form 6-NDFL if you change the conditions of the example so that the specified additional payment is made by a department with OKTMO2? | |

| 7 | In January, an employee works in an OP with OKTMO-1. Then, from 02/01/2018, he is transferred to the OP with OKTMO-2. In February, he is given an additional salary for work on the territory of OKTMO-1 and/or for any other type of income. The additional payment is made by the department with OKTMO-1. | When filling out 6-NDFL, is it necessary to divide the amount of tax on additional salary and (or) any other type of income between departments with OKTMO-1 and OKTMO-2? | |

| 8 | In January, the employee works in an OP with OKTMO-1, and from 02/01/2018 - in an OP with OKTMO-2. He was granted leave in January. Based on the order, the company carried out a serious salary indexation in February from 01/01/2018. Payment occurs during the period of work in the territory with OKTMO-2 through the cash desk in the territory with OKTMO-2. | How to reflect the indexation for the period of work in the territories with OKTMO-1 and OKTMO-2? | Since the payment of income in the form of salary indexation is made by the OP with OKTMO-2, this operation is reflected in 6-NDFL, which is submitted by the OP with OKTMO-2. |

| 9 | In January, the employee works in the OP with OKTMO-1, and from 02/01/2018 - in the OP OKTMO-2. He was granted leave in January. Based on the order, the company carried out individual salary indexation in February from 01/01/2018. Payment occurs during the period of work in the territory with OKTMO-2 through the cash desk in the territory with OKTMO-2. |

In practice, an accountant often faces a dilemma about how to pass 6-NDFL with different OKTMO. Especially if, within the framework of one 6-personal income tax calculation, there are different OKTMOs in the same tax office.

Also see “December salary paid in January 2021: how to reflect it in 6-NDFL.”

You can also clarify the question of which OKTMO 6-NDFL would be more correct to fill out, can be discussed on our forum. Here is the exact link:

Read also

19.05.2018

How to pay personal income tax correctly

Let’s assume that an entry about changes in the Unified State Register of Legal Entities was made on May 20. From this date, transfer personal income tax and submit reports to the new tax office. The chronology will be like this:

| April 10th | Salaries for March were issued |

| 11 April | Paid personal income tax on March salary using old details |

| May 10 | Paid salaries for April |

| may 13 | Paid personal income tax on April wages using old details |

| May 20 | An entry has appeared in the Unified State Register of Legal Entities: new OKTMO, checkpoint and inspection code |

| June 10th | Salaries for May were issued |

| June 11 | We paid personal income tax on May salaries using new details |

To ensure that correct payments are generated in Elba, change the details to the current ones.

How to create two sets of 6-NDFL

In the instructions we rely on the explanations from the letter of the Federal Tax Service No. BS-4-11 / [email protected] :

The 6-NDFL report is submitted quarterly. The move took place in May, so for the six months it is necessary to generate two sets of reports: both for the new tax office, with a new checkpoint. The first report will contain accruals before the move and the old OKTMO, the second will contain accruals after the move and the new OKTMO.

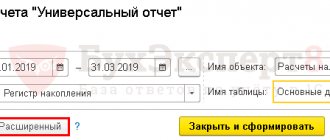

- In Elba, find the task “Submit the 6-NDFL report for the first half of the year”, in the last step click “Save file for the Federal Tax Service” - the report file will be downloaded in xml format.

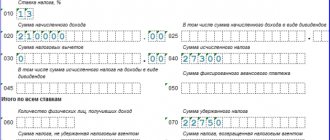

Section 2 contains three personal income tax charges: from wages for March, April and May. If you submit the report in this form, then all of them will be submitted to the new OKTMO. This will lead to arrears and overpayments.

- Copy the report. A copy will be needed later to make a report with the new OKTMO.

- Download Taxpayer Legal Entity, run the program. Add your organization details in the “Taxpayer” section.

- Go to the section Service → Reception of documents from files.

- Open the file you downloaded from Elba. Indicate the old OKTMO on the title page.

Go to Section 2 and delete the June payment: right-click → delete line.

Save the file on your computer in xml format (not Excel). This will be the first set of reports with the old OKTMO.

- Use Taxpayer to open a copy of the report downloaded from Elbe. Remove the first two accruals - only the June payment will remain. Check that the new OKTMO is indicated on the title page. This is the second set of half-year reports.

- After correction, send the reports to us, we will upload them to your account for sending to the tax office. In the subject of the letter, write: “Uploading 6-NDFL reports due to a change of legal address.”

Generate reports for 9 months and a year in Elba as usual; you do not need to edit them.

How to switch to a new order

Here, too, everything is ambiguous. All tax authorities with which the organization is registered at the location of its separate divisions must be notified of the transition to centralized reporting and personal income tax payment (clause 2 of Article 230 of the Tax Code of the Russian Federation). However, it is not stipulated that inspections need to be notified only in the territory where the new procedure will be applied.

In other words, strictly according to the letter of the Tax Code of the Russian Federation, if an organization, for example, has two divisions in Irkutsk and one in Khabarovsk, then when switching to the “one window” principle, it must send notifications to three Federal Tax Service Inspectors at once (to Irkutsk at the location of each divisions and in Khabarovsk). Considering that the tax authorities are a unified and centralized system (clause 1 of Article 30 of the Tax Code of the Russian Federation), such a notification procedure is clearly redundant. This was confirmed by the Federal Tax Service of Russia, which indicated that it is necessary to submit a notification about the transition to centralized payment of personal income tax only once - to the “responsible” division (parent organization). The Federal Tax Service will send out all further notices itself (letters from the Federal Tax Service of Russia dated December 27, 2019 No. BS-4-11 / [email protected] and dated December 16, 2019 No. BS-4-11 / [email protected] ).

As for the deadline for submitting a notification about the transition to centralized payment of personal income tax, the Tax Code requires this to be done before January 1 of the next year (clause 2 of Article 230 of the Tax Code of the Russian Federation). But since January 1 is always a day off, the deadline is moved to the first working day of the year (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). And for 2021, this could have been done right up to the end of January (letter of the Federal Tax Service of Russia dated December 25, 2019 No. BS-4-11/26740). The notification form was approved by Order of the Federal Tax Service of Russia dated December 6, 2019 No. ММВ-7-11/ [email protected]

Source: kontur.ru

How to create two sets of 2-NDFL

2-NDFL certificates are submitted at the end of the year. The first set should contain income before the change of address and the old OKTMO, the second set should contain the amounts after the change of address and the new OKTMO. The principle is the same as with 6-NDFL.

- Generate 2-NDFL in Elba, save the file for the Federal Tax Service. Keep in mind: the challenge opens in January.

- Open certificates in the Taxpayer, edit accruals by month, check OKTMO. Save the files in xml format.

- Send both files to technical support at

Checkpoint "isolations"

According to the approved rules, when a company with separate divisions enters data into the calculation using the line “KPP” (reason code), it provides the code at the location of its such division. It is indicated immediately after the field with the TIN. This is required by clause 2.2 of the second section of the Procedure for filling out and submitting the 6-NDFL calculation (approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/450).

For more information about this, see “Checkpoint of a separate unit: how to find out and receive.”