Calculation according to Form 6-NDFL is one of the reports relating to personal income tax, which is submitted by employers to inform the taxman about the taxation of employee income. The report is quarterly, which means you have to fill it out regularly.

The calculation is not large, it includes two small sections, but there are quite a lot of difficulties in filling them out. One of the questions that employers are regularly asked when preparing Form 6-NDFL is what amounts of income should be included in line 020 of Section 1, and what is not included there.

Grounds for submitting 6-NDFL

From 01/01/2016, 6-NDFL is submitted quarterly to the Federal Tax Service by all organizations and individual entrepreneurs that are tax agents. The calculation reflects information on income received and personal income tax paid to employees of the entire organization.

The calculation consists of the following parts:

- title page

- section 1, reflecting general information on the organization or individual entrepreneur

- section 2, reflecting information on: dates, types and amounts of income and calculated taxes

The information base for 6-NDFL is the data contained in the tax registers for all employees, which must be maintained by all organizations and individual entrepreneurs. The organization develops registers independently and approves them in its accounting policies. During the work, the register reflects data that represents the basis for 6-NDFL (dates of accrual, transfer and withholding).

If the employer did not make any payments to employees, then the zero calculation does not need to be submitted on the basis that the calculation is submitted by tax agents who made payments of taxable income to the taxpayer. But at the same time, you need to provide information to the Federal Tax Service in writing that there were no payments or submit a zero calculation, which the Federal Tax Service does not have the right not to accept.

Composition of line 020 of the 6-NDFL calculation

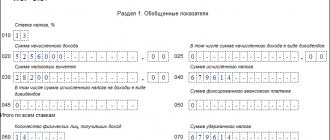

Data on page 020 “Amount of accrued income” is reflected in section 1 6-NDFL, which is filled out separately at personal income tax rates and reflects the income of all persons who received income subject to personal income tax for the reporting period.

Line 020 is filled with a cumulative total , i.e. in each subsequent calculation, the amount on line 020 will include the data on line 020 from the previous report and taxable income for the next 3 months. Income can either increase or remain unchanged if no payments were made to the organization during the reporting quarter.

Income is shown by the date of accrual and receipt by employees. That is, when paying wages in January for December according to line 020 of the calculation, it will be reflected in the annual report, because it was accrued in December and should not be reflected in the 2021 reporting on line 020.

How do changes in the Tax Code of the Russian Federation for 2016-2020 affect the algorithm for generating section 1 of the 6-NDFL report?

The Tax Code of the Russian Federation has also found room for significant changes in the procedure for calculating the tax specified in Art. 226 Tax Code of the Russian Federation.

Thus, the previous version of Art. 226 of the Tax Code of the Russian Federation directly required that personal income tax be calculated by tax agents based on the results of each past month (clause 3 of Article 226 in previous editions of the Tax Code of the Russian Federation). Thus, information in the personal income tax registers had to be entered monthly, and there was a separate concept of “calculated tax,” i.e., personal income tax calculated from the amounts accrued according to accounting for individuals, but not necessarily already withheld and transferred to the budget.

In the new edition of Art. 226 of the Tax Code of the Russian Federation, the moment of tax calculation is clearly tied to the moment of receipt of income. In turn, this moment is the day when an individual receives money (or valuables in kind) in his hands in all cases, except those specifically mentioned in paragraphs. 2–5 tbsp. 223 Tax Code of the Russian Federation.

Thus, in the version of the Tax Code of the Russian Federation, effective in 2016–2020, the concepts of “tax calculated” and “tax withheld” have practically merged. From here there are immediately 2 important consequences that help to reason correctly when generating lines 020 and 040 of the 6-NDFL report in complex cases (for example, with carryover income accrued in accounting in one quarter (year) and paid in another):

- In accordance with the edited requirements of Art. 226 of the Tax Code of the Russian Federation to the calculation of personal income tax, the fact of the end of the month (or other reporting/contractual period) in itself is not a basis for calculating personal income tax for this month (period). The starting point for the calculation, deduction and transfer of personal income tax is the actual payment of income to an individual. The only exceptions are the calculations listed in paragraphs. 2–5 tbsp. 223 of the Tax Code of the Russian Federation (primarily wages).

- Amounts of income of an individual (except for exceptions under Article 223 of the Tax Code of the Russian Federation), reflected in tax registers according to the norms of Art. 226 of the Tax Code of the Russian Federation, now fall into these registers strictly on the date of actual receipt of income by an individual. And since the data for inclusion in the 6-NDFL report must be taken from the personal income tax registers (clause 1 of Article 230 of the Tax Code of the Russian Federation), then line 020 for the period will only include that income that is reflected in the tax registers, namely: calculated on the date the individual actually received income.

