Deadlines and procedure for submitting calculations

The calculations are submitted by tax agents (clause 2 of Article 230 of the Tax Code of the Russian Federation).

A zero calculation is not submitted if income subject to personal income tax was not accrued or paid (letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11/ [email protected] ).

If a “null” is nevertheless submitted, then the Federal Tax Service will accept it (letter of the Federal Tax Service of the Russian Federation dated May 4, 2016 No. BS-4-11 / [email protected] ).

Calculations for the first quarter, half a year and 9 months are submitted no later than the last day of the month following the specified period. Therefore, quarterly calculations in 2021 are submitted within the following terms (clause 7, article 6.1, clause 2, article 230 of the Tax Code of the Russian Federation):

- for the first quarter - no later than April 30;

- for half a year - no later than July 31;

- for 9 months - no later than October 31.

The annual calculation is submitted in the same way as 2-NDFL certificates for 2021 - no later than 04/01/2019.

Calculation of 6-NDFL is submitted only in electronic form according to the TKS, if in the tax (reporting) period income was paid to 25 or more individuals, if 24 or less, then employers themselves decide how to submit the form: virtually or on paper (clause 2 of Art. 230 of the Tax Code of the Russian Federation).

As a general rule, the calculation must be submitted to the Federal Tax Service at the place of registration of the organization (registration of individual entrepreneurs at the place of residence).

If there are separate subdivisions (SP), the calculation in form 6-NDFL is submitted by the organization in relation to the employees of these subdivisions to the Federal Tax Service Inspectorate at the place of registration of such subdivisions, as well as in relation to individuals who received income under civil contracts to the Federal Tax Service Inspectorate at the place of registration of the subdivisions that entered into such contracts (clause 2 of article 230 of the Tax Code of the Russian Federation).

The calculation is filled out separately for each OP, regardless of the fact that they are registered with the same inspection, but in the territories of different municipalities and they have different OKTMO (letter of the Federal Tax Service of the Russian Federation dated December 28, 2015 No. BS-4-11 / [email protected] ) .

If the OPs are located in the same municipality, but in territories under the jurisdiction of different Federal Tax Service Inspectors, the organization has the right to register with one inspectorate and submit calculations there (clause 4 of Article 83 of the Tax Code of the Russian Federation).

The employee worked in different branches . If during the tax period an employee worked in different branches of the organization and his workplace was located at different OKTMO, the tax agent must submit several 2-NDFL certificates for such an employee (according to the number of combinations of TIN - KPP - OKTMO code).

Regarding the certificate, the tax agent has the right to submit multiple files: up to 3 thousand certificates in one file.

Separate calculations are also submitted in form 6-NDFL, differing in at least one of the details (TIN, KPP, OKTMO code).

Regarding the registration of 6-NDFL and 2-NDFL: in the title part, the TIN of the parent organization, the checkpoint of the branch, OKTMO at the location of the individual’s workplace is affixed. The same OKTMO is indicated in the payment slips (letter of the Federal Tax Service of the Russian Federation dated July 7, 2017 No. BS-4-11/ [email protected] ).

If the company has changed its address , then after registering with the Federal Tax Service at the new location, the company must submit to the new inspection 2-NDFL and 6-NDFL:

- for the period of registration with the Federal Tax Service at the previous location, indicating the old OKTMO;

- for the period after registration with the Federal Tax Service at the new location, indicating the new OKTMO.

At the same time, in the 2-NDFL certificates and in the 6-NDFL calculation, the checkpoint of the organization (separate division) assigned by the tax authority at the new location is indicated (letter of the Federal Tax Service of the Russian Federation dated December 27, 2016 No. BS-4-11 / [email protected] ).

Deadlines for submitting 6-NDFL in 2021

The period for which 6-NDFL is submitted is a quarter, six months, 9 months and a year. The calculation is due before the last day of the month following the reporting period. The most exciting question for accountants is: by what date should the declaration be submitted?

The declaration must be completed and submitted within the following deadlines:

- for the quarter until April 30;

- 6 months before July 31;

- 9 months before October 31st.

That is, the deadline for filing the 6-NDFL declaration is the last day of the month following the reporting month.

The deadlines for submitting the annual 6-personal income tax for the calendar year are being shifted. The declaration must be submitted before the last day of the month following the reporting period, i.e. before March 31 (for 2021 in 2019).

When do you need to submit zero 6-NDFL? The deadline for submitting the “zero” is the same as for the completed declaration:

- April 30;

- July 31;

- October 31;

- March 31.

Calculation form 6-NDFL

Form 6-NDFL is submitted as amended by Order of the Federal Tax Service of the Russian Federation dated January 17, 2018 No. ММВ-7-11/ [email protected]

It must show all the income of individuals from whom personal income tax is calculated. Form 6-NDFL will not include income on which the tax agent does not pay tax (for example, child benefits, payment amounts under a property purchase and sale agreement concluded with an individual).

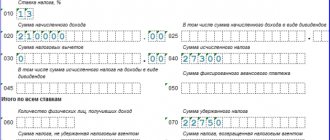

Section 1 of the calculation is filled out with a cumulative total, it reflects:

- on page 010 – the applied personal income tax rate;

- on page 020 – income of individuals since the beginning of the year;

- on page 030 - deductions for income shown in the previous line;

- on page 040 - calculated from personal income tax;

- on pages 025 and 045 – income in the form of dividends paid and the tax calculated on them (respectively);

- on page 050 - the amount of the advance payment paid by the migrant with a patent;

- on page 060 - the number of those people whose income was included in the calculation;

- on page 070 - the amount of tax withheld from the beginning of the year;

- on page 080 - personal income tax, which the tax agent cannot withhold;

- on page 090 – the amount of tax returned to the individual.

When using different personal income tax rates, you will have to fill out several blocks of lines 010–050 (a separate block for each rate). Lines 060–090 show the summed figures for all bets.

Section 2 includes data on those transactions that were carried out over the last 3 months of the reporting period. Thus, section 2 of the calculation for 2021 will include payments for the fourth quarter.

For each payment, the date of receipt of income is determined - on page 100, the date of tax withholding - on page 110, the deadline for paying personal income tax - on page 120.

