Bank, cash desk

Natalya Vasilyeva

Certified Tax Advisor

Current as of February 4, 2020

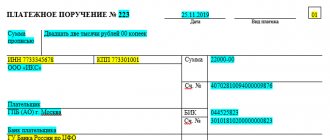

When drawing up a payment order, you must fill out all the details correctly. One of them is the purpose of payment. Its indication is important not only for the payment by the bank, but also for the accounting of the payer himself and the one to whom the funds are transferred. Let's look at how to fill out the payment purpose in a payment order.

Payment purpose field in a payment order

All payment documents, including payment orders, must contain a clear statement of the nature of the transaction being carried out. To do this, the purpose of the payment is indicated in the payment order (clause 1.7.2 of Bank of Russia Regulation No. 579-P dated February 27, 2017).

Field 24 “Purpose of payment” is reserved for the description of the payment in the payment order. This is a required detail and the bank will not be able to process the payment without it. The law does not impose strict requirements for filling it out, but it should make it clear what exactly the funds are being transferred for. There may be several options:

- Payment of mandatory payments (taxes, fees, insurance premiums, penalties, fines, etc.).

- Transfer of salaries to employees.

- Transfer of funds to an accountable person for expenses.

- Payment of household needs.

- Transfer of funds to counterparties.

- Payment of income to founders.

- Payment for goods purchased, services provided or work performed.

- Transfer of funds to another account of an organization or individual entrepreneur.

Depending on the basis for transferring funds, the purpose of the payment also changes. Let's consider what to write in field 24 for different types of payments.

When filling out field 24, you must keep it within 210 characters (Appendix 11 to the Procedure, approved by Bank of Russia Regulation No. 383-P dated June 19, 2012).

The order of payment in the payment order

Priority for Adequacy of Funds The priority of payment is indicated in the payment order with one number - from 1 to 5, which indicate the order in which funds are debited from the account.

Step-by-step instructions for filling out a payment order On the sample form, each cell is assigned conventional numbers to make it easier to explain its meaning and clarify exactly how it needs to be filled out. If there is an amount in the current account that is sufficient for all payments, these funds are written off in the order in which orders are received from the organization to the bank (Article 855 of the Civil Code of the Russian Federation): Payments for salaries, taxes and contributions have equal priority and belong to the same queue. 1st turn. Transfer (issue) of funds from a current account for claims for compensation for harm caused to life and health, for claims for alimony; 2nd stage.

Transfer (issuance) of funds for settlements for the payment of severance pay and wages with persons working under an employment contract, under a contract, for the payment of remuneration under an author's agreement; 3rd stage.

The Ministry of Finance does not consider bonuses as wages and requires personal income tax to be transferred from them immediately upon payment to the employee (Vaitman E, Chaplygin D

For failure to fulfill this obligation or violation of deadlines for submitting calculations, a fine of 1000 rubles is established.

for each full or partial month from the day when it had to be submitted to the inspection (clause 1.2 of Article 126 of the Tax Code of the Russian Federation as amended). - on the day of receipt of cash from the bank for payment of vacation pay; — on the day of transfer of vacation pay to the employee’s bank card or account; - the next day after payment of vacation pay from cash proceeds received by the organization’s cash desk from the sale of goods, work or services. The Federal Tax Service of Russia sent this Letter to lower-level inspectorates and ordered its use in their work (Letter dated 04/07/2015 N. Explanations from the Ministry of Finance of Russia are important for those employers who pay bonuses separately from wages or together with an advance payment.

For example, on the basis of an order from the general director or another document.

Filling in the purpose of payment in a payment order when paying taxes

When filling out a tax payment invoice, in field 24 you will need to indicate:

- type of tax;

- reporting or tax period;

- basis for payment (if the tax is paid at the request of the Federal Tax Service).

| Type of tax | Example of filling out field 24 “Purpose of payment” | Sample of filling out a payment order |

| simplified tax system 6% per year | “Tax for 2021 transferred in connection with the application of the simplified taxation system (object “income”)” | Payment order simplified tax system 6% for 2021 |

| simplified tax system 15% per year | “Tax for 2021 transferred in connection with the application of the simplified taxation system (object “income minus expenses”)” | Payment order of the simplified tax system income minus expenses 2019 |

| Income tax for the year |

Or

| Payment order for income tax for 2021: sample |

| Income tax (advance payment) |

Or:

| Payment order for advance payment of income tax 2020 |

| Unified agricultural tax for the year | “Tax for 2021 transferred in connection with the application of the Unified Agricultural Tax” | Payment order of the Unified Agricultural Tax for 2021 |

| VAT | “Value added tax on goods (work, services) sold in the Russian Federation for the 1st quarter of 2021 | Payment order for VAT payment in 2021 |

Purpose of payment when paying contributions

When paying insurance premiums, the purpose of payment must indicate:

- type of insurance premium;

- the period for which contributions are paid;

- FSS registration number (only for contributions for “injuries”).