If you doubt whether you filled out the report correctly, look at the ready-made sample 6-NDFL, which was prepared by ConsultantPlus experts. Trial access to the system can be obtained for free.

Income included in line 020

The following income is included, taxed at different personal income tax rates:

- in the form of wages

- in the form of remuneration upon termination of the employment relationship before the end of the calendar month

- in cash:

- vacation pay

- temporary disability benefit

- payment under GPC agreements

- financial assistance (over RUB 4,000)

- dividends

- in kind

- received by offsetting counterclaims of the same type

- from writing off bad debt

- arising in connection with reimbursement of travel expenses to an employee

- in the form of material benefits from savings on interest when receiving borrowed (credit) funds (35% for tax residents and 30% for tax non-residents)

Important! Line 020 reflects all employee remunerations on an accrual basis, and line 025 should highlight dividends received.

An example of reflecting on page 020 the material benefit of an employee

Abdullin A.V. (resident of the Russian Federation) 08/01/2021 issued an interest-free loan in the amount of 100,000 rubles. The marginal rate in this period was:

2/3 * 7,25% = 4,83%

Material benefits in August amounted to:

2/3 * 7.25% * 100000 * 31 / 365 = 410.50 rub.

Amount 410.50 rub. should be reflected on page 020

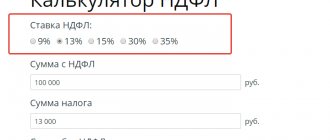

Personal income tax on material payments will be:

RUB 410.50 * 35% = 144 rub.

Reflection on line 020 of partially taxable income

Line 020 does not reflect income on which personal income tax is not charged. There are 2 types of income not subject to personal income tax:

- completely tax-free

- partially tax-free

Income that is completely exempt from personal income tax is not reflected on line 020 of the 6-personal income tax report, for example: maternity benefits are not completely included in line 020.

Partially taxable income is indicated on line 020 in full and at the same time on line 030 the non-taxable amount is shown, for example: financial assistance, gifts, etc.

Filling line 030 - example

Let’s say an organization employs 8 workers. Total income for 9 months. 2021 is 2,160,000 rubles. During this period, the staff were provided with the following deductions:

- Standard for children - three employees use deductions in the amount of 1,400 rubles.

- Property - according to the notification of the Federal Tax Service, one employee applies a deduction for the purchase of housing. Amount from January 2021 = 38,000 rubles.

In addition, due to a difficult life situation, the employer provided one employee with financial assistance in the amount of 12,000 rubles. Let's look at how to fill out lines 020, 030, 040 in 6-NDFL:

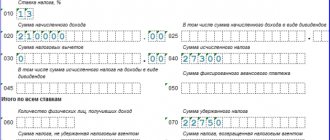

- Page 020 = 2160000 + 12000 = 2172000 – reflects the total amount of income.

- Page 030 = 3 x 1400 x 9 + 4000 = 41800 – the total amount of deductions provided is calculated.

- Page 040 = (2172000 – 41800) x 13% = 276926 – tax calculated for 9 months. 2021

Taking into account all benefits, the employer for 9 months. 2021 will accrue personal income tax in the amount of 276,926 rubles. Deductions are provided for the children of employees, as well as for the amount of financial assistance issued in the amount of 4,000 rubles.

Example for reflecting on page 020 travel expenses

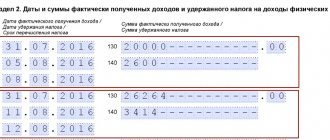

On 08/08/2021, funds were issued for travel expenses (within the Russian Federation, the duration of the business trip is from August 13 to 18) in the form of daily allowance in the amount of 5,000 rubles. financial assistance for vacation in the amount of 5,000 rubles was paid. These daily allowances must be reflected on page 020 because they are higher than the standards (over 700 rubles in the Russian Federation). The calculation will reflect:

p.020 – 5000 rub.

page 030 – 3500 rub. (700 RUR * 5 days)

page 040 – 195 rub. ((5000 rub. – 3500 rub.) * 13%)

On line 020, reflect all employee income on an accrual basis from the beginning of the year. Focus not on accruals in accounting, but on the date of receipt of income for personal income tax purposes.