Article 223 of the Tax Code of the Russian Federation determines the dates of occurrence of various types of income, and Art. 226–226.1 of the Tax Code of the Russian Federation indicate the timing of tax transfer to the budget. We present them in the table:

| Main types of income | Date of receipt of income | Deadline for transferring personal income tax |

| Salary (advance), bonuses | The last day of the month for which the salary or bonus for the month was calculated, included in the remuneration system (clause 2 of Article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service dated 08/09/2016 No. GD-4-11/14507, dated 08/01/2016 No. BS- 4-11/[email protected], letter from the Ministry of Finance dated 04/04/2017 No. 03-04-07/19708). If an annual, quarterly or one-time premium is paid, the date of receipt of income will be the day the premium is paid (letter of the Ministry of Finance of the Russian Federation No. dated September 29, 2017 No. 03-04-07/63400) | No later than the day following the day of payment of the bonus or salary upon final payment. If the advance is paid on the last day of the month, then in essence it is payment for the month and when it is paid, personal income tax must be calculated and withheld (clause 2 of Article 223 of the Tax Code of the Russian Federation). In this case, the advance amount in the calculation is shown as an independent payment according to the same rules as salary |

| Vacation pay, sick pay | Payment day (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of the Russian Federation dated January 25, 2017 No. BS-4-11/ [email protected] , dated August 1, 2016 No. BS-4-11/ [email protected] ) . | No later than the last day of the month in which vacation pay or temporary disability benefits were paid |

| Payments upon dismissal (salary, compensation for unused vacation) | Last day of work (clause 1, clause 1, clause 2, article 223 of the Tax Code of the Russian Federation, article 140 of the Labor Code of the Russian Federation) | No later than the day following the day of payment |

| Help | Payment day (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of the Russian Federation dated May 16, 2016 No. BS-4-11/ [email protected] , dated August 9, 2016 No. GD-4-11/14507) | |

| Dividends | No later than the day following the day of payment (if the payment is made by LLC). No later than one month from the earliest of the following dates: the end of the relevant tax period, the date of payment of funds, the date of expiration of the agreement (if it is a JSC) | |

| Gifts in kind | Day of payment (transfer) of the gift (clauses 1, 2, clause 1 of Article 223 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of the Russian Federation dated November 16, 2016 No. BS-4-11/ [ email protected] , dated March 28, 2016 No. BS-4-11 / [email protected] ) | No later than the day following the day the gift was issued |

The date of tax withholding almost always coincides with the date of payment of income (clause 4 of Article 226 of the Tax Code of the Russian Federation), but there are exceptions. So, the date of personal income tax withholding:

- from the advance payment (salary for the first half of the month) there will be a payday for the second half (letter of the Federal Tax Service of the Russian Federation dated 04/29/2016 No. BS-4-11/7893, Ministry of Finance of the Russian Federation dated 02/01/2017 No. 03-04-06/5209);

- for excess daily allowances - the nearest salary payment day for the month in which the advance report was approved (letter of the Ministry of Finance of the Russian Federation dated 06/05/2017 No. 03-04-06/35510);

- for material benefits, gifts worth more than 4 thousand rubles (other income in kind) - the nearest salary payment day (clause 4 of article 226 of the Tax Code of the Russian Federation).

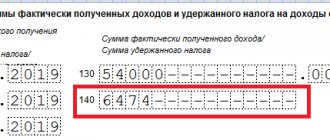

Income in line 130 of the calculation is indicated in full, without reduction for personal income tax and deductions.

Income for which all three dates on lines 100–120 coincide are reflected in one block of lines 100–140. For example, together with the salary, you can show the bonus paid for the month; vacation and sick pay are always shown separately from the salary.

If the tax payment deadline occurs in the first quarter of the next year (for example, the December salary was paid in January), there is no need to show income in section 2 of the calculation for the year, even if it is reflected in section 1. Such income will be reflected in section 2 of the calculation for the first quarter of 2021 year (letter of the Federal Tax Service of the Russian Federation dated July 21, 2017 No. BS-4-11 / [email protected] ).

Section 1. General indicators

Section 1 indicates the total amounts of accrued income, calculated and withheld tax.

Attention! If the tax agent paid income to individuals taxed at different tax rates, then lines 010 – 050

are filled out separately for each bet.

In this case, lines 060 – 090

are final for all bets.

On line 010

the appropriate tax rate is indicated.

By line 020

reflects the total amount of income accrued to individuals on an accrual basis from the beginning of the tax period.

If the tax agent accrued income to individuals in the form of dividends, then they are indicated in line 025

.

By line 030

the total amount of tax deductions that reduce the taxable income indicated in

line 020

.

By line 040

The amount of calculated tax is reflected on an accrual basis from the beginning of the year, which is defined as the total amount of personal income tax accrued from the income of all employees.

By line 045

The amount of calculated tax on dividends is reflected.

Attention! Tax on dividends is calculated for the taxpayer separately for each payment of income, and not on an accrual basis.

On line 050

indicates the amount of fixed advance payments that the foreigner paid when obtaining a patent. By this amount, the tax agent can reduce the amount of calculated tax if the appropriate documents are available (application from an employee, notification from the Federal Tax Service, receipts for payment of fixed payments).

By line 060

reflects the number of people who received income during the corresponding period.

Attention! If the same individual is fired and hired during the same tax period, he is counted only once.

On line 070

The amount of tax withheld is indicated, calculated on an accrual basis from the beginning of the tax period.

Attention! If the tax agent reflected data on advances in line 050

, then the tax amount in

line 070

must be indicated minus these advances.

By line 080

The amount of tax not withheld by the tax agent is reflected. This is a tax that the organization will not be able to withhold until the end of the year, and which at the end of the calendar year will be reflected in 2-NDFL certificates with the sign “2”. If the organization is able to withhold it until the end of the year, then such tax is not shown in this line (letter of the Federal Tax Service of Russia dated June 14, 2016 No. BS-3-11 / [email protected] ).

On line 090

the amount of tax returned by the tax agent is indicated (for example, in the case of excessive tax withholding from the employee’s income).

Example of filling out 6-NDFL for 2021

In the line “Submission period (code)” on the title page, enter the code of the period for which the calculation is submitted. For 12 months this code is “34”.

The organization has 15 employees.

For 2021, salaries, bonuses, vacation pay and temporary disability benefits were accrued in the total amount: 9,285,460.50 rubles, deductions were provided - 43,200 rubles. Personal income tax on all payments is RUB 1,201,494. All personal income tax is withheld and transferred to the budget, except personal income tax in the amount of 100,100 rubles. from salary for December - 770,000.00 rubles.