Here are examples of filling out field 24 when paying contributions for employees to compulsory health insurance, compulsory medical insurance, compulsory social insurance:

| Type of insurance premium | Example of filling out field 24 “Purpose of payment” | Sample of filling out a payment order |

| For pension insurance (at the Federal Tax Service) | “Insurance contributions for compulsory pension insurance for February 2021” | Sample payment order to the Pension Fund for contributions for employees in 2020 |

| For medical insurance (at the Federal Tax Service) | “Insurance premiums for compulsory health insurance for February 2021” | Sample payment order to compulsory medical insurance for contributions for employees in 2020 |

| In case of temporary disability and maternity (at the Federal Tax Service) | “Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity for February 2021” | Payment order for VNiM contributions for employees in 2021 |

| For injuries (in the Social Insurance Fund) | “Insurance contributions to the Social Insurance Fund for compulsory social insurance against industrial accidents and occupational diseases for January 2021. Registration number in the FSS - 7712123453" | Payment order for injury contributions in 2021 |

How to indicate a one-time bonus in the payment purpose

On the eve of the next deadline for paying insurance premiums, tax officials decided to draw the attention of payers to the most common mistakes made when filling out payment orders for transferring contributions to the budget.

For the first time, a new unified calculation of contributions must be submitted to the Federal Tax Service no later than May 2. We recommend reading: Are there cases of refunds under insurance for a Renaissance loan?

The Federal Tax Service has edited the control ratios of VAT declaration indicators.

This is due to the entry into force of the order amending the VAT reporting form. In the case when a “physicist”, not registered as an individual entrepreneur, purchases goods using a foreign Internet service (for example, eBay), the duties of a tax agent for VAT are not assigned to him.

On the eve of the next deadline for paying insurance premiums, tax officials decided to draw the attention of payers to the most common mistakes made when filling out payment orders for transferring contributions to the budget. For the first time, a new unified calculation of contributions must be submitted to the Federal Tax Service no later than May 2. Bonuses are incentive payments that are paid to employees for conscientious performance of work duties or achievement of certain labor indicators (Art.

Art. 129. 191 Labor Code of the Russian Federation). Prize by virtue of Part.

1 tbsp. 129 of the Labor Code of the Russian Federation is part of wages. The grounds (reasons) for paying bonuses may be related to labor results (production bonuses) or independent of such results (non-production bonuses).

“On the rules for transferring funds”

It has been established that the transfer of funds is carried out by banks on the orders of clients, including those used within the framework of non-cash payment forms.

“On the rules for transferring funds”

Organizations can issue accountable amounts to employees by transferring funds to their bank card accounts, and the card can be either personal or corporate.

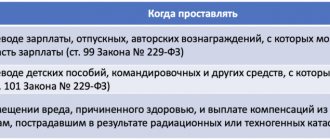

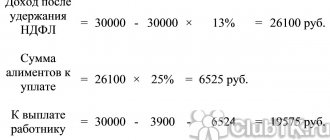

Purpose of payment when transferring salary

When transferring salaries to employees, you will need to indicate in the payment purpose:

- type of income;

- the period for which it is paid;

- date and register number (when transferring salaries to a salary account);

- indication of VAT (without VAT);

- Full name of the employee and his personal account number (if the salary is transferred not to the salary account, but to a specific employee)

| Who is the salary transferred to? | Example of filling out field 24 “Purpose of payment” | Sample of filling out a payment order |

| To a specific employee on the card | “The salary for February 2021 is being transferred to Sergei Dmitrievich Stepanov to personal account 40817810416604007788” | |

| To a salary account in a bank (for all employees) | “Salaries for February 2021 are transferred according to register 10. The amount is 920,856 rubles. Without VAT" | Payment order to transfer wages to a card: sample for 2019 |

Purpose of payment for premiums in payment slips

Transfer salaries to employees' bank accounts at least every six months (Part 6, Article 136 of the Labor Code of the Russian Federation). What is considered a “pay day” To transfer your salary to bank accounts in 2021

- other information;

- allocation of VAT in the transfer amounts.

- numbers and dates of contracts, invoices, and other documents;

- purpose of payment;

- name of goods/services;

Let's take a closer look at each item on the list.

So, the 24th field should reflect the essence of the payment, i.e.

e. indicate for what purposes it is carried out - for the payment of wages to personnel, amounts for reporting or for travel expenses, for the purchase of goods or for services performed.

Purpose of payment when paying dividends

Fill out the purpose of payment in the payment slip when paying dividends as follows:

- type of transaction (payment of dividends);

- details of the minutes of the shareholders meeting, on the basis of which funds are transferred.

For example: “Transfer of dividends according to the minutes of the shareholders meeting No. 5 dated 02/01/2020.”

If tax is paid on dividends paid, then in field 24 you need to indicate:

- type of tax paid (income tax if dividends are paid to an organization or personal income tax if to an individual);

- date of transfer of income.

For example: “Income tax for individuals on the income of the founder. The income payment date is February 4, 2021.”

Registration of the column “Purpose of payment” depending on its type

There are several types of payments from individuals. Depending on this, the text in the destination field changes. Let's look at the most popular operations and examples of filling out the 24th column.