Acting State Advisor of the Russian Federation, 3rd class, Ph.D. A. Kizimov

Control ratios regarding page 020 calculation

To submit correct reports for 6-NDFL, control ratios have been developed that must be observed when checking the Federal Tax Service . So, before submitting the calculation, you can check it using these relationships. In relation to page 020, the following ratios are distinguished:

| Ratio | What does non-compliance mean? |

| line 020 =, > line 030 | line 020 < line 030 – the amount of deductions is overstated |

| line 020 – line 030) / 100 * line 010 = line 040 | If the resulting value is not equal to line 040, then the personal income tax amount is overestimated or underestimated, but an error is allowed: line 060 * 1 rub. * number of lines 100 |

| line 020 at a certain rate from line 010 = the sum of lines “Total amount of income” at the same tax rate of 2 personal income tax certificates with attribute 1, for taxpayers by this tax agent, and lines 020 at this tax rate from line 010 (in relation to the annual calculation ) | if the ratio is not observed, then the amount of accrued income is underestimated or overestimated |

Error when calculating personal income tax from a non-resident

The company paid an individual, not a resident of the Russian Federation, 50,000 rubles. for the provision of services in the Republic of Kazakhstan. RUB 15,000 was mistakenly withheld. Personal income tax at a rate of 30% and transferred to the budget. The calculation of 6-NDFL reflected:

| Page 010 | 30 |

| Page 020 | 50000 |

| Page 040 | 15000 |

| Page 070 | 15000 |

Services provided outside the Russian Federation relate to income from sources outside the Russian Federation and are not taxable income. If an error is detected, the withheld funds are returned to the individual. An updated calculation must be submitted.

6-NDFL must be filled out as follows:

- The correction number is indicated on the title page

- section 1 at a rate of 30% is not filled in as part of the updated calculation

- in the “Total for all bets” part, the amount of 50,000 is excluded

- Line 070, calculated on an accrual basis, is reduced by 15,000 rubles.

In this case, the organization can issue a refund upon a written application from an individual and contact the Federal Tax Service with the organization’s application for the return of the excessively withheld amount of personal income tax to the organization’s current account.

The role of deductions in calculating personal income tax and their types

The procedure for calculating personal income tax provides for the possibility of applying deductions in relation to income subject to taxation, which leads to a decrease in the size of the tax base (clause 3 of Article 210 of the Tax Code of the Russian Federation).

There are several types of deductions:

- standard (Article 218 of the Tax Code of the Russian Federation), among which are those due to persons with special merits to the state and provided for children;

- social (Article 219 of the Tax Code of the Russian Federation), associated with a person’s material contribution to the activities of socially oriented non-profit legal entities, as well as expenses for treatment, training, payment of pension contributions and voluntary life insurance;

- investment (Article 219.1 of the Tax Code of the Russian Federation), relating to monetary investments in financial transactions that generate profit;

- property (Article 220 of the Tax Code of the Russian Federation), applied both to expenses for the purchase (creation) of capital property and to income from its sale;

- professional (Article 221 of the Tax Code of the Russian Federation), available to individual and private practitioners.

Some of them are set in fixed amounts, others depend on the size of the amounts recorded in the supporting documents.

Answers to common questions

Question No. 1 : The bonus based on the results of work for the 2nd quarter of 2021 was accrued and paid in August 2021. In the initial calculation of 6-NDFL, submitted to the Federal Tax Service before July 31, 2021, the bonus amounts on line 020 are not indicated. Do they need to be submitted to the Federal Tax Service? corrective 6-NDFL?

Answer : The organization submitted 6-NDFL for the first half of 2021 to the Federal Tax Service on time on 07/31/2021 and reflected data on the results of accruals as of 06/30/2021, which is not unreliable and does not require the submission of an adjustment. This premium will be reflected in 6-NDFL for 9 months and for the year 2021.

Question No. 2 : For what periods should clarifications be provided if the organization discovered errors reflected in the calculation for the first quarter, which led to an understatement of tax amounts, and calculations for the 1st quarter and half of the year have already been submitted?

Answer : Section 1 must be completed with a cumulative total. If you find erroneous information in an already submitted calculation, you need to make changes and submit an updated calculation to the Federal Tax Service. On the title page you need to indicate the correction number (“001”, “002” and so on). Thus, if an error is detected in understating the amount of personal income tax in the calculation for the first quarter, it is necessary to submit updated calculations for the 1st quarter and half of the year, because Section 1 is filled in with a cumulative total.

Results

The algorithm for generating line 020 in 6-NDFL is determined by Order No. ММВ-7-11/ [email protected] and the requirements of the Tax Code of the Russian Federation. All other explanations by authorized persons and bodies must comply with the principles established by these regulations.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.