In October 2021, personal income tax was withheld in the amount of RUB 92,014. from salary for September 2021 RUB 715,000.00, deduction - RUB 7,200. In total, personal income tax was withheld for the year in the amount of 1,193,408 rubles. (RUB 1,201,494 – RUB 100,100 + RUB 92,014)

In the fourth quarter paid:

- 10/05/2018 – salary for September in the amount of 715,000 rubles, from which personal income tax was withheld and transferred – 92,014 rubles, deduction – 7,200 rubles;

- 11/02/2018 – employee salary for October was 715,238.30 rubles, personal income tax was calculated from the salary - 92,981 rubles, personal income tax was withheld and transferred to the budget in full;

- 11/02/2018 – bonus for October 200,000 rubles, personal income tax on it – 26,000 rubles;

- 02.11.2018 – vacation pay in the amount of 8,500.00 rubles, personal income tax calculated and withheld – 1,105 rubles. Leave was granted from 06.11.2018 to 12.11.2018;

- 11/19/2018 – temporary disability benefit – 6,457.00 rubles, personal income tax from it – 839 rubles. Sick leave issued from November 12, 2018 to November 15, 2018;

- 12/05/2018 – salary for November – 705,168.85 rubles, personal income tax on it – 91,672 rubles.

The salary for October and the bonus are included in one block of lines: 100 – 140, since all three dates in lines 100, 110 and 120 coincide. The total amount is 915,238.30 rubles, the tax withheld from it is 118,981 rubles. (92,981 rub. + 26,000 rub.)

The salary for December is not included in section 2, since it is paid already in January 2021, and, therefore, will be reflected in 6-NDFL for the first quarter of 2021

The organization provided the calculation on March 15, 2019.

Reflecting overpaid tax

According to line 090 f. 6-NDFL indicates the total amount of tax that the tax agent returns to taxpayers. The amount is shown as a cumulative total from the beginning of the year.

If in 2021 a company returns to an individual personal income tax that was excessively withheld from last year’s income, then this amount will be reflected on page 090 of section 1 of the calculation for the corresponding period of the current year.

This operation is not included in section 2 of the form. There is no need to submit an updated calculation of 6-NDFL for the previous year.

In this case, the company must submit corrected information to the inspectorate in Form 2-NDFL.

The personal income tax payable must be reduced by the amount of the refund made. If the tax agent transferred the tax without taking this amount into account, then an overpaid amount of tax arises, which must be returned from the budget.

LETTER from the Federal Tax Service of the Russian Federation for Moscow dated June 30, 2017 No. 20-15/ [email protected]

Editor's note:

a tax refund situation arises, in particular, if the company provided the employee with a property deduction (letter of the Federal Tax Service of the Russian Federation for Moscow dated June 30, 2017 No. 20-15/ [email protected] ).

If the employee was provided with a property deduction in October 2021: the tax withheld from the beginning of the year was returned. At the same time, the calculation of 6-NDFL for 9 months has already been submitted to the inspectorate. In this situation, there is no need to clarify the submitted form. The personal income tax refund operation will be reflected in the following statements - for 2021 on lines 030 and 090 of the calculation.

The line 070 indicator does not need to be reduced by the amount of tax to be refunded on the basis of a notification confirming the right to a property tax deduction.

Let's sum it up

Form 6-NDFL for the 2nd quarter of 2021 serves for operational control over the fulfillment by tax agents of their duties to transfer income taxes. It shows the amount of income, accrued and withheld tax and the established deadlines for transfer.

If difficulties arise in its preparation, you should first of all pay attention to the established date for transferring personal income tax for this type of income. If the question still remains, you need to be guided by letters from regulatory authorities explaining the relevant provision of the instructions for filling.

Read also

26.08.2020

We include additional payment for vacation in the calculation

The date of receipt of income in the form of a one-time supplement to annual leave is the day of its actual payment. The Federal Tax Service of the Russian Federation suggests filling out section 2 of 6-NDFL as follows:

- the dates indicated in lines 100 and 110 are the same - the day the additional payment was actually received;

- line 120 indicates the day following the day of actual payment of income.

Form 2-NDFL certificate approved by Order of the Federal Tax Service of the Russian Federation dated October 30, 2015 No. MMV-7-11/ [email protected] Income of individuals is reflected in the form in accordance with the codes that are given in the list approved by Order of the Federal Tax Service of the Russian Federation dated September 10, 2015 No. MMV- 7-11/ [email protected] If any income is not named in the list, then it is included in 2-NDFL under code 4800 “Other income”.

So, if a company pays an employee a one-time additional payment for annual leave, then in form 2-NDFL this amount is reflected with code 4800.

LETTER of the Federal Tax Service of the Russian Federation dated August 16, 2017 No. ZN-4-11/ [email protected]

We show material benefits in the calculation

According to the general rules, line 80 of section 1 of the calculation reflects on an accrual basis the amount of tax not withheld as of the reporting date on income received by an individual in kind in the form of financial benefits in the absence of cash payments.

When a citizen receives such income, the calculated amount of personal income tax is withheld by the tax agent at the expense of any cash income. In this case, you can withhold no more than half of the amount paid.

If it is impossible to withhold the calculated amount of tax during the year, then before March 1 of the next year it is necessary to notify the individual and the tax authorities in writing about this and the amount of unwithheld personal income tax.

Example. The employee received income in kind on 10/17/2018, tax was withheld upon the next payment on 10/31/2018.

This operation was reflected in the calculation form for 2021:

1) in section 1:

- on lines 020, 040, 070 the corresponding values are indicated;

- the operation is not reflected in line 080;

2) in section 2:

- line 100 indicates 10/17/2018;

- on line 110 - 10/31/2018;

- along lines 130, 140 - the corresponding values.

LETTER of the Federal Tax Service of the Russian Federation dated May 22, 2017 No. BS-4-11/9569

Sample format for a semi-annual report

Let's look at the preparation of 6-NDFL for the 2nd quarter of 2021 using an example (we assume that the organization did not go into quarantine and fills out the calculation in the usual manner without taking into account the features discussed above):

Let’s assume that Sirius LLC, registered in St. Petersburg, employed 10 people at the beginning of 2021. Their total earnings for 6 months of 2021 amounted to 2,040,000 rubles. The amount of deductions applied in connection with the presence of children for the same period is 109,200 rubles. Accordingly, the amount of income tax accrued at a rate of 13% amounted to RUB 251,004.

Salaries are paid every 2 weeks: on the 28th the advance payment for the current month is issued, on the 13th of the next month - the salary for the past month. During the reporting period, no payments other than wages were made; There were no changes in wages or deductions. That is, the amount of earnings accrued for 1 month is 340,000 rubles, the amount of deductions is 18,200 rubles, and the tax calculated from these data is 41,834 rubles.

Read about the nuances of determining the date of receipt of income for different types of payments in the article “Date of actual receipt of income in form 6-NDFL” .

In the report, figures relating to the half-year will be shown in the lines of section 1. And in section 2 in relation to the dates of the final calculation for each month (recall that the payment of the advance is not associated with the event from which the tax payment deadline is calculated) and, accordingly, the total The amounts of monthly accruals (including those issued in advance) will reflect each of the payments made during the 2nd quarter. Moreover, a prerequisite for highlighting a group of lines in Section 2 to show the amounts associated with the amount of tax tied by the payment deadline to a specific date is that this date belongs to the 2nd quarter.

Sample 6-NDFL for the 2nd quarter of 2021, filled out according to the above data, can be found on our website:

Our materials will help you fill out the lines of this report correctly:

- The procedure for filling out line 060 of form 6-NDFL;

- The procedure for filling out line 70 of form 6-NDFL;

- The procedure for filling out line 140 of form 6-NDFL.

Our material “How to reflect vacation pay in the 6-NDFL form” will help you avoid getting confused in the order of reflecting vacation pay in the 6-NDFL form for the 2nd quarter.

We issue 6-NDFL when paying sick leave

When paying temporary disability benefits to an employee (including benefits for caring for 1 sick child) and vacation pay, tax agents are required to transfer personal income tax amounts no later than the last day of the month in which the money was transferred.

At the same time, the Tax Code of the Russian Federation establishes that if the tax payment deadline falls on a weekend or holiday, it is postponed to the next working day.

Example. The employee was paid sick leave on 12/09/2018. In this case, the deadline for transferring tax from the specified payment occurs in another submission period, namely 01/09/2019. In this case, regardless of the date of direct transfer of personal income tax to the budget, this operation is reflected in lines 020, 040, 070 of section 1 of the 6-personal income tax calculation for 2021.

In section 2 of form 6-NDFL for the first quarter of 2021, the transaction in question is reflected as follows:

- line 100 indicates 12/09/2018;

- on line 110 - 12/09/2018;

- on line 120 - 01/09/2019 (taking into account the provisions of clause 7 of article 6.1 of the Code);

- on lines 130 and 140 - the corresponding total indicators.

LETTER of the Federal Tax Service of the Russian Federation dated March 13, 2017 No. BS-4-11/ [email protected]

Reflection of transitional payments

Taxpayers have many questions regarding the inclusion of so-called transitional payments in the 6-NDFL calculation. These are situations where income is paid in one reporting period, but tax is due in another.

Situation 1: March salary was paid in April

For example, salaries for March 2021 were paid on 04/10/2020.

In this case, in the 6-NDFL report for the 1st quarter, the March salary will be reflected only in Section 1:

- on page 020 – the amount of accrued wages;

- on page 040 – tax on this amount.

All other information will already be included in the report for the 2nd quarter:

- on page 70 section. 1 – amount of tax withheld;

- on page 100 section. 2 – 03/31/2020 (the date of receipt of income in the form of salary is the last day of the billing month);

- on page 110 section. 2 – 04/10/2020 (tax withheld when paying salaries);

- on page 120 section. 2 – 04/13/2020 (the date established by the Tax Code of the Russian Federation for transferring personal income tax from wages is the next working day after payment);

- on page 130 section. 2 – amount of accrued wages;

- on page 140 section. 2 – the amount of tax withheld from this payment.

Situation 2: June salary was paid in July

The most common situation is when wages for June were paid in July (i.e. already in the 3rd quarter of 2021).

In this case, the advance and salary for June 2021 do not need to be reflected in section 2 of form 6-NDFL for the six months, because the tax will actually be withheld only in July 2020 .

Accordingly, the amounts of advance payment and salary for June, as well as withheld tax, will be reflected in section 2 of the calculation for 9 months of 2021. But in section 1, the advance and salary amounts for June should be , because the dates for calculating personal income tax fall in the first half of 2021. Here's an example to fill out.

EXAMPLE

The organization paid the salary advance for June on June 26 - 35,000 rubles. The organization paid the second part of the salary on July 10, 2020 in the amount of 40,000 rubles. Total – 75,000 rubles. This amount is subject to income tax at a rate of 13 percent in the amount of RUB 9,750. (RUB 75,000 × 13%). On the day of salary payment (July 10), this tax will be withheld, and the next day it will be transferred.

Show the June salary paid in July 2021 in section 1 of the 6-NDFL calculation for the first half of 2021. Moreover, enter into the report only accrued income, deductions and personal income tax (lines 020, 030 and 040). In lines 070 and 080, do not show . After all, the tax withholding date (the day of actual salary payment) has not yet arrived . Such a tax cannot .

Withhold personal income tax from the June salary only in July at the time of payment. Therefore, show it in line 070 of section 1, and the operation itself in section 2 of the report for 9 months of 2021. This is consistent with the letter of the Federal Tax Service of Russia dated August 1, 2016 No. BS-4-11/13984.

Salary advances can also be paid on the last day of the month. ConsultantPlus explains how to show this in 6-NDFL

Usually there is no need to withhold personal income tax from the salary advance and show it separately in the calculation of 6-personal income tax.

But this rule does not apply if the organization has established payment of the advance on the last day of the month. Recent judicial practice confirms this. Read the complete solution.

Tax officials explained how to reflect the recalculation of vacation pay in 6-NDFL

The date of actual receipt of vacation pay for personal income tax purposes is the day of their direct payment. Tax on these amounts is paid on the last day of the month in which the money was issued. You can find out how to do this here.

In the situation considered, the company recalculated vacation pay in connection with bonus payments to employees. For some of them, the issuance of vacation pay and their recalculation occur in different reporting periods. How to fill out 6-NDFL in this case.

Fiscal officials noted that the procedure for filling out 6-NDFL when recalculating these payments depends on whether the amount has decreased or, conversely, increased.

In the first case, you will have to submit to the Federal Tax Service an adjusted personal income tax report for the period in which the payments were accrued. In section 1 of this form, the total values should be written down, taking into account the reduced amount of vacation pay.

If, as a result of the recalculation, the company paid additional vacation pay to the employee, there is no need to provide an “adjustment”. In this case, in section 1 of form 6-NDFL of the reporting period in which the additional payment was issued, the total amounts are indicated, taking into account the additional payment of vacation pay.

Surrender procedure and sanctions for violation

The legally established deadline for submitting Form 6-NDFL is the last day of the month following the billing period. This means that the report for the 2nd quarter of 2021 must be submitted no later than 07/31/2020.

The fine for violating the deadlines for submission is 1000 rubles. for each full or incomplete month (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). In case of providing false data, the fine will be 500 rubles. for each report (Article 126.1 of the Tax Code of the Russian Federation).

In truth, the sanctions listed above are not particularly significant even for small enterprises, not to mention medium and large businesses. Blocking a current account can become much more sensitive : tax authorities have the right to it if the delay exceeds 10 days (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

After filling out 6-NDFL, it is necessary to check the correctness of all indicators and the absence of contradictions between them. The most effective method with links is offered by ConsultantPlus:

Before submitting the 6-NDFL calculation to the tax authority, we recommend checking it. This can be done using control ratios, just like the tax office: ... (read more).

6-NDFL: employee is transferred between departments with different OKTMO

| Situation | Solution |

| Until January 15, the employee works in a division of the organization registered in the territory belonging to OKTMO1. Since January 16, he has been working in the OP with OKTMO2, at the end of the month the salary for the month is calculated. Should each separate division pay personal income tax and submit reports separately? | Personal income tax must be transferred to the budgets both at the location of the unit with OKTMO1 and OKTMO2, taking into account the actual income received from the corresponding OP. Accordingly, the company must submit two 6-NDFL calculations to the Federal Tax Service: — at the location of the unit with OKTMO1; — at the location of the unit with OKTMO2 |

| In January, the employee works in a department with OKTMO1. In the same month, he submits an application for leave from 02/01/2017 to 02/15/2017. The money is issued by the OP with OKTMO1 on 01/31/2017. Then, from February 1, 2017, the employee is transferred to a unit with OKTMO2. When filling out form 6-NDFL, which OKTMO should the amounts of vacation pay and personal income tax be attributed to? | Since vacation pay is paid by the department with OKTMO1, this operation is reflected in Form 6-NDFL, submitted by the OP with OKTMO1 |

| In January, the employee is on the staff of the OP with OKTMO1. Then, from 02/01/2017, he is transferred to a unit with OKTMO2. In February, additional wages are accrued in the department with OKTMO1. The additional payment is issued by the department with OKTMO1. When filling out 6-NDFL, to which OKTMO and to which month should the amount of the additional payment and the corresponding personal income tax be attributed? How to fill out form 6-NDFL if you change the conditions of the example so that the specified additional payment is issued by a department with OKTMO2? | If a division with OKTMO1 pays an employee wages (sick leave or vacation pay) accrued for the time he worked in it, then this operation is reflected in Form 6-NDFL, which is submitted by this division. If this money is paid by a division with OKTMO2, then the operation is reflected in its 6-NDFL calculation. In this case, the amounts of wages additionally accrued to the employee are reflected in the month for which they are accrued, and benefits and vacation pay are reflected in the month in which they were directly issued. |

| In January, the employee works in a department with OKTMO1, from 02/01/2017 - in a department with OKTMO2. The employee goes on vacation in January. Since 01/01/2017, the company has been indexing salaries. The payment is made during the period of work in the OP with OKTMO2 through the cash desk of the same department. How to reflect in reporting the indexation for the period of work in the territories related to OKTMO1 and OKTMO2? | Since the payment of wage indexation amounts to the employee is carried out by a separate division with OKTMO2, this operation is reflected in his personal income tax reporting |

LETTER of the Federal Tax Service of the Russian Federation dated February 14, 2018 No. GD-4-11/ [email protected]

Tax officials cited the most common errors in form 6-NDFL

| The norms of the Tax Code of the Russian Federation that were violated | Violations | How to correctly fill out and submit 6-NDFL to the Federal Tax Service |

| Art. 226, 226.1, 230 | The amount of accrued income on line 020 of section 1 of calculation 6-NDFL is less than the sum of the lines “Total amount of income” of certificates in form 2-NDFL. | The amount of accrued income (line 020) at the corresponding rate (line 010) must correspond to the sum of lines “Total amount of income” at the corresponding tax rate of 2-NDFL certificates with attribute 1, submitted for all taxpayers by this tax agent, and lines 020 at the corresponding tax rate (line 010) of appendices No. 2 to the DNP, submitted for all taxpayers by this tax agent (the ratio applies to form 6-NDFL for the year) (letter of the Federal Tax Service of the Russian Federation dated March 10, 2016 No. BS-4-11 / [email protected] ) |

| Art. 226, 226.1, 230 | Line 025 of section 1 of form 6-NDFL at the corresponding rate (line 010) does not correspond to the amount of income in the form of dividends (according to income code 1010) of certificates of form 2-NDFL with sign 1, presented for all taxpayers | The amount of accrued dividends (line 025) must correspond to the amount of dividends (according to income code 1010) of 2-NDFL certificates with attribute 1, submitted for all taxpayers by this tax agent, and dividends (according to income code 1010) of Appendix No. 2 to the DNP, presented for all to taxpayers by this tax agent (the ratio applies to form 6-NDFL for the year) (letter of the Federal Tax Service of the Russian Federation dated March 10, 2016 No. BS-4-11/ [email protected] ) |

| Art. 226, 226.1, 230 | The amount of calculated tax on line 040 of section 1 of the 6-NDFL calculation is less than the sum of the lines “Calculated tax amount” of 2-NDFL certificates for 2021 | The amount of calculated tax (line 040) at the corresponding tax rate (line 010) must correspond to the sum of lines “Calculated tax amount” at the corresponding tax rate of 2-NDFL certificates with attribute 1, submitted for all taxpayers by this tax agent, and lines 030 at the corresponding rate tax (line 010) of appendices No. 2 to the DNP, submitted for all taxpayers by this tax agent (the ratio applies to form 6-NDFL for the year) (letter of the Federal Tax Service of the Russian Federation dated March 10, 2016 No. BS-4-11 / [email protected] ) |

| clause 3 art. 24, art. 225, 226 | According to line 050 of section 1 of form 6-NDFL, the amount of fixed advance payments exceeds the amount of calculated tax | The amount of fixed advance payments on line 050 of section 1 of form 6-NDFL should not exceed the amount of calculated tax for the taxpayer (letter of the Federal Tax Service of the Russian Federation dated March 10, 2016 No. BS-4-11 / [ email protected] ) |

| Art. 226, 226.1, 230 | Overstatement (understatement) of the number of individuals (line 060 of section 1 of form 6-NDFL) who received income (inconsistency with the number of 2-NDFL certificates) | The value of line 060 (the number of individuals who received income) must correspond to the total number of 2-NDFL certificates with sign 1 and appendices No. 2 to the DNP, submitted for all taxpayers by this tax agent (the ratio applies to form 6-NDFL for the year) (letter from the Federal Tax Service of the Russian Federation dated March 10, 2016 No. BS-4-11/ [email protected] ) |

| clause 2 art. 230 | Section 1 of form 6-NDFL is filled out not on an accrual basis | Section 1 of form 6-NDFL is filled out with an accrual total for the first quarter, six months, 9 months and a year (clause 3.1 of section III of the Procedure for filling out and submitting 6-NDFL, approved by Order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/ [ email protected] ) |

| clause 2 art. 230, art. 217 | Line 020 of Section 1 of Form 6-NDFL indicates income that is completely exempt from personal income tax. | Form 6-NDFL does not reflect income that is not subject to personal income tax (letter of the Federal Tax Service of the Russian Federation dated August 1, 2016 No. BS-4-11 / [email protected] ) |

| Art. 223 | Line 070 of Section 1 of Form 6-NDFL reflects the amount of tax that will be withheld only in the next reporting period (for example, wages for March paid in April) | Line 070 of Section 1 of Form 6-NDFL indicates the total amount of tax withheld by the tax agent, cumulatively from the beginning of the year. Since the tax agent must withhold the amount of tax from wages accrued for May, but paid in April, in April directly when paying the money, line 070 of section 1 of form 6-NDFL for the first quarter of 2021 is not filled in (letter of the Federal Tax Service of the Russian Federation dated 01.08. 2016 No. BS-4-11/ [email protected] |

| pp. 1 clause 1 art. 223 | Income in the form of temporary disability benefits is reflected in section 1 of form 6-NDFL in the period for which the benefit is accrued | The date of actual receipt of benefits for temporary disability is the day the income is paid (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). The amount of the benefit is reflected in the period in which such income was paid (letter of the Federal Tax Service of the Russian Federation dated 08/01/2016 No. BS-4-11 / [email protected] |

| clause 5 art. 226, paragraph 14 of Art. 226.1 | Line 080 of Section 1 of Form 6-NDFL indicates the amount of salary tax that will be paid in the next reporting period (submission period), that is, when the deadline for withholding and transferring personal income tax has not yet arrived | Line 080 of Section 1 of Form 6-NDFL reflects the total amount of tax not withheld by the tax agent from income in kind and in the form of material benefits in the absence of payment of other income in cash. When reflecting on line 080 the amount of tax withheld in the next reporting period (submission period), the tax agent needs to submit a “clarification” on 6-NDFL for the corresponding period (letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11 / [email protected ] |

| clause 5 art. 226 | Incorrect completion of line 080 of section 1 of form 6-NDFL in the form of the difference between calculated and withheld tax | Line 080 of Section 1 of Form 6-NDFL reflects the total amount of tax not withheld by the tax agent from income in kind and in the form of material benefits in the absence of payment of other income in cash (letter of the Federal Tax Service of the Russian Federation dated August 1, 2016 No. BS-4-11 / [email protected] ) |

| Art. 126, paragraph 2 of Art. 230 | Filling out section 2 of form 6-NDFL on a cumulative basis | Section 2 of Form 6-NDFL for the reporting period reflects those transactions that were carried out over the last three months of this period (letters of the Federal Tax Service of the Russian Federation dated 02/25/2016 No. BS-4-11/3058 and dated 02/21/2017 No. BS-4-11/ [email protected] ) |

| clause 6 art. 226 | Lines 100, 110, 120 of section 2 of form 6-NDFL indicate periods outside the reporting period | Section 2 of Form 6-NDFL reflects those transactions that were carried out over the last three months of the reporting period. If a tax agent performs a transaction in one reporting period and completes it in another, then the transaction is reflected in the completion period. In this case, the operation is considered completed in the reporting period in which the deadline for tax transfer occurs in accordance with clause 6 of Art. 226 and paragraph 9 of Art. 226.1 of the Tax Code of the Russian Federation (letters of the Federal Tax Service of the Russian Federation dated 02.25.2016 No. BS-4-11/3058 and dated 02.21.2017 No. BS-4-11 / [email protected] ) |

| clause 6 art. 226 | Line 120 of Section 2 of Form 6-NDFL incorrectly reflects the timing of personal income tax remittance (for example, the date of actual tax remittance is indicated) | Line 120 of section 2 of form 6-NDFL is filled out taking into account the provisions of clause 6 of Art. 226 and paragraph 9 of Art. 226.1 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of the Russian Federation dated February 25, 2016 No. BS-4-11/3058) |

| clause 2 art. 223 | On line 100 of section 2 of form 6-NDFL, when paying salaries, the date of transfer of funds is indicated | Line 100 of section 2 of form 6-NDFL is filled out taking into account the provisions of Art. 223 Tax Code of the Russian Federation. The date of actual receipt of wages is the last day of the month for which income was accrued in accordance with the employment contract (letter of the Federal Tax Service of the Russian Federation dated February 25, 2016 No. BS-4-11/3058) |

| clause 2 art. 223 | On line 100 of section 2 of form 6-NDFL, when paying a bonus based on the results of work for the year, indicate the last day of the month on which the bonus order is dated | Line 100 of section 2 of form 6-NDFL is filled out taking into account the provisions of Art. 223 Tax Code of the Russian Federation. The date of actual receipt of the annual bonus is determined as the day of its payment (letter of the Federal Tax Service of the Russian Federation dated October 6, 2017 No. GD-4-11 / [email protected] ) |

| Art. 231 | On line 140 of section 2 of form 6-NDFL, the amount of tax withheld is indicated taking into account the amount of personal income tax returned by the tax agent | Line 140 of Section 2 of Form 6-NDFL indicates the generalized amount of tax withheld on the date indicated in line 110. That is, the amount of personal income tax that is withheld is reflected (clauses 4.1, 4.2 of the Procedure for filling out and submitting 6-personal income tax, approved by Order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11 / [email protected] ) |

| clause 2 art. 230 | Duplication in section 2 of form 6-NDFL of operations started in one reporting period and completed in another | Section 2 of Form 6-NDFL for the corresponding reporting period reflects those transactions that were carried out over the last three months of this period. If a tax agent performs an operation in one reporting period and completes it in another, then the payment is reflected in the completion period (letters of the Federal Tax Service of the Russian Federation dated 02/25/2016 No. BS-4-11/3058 and dated 02/21/2017 No. BS-4-11/ [email protected] ) |

| pp. 2 clause 6 art. 226 | Interpayments (salaries, vacation pay, sick leave, etc.) are not included in a separate group. | The block of lines 100-140 of section 2 of form 6-NDFL is filled out for each tax transfer deadline separately, if in relation to different types of income that have the same date of their actual receipt, the tax transfer deadlines are different (Order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. MMV-7- 11/ [email protected] , clause 4.2) |

| clause 2 art. 230 | When changing the location of an organization (separate division), submit form 6-NDFL to the Federal Tax Service at the previous place of registration | After registering with the Federal Tax Service at the new address of the organization (OP), the tax agent submits to the new inspection: — calculation of 6-NDFL for the period of registration with the Federal Tax Service at the previous location, with the old OKTMO of the company (OP); — calculation of 6-NDFL for the period after registration with the new Federal Tax Service with OKTMO at the new location of the organization (OP). In this case, the checkpoint assigned by the Federal Tax Service at the new address is indicated in the calculation (letter of the Federal Tax Service of the Russian Federation dated December 27, 2016 No. BS-4-11 / [email protected] ) |

| clause 2 art. 230 | Submission by tax agents of Form 6-NDFL on paper if the number of employees is 25 or more people | If the number of individuals who received income from a tax agent is more than 25 people, you need to submit form 6-NDFL to the Federal Tax Service in electronic form according to the TKS |

| clause 2 art. 230 | Submission by tax agents with an average payroll of more than 25 people of Form 6-NDFL for separate divisions on paper (if the number of a separate division is less than 25 people). | If the number of individuals who received income from a tax agent is more than 25 people, you need to submit form 6-NDFL to the Federal Tax Service in electronic form according to the TKS |

| clause 2 art. 230 | Organizations that have separate divisions and operate within the same municipality submit one 6-NDFL calculation | The calculation for 6-NDFL is filled out by the tax agent separately for each separate subdivision (SP) registered, including those cases when the SB are located in the same municipality. When filling out the OP on the line “KPP”, the checkpoint is indicated at the place of registration of the organization at the location of its separate division (clause 2.2 of section II of the Procedure for filling out 6-NDFL, approved by Order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/ [email protected] |

| clause 2 art. 230 | Inaccurate information regarding calculated personal income tax amounts (over/understated) | If, after submitting to the Federal Tax Service, an error is discovered regarding the understatement (overstatement) of the amount of calculated tax in Form 6-NDFL, an updated calculation must be submitted to the inspectorate (letter of the Federal Tax Service of the Russian Federation dated July 21, 2017 No. BS-4-11/ [email protected] , question No. 7) |

| clause 7 art. 226 | Errors when filling out the checkpoint and OKTMO. Discrepancies between OKTMO codes in calculations and personal income tax payments, leading to unreasonable overpayments and arrears | If, when filling out form 6-NDFL, an error was made when filling out the checkpoint or OKTMO, then if it is discovered, you need to submit two calculations to the inspectorate: - updated calculation to the previously presented one, indicating the corresponding checkpoints or OKTMO and zero indicators for all sections of the calculation; — primary calculation indicating the correct checkpoint or OKTMO. (letter of the Federal Tax Service of the Russian Federation dated August 12, 2016 No. GD-4-11/ [email protected] ) |

| clause 2 art. 230 | Late submission of Form 6-NDFL | Form 6-NDFL for the first quarter, six months, 9 months is submitted to the Federal Tax Service no later than the last day of the month following the quarter, for the year - no later than April 1 of the year following the expired tax period |

LETTER of the Federal Tax Service of the Russian Federation dated November 1, 2017 No. GD-4-11/ [email protected]

Title page

On the title page, the tax agent fills in all the details, except for the section “To be filled out by a tax authority employee”

.

When filling out the “Adjustment number”

in the primary calculation, “0” is automatically entered; in the updated calculation for the corresponding period, it is necessary to indicate the adjustment number (for example, “1”, “2”, etc.).

Field "Representation period (code)"

filled out in accordance with the codes given in the directory. For example, when submitting a report for the first quarter, the code “21” is indicated, for the six months – “31”, etc.

In the “Tax period (year)”

The year for the tax period for which the calculation is submitted is automatically indicated.

When filling out the field “Submitted to the tax authority (code)”

The code of the tax authority to which the calculation is submitted is reflected. It is selected from the directory. By default, the field is automatically filled with the code that was specified when the client registered in the system.

In the field “At location (accounting) (code)”

the code for the place where the calculation is submitted by the tax agent is selected from the corresponding directory. Thus, agents who are ordinary organizations choose code “214”, the largest taxpayers - “213”, individual entrepreneurs - “120”, etc.

When filling out the “Tax Agent”

The short name of the organization is reflected in accordance with the constituent documents, and if there is none, the full name. Entrepreneurs, lawyers, notaries indicate their full (without abbreviations) last name, first name, patronymic (if any).

Attention! Fields “Form of reorganization (liquidation) (code)”

and

“TIN/KPP of a reorganized organization”

are filled out only by those organizations that are reorganized or liquidated during the reporting period.

In the “OKTMO code”

indicated by OKTMO of the municipality. This code is selected from the corresponding classifier. You can find out your OKTMO code using the electronic services of the Federal Tax Service “Find out OK” (https://nalog.ru, section “All services”).

Attention! Calculation of 6-NDFL is completed separately for each OKTMO.

When filling out the “Contact phone number”

The telephone number of the tax agent specified during registration is automatically reflected.

When filling out the indicator “On ____ pages”

The number of pages on which the calculation is compiled is indicated. The field value is filled in automatically and recalculated when the composition of the calculation changes (adding/deleting sections).

When filling out the indicator “with the attachment of supporting documents or their copies on ___ sheets”

the number of sheets of supporting documents and (or) their copies (if any) is reflected, for example, the original (or a certified copy) of a power of attorney confirming the authority of a representative of a tax agent (if the calculation is submitted by a representative of a tax agent).

In the section of the title page “I confirm the accuracy and completeness of the information:”

reflected:

- Manager - if the document is submitted by a tax agent,

- Authorized representative - if the document is submitted by a representative of the tax agent. In this case, the name of the representative and the document confirming his authority are indicated.

Attention! To change the signatory in the report, you need to go to the “Details”

and provide the required information.

Also on the title page, in the field “I confirm the accuracy and completeness of the information”

The date is automatically indicated.

How to submit 6-NDFL during reorganization

The founder of several legal entities wants to reorganize them in different forms and is interested in how to provide the 6-personal income tax calculation in this case and whether it will differ depending on the form of reorganization.

In response to this appeal, the tax office reported the following.

According to Art. 84 of the Tax Code of the Russian Federation, during reorganization, a company is deregistered with the Federal Tax Service when it ceases operations. The date the entry is made in the Unified State Register of Legal Entities will be the day the company is deregistered.

If the founder liquidates or reorganizes his company, the last tax period for it is considered to be the period of time from the beginning of the year until the day when the termination of the company’s work is registered with government agencies. The company provides calculations in Form 6-NDFL for the same period.

According to Art. 230 of the Tax Code of the Russian Federation, tax agents must provide 6-NDFL in their tax calculations. The assignee does not submit such a settlement for the reorganized company. However, if the company that is being reorganized has not fulfilled its obligations, then the legal successors must provide all required documents to government agencies. If there are several “heirs”, then their responsibilities are distributed based on the transfer deed or separation balance sheet.

LETTER from the Federal Tax Service for Moscow dated January 10, 2018 No. 13-11/ [email protected]

Valid form

It was expected that in 2021 the personal income tax form would change - the plans spoke of merging forms 2-NDFL and 6-NDFL. The new form was never adopted, so the report for the 1st half of 2021 is drawn up on the same form, approved. by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended by the order of the Federal Tax Service of Russia dated January 17, 2018 No. ММВ-7-11/ [email protected] ).

Companies and individual entrepreneurs can submit a paper copy of 6-NDFL to the Federal Tax Service if the number of individuals who received taxable income is less than 10 people (clause 2 of Article 230 of the Tax Code of the Russian Federation). For other tax agents, reporting is possible only in electronic format; a fine is imposed for violating the established procedure.

We hand over the “clarification”

You will have to clarify the calculation if you forgot to indicate any information in it or if errors were found (in the amounts of income, deductions, tax or personal data, etc.).

Also, the “clarification” is submitted when recalculating personal income tax for the past year (letter of the Federal Tax Service of the Russian Federation dated September 21, 2016 No. BS-4-11 / [email protected] ).

The Tax Code of the Russian Federation does not determine the deadline for submitting the updated calculation. However, it is better to send it to the inspectorate before the tax authorities find an inaccuracy. Then you don’t have to worry about a fine of 500 rubles.

In the “Adjustment number” line, “001” is indicated if the calculation is corrected for the first time, “002” when submitting the second “clarification,” and so on. In the lines where errors are found, the correct data is indicated, in the remaining lines - the same data as in the primary reporting.

The calculation indicates the checkpoint or OKTMO incorrectly. In this case, you also need to submit a “clarification.” In this case, two calculations are submitted to the inspection (letter of the Federal Tax Service of the Russian Federation dated August 12, 2016 No. GD-4-11/14772):

- in one calculation, the adjustment number “000” is indicated, the correct values of the checkpoint or OKTMO are entered, the remaining lines are transferred from the primary calculation;

- the second calculation is submitted with the correction number “001”, KPP or OKTMO indicate the same as in the erroneous report, zeros are entered in all sections of the calculation.

If the calculation with the correct checkpoint or OKTMO is submitted late, the fine under clause 1.2 of Art. 126 of the Tax Code of the Russian Federation (for violation of the reporting deadline) does not apply.

To reliably formulate the status of settlements with the budget, in the event that the data of the CRSB changes after the submission of updated calculations, you can submit an application to clarify the erroneously filled in details of settlement documents.

Editor's note:

In connection with the transfer of personal income tax administration by interregional (interdistrict) inspectorates for the largest taxpayers to the territorial tax authorities, the Federal Tax Service of the Russian Federation announced the following.

Starting from reporting for 2021, the largest taxpayers with OP need to submit 6-NDFL and 2-NDFL to the territorial tax authorities. Moreover, if “clarifications” on personal income tax for past periods are submitted after 01/01/2017, then they should also be sent to regular inspections (letter of the Federal Tax Service of the Russian Federation dated December 19, 2016 No. BS-4-11 / [email protected] ).

Control ratios in calculation: how tax authorities check the declaration

Be sure that the fiscal regulator will check the data provided in the calculation. Let us remember that income tax collections consistently hold one of the leading places in the formation of the state budget.

The audit is carried out using control ratios (CRs) established by the tax service. And taking into account the points that relate to the CS, the declarant, already during the preparation of the calculation, has the opportunity to immediately double-check specific data and, if necessary, correct them. This allows you to mitigate the risks of returning your declaration and penalties from tax authorities.

Let us note right away that sections 1 and 2 of the declaration do not correspond with each other at all, that is, there are no interrelations between them, and accordingly, the figures indicated in them do not pass through the prism of control ratios.

According to the calculation, all CS can be divided into several large blocks:

- First, the tax regulator will check the data on the title sheet, in particular, the correctness of the deadline for submitting the form. And regarding the correctness of registration: are all lines filled out correctly, in the form regulated by the above-mentioned Order of the tax authorities. We will talk further about sanctions for late submission of the calculation or submission of it in the wrong form. Believe me, the fiscal officers will not teach anyone, take into account that the report is being submitted for the first time and other points, so you need to pay maximum attention to filling it out.

- The next thing is the correctness of arithmetic formulas. When tax deductions exceed income or the amount of collection “does not fit” with the calculation of the tax rate and income, there are elementary errors in the declaration, such a calculation will not be accepted even for verification under the Constitutional Code.

- One of the key points of the CS is checking against internal control indicators:

- Section No. 1: the amount on the one hundred and fortieth line minus the figure on line “090” (deductions) must “fight” with the total indicator of the income tax paid to the state treasury.

- The dates of tax payments to the state budget under section No. 2 (line 120) will also be checked.

- KS on line “040” (accrued personal income tax) is a special item. Few declarants, when checking themselves, notice discrepancies of several rubles that appear in the formula when calculating the amount of income multiplied by the rate. This is acceptable, especially in enterprises where there are many employees, because when rounding, pennies can affect the result.

- Inter-document control ratios are a more in-depth analysis of indicators. A reconciliation with the figures reflected in the 2NDFL certificates for the enterprise will be sure to be checked:

- Thus, according to the final annual calculation, the data on the indicators of calculated income (on line “020”) and the final total figure for all 2 personal income taxes will be checked. If inconsistencies are found in the calculation, the report will be considered incorrect.

- The amount entered in line “025” (dividends received) must correspond to the corporate income tax. faces and again with numbers for 2NDFL.

- Lines “040” and “080” should also match the indicators for 2NDFL and corporate income tax.

- The number in line “060” should correlate with the number of people for whom 2NDFL and Appendix No. 2 to the corporate income tax were submitted. And please note that what is important here is not the number of certificates, but the number of people (we already mentioned this when analyzing the filling algorithm).

- The final block of verification under the KS can be carried out using a reconciliation of advance mandatory payments of the agent enterprise.