Transfer of taxes and contributions

First of all, you need to indicate the name of the tax. For example, “Transport tax”. Next, the month for which the transfer takes place. This information is quite enough. If you are making a contribution to the Pension Fund, it would be wiser to also indicate your SNILS number. If you pay a fine, write the reason for this, i.e. the number and date of the document according to which you were charged the amount for the violation.

Payment for goods and services

A simple phrase “For the supply of goods” will not work. We need to specify the operation. For example, “For the supply of computer equipment under contract dated 10/07/2019 No. 10. Without VAT.” Or “Advance payment for transport services under agreement No. 20 dated October 8, 2019, including VAT in the amount of 1,000 rubles.”.

Recently, there has been an increase in the number of blocking accounts by individual banks and individuals who accept payments without paperwork. Some want to evade taxes, others monitor such suspicious transactions and suspend all movement of money through the account until the reasons are clarified.

Imagine a situation where a manicurist receives clients at home who transfer him 1,000 rubles. to a bank card. And there may be more than one or two such transfers per day. In the purpose of payment, people either do not write anything, or write standard phrases like “Repayment of debt” or “Donation”.

There is a high probability that at one point the bank will become interested in such receipts, block the account and demand documentary evidence. And this will not be easy to do.

Enterprises and organizations often suggest what exactly should be written in field 24. For example, I replenish my brokerage account monthly using bank details. The broker provides this template, in which I simply copy the text from the field and paste it into the payment order.

Transfer to yourself or a relative

Sometimes you have to transfer money from one account to another. They may be in the same or different banks. To be on the safe side and not run into bank sanctions, it is better to write “Transfer of own funds” or “Transfer to your account” in the destination field.

I often do this myself and I think I’m not the only one. I transfer money to my daughter, mother and other relatives. As a rule, this happens through a mobile bank or online bank, for example, Sberbank Online. When transferring to a bank card, there is no payment purpose field, but there is a “Message to recipient” column. This is where I recommend writing the purpose of the operation.

For example, “Money transfer from mom”, “Financial assistance”, “Birthday gift”, etc. This is not subject to income tax, so the bank will not have any questions. If you make a transfer using the details, then column 24 will definitely appear.

Payment of utility services

In most cases, we pay for ready-made receipts from service organizations. It is enough to take them to the nearest settlement center, bank, post office or ATM.

The procedure is further simplified if you use the service code in the form of a barcode or QR code on the receipt. Go to the mobile application, scan the received invoice with your phone, all data instantly appears on the screen. All that remains is to check them carefully and enter additional information (for example, meter readings for paying for gas, water, electricity).

If you pay for utilities using the organization’s details, then in column 24 you need to write what you are paying for and for what period, and also indicate your personal account number. For example, “For the removal of solid waste for October 2021. Payer’s personal account No. 12345.”

Purpose of payment: payment for goods, work, services

When transferring funds to pay for goods, work or services, in field 24 you must indicate:

- for what goods (works, services) funds are transferred;

- details of the documents on the basis of which payment is made (agreement, invoice, acceptance certificate for work performed, delivery note, etc.);

- the amount of VAT or the mark “excluding VAT”;

- type of transfer (advance or payment).

For example: “Payment for construction materials under contract No. 15 dated 10/14/2019 and delivery note No. 10 dated 02/04/2020. Including VAT 5,870.00 rubles.”

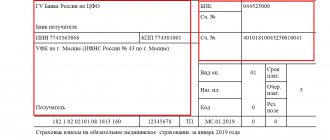

Purpose of payment: tax for a third party

When paying tax for another person, the “payment purpose” field is filled in taking into account the following features:

- First, the TIN and KPP (if necessary) of the person paying the tax are indicated. INN and checkpoint are separated from each other by the sign //;

- after the TIN and KPP, the name of the person for whom the tax is paid is entered and the sign // is placed;

- at the very end the type of tax paid is reflected.

For example: “7729202234//772901001//LLC “Kadrovik”//Tax for 2019, transferred in connection with the application of the simplified taxation system (object “income”)”

Let's sum it up

- Field 24 “Purpose of payment” is mandatory; without it, the bank will not process the payment.

- In the “Purpose of payment” field, you must indicate what exactly the funds are being transferred to, on the basis of what documents and in what amount.

- The maximum number of characters that can be entered in the 24 field is 210.

- When paying tax for a third party, information about who is making the payment, for whom it is being paid and the type of tax are separated by the sign “//”.

If you find an error, please select a piece of text and press Ctrl+Enter.

How to replace a payroll

The use of a unified payroll in form T-53 is not the only option for processing the issuance of earned funds to an eligible person. This procedure can also be completed using other documents - they are provided for by the same Directive No. 3210-U.

For example, you can issue a salary to one person using an expense cash order (Form No. KO-2), and organize a group payment using a payroll slip (Form T-49).

The materials on our website will help you document the payment of your salary:

- “Unified form No. T-49 - form and sample”;

- “Unified form No. KO-2 - cash receipt order